Problem Set #3

advertisement

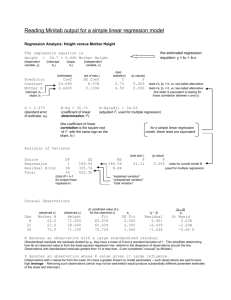

Problem session #3 Q.1 The t-statistic is calculated by dividing a. the OLS estimator by its standard error. b. the slope by the standard deviation of the explanatory variable. c. the estimator minus its hypothesized value by the standard error of the estimator. d. the slope by 1.96. Q.2 If the absolute value of your calculated t-statistic exceeds the critical value from the standard normal distribution, you can a. reject the null hypothesis. b. safely assume that your regression results are significant. c. reject the assumption that the error terms are homoskedastic. d. conclude that most of the actual values are very close to the regression line. Q.3 Consider the following regression line: TestScore 698.9 2.28 STR . You are told that the t-statistic on the slope coefficient is 4.38. What is the standard error of the slope coefficient? a. 0.52 b. 1.96 c. -1.96 d. 4.38 Q.4 One of the following steps is not required as a step to test for the null hypothesis: a. b. c. d. Q.5 compute the standard error of 1 . test for the errors to be normally distributed. compute the t-statistic. compute the p-value Finding a small value of the p-value (e.g. less than 5%) a. indicates evidence in favor of the null hypothesis. b. implies that the t-statistic is less than 1.96. c. indicates evidence in against the null hypothesis. d. will only happen roughly one in twenty samples Q.6 True or False. Explain a. Best of BLUE describes maximum variance. b. hat 2 = .50 our null hypothesis is 2 = 0 You must reject the null based on these two facts. C c. Our obtained (calculated) t equals 19, the beta in question is statistically not significant? d. The method of least squares maximizes the explained variation. Analytical Questions Q.1 SCENARIO: The marketing sub-committee for a consortium of dealers of American-made luxury automobiles has hired your consulting firm to tell them about the determinants of demand for their products. For a random sample of 17 dealerships in different neighborhoods, you collect data on the average number of cars sold per month (carsi), the median age of the population in the same zipcode as the dealership (agei), the median household income (in thousands of dollars) from all sources in the same zipcode (inci), median price of luxury cars stocked at the dealership (in thousands of dollars) (pricei), and distance from the nearest foreign luxury car dealership (disti). The statistical analyses you perform are given in the Exhibit below a. Using the information under descriptive statistics and the regression output, fill in the 7 blanks marked with XXXX under Regression 1 in the Exhibit below. Based on Regression 1, what is the verbal interpretation of the estimated regression equation? Is the intercept meaningful? Why or why not? Based upon the simple regression results the Regression 1, do cars appear to be inferior (as opposed to normal) goods? Explain how you have reached this conclusion.? Based upon the simple regression results in Regression 1, does income appear to have any significant relationship with cars? Test the hypothesis at the 5% level. Based on Regression 1, what level of monthly average car sold is expected for a median household income of $50,000 in the same zipcode? Give the formula and BUT DO NOT CALCULATE how a 95% confidence interval for this prediction would be constructed The chairperson for the consortium says "I took Econ 1 and I know that demand curves slope downwards from left to right. I don't think much of your skills as an economist if the demand curve you estimate in Regression 2 is not characterized by a negative slope." Based upon Regression 2 in the Exhibits, is it possible that there is a downward sloping demand curve for these cars? Explain how you have reached this conclusion b. c. d. e. f. Q.2 Consider the regression model Y = A+BX+, where Y is the aggregate investment for all firms over a number of past periods (in billions of dollars) and X is the composite price index of common stocks over the given period. You wish to estimate the regression based on 50 sample data. A spreadsheet calculation with these 50 observations gave the following results: i = 13778.4 Yi = 1778.3 iYi = 412329.68 i2 = 4425379.14 Yi2 = 74711,37 a. Determine the least square regression equation. (5) b. Calculate the proportion of investment level that is explained by the price index? (3) c. Test the hypothesis that there is no significant relationship between aggregate investment and the composite price index at the 5% level Q.3 Given the following estimated value for the following regression (standard errors of estimated coefficients are in brackets) Pwidth = 2.5 - .77height ( .77) (.33) Test the hypothesis that I think there is a direct relationship between height and Pwidth: hint: test if B1 =1 EXHIBITS |_* Descriptive Statistics NAME N MEAN AGE 17 55.041 INC 17 186.94 CARS 17 6.2659 PRICE 17 53.941 DIST 17 11.414 ST. DEV VARIANCE MINIMUM MAXIMUM 13.538 183.29 29.714 70.265 38.230 1461.6 100.00 250.00 3.1415 9.8688 1.7955 12.357 2.5365 6.4338 49.000 59.000 6.5447 42.833 2.0830 21.814 Regression 1 |_ols cars inc R-SQUARE = XXXXX STANDARD ERROR OF THE ESTIMATE-SIGMA = XXXXX SUM OF SQUARED ERRORS-SSE= 86.037 MEAN OF DEPENDENT VARIABLE = XXXXX ∑ 𝑌 2 = 𝑋𝑋𝑋𝑋𝑋 ANALYSIS OF VARIANCE SS DF MS REGRESSION 71.865 1. 71.865 ERROR 86.037 15. 5.7358 TOTAL 157.90 XXXXX. 9.8688 VARIABLE ESTIMATED STANDARD T-RATIO NAME COEFFICIENT ERROR 15 DF P-VALUE INC 0.055436 0.01566 XXXXX 0.003 CONSTANT -4.0973 XXXXX -1.373 0.190 |_* Regression 2 |_ols cars price R-SQUARE = 0.1185 R-SQUARE ADJUSTED = 0.0597 VARIANCE OF THE ESTIMATE-SIGMA**2 = 9.2795 STANDARD ERROR OF THE ESTIMATE-SIGMA = 3.0462 SUM OF SQUARED ERRORS-SSE= 139.19 MEAN OF DEPENDENT VARIABLE = 6.2659 ANALYSIS OF VARIANCE - FROM MEAN SS DF MS REGRESSION 18.709 1. 18.709 ERROR 139.19 15. 9.2795 TOTAL 157.90 16. 9.8688 VARIABLE ESTIMATED STANDARD T-RATIO NAME COEFFICIENT ERROR 15 DF P-VALUE PRICE 0.42632 0.3002 1.420 0.176 CONSTANT -16.730 16.21 -1.032 0.318