Ch12 Inputs and cost..

advertisement

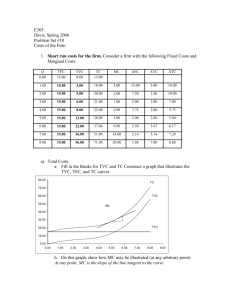

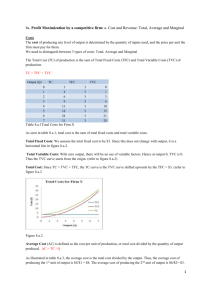

INPUTS AND COSTS Profit Defined π = TR − TC Total Revenue TR = P × Q Costs “Costs merely register competing attractions.” Explicit versus Implicit Opportunity Costs Page 1 of 18 Economic Profit Versus Accounting Profit TR₀ = P₀Q = $4 × 100,000 = $400,000 Explicit Costs = $320,000 Accounting profit = 400,000 – 320,000 = $80,000 Implicit Costs = $50,000 Economic profit = 400,000 – (320,000 + 50,000) = 30,000 Page 2 of 18 Economic Profit Versus Normal Profit TR₀ = P₀Q = $3.70 × 100,000 = $370,000 Explicit Costs = $320,000 Accounting profit = 370,000 – 320,000 = $80,000 Implicit Costs = $50,000 Economic profit = 370,000 – (320,000 + 50,000) = 0 Any return above the return on the next best alternative line of business is an economic profit. When economic profit is zero, the firm is making a normal profit. Thus, the earnings or the return that is equal to the return on the next best alternative is a normal profit. Short Run Versus Long Run Decisions Tom faces two time horizons regarding his business decisions whether to expand his operations (produce more) or reduce them. These time horizons are not measured in any specific time periods such as months or years. They are rather a time frame within which Tom is able to change the scale (or the size of physical plant) of his operations. In the short run, responding to higher price of corn, he could increase output by using more intensive production method, use more fertilizer, and hire more workers. However, his expansion of production is limited by the size of his farm and the size of heavy farming equipment. Simply put, in the short run, Tom can only change his variable inputs and is forced to keep some inputs fixed (fixed inputs). In the long run, if the corn market remains robust, Tom can expand the size of his farm and buy bigger or additional heavy equipment. So in the long run no inputs remain fixed. Page 3 of 18 Production Function Total Product Q = 15L² − L³ 550 0 1 2 3 4 5 6 7 8 9 10 11 Output Q 500 0 14 52 108 176 250 324 392 448 486 500 484 450 Total product (Units of output, Q) Variable input L 400 350 300 250 200 150 100 50 0 0 1 2 3 4 5 6 7 Units of variable input (L) Page 4 of 18 8 9 10 11 Marginal Product Variable input L Total product Q = 15L² − L³ 0 Marginal Product MP = ∆Q ⁄∆L 0 80 14 38 2 52 56 3 108 68 4 176 74 5 250 74 6 392 448 38 9 486 14 10 Page 5 of 18 50 40 30 20 10 500 0 0 1 2 3 4 5 6 7 Units of variable input (L) 56 8 60 324 68 7 70 14 Marginal product (Units of output, Q) 1 8 9 10 The law of diminishing returns Alternative presentation of marginal product: marginal product of a very small Increase in the variable input Variable input L 0 1 2 3 4 5 6 7 8 9 10 Page 6 of 18 Total product Q = 15L² − L³ 0 14 52 108 176 250 324 392 448 486 500 Marginal Product MP = 30L − 3L² MP = ∆Q ⁄∆L MP = dQ ⁄dL 0 14 27 38 48 56 63 68 72 74 75 74 72 68 63 56 48 38 27 14 0 Q 0 14 52 108 176 250 324 392 448 486 500 MP 0 27 48 63 72 75 72 63 48 27 0 550 500 450 Total product (Units of output, Q) L 0 1 2 3 4 5 6 7 8 9 10 400 350 300 250 200 150 100 50 0 0 1 2 3 4 5 6 7 8 9 10 8 9 10 Units of variable input (L) Marginal product (Units of output, Q) 80 70 60 50 40 30 20 10 0 0 1 2 3 4 5 6 7 Units of variable input (L) Page 7 of 18 Average Product Variable input L 0 1 2 3 4 5 6 7 8 9 10 Page 8 of 18 Total product Q = 15L² − L³ 0 14 52 108 176 250 324 392 448 486 500 Marginal Product MP = ∆Q ⁄∆L MP = dQ ⁄dL 0 14 27 38 48 56 63 68 72 74 75 74 72 68 63 56 48 38 27 14 0 Average Product AP = Q ⁄ L 14 26 36 44 50 54 56 56 54 50 The Relationship Between Marginal Product and Average Product Figure 9-5 shows the relationship between marginal product and the average product. The behavior of the AP curve follows directly from that of the MP curve. This behavior follows simply the mathematical relationship between average and marginal values: When the marginal value is greater than the average value, then the average rises. In Figure 9-5 up to point M marginal product is above the average product and, therefore, it pulls the average product up. After M marginal product is below the average product and, therefore, pulls the average product down. Thus, the marginal and average products are equal when the average product reaches the maximum. Consider the following simple example close to your own personal experience: suppose an economics course requires five tests and your average score for the first four is 80. If you score above 80 on the 5th test (the marginal test), then your average score will rise above 80, and If the score on the fifth test is below 80, your average will fall below 80. For example, if your score on the 5th test is 84, then your average will rise from 80 to 80.8. If, on the other hand, your score on the 4th test is 76, then the average will fall from 80 to 79.2. The same is true, therefore, of the relationship between the average product and the marginal product. Marginal product (Units of output, Q) 80 70 60 50 40 30 20 10 0 0 1 2 3 4 5 6 Units of variable input (L) Page 9 of 18 7 8 9 10 Short-Run Cost Functions Fixed Costs ) Total Fixed Cost (TFC) and Average Fixed Cost (AFC) AFC - $1,100 $1,100 $1,000 $1,000 $900 $900 $800 $800 Average fixed cost TFC $1,000 Total fixed cost Q 0 1 2 3 4 5 6 7 8 9 10 $700 $600 $500 $400 $600 $500 $400 $300 $300 $200 $200 $100 $100 $0 $0 0 Page 10 of 18 $700 1 2 3 4 5 6 7 Units of output (Q) 8 9 10 0 1 2 3 4 5 6 7 Units of output (Q) 8 9 10 Variable Costs Total Variable Cost (TVC) is the firm's total cost of hiring variable inputs in producing a given level of output. Unlike the fixed cost, TVC varies with the level of output. For a given size workshop, plant, or farm, to increase output the firm’s must hire or use more variable inputs. The opportunity cost of variable inputs, both implicit and explicit costs, is the variable cost. The total variable cost function is denoted as, TVC = f(Q) which states that TVC is a function of the level of output. The Relationship Between the Production Function and the Total Variable Cost Function Q = f(L) TVC = f(Q) (1) (2) Production Function L Q = 15L2 − L3 0 0 1 14 2 52 3 108 4 176 5 250 6 324 7 392 8 448 9 486 10 500 Page 11 of 18 Total Variable Cost Q TVC = $400L 0 $0 14 400 52 800 108 1,200 176 1,600 250 2,000 324 2,400 392 2,800 448 3,200 486 3,600 500 4,000 550 $4,500 500 $4,000 450 $3,500 Total variable cost Uints of output (Q) 400 350 300 250 200 $3,000 $2,500 $2,000 $1,500 150 $1,000 100 $500 50 0 $0 0 1 2 3 4 5 6 7 Units of variable input (L) Page 12 of 18 8 9 10 0 14 52 108 176 250 324 392 Units of output (Q) 448 486 500 A different numerical example TVC = 60Q − 12Q² + Q³ TVC 0 49 80 99 112 125 144 175 224 297 400 $450 $400 $350 $300 Cost Q 0 1 2 3 4 5 6 7 8 9 10 $250 $200 $150 $100 $50 $0 0 1 2 3 4 5 6 Units of output (Q) Page 13 of 18 7 8 9 10 Marginal Cost $450 $400 $350 MC TVC 0 49 80 99 112 125 144 175 224 297 400 ∆TVC ∕ ∆Q 49 31 19 13 13 19 31 49 73 103 dTVC ∕ dQ 60 39 24 15 12 15 24 39 60 87 120 $300 Cost Q 0 1 2 3 4 5 6 7 8 9 10 $250 $200 $150 $100 $50 $0 0 1 2 3 4 5 6 7 8 9 10 7 8 9 10 Units of output (Q) $140 $120 Cost $100 $80 $60 $40 $20 $0 0 1 2 3 4 5 6 Units of output (Q) Page 14 of 18 Average Variable Cost TVC 0 49 80 99 112 125 144 175 224 297 400 AVC = TVC ∕ Q $140 $120 49 40 33 28 25 24 25 28 33 40 $100 Cost Q 0 1 2 3 4 5 6 7 8 9 10 MC = ∆TVC ∕ ∆Q dTVC ∕ dQ 60 49 39 31 24 19 15 13 12 13 15 19 24 31 39 49 60 73 87 103 120 $80 $60 $40 $20 $0 0 1 2 3 4 5 6 Units of output (Q) Page 15 of 18 7 8 9 10 Total Cost and Average Total Cost $600 $550 $500 TFC 200 200 200 200 200 200 200 200 200 200 200 TVC 0 49 80 99 112 125 144 175 224 297 400 TC 200 249 280 299 312 325 344 375 424 497 600 MC 49 31 19 13 13 19 31 49 73 103 MC 60 39 24 15 12 15 24 39 60 87 120 AFC AVC $450 ATC $400 200.00 100.00 66.67 50.00 40.00 33.33 28.57 25.00 22.22 20.00 49 249.00 40 140.00 33 99.67 28 78.00 25 65.00 24 57.33 25 53.57 28 53.00 33 55.22 40 60.00 $350 Cost Q 0 1 2 3 4 5 6 7 8 9 10 $300 $250 $200 $150 $100 $50 $0 0 1 2 3 4 5 6 7 8 9 10 7 8 9 10 Units of output (Q) $250 $200 Cost $150 $100 $50 $0 0 1 2 3 4 5 6 Units of output (Q) Page 16 of 18 $160 $150 $140 $130 $120 $110 Cost $100 $90 $80 $70 $60 $50 N $40 $30 M $20 $10 $0 0 1 2 3 4 5 6 7 8 9 Units of output (Q) Page 17 of 18 10 11 12 13 14 15 Some important points to keep in mind about the above cost curves. 1) Why is MC U-shaped? In the production process, initially each additional variable input improves efficiency through better division of labor and specialization of tasks. This implies that marginal product of labor increases, production is subject to increasing returns. So each additional unit of output embodies or incorporates smaller amount of the variable input. Therefore, cost of producing each additional unit of output first decreases. This is why MC decreases first. But soon, as more workers and other variable inputs are put to work with a fixed input, diminishing returns sets in. Thus, each additional unit of output incorporates increasing amount of the variable input. MC, therefore, begins to rise. This is the explanation behind the so called “U” shape of the MC curve. 2) Why is AVC U-shaped? The behavior of AVC follows or trails the behavior of MC. While MC is below AVC, AVC will decrease. (Recall the example of your average and marginal test scores.) Note that, as shown in Figure 9-10, MC may be decreasing or increasing when below the AVC. MC may be increasing, but still below the AVC. Regardless, as long as MC is below AVC, average variable cost will be falling. But once MC exceeds AVC, the latter will begin to increase. Thus, MC must necessarily cross the U-shaped AVC at the minimum point M. 3) Why does ATC reach the minimum at a higher output level than AVC? Note that ATC consists of two components, AFC and AVC: ATC = AFC + AVC. Up to point N on the graph of ATC, two factors cause the ATC fall. First is the role of spreading effect attributed to average fixed cost. This effect is caused by the fact that as quantity of output increases, fixed costs are distributed or spread over larger quantities, leading to lower AFC. Also, the AVC component decreases first due to specialization, but soon it will rise due to diminishing returns effect. At low levels of output the spreading effect of AFC far outweighs the diminishing returns effect, causing ATC to continue to decrease while AVC rises. But at higher levels of output, the spreading effect loses its impact and is outweighed by the diminishing returns effect. In the graph you can clearly observe that AVC and ATC converge asymptotically (they get very close, but don’t touch each other) at higher levels of output. Page 18 of 18