Cash Circulation: Models, Standards, Tendencies

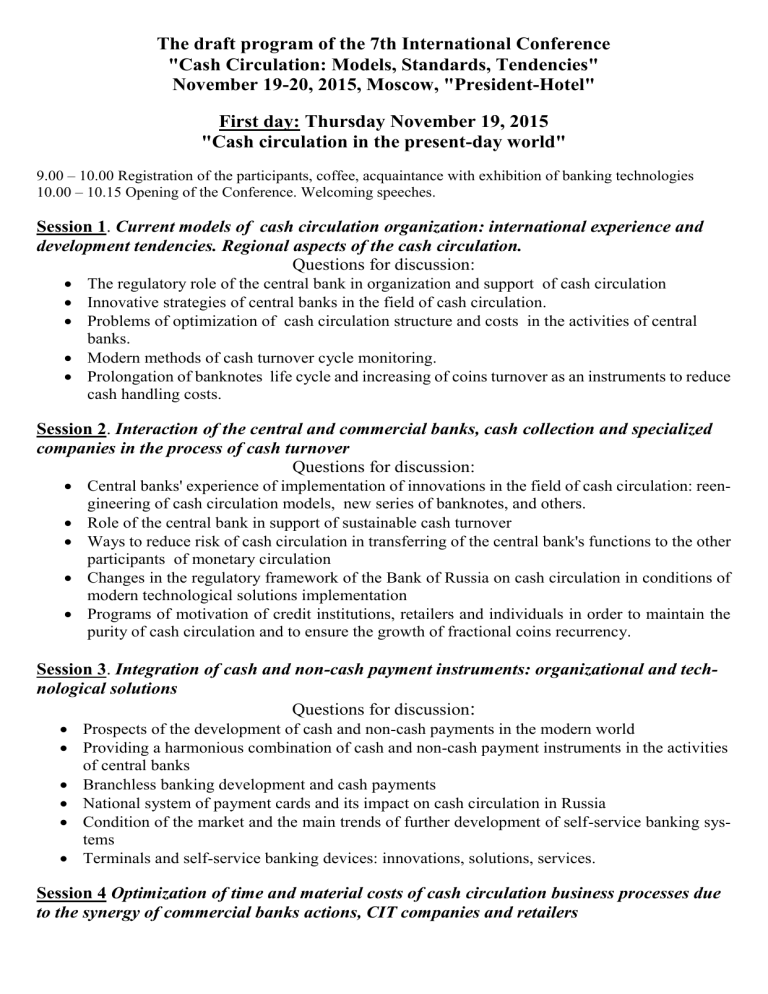

The draft program of the 7th International Conference

"Cash Circulation: Models, Standards, Tendencies"

November 19-20, 2015, Moscow, "President-Hotel"

First day: Thursday November 19, 2015

"Cash circulation in the present-day world"

9.00 – 10.00 Registration of the participants, coffee, acquaintance with exhibition of banking technologies

10.00 – 10.15 Opening of the Conference. Welcoming speeches.

Session 1 . Current models of cash circulation organization: international experience and

development tendencies. Regional aspects of the cash circulation.

Questions for discussion:

The regulatory role of the central bank in organization and support of cash circulation

Innovative strategies of central banks in the field of cash circulation.

Problems of optimization of cash circulation structure and costs in the activities of central banks.

Modern methods of cash turnover cycle monitoring.

Prolongation of banknotes life cycle and increasing of coins turnover as an instruments to reduce cash handling costs.

Session 2 . Interaction of the central and commercial banks, cash collection and specialized companies in the process of cash turnover

Questions for discussion:

Central banks' experience of implementation of innovations in the field of cash circulation: reengineering of cash circulation models, new series of banknotes, and others.

Role of the central bank in support of sustainable cash turnover

Ways to reduce risk of cash circulation in transferring of the central bank's functions to the other participants of monetary circulation

Changes in the regulatory framework of the Bank of Russia on cash circulation in conditions of modern technological solutions implementation

Programs of motivation of credit institutions, retailers and individuals in order to maintain the purity of cash circulation and to ensure the growth of fractional coins recurrency.

Session 3 . Integration of cash and non-cash payment instruments: organizational and technological solutions

Questions for discussion :

Prospects of the development of cash and non-cash payments in the modern world

Providing a harmonious combination of cash and non-cash payment instruments in the activities of central banks

Branchless banking development and cash payments

National system of payment cards and its impact on cash circulation in Russia

Condition of the market and the main trends of further development of self-service banking systems

Terminals and self-service banking devices: innovations, solutions, services.

Session 4 Optimization of time and material costs of cash circulation business processes due to the synergy of commercial banks actions, CIT companies and retailers

Questions for discussion :

Optimization of cash handling infrastructure and logistic solutions for central and commercial banks and CIT companies

Cash-management is a necessary condition for cost optimization of cash turnover

Cash circulation and retail trade. The requirements of retail chains to automation of cash flow processing.

Bank branches: network optimization, improving of the functioning efficiency (queues management systems, electronic cashiers, bank terminals)

Key directions of intersectoral synergy in the activities of commercial banks, cash collectors and retailers: the introduction of self-service systems, auto cash collection, cash recirculation

The problems of cash collection and the new technologies of reception / delivery of cash.

Ensuring security in cash turnover cycle.

18.00 – 19.00 Welcoming buffet. Visiting of the exhibition of banking technologies

Second day: Friday November 20, 2015

"Ways to improve cash turnover cycle"

Session 5 . New approaches and solutions in the field of cash operations and process of cash handling automation

Questions for discussion :

Standardization of cash operations and organization of cash centers work in commercial banks.

The analysis of cash transactions efficiency of the bank.

New IT solutions for automation of cash accounting for continuous processing of banknotes and coins in the cash centers of banks.

Experience of new solutions application for optimization of cash flow in commercial banks and

CIT companies.

Innovations in cash and settlement services. Experience in projects implementation.

Complex solutions on processing and packaging of coins on the basis of high-tech products and innovative technologies

Session 6.

Improving of the efficiency of cash transactions. Recycling and outsourcing as instruments to reduce costs of money turnover

Questions for discussion :

Modernization and optimization of cash handling processes, new trends and directions of development

Estimation of economic efficiency of operational processes in cash centers of commercial banks

Recirculation technologies as means of reducing the cost of cash handling and automation of management process of its turnover.

New cash registers technologies and self-service devices in retail

Modern equipment for processing, storage and transportation of fractional coins

Condition of the market and main trends of further development of self-service banking technology

Session 7.

Interaction of banks, retailers and law enforcement agencies in combating against counterfeiting.

Questions for discussion :

Banknotes of new generations and modern requirements for the banknotes protection

Combating cash circulation crimes and counterfeiting prevention

The experience of law enforcement agencies in counterfeiting combating

Modern technologies of verification of banknotes and coins authenticity

Traditional and new methods of counterfeit banknotes detecting in retail

Using of ATMs for frauds. Methods for identifying and combating

16.45 – 17.00 Summarizing and closing of the Conference

17.00 – 19.00 Closing Reception.