How are physicians paid -- A quick primer on RVU and CPT

advertisement

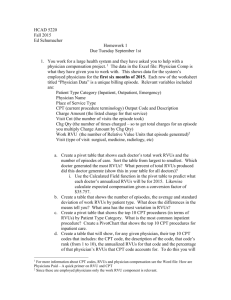

How are Physicians Paid? Generally physicians are paid on a fee-for-service basis. Today about 89 percent of physician revenue comes from third-party payments. What the physician is actually paid is generally different from charges. One of the first steps in the evolution of physician payment was the development of usual, customary, and reasonable (UCR). The Blue Shield plans (the physician side of the blues) collected information on what each physician charged for each service in a local area during the previous year. When a physician submitted a bill, it was checked to determine if it was above his or her median charge for the same service the previous year (usual), above the 75th percentile of charges by all doctors in the area (customary) or justifiably higher because of a patient’s complicating illness or another acceptable reason (reasonable). Next was the development of fee schedules – a menu of prices for each service agreed upon in advance. This requires an amazingly large number of services that must be priced. So this led to relative value scales – which give each service a point value. A common service (standard office visit, hernia repair surgery) is usually given a weight of one point and all other services are given point values relative to that standard unit of service. Once we have a point value system, then payment for each service is determined (so if value per point is $20, a physician providing a 3.5 point service is paid 3.5x20=$70). In 1992 Medicare implemented resource-based relative value scale (RBRVS). A team of economists and health service researchers estimated a point value for each service based on 1) physician time, 2) intensity of effort, 3) practice costs, and 4) costs of advanced specialty training. So everything a physician does has a point value associated with it – and any given procedure can be compared in points to any other and (theoretically) the difference reflects the difference in value between the two procedures. Once this is established, all they have to do is set a dollar value per point. CMS sets this value. The dollar value was $34.59 in 2003, and $35.7547 in 2015. The RBRVS is a list of physician services with RVUs assigned to each service. The units indicate a service’s cost relative to that of the typical physician service, which has a relative value of 1.0 units. A service with 1.559 units is 55.9 percent more costly to provide than the typical services, while a service with .693 units is 30.7 percent less costly. The RVU is made up of three components: 1) Physician work (pw) the time spent, effort exerted, and skills used by the physician to furnish the service. 2) Practice expenses (pe) – the wages, salaries and fringe benefits the physician provides office staff and money spent on other office expenses – often there is a separate component for facility practice expenses and non-facility. Facility setting RVUs tend to be lower since the physician does not absorb the full cost of services in these settings. 3) Malpractice insurance (mi) – highly variable across specialty so it is broken out. Physician work accounts for about 55 percent of total RVUs, practice expenses about 42 percent, and malpractice insurance about 3 percent. Level 1 of the CMS Common Procedural Coding System is used to identify the services. CPT-4 (the 4 is for the 4th edition) is the most widely used coding system for office visits, consultations, surgery, imaging, and other services. About 7,500 CPT codes are paid under the RBRVU fee schedule. Dallas Texas RVUs adjusted for geographic practices costs – 2015 and 100% Medicare payment rates. CPT Code Description GPCI Adjusted Work RVUs GPCI Adjusted NonFacility PE RVUs GPCI Adjusted Facility PE RVUs GPCI Adjusted PLI RVUs 100% of Medicare RBRVS (NF; GPCI Adjusted) 100% of Medicare RBRVS (F; GPCI Adjusted) 99201 Office/outpatient visit new 0.49 0.70 0.22 0.03 $43.63 $26.57 99202 Office/outpatient visit new - w/cc 0.94 1.09 0.42 0.06 $74.99 $50.67 99203 1.44 1.49 0.61 0.10 $108.66 $77.09 99204 2.46 2.02 1.04 0.18 $166.81 $131.97 99205 3.21 2.38 1.34 0.21 $207.91 $170.53 0.18 0.37 0.07 0.01 $20.25 $9.37 0.49 0.71 0.19 0.03 $43.99 $25.48 99213 0.98 1.01 0.41 0.06 $73.54 $51.76 99214 1.52 1.43 0.62 0.08 $108.53 $79.50 99215 2.14 1.81 0.88 0.10 $145.34 $111.95 99211 99212 Office Visit - established patient Office Visit - established patient w/cc So cpt 99201 is .49 work RVUs, if the physician performs the procedure in his/her office he/she gets .7 more, if it is in another facility it only adds .22, the malpractice component is .03. So this code generates 1.22 RVUs if done in the physician’s office, and .74 RVUs if done in the hospital. The RVUs for new patient visits exceed those for an established patient visit. And they vary with the level of care. Diagnostic and therapeutic radiology services have a professional and technical component. The professional component represents the portion of the service associated with the interpretation of the test. The technical component is the portion associated with the performance of the test. Often a physician is paid for the professional component while the hospital where the service is furnished is paid for the technical component. The RVUs are adjusted for geographic variations in wage rates and other prices that physicians pay for the resources used to produce patient care. The adjustment is based on geographic practice costs indexes (GPCIs) for physician work, practice expenses, and malpractice insurance. There are about 90 Medicare payment areas nationally. In Texas – Austin, Beaumont, Brazoria, Dallas, Fort Worth, Galveston, Houston, and the rest of Texas. The above table uses the Dallas indices to adjust the RVUs.