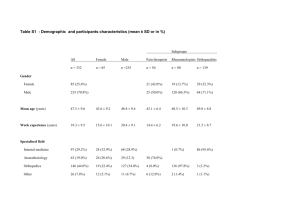

RIS3 National Assessment Greece

advertisement