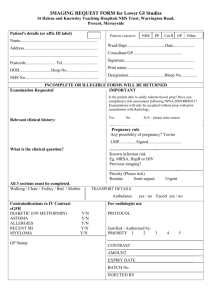

Ref costs guidance

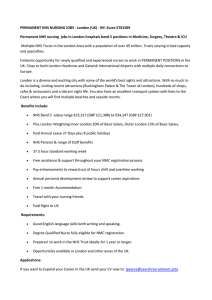

advertisement