DIBP PBS 2014-15 - Department of Immigration and Border Protection

advertisement

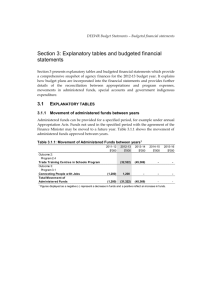

Migration Review Tribunal And Refugee Review Tribunal Agency resources and planned performance MIGRATION REVIEW TRIBUNAL AND REFUGEE REVIEW TRIBUNAL Section 1: Agency Overview and Resources ........................................................... 69 1.1 Strategic Direction Statement ......................................................................... 69 1.2 Agency Resource Statement .......................................................................... 70 1.3 Budget Measures ............................................................................................ 71 Section 2: Outcomes and Planned Performance ..................................................... 72 2.1 Outcomes and Performance Information ........................................................ 72 Section 3: Explanatory Tables and Budgeted Financial Statements ..................... 76 3.1 Explanatory Tables ......................................................................................... 76 3.2 Budgeted Financial Statements ...................................................................... 76 MRT-RRT Budget Statements MIGRATION REVIEW TRIBUNAL AND REFUGEE REVIEW TRIBUNAL Section 1: Agency Overview and Resources The Migration Review Tribunal (the MRT) and the Refugee Review Tribunal (the RRT) are statutory bodies providing a final, independent merits review of visa and visarelated decisions made by the Minister or delegates of the Minister for Immigration and Border Protection. The MRT and the RRT (the tribunals) are established and operate under the Migration Act 1958 (the Migration Act). The tribunals' jurisdictions, powers and procedures are set out in the Migration Act and the Migration Regulations 1994. The tribunals comprise members (appointed by the Governor-General under the Migration Act for fixed terms) and staff (appointed under the Migration Act and employed under the Public Service Act 1999). The tribunals operate as a single agency for the purposes of the Financial Management and Accountability Act 1997. 1.1 STRATEGIC DIRECTION STATEMENT The key strategic priorities for the tribunals are to deliver independent and timely reviews and lawful decisions. Each review has to be conducted in a way that ensures, as far as practicable, that an applicant understands the issues and has a fair opportunity to respond to any matters which might lead to an adverse outcome. The tribunals have published a Strategic Plan which sets out the tribunals’ strategic direction through to 2016. The plan outlines our commitment to providing independent, expert review of migration and refugee decisions that is efficient and accessible, and the strategies and actions which will support this. The number of reviews conducted during a year depends on the types of applications that are made, the availability of members, staff resources and impacts that case law and legislative changes may have on the conduct of reviews. The estimates are based on the tribunals conducting 18,000 reviews in 2014-15 with any adjustments based on actual demand to be proposed at additional estimates. . 69 MRT-RRT Budget Statements 1.2 AGENCY RESOURCE STATEMENT Table 1.1 shows the total resources from all sources. The table summarises how resources will be applied by outcome and by administered and departmental classification. Table 1.1: MRT-RRT Resource Statement — Budget Estimates for 2014-15 as at Budget May 2014 Estimate of prior year amounts available in 2014-15 $'000 Ordinary annual services 1 Departm ental appropriation Prior year departmental appropriation2 Departmental appropriation3 27,600 -- Total ordinary annual services 27,600- + Proposed at Budget Total estimate Actual available appropriation 2014-15 $'000 2014-15 $'000 2013-14 $'000 60,66060,660- 27,600 60,660 88,260- 84,06884,068- = - Other services Departm ental non-operating Equity injections Total -- Total other services -- -- 41 41- ----Total net resourcing for MRT-RRT 27,600 60,660 88,260 84,109 1. Appropriation Bill (No. 1) 2014-15. 2. Estimated adjusted balance carried from previous year for annual appropriations. 3. Includes an amount of $1.3 million in 2013-14 for the Departmental Capital Budget (refer to table 3.2.5 for further details). For accounting purposes this amount has been designated as 'contributions by owners'. Reader note: All figures are GST exclusive. 70 MRT-RRT Budget Statements 1.3 BUDGET MEASURES Table 1.2 summarises new government measures taken since the 2013-14 Mid-Year Economic and Fiscal Outlook (MYEFO). Table 1.2: MRT-RRT 2014-15 Budget measures Part 1: Measures announced since the 2013-14 MYEFO Programme 2013-14 2014-15 2015-16 2016-17 2017-18 $'000 $'000 $'000 $'000 $'000 - (152) (305) (458) (455) - (152) (305) (458) (455) (458) (455) Expense m easures Increased Efficiency Dividend Departmental expenses Total Total expense m easures (152) (305) Prepared on a Government Finance Statistics (fiscal) basis. 71 MRT-RRT Budget Statements Section 2: Outcomes and Planned Performance 2.1 OUTCOMES AND PERFORMANCE INFORMATION Outcome 1: To provide correct and preferable decisions for visa applicants and sponsors through independent, fair, just, economical, informal and quick merits reviews of migration and refugee decisions. Outcome 1 Strategy The tribunals operate in a high-volume decision-making environment where the case law and legislation are complex and technical. In this context, fair and lawful reviews are dependent on a number of factors, including adequate numbers of skilled member and staff resources, and the success of strategies to respond to a substantial growth in caseloads. Programme Objective The MRT and the RRT are established and operate under the Migration Act. Sections 353 and 420 respectively state: The tribunals shall, in carrying out its functions under this Act, pursue the objective of providing a mechanism of review that is fair, just, economical, informal and quick. Program Expenses The tribunals’ expenses are directly related to the conduct of reviews. The tribunals’ caseload is determined by the level and outcome of visa and related decisions made within DIBP. Changes in visa criteria, the demand for visas and to the tribunals’ jurisdictions may affect the number of persons who may apply to the tribunals for a review of a decision. 72 MRT-RRT Budget Statements Programme 1.1 Deliverables Merits review is an administrative reconsideration of a case. The principal objective of merits review is to ensure that the correct or preferable decision is reached in each case on the facts before the review body. The decisions of the review body should also improve the general quality and consistency of decision-making, and enhance openness and accountability. The program deliverables are essentially the decisions that the tribunals make on individual applications for review. The tribunals may set aside or vary decisions under review, substitute another decision, or remit cases to DIBP for consideration with directions. The tribunals are required to provide written statements of decision, which must set out the reasons for the decision, set out the findings on any material questions of fact, and refer to the evidence or any other material on which findings of fact were based. The tribunals are required by law to conduct hearings at which applicants can give oral evidence and present arguments, and where other persons can give oral evidence. The tribunals are required by law to invite an applicant to comment on or respond to information or issues that may lead to a decision under review being affirmed. The tribunals publish decisions of particular interest. Programme 1.1 Deliverables Cases Decided 2013-14 Estimated actual $'000 2014-15 Budget 18,000 18,000 $'000 73 2015-16 Forw ard estimate $'000 2016-17 Forw ard estimate $'000 2017-18 Forw ard estimate $'000 18,000 18,000 18,000 MRT-RRT Budget Statements Programme 1.1 Key Performance Indicators 2013-14 Estimated actual $'000 <5% 2014-15 Budget 2015-16 Forw ard estimate $'000 <5% 2016-17 Forw ard estimate $'000 <5% 2017-18 Forw ard estimate $'000 <5% $'000 Tribunal decisions set aside by <5% judicial review Bridging visa (detention cases) 70% 70% 70% 70% 70% decided w ithin 7 w orking days RRT cases decided w ithin 90 70% 70% 70% 70% 70% calendar days MRT visa cancellation cases 70% 70% 70% 70% 70% decided w ithin 150 calendar days All over MRT cases decided 70% 70% 70% 70% 70% w ithin 350 days Complaints received per 1,000 <5 <5 <5 <5 <5 cases Decisions published 4,500 3,000 3,000 3,000 3,000 Note: The key performance indicator for the for the publications of decisions has been revised from 4,500 to 3,000 for 2014-15 and subsequent years. The tribunals are required under the Migration Act to publish decisions of particular interest. 74 MRT-RRT Budget Statements Outcome 1 Expense Statement Table 2.1 provides an overview of the total expenses for Outcome 1. Table 2.1 Budgeted Expenses for Outcome 1 Program m e 1.1: Final independent m erits review of decisions concerning refugee status and the refusal or cancellation of m igration and refugee visas. Administered expenses Write-dow n of assets - bad debts Refund of application fees Departmental expenses Departmental appropriation 1 Total for Program m e 1.1 2013-14 Estimated actual expenses $'000 2014-15 Estimated expenses 2,600 5,700 2,600 5,700 84,068 60,660 92,368 68,960 $'000 2013-14 2014-15 Average Staffing Level (num ber) 420 420 1. Departmental Appropriation consists of ‘Ordinary annual services (Appropriation Bill No. 1) 75 MRT-RRT Budget Statements Section 3: Explanatory Tables and Budgeted Financial Statements Section 3 presents explanatory tables and budgeted financial statements which provide a comprehensive snapshot of agency finances for the 2014-15 budget year. It explains how budget plans are incorporated into the financial statements and provides further details of the reconciliation between appropriations and programme expenses, movements in administered funds, special accounts and government indigenous expenditure. 3.1 EXPLANATORY TABLES 3.1.1 Movement of Administered Funds Between Years There was no movement of administered funds between years. 3.1.2 Special Accounts The tribunals have no special accounts. 3.1.3 Australian Government Indigenous Expenditure The tribunals has no indigenous expenditure. 3.2 BUDGETED FINANCIAL STATEMENTS 3.2.1 Analysis of Budgeted Financial Statements There are no significant movements in the tribunals financial statements between budget periods. 76 MRT-RRT Budget Statements 3.2 BUDGETED FINANCIAL STATEMENTS TABLES Table 3.2.1 Comprehensive Income Statement (Showing Net Cost of Services) (for the period ended 30 June) 2013-14 Estimated actual $'000 2014-15 Budget EXPENSES Employee benefits Supplier expenses Depreciation and amortisation Finance costs Total expenses 72,718 8,956 1,231 80 82,985- LESS: OWN-SOURCE INCOME Gains Other Total gains Total ow n-source incom e 60 60 60 Net cost of (contribution by) services 2015-16 Forw ard estimate $'000 2016-17 Forw ard estimate $'000 2017-18 Forw ard estimate $'000 50,753 8,683 1,231 60,667- 50,640 8,785 1,231 60,656- 50,512 8,875 1,850 61,237- 49,854 9,193 1,850 60,897- 56 56 56 60 60 60 60 60 60 42 42 42 $'000 Revenue from Government 82,92581,694- 60,61159,380-* 60,59659,365-* 61,17759,327-* 60,85559,005-* Surplus (Deficit) attributable to the Australian Governm ent (1,231) (1,231) (1,231) (1,850) (1,850) 2015-16 $'000 2016-17 $'000 2017-18 $'000 (1,231) - (1,850) - (1,850) - 1,231- 1,850- 1,850- - - Note: Im pact of Net Cash Apppropriation Arrangem ents 2013-14 2014-15 $'000 $'000 Total Com prehensive Incom e (loss) excluding depreciation/ am ortisation expenses previously funded through revenue appropriations. (1,231) (1,231) less depreciation/amortisation expenses previously funded through revenue appropriations 1,231- 1,231- Total Com prehensive Incom e (loss) - as per the Statem ent of Com prehensive Incom e Prepared on Australian Accounting Standards basis. 77 MRT-RRT Budget Statements Table 3.2.2: Budgeted Departmental Balance Sheet (as at 30 June) 2013-14 Estimated actual $'000 2014-15 Budget $'000 2015-16 Forw ard estimate $'000 2016-17 Forw ard estimate $'000 2017-18 Forw ard estimate $'000 ASSETS Financial assets Cash and cash equivalents Trade and other receivables Total financial assets 229 39,188 39,417 252 39,088 39,340 (1,373) 39,088 37,715 (1,373) 39,088 37,715 (1,373) 39,088 37,715 Non-financial assets Land and buildings Property, plant and equipment Intangibles Other Total non-financial assets 5,213 2,424 2,490 53 10,180 5,142 2,950 2,085 53 10,230 5,442 3,125 1,878 53 10,498 5,592 3,563 1,178 53 10,386 5,342 3,077 2,229 53 10,701 Total assets 49,597 49,570 48,213 48,101 48,416 6,088 6,088 6,088 6,088 6,088 6,088 6,088 6,088 6,088 6,088 101 25 25 25 25 101 25 25 25 25 Provisions Employee provisions Other provisions Total provisions 11,335 1,678 13,013 11,335 1,678 13,013 11,335 1,678 13,013 11,335 1,678 13,013 11,335 1,678 13,013 Total liabilities 19,202 19,126 19,126 19,126 19,126 Net assets 30,395 30,444 29,087 28,975 29,290 25,183 384 26,463 384 26,337 384 28,075 384 30,240 384 516 28,975 (1,334) 29,290 LIABILITIES Payables Suppliers Total payables Interest bearing liabilities Leases Total interest bearing liabilities EQUITY Parent entity interest Contributed equity Reserves Retained surplus (accumulated deficit) Total equity 4,828 3,597 2,366 30,395 30,444 29,087 Prepared on Australian Accounting Standards basis. 78 MRT-RRT Budget Statements Table 3.2.3: Departmental Statement of Changes in Equity — Summary of Movement (Budget year 2014-15) Retained earnings Opening balance as at 1 July 2014 Surplus (deficit) for the period Total comprehensive income recognised directly in equity $'000 4,828 (1,231) 3,597 Asset revaluation reserve $'000 384 384 Contributed equity/ capital $'000 25,183 - Total equity $'000 30,395 (1,231) 25,183 29,164 1,280 26,463 1,280 30,444 Estim ated closing balance as at 30 June 2015 3,597 384 26,463 Prepared on Australian Accounting Standards basis. 30,444 Transactions w ith ow ners Contributions by owners Appropriation (departmental capital budget) Sub-total transactions with owners 3,597 79 384 MRT-RRT Budget Statements Table 3.2.4: Budgeted Departmental Statement of Cash Flows (for the period ended 30 June) 2013-14 Estimated actual $'000 2014-15 Budget OPERATING ACTIVITIES Cash received Appropriations Total cash received Cash used Employees Suppliers Borrow ing costs Total cash used Net cash from (used by) operating activities INVESTING ACTIVITIES Cash used Purchase of property, plant and equipment Total cash used $'000 2015-16 Forw ard estimate $'000 2016-17 Forw ard estimate $'000 2017-18 Forw ard estimate $'000 81,726 81,726 59,480 59,480 59,365 59,365 59,327 59,327 59,005 59,005 72,718 8,896 50,753 8,617 50,640 8,725 50,512 8,815 49,854 9,151 - - - - 81,694 59,370 59,365 59,327 59,005 32 90 - - - 1,974 1,974 1,271 1,271 1,509 1,509 1,738 1,738 2,165 2,165 (1,974) (1,271) (1,509) (1,738) (2,165) 2,056 2,056 1,280 1,280 (116) (116) 1,738 1,738 2,165 2,165 162 162 76 76 1,894 1,204 80 Net cash from (used by) investing activities FINANCING ACTIVITIES Cash received Contributed equity Total cash received Cash used Repayments of borrow ings Total cash used Net cash from (used by) financing activities (116) Net increase (decrease) in cash held (48) 23 (1,625) Cash and cash equivalents at the beginning of the reporting period 277 229 252 Cash and cash equivalents at the end of the reporting period 229 252 (1,373) Prepared on Australian Accounting Standards basis. 80 1,738 2,165 - - (1,373) (1,373) (1,373) (1,373) MRT-RRT Budget Statements Table 3.2.5: Departmental Capital Budget Statement 2013-14 Estimated actual $'000 CAPITAL APPROPRIATIONS Capital budget - Bill 1 (DCB) Total capital appropriations 2014-15 Budget $'000 2015-16 Forw ard estimate $'000 2016-17 Forw ard estimate $'000 2017-18 Forw ard estimate $'000 2,367 2,367- 1,280 1,280- 1,844 1,844- 2,238 2,238- 2,269 2,269- 2,367 2,367- 1,280 1,280- 1,844 1,844- 2,238 2,238- 2,269 2,269- 2,367 1,280 1,844 2,238 2,269 2,3670 1,280- 1,8440 2,2380 2,2690 2,367 1,280 1,844 2,238 2,269 2,367 1,280 1,844 Prepared on Australian Accounting Standards basis. 2,238 2,269 Total new capital appropriations Represented by: Purchase of non-financial assets Total Item s PURCHASE OF NON-FINANCIAL ASSETS Funded by capital appropriation - DCB TOTAL RECONCILIATION OF CASH USED TO ACQUIRE ASSETS TO ASSET MOVEMENT TABLE Total purchases Total cash used to acquire assets 81 MRT-RRT Budget Statements Table 3.2.6: Statement of Asset Movements (2014-15) Asset Category (as appropriate) Buildings Other property, Computer plant and softw are and equipment intangibles $'000 $'000 $'000 As at 1 July 2014 Gross book value Accumulated depreciation/amortisation and impairment Opening net book balance Total $'000 7,836 3,256 8,049 19,141 (2,623) 5,213 (832) 2,424 (5,559) 2,490 (9,014) 10,127 CAPITAL ASSET ADDITIONS Estim ated expenditure on new or replacem ent assets By purchase - appropriation ordinary annual services Total additions 30 30 955 955 295 295 1,280 1,280 Other m ovem ents Assets held for sale or in a disposal group held for sale Depreciation/amortisation expense Total other m ovem ents 102 102 429 429 700 700 1,231 1,231 As at 30 June 2015 Gross book value 7,867 4,211 8,344 Accumulated depreciation/amortisation and impairment (2,725) (1,261) (6,259) Closing net book balance 5,142 2,950 2,085 Prepared on Australian Accounting Standards basis. 82 20,422 (10,245) 10,177 MRT-RRT Budget Statements Schedule of Administered Activity Table 3.2.7: Schedule of Budgeted Income and Expenses Administered on Behalf of Government (for the period ended 30 June) 2013-14 Estimated actual $'000 2014-15 Budget $'000 2015-16 Forw ard estimate $'000 2016-17 Forw ard estimate $'000 2017-18 Forw ard estimate $'000 Non-taxation revenue Fees Total non-taxation revenue 28,431 28,431 26,431 26,431 26,431 26,431 26,400 26,400 26,400 26,400 Total incom e adm inistered on behalf of Governm ent 28,431 26,431 26,431 26,400 26,400 2,600 5,700 2,600 5,700 8,300 8,300 INCOME ADMINISTERED ON BEHALF OF GOVERNMENT Revenue EXPENSES ADMINISTERED ON BEHALF OF GOVERNMENT Bad Debts - RRT Post Decision Fees 2,600 2,600 2,600 Refunds - MRT Application Fees 5,700 5,700 5,700 Total expenses adm inistered on behalf of Governm ent 8,300 8,300 8,300 Prepared on Australian Accounting Standards basis. Table 3.2.8: Schedule of Budgeted Assets and Liabilities Administered on Behalf of Government (as at 30 June) 2013-14 Estimated actual $'000 2014-15 Budget $'000 2015-16 Forw ard estimate $'000 2016-17 Forw ard estimate $'000 2017-18 Forw ard estimate $'000 ASSETS ADMINISTERED ON BEHALF OF GOVERNMENT Financial assets Cash and cash equivalents Receivables Total financial assets 123 2,058 2,181 123 2,058 2,181 123 2,058 2,181 123 2,058 2,181 123 2,058 2,181 Total assets adm inistered on behalf of Governm ent 2,181 2,181 2,181 2,181 2,181 LIABILITIES ADMINISTERED ON BEHALF OF GOVERNMENT Total liabilities adm inistered on behalf of Governm ent Prepared on Australian Accounting Standards basis. 83 - - MRT-RRT Budget Statements Table 3.2.9: Schedule of Budgeted Administered Cash Flows (for the period ended 30 June) OPERATING ACTIVITIES Cash received Rendering of services Total cash received Cash used Refunds Total cash used Net cash from (used by) operating activities 2013-14 Estimated actual $'000 2014-15 Budget $'000 2015-16 Forw ard estimate $'000 2016-17 Forw ard estimate $'000 2017-18 Forw ard estimate $'000 25,831 25,831 23,831 23,831 23,831 23,831 23,800 23,800 23,800 23,800 5,700 5,700 5,700 5,700 5,700 5,700 5,700 5,700 5,700 5,700 20,131 18,131 18,131 18,100 18,100 18,100 18,100 123 123 123 123 18,100 18,100 18,100 18,100 Net increase (decrease) in cash held 20,131 18,131 18,131 Cash and cash equivalents at beginning of reporting period 123 123 123 Total 123 123 123 Cash to Official Public Account for: - Appropriations 20,131 18,131 18,131 Total 20,131 18,131 18,131 Cash and cash equivalents at end of reporting period 123 123 123 Prepared on Australian Accounting Standards basis. 123 Table 3.2.10: Schedule of Administered Capital Budget Statement The tribunals do not have an administered capital budget. Table 3.2.11: Statement of Administered Asset Movements (2014-15) The tribunals do not have an administered capital budget. 84 123