20-credit External - Mathematics and small business focus

advertisement

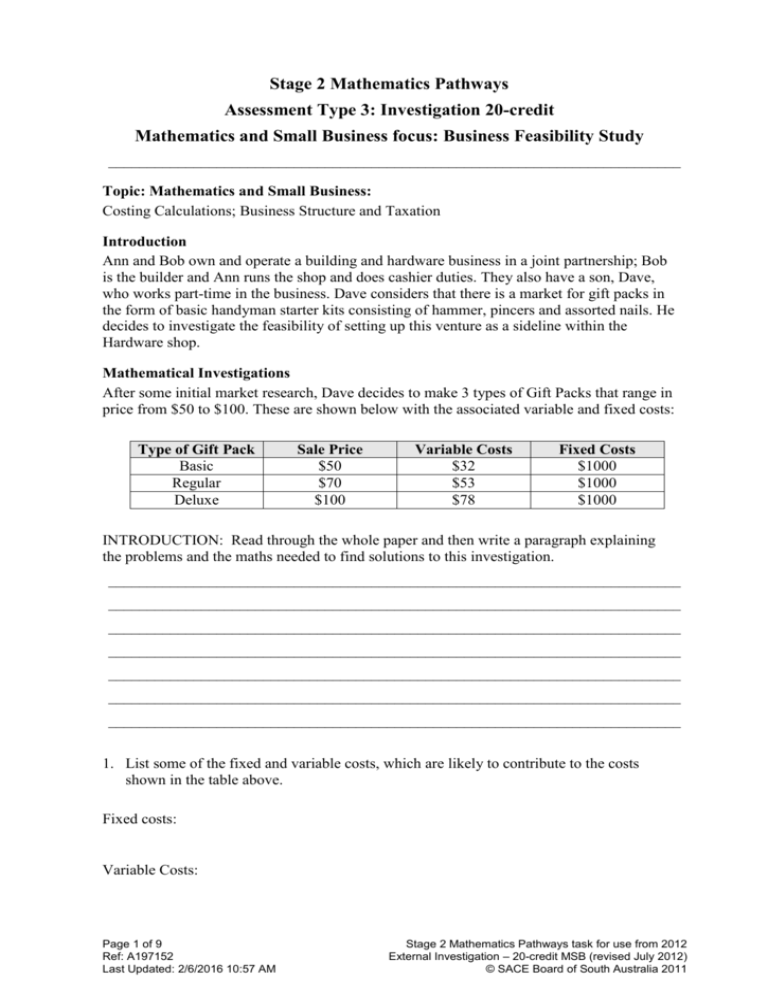

Stage 2 Mathematics Pathways Assessment Type 3: Investigation 20-credit Mathematics and Small Business focus: Business Feasibility Study __________________________________________________________________________ Topic: Mathematics and Small Business: Costing Calculations; Business Structure and Taxation Introduction Ann and Bob own and operate a building and hardware business in a joint partnership; Bob is the builder and Ann runs the shop and does cashier duties. They also have a son, Dave, who works part-time in the business. Dave considers that there is a market for gift packs in the form of basic handyman starter kits consisting of hammer, pincers and assorted nails. He decides to investigate the feasibility of setting up this venture as a sideline within the Hardware shop. Mathematical Investigations After some initial market research, Dave decides to make 3 types of Gift Packs that range in price from $50 to $100. These are shown below with the associated variable and fixed costs: Type of Gift Pack Basic Regular Deluxe Sale Price $50 $70 $100 Variable Costs $32 $53 $78 Fixed Costs $1000 $1000 $1000 INTRODUCTION: Read through the whole paper and then write a paragraph explaining the problems and the maths needed to find solutions to this investigation. __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ 1. List some of the fixed and variable costs, which are likely to contribute to the costs shown in the table above. Fixed costs: Variable Costs: Page 1 of 9 Ref: A197152 Last Updated: 2/6/2016 10:57 AM Stage 2 Mathematics Pathways task for use from 2012 External Investigation – 20-credit MSB (revised July 2012) © SACE Board of South Australia 2011 2. Calculate the number of packs required to break-even in each of the three scenarios listed above and calculate the revenue from these sales. Basic Regular Deluxe Breakeven number Revenue 3. Explain why these solutions do not give Dave a useful indication of the number of packs that he needs to sell in his business plan. __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ Page 2 of 9 Ref: A197152 Last Updated: 2/6/2016 10:57 AM Stage 2 Mathematics Pathways task for use from 2012 External Investigation – 20-credit MSB (revised July 2012) © SACE Board of South Australia 2011 4. Dave has now realised that he needs to focus on one specific type of gift pack. Using the ‘regular’ pack above and using the figures for variable and fixed costs given, graphically display Dave’s breakeven scenario, using appropriate technology. Paste printout or graph paper here. 5. Discuss how realistic the breakeven number is for Dave’s business. __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ Page 3 of 9 Ref: A197152 Last Updated: 2/6/2016 10:57 AM Stage 2 Mathematics Pathways task for use from 2012 External Investigation – 20-credit MSB (revised July 2012) © SACE Board of South Australia 2011 6. a) Assuming that Dave makes a profit in his first year of operating this business, predict the number of gift packs he might sell and the profit made in this year. b) Give some indication of the placement of the business premises and the effect that this might have on sales. __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ 7. In addition to Dave’s salary of $35,000 from working for ‘Bob’s Building and Hardware’, he retains the profits from the sale of the gift packs. Calculate his taxable income, tax payable and his net income for 2011/2012, including the Medicare levy and assuming he has private health cover. Page 4 of 9 Ref: A197152 Last Updated: 2/6/2016 10:57 AM Stage 2 Mathematics Pathways task for use from 2012 External Investigation – 20-credit MSB (revised July 2012) © SACE Board of South Australia 2011 8. Using the ‘Regular’ pack chosen previously, and initially assuming 300 sales in a year, use appropriate technology to investigate the effect of varying the sales price. Complete the table below for sales figures of 300 ‘Regular’ packs. Selling Price Revenue Total costs Profit Breakev en no. Dave’s income before tax Tax payable Dave’s net income $70 $80 $65 Now investigate sales per year of 400 ‘Regular’ packs. Choose two further appropriate selling prices to investigate mathematically other than $70. Selling price Revenue Total costs Profit Breakev en no. Dave’s income before tax Tax payable Dave’s net income $70 Include calculations completed by hand in the tables above. Include excel printouts showing calculations completed electronically and graphs on the following page. This page could include: Graphs representing the information for the sales of 300 and 400‘Regular’ packs Excel printouts of tables if completed electronically rather than by hand. Page 5 of 9 Ref: A197152 Last Updated: 2/6/2016 10:57 AM Stage 2 Mathematics Pathways task for use from 2012 External Investigation – 20-credit MSB (revised July 2012) © SACE Board of South Australia 2011 9. Analysis/Discussion for question 8. Critically analyse your results, considering the appropriateness of each of the chosen sale price scenarios. Consider: Highest and lowest realistic possible prices for the gift packs and why. How the packs could be made and sold more cheaply, and the effect this would have on his profit. How Dave could increase the number of sales made in a year and what effect this would have on his profit. The effect of employing a second person to prepare and distribute the gift packs if he were unable to cope with the demand by himself. How many packs would need to be sold to enter the next tax bracket and would it be feasible or worth the effort? Page 6 of 9 Ref: A197152 Last Updated: 2/6/2016 10:57 AM Stage 2 Mathematics Pathways task for use from 2012 External Investigation – 20-credit MSB (revised July 2012) © SACE Board of South Australia 2011 10. Conclusion In concluding this section, justify your choice of the best scenario for Dave, that is, the recommended selling price and predicted number to be sold in a year, referring to the limitations of the original problem as well as appropriate refinements or extensions. 11. a) If Bob and Ann were to offer Dave a 30% (Bob) – 30% (Ann) – 40% (Dave) partnership in the business for 2012-13, instead of the wage he currently receives, by how much would Dave be better off if the business were expected to earn $120,000 net profit for the following financial year? Compare Dave’s net income for each year, assuming the tax table is unchanged. Page 7 of 9 Ref: A197152 Last Updated: 2/6/2016 10:57 AM Stage 2 Mathematics Pathways task for use from 2012 External Investigation – 20-credit MSB (revised July 2012) © SACE Board of South Australia 2011 12. Analysis/Discussion/Conclusion for question 11. Discuss who will benefit most from a partnership split, justifying your points with figures. What is your advice to Bob, Ann and Dave on what action to take for the following year? Should Dave continue with his gift pack venture in 2012-13, if he were to take up the partnership offer, or not bother? Page 8 of 9 Ref: A197152 Last Updated: 2/6/2016 10:57 AM Stage 2 Mathematics Pathways task for use from 2012 External Investigation – 20-credit MSB (revised July 2012) © SACE Board of South Australia 2011 Formula Sheet for Investigation Under Supervision Revenue = Selling Price per item X Number of items sold, i.e. Revenue = price X turnover Total costs = Fixed costs + Variable costs per item X No. of items. Marginal income = Selling price – Variable costs per item. Breakeven number occurs when Revenue = Total costs. Breakeven number = Profit = Revenue – Total Costs Tax rates 2010-11 Taxable income Tax on this income 0 - $6,000 Nil $6,001 - $37,000 15c for each $1 over $6,000 $37,001 - $80,000 $4,650 plus 30c for each $1 over $37,000 $80,001 - $180,000 $17,550 plus 37c for each $1 over $80,000 $180,001 and over $54,550 plus 45c for each $1 over $180,000 The above rates do not include the Medicare levy of 1.5% of taxable income. Net income = Taxable Income – Tax payable(including Medicare levy) (Include a photocopy of Tax spreadsheet here) Page 9 of 9 Ref: A197152 Last Updated: 2/6/2016 10:57 AM Stage 2 Mathematics Pathways task for use from 2012 External Investigation – 20-credit MSB (revised July 2012) © SACE Board of South Australia 2011