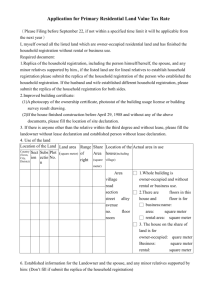

Owner-Occupied Residential Land Value Tax Application

advertisement

Application for Self-use Residential Land Value Tax Rate (Please Filing before September 22, if not within a specified time limit it will be applicable from the next year) I myself owned all the listed land, which are self-use residential land and has finished the household registration without rental or business use. Required document: 1.Copy of the household registration certificate, including the person himself/herself, the spouse, and minor dependents, if the listed land are for lineal relatives to establish household registration please submit the copy of the household registration certificate of the person who established the household registration. If the husband and wife established different household registration, please submit the copy of the household registration certificate for both sides. 2.Improved building certificate: (1) A copy of the ownership certificate, copy of the building usage license or building survey result drawing. (2) If the house finished construction before April 29, 1988 and without any of the above documents, please fill the location of site declaration. 3. If there is anyone other than the relative within the third degree and without lease, please fill the landowner without lease declaration and established person without lease declaration. 4. Use of the land Location of the Land Land Range Share Location of the Actual area in use Townsh Secti Sub- Plot Area ip, City, on secti No. (m2) District on of right Area house (including 2 village) (m ) Room , □ 1.Whole building is primary and Fl., No. without rental or business use. Alley, □ 2.There are floors in this Lane, house and floor is for □business: name: Section, Rd./St., area: m2 □rental: area: m2 Village, Township □ 3. The house on the share of land /City/District is for self-use: m2 business: m2 rental: m2 0401 5. Established information for the Landowner and the spouse, and minor dependents: (Don’t fill if submit the copy of the household registration certificate) Item Name Landowner ID No. Date of Address of his/her household birth registration (including village) Room , Fl., No. , Alley, Lane, Section, Rd./St., Village, Township/City/District Spouse Room , Fl., No. , Alley, Section, Lane, Rd./St., Village, Township/City/District Prefix Minor dependents Room , Fl., No. , Alley, Lane, Section, Rd./St., Village, Township/City/District Room , Fl., No. , Alley, Lane, Section, Rd./St., Village, Township/City/District The person in the household (prefix) 0401 Room , Fl., No. Alley, Lane, Section, Rd./St., Village, Township/City/District , 6.Originally approved to enjoy primary residential land tax rate, and now is willing to give up and change to be at normal tax rate. (Need not to fill if no such condition) □ Principal □ Spouse ( name: ) □ Minor dependents. All the land located at county/city subsection plot no. township/city/district section 7. The landowner who has two or more self-use residential lands fills this item. □ Principal □ Spouse ( name: ) □ Minor dependents. All the land located at county/city subsection plot no. township/city/district section has already enjoyed primary residential land tax rate, but the land is for establishing household registration of the following relatives : □ Principal □ Lineal relatives □ Children over 20 □ Spouse and minor dependents relatives supported by him 8. Above-mentioned houses are for use, and now alter to be residential use, please change to collect house tax by residential tax rate in the mean time. To Local Tax Bureau, County/City Owner’s name: (Signature/Seal) ID C or the Tax Code Number of Withholding Agencies: □□□□□□□□□□ Telephone Number: Address: Filing date: 0401 yyyy/mm/dd Description 1. The term “self-use residential land” herein means residential land under which the landowner or his/her spouse and/or relatives of direct lineage have their household registration and such land is not rented or used for business purpose. A landowner, his/her spouse, and his/her minor dependents may be eligible for the tax rate described in the first paragraph hereof for one parcel of land used for the purpose of self-use residence. (Article 9 and Article 17, Land Tax Act) 2. The self-use residential land apply to special tax rates, the landowner shall apply for the application of special tax rate at least forty days (Sep. 22) before the collection starting date each year (period); applications made past the aforesaid deadline will have special rate applied starting the following year. For land that has been approved for application of special rate, no application is required for subsequent years provided the use of land stays unchanged. Landowner shall report to the competent tax authority immediately when the condition for the application of special tax rate ceases to exist. (Article 41, Land Tax Act) 3. The land obtains to succession or bestowed to a spouse, the new landowner shall apply after registration. The land value tax on self-use residential land in following conditions shall be subject to 2‰ tax rate: (1) The portion of urban land less than three acres in area. (2) The portion of non-urban land less than seven acres in area. (Article 17,Land tax Act) 4. The self-use residential land as referred to under Article 9 of this Act is limited to those on which the buildings/improvements are owned by the landowners themselves or by their spouse or lineal relatives. (Article 4, the Enforcement Rules of the Land Tax Act) 5. For applying for eligibility of self-use residential land special rate on land value tax, landowners shall submit a completed application form along with a copy of household registration certificate and the buildings/improvement certificate to the competent taxation authority for approval. (Article 11, the Enforcement Rules of the Land Tax Act) 0401