Summary of the Spending Review impacts on the Carbon Reduction

advertisement

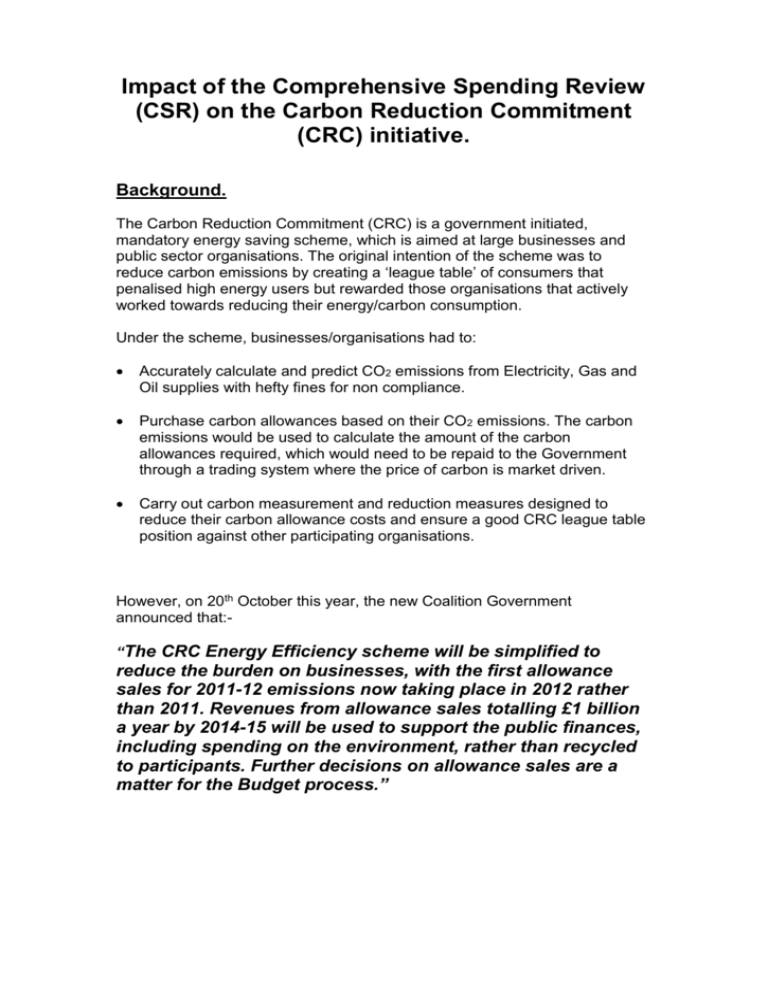

Impact of the Comprehensive Spending Review (CSR) on the Carbon Reduction Commitment (CRC) initiative. Background. The Carbon Reduction Commitment (CRC) is a government initiated, mandatory energy saving scheme, which is aimed at large businesses and public sector organisations. The original intention of the scheme was to reduce carbon emissions by creating a ‘league table’ of consumers that penalised high energy users but rewarded those organisations that actively worked towards reducing their energy/carbon consumption. Under the scheme, businesses/organisations had to: Accurately calculate and predict CO2 emissions from Electricity, Gas and Oil supplies with hefty fines for non compliance. Purchase carbon allowances based on their CO2 emissions. The carbon emissions would be used to calculate the amount of the carbon allowances required, which would need to be repaid to the Government through a trading system where the price of carbon is market driven. Carry out carbon measurement and reduction measures designed to reduce their carbon allowance costs and ensure a good CRC league table position against other participating organisations. However, on 20th October this year, the new Coalition Government announced that:“The CRC Energy Efficiency scheme will be simplified to reduce the burden on businesses, with the first allowance sales for 2011-12 emissions now taking place in 2012 rather than 2011. Revenues from allowance sales totalling £1 billion a year by 2014-15 will be used to support the public finances, including spending on the environment, rather than recycled to participants. Further decisions on allowance sales are a matter for the Budget process.” Current Position. The Comprehensive Spending Review (CSR) incorporates plans to alter the CRC proposals. Further public consultation on the CRC is expected to commence early next month, which may result in further changes being agreed before any legal alterations are made in early 2011. Changes to the CRC as detailed in the CSR “The first sale of Allowances for 2011/12 emissions will now take place in 2012 rather than 2011.” What this actually means. The initial sale of allowances will take place in 2012. This will postpone by 12 months the date by which the initial payment will need to be made. In practice participants (Local Authorities etc.) will need to purchase allowances to cover 2011/12 at the end of that financial year. Impact for Local Authorities: LA’s will have to purchase allowances for 2011/12 but not until after the end of that financial year. The start of 2012/13 may therefore require a double payment of CRC allowances, as allowances for 2012/13 may also need to be purchased. (Any amendment to this by the Government will require a change to the current CRC law) “Revenue from the sale of Allowance sales (which the Treasury estimates will total £1 billion a year by 2014-15) will be used to support the public finances (including spending on the environment), rather than recycled back to Participants in the scheme.” What this actually means: In order to support public finances, revenue from allowance sales will not be recycled back to participating organisations, but will be retained by central government. Impact: Under the previous guidance the CRC on average would cost a City Council the size of Bristol around £78,000 in 2011/12, increasing to around £390,000 in 2015/16. These figures are based on 65,000 tonnes of CO2, an average league table position and recycling payments. However that same City Council will now be liable for around £780,000 per annum in CRC costs based on a carbon price of £12/tonne and 65,000 tonnes of CO2 per annum. Year 2010/11 2011/12 2012/13 2013/14 2014/15 2015/16 CRC Allowance cost* N/a £0 £1.53 million £733,000 £712,000 £690,000 Comments Footprint year Delayed CRC until 2012/13 ‘12/13 AND ‘11/12 *Based on £12/tonne of Carbon and 3% carbon reduction actions “Further decisions on the sale of Allowances are a matter for the Budget process.” What this actually means: Allowance costs will no longer be based on carbon trading activity but will be controlled by the government. Impact: This should allow Local Authorities to budget more accurately in future years as the CO2 cost will now be agreed in advance by central government. Future Predictions Until further information is made available, there will continue to be uncertainty in the way that the scheme will be made to operate. This is creating additional risks for Local Authorities. The Environment Agency issued a statement on the 29th of October, which raised further questions, e.g. Details of how the Government is intending to simplify the scheme. As a ‘Performance League Table’ will be retained, how will Government ensure that it is a reputable driver with metric weightings and publication dates (as per current legislation). What form will the public consultation take. Confirmation of the proposed Legislative changes to the CRC. Is the end of November a realistic date for publication of details of the public consultation. Uncertainties yet to be addressed:A number of issues remain to be answered regarding the final workings of the revised CRC. These issues are unlikely to be addressed until after the consultation period has been completed. Subjects that require clarification include: Will the CRC be seen as just a further tax on consumers? Will procedures be consolidated regarding allowance sales, caps and trading? Will the purchase of allowances be confined to the end of the financial year? Landlord/ tenant responsibilities – the debate continues… Will the Performance League Table be retained in its present format? Will the threshold for inclusion in the scheme be lowered? Will the CRC just cover electricity and gas and remove the need for residual fuel counting? How will carbon emissions resulting from transportation be addressed? Increases in the cost of Carbon? Will the Government change the cost of carbon to raise further revenue? Commentators on the subject have suggested that the cost of allowances may rise from £12 to £16/tonne to meet the tax revenue that the government is looking to generate from the CRC. A £16/tonne Carbon price will result in an increase in the annual CRC cost of 25% (Based on the previous example, the cost to an average sized City Council would increase to £1,040,000 per annum. Summary In conclusion, recent correspondence, circulated jointly by The Scottish Government, The Welsh Assembly Government, The Department of the Environment and The Department of Energy & Climate Change states: “The CRC scheme is a joint scheme between Central Government and the Devolved Administrations, and revenue recycling is a matter for all the devolved administrations to review following the UK Government’s announcement. All four administrations are aware that stakeholders are concerned over the complexity of the CRC. A public dialogue and consultation with participants on how to simplify the CRC further will begin shortly.” – Watch this space!! Geoffrey Robinson (11/11/2010)