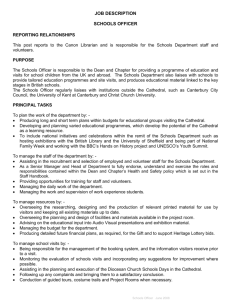

Accounting and Reporting

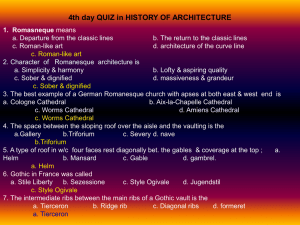

advertisement