ACC2 - Chemicals Policy & Science Initiative

advertisement

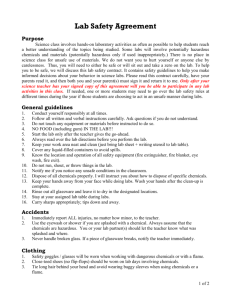

January 11, 2002 IMPACT OF THE PROPOSED EU CHEMICALS POLICY ON U.S. EXPORTS Executive Summary The European Union (EU) has proposed a policy to require the registration, evaluation, and authorization of chemicals in commerce. About 30,000 chemicals would have to be registered, and about 5,000 of these chemicals evaluated after extensive testing. For at least 850 chemicals, government authorization would be required. Any chemical that is not authorized would not be allowed into the EU market. The proposed EU policy will cost between $5.5 billion and $9.6 billion, with a best estimate of $7.2 billion over its projected 11-year duration. The cost of the program (equivalent to 3% of EU chemical R&D) will draw resources away from commercial R&D, which will adversely affect innovation. U.S. exports of chemicals to the EU, which represent about $17 billion in sales, are also affected adversely. U.S. exporters are expected to pay about $400 million of the cost of the program. The imposition of such costs will likely cause some U.S. exporters, especially small and medium enterprises (SMEs), to withdraw from the EU market because profit margins will be reduced. Because the EU policy requires authorization (explicit government approval) for at least 850 chemicals, a subset of these chemicals will be banned from the EU market. The value of U.S. exports of chemicals subject to authorization was between $200 and $900 million in the year 2000. This figure does not include the export value of some 500 chemicals that the EU expects to add to the authorization list after the program begins. Should the EU impose fees on exporters of finished products made from chemicals, the impact will be very wide in scope because chemicals serve as building blocks for all downstream products. Should the EU fail to authorize commercially important chemicals, exports of finished products would be adversely affected. Exports of selected finished products made from just four chemicals on the authorization list are currently valued at $8.8 billion. If the EU is successful in targeting finished products made from chemicals, the impact would be far reaching because (1) production of nearly all U.S. exports involve chemicals subject to the EU policy; (2) confidential business information would be disclosed, affecting the decision to export; and (3) innovation would be adversely affected. 1 Introduction The European Union (EU) has proposed a policy to require the registration, evaluation, and authorization of chemicals in commerce. According to the EU white paper, “Strategy for a Future Chemicals Policy”, about 30,000 chemicals would have to be registered, and about 5,000 of these chemicals evaluated after extensive testing. For at least 850 chemicals1, government authorization would be required. Any chemical that is not authorized would not be allowed into the EU market. The EU envisions a system that minimizes disruptions to European chemical producers. “Everyone who imports substances into the Community would make a fair contribution to these [testing] costs.” “The administrative costs . . . will be recovered through a feebased system.” (See white paper, section 3.4.) Clearly, U.S. exporters of chemicals are affected by the proposal. Less clear is the role of downstream users of covered chemicals. The white paper raises the possibility that U.S. exporters of products made from covered chemicals will incur registration, evaluation, and authorization costs. The purpose of this paper is to show the potential impact of the proposed policy on U.S. exports to the EU. Three tasks were undertaken. First, the Council developed a model to estimate the direct cost of data generation to U.S. chemical exporters. Second, the Council estimated the annual value of U.S. chemical exports at risk under the proposed policy. Finally, the Council examined the impact of the proposed policy on U.S. exports of finished products made from chemicals. Cost of Data Generation ACC developed a model to estimate the cost of the EU white paper on U.S. chemical exporters. The model is based on the EU’s assumptions about the number of chemicals subject to registration, evaluation, and authorization; the cost of data generation and risk assessment; the timeframe required for the program; and the administrative costs of the program. Estimates of the per-chemical cost of certain toxicological tests, exposure assessment, and risk assessment were determined from discussions with ACC companies and consultants in toxicology and risk assessment. The model assigns U.S. exporters a share of the program cost equal to the percentage of EU chemical demand met by US imports. The Council estimates the total direct cost of the program to be between $5.5 billion and $9.6 billion over the course of the program, with a best estimate of $7.2 billion. (This aggregate estimate of program cost is similar to other estimates, such as that developed by KPMG and CEFIC.2) This estimate includes all of the costs associated with 1 The actual number of chemicals subject to authorization would probably be much greater than 850, the minimum number provided in the white paper. For example, the white paper estimates that five hundred more may be added after testing is completed. 2 See CEFIC, “Barometer of Competitiveness: White Paper on Chemicals Policy”, Fall 2001 and KPMG, “The European Commission’s Chemicals Policy—Is It Viable?”, summer 2001. 2 registration, evaluation, and authorization, including the cost of administering the program. The cost may be even higher than these figures suggest because (1) more than 30,000 chemicals may be subject to the program, (2) the authorization process may be much more burdensome than envisioned by the white paper, and (3) demand for laboratory capacity may result in much higher prices for testing than current market conditions dictate.3 Given this program cost, innovation will be adversely affected. CEFIC data show that, at $7.2 billion over 11 years, the proposed EU policy equates to 3% of chemical R&D spending in the EU. Because it is likely that the proposed policy will draw resources away from commercial R&D, the EU chemical industry will be adversely affected. 4 The impact on U.S. exporters is shown in Table 1. Under an equitable (i.e., marketshare-based) allocation system, U.S. exporters would be expected to pay $387 million over the 11-year period envisioned by the EU. Of the total cost to U.S. exporters, 86% would be for chemical testing, 4% for risk assessment (including exposure assessment), and 10% for recovery of administrative costs. Note that these costs are only those related to information provision and evaluation. Such costs are considerably less than the value of U.S. exports that would be lost if chemicals are not authorized. Inappropriate product bans would occur if the EU fails to authorize a chemical due to incorrect (e.g., a false positive test) information, incomplete (e.g., companies miss the deadline) information, or administrative delay. Table 1. Direct Cost (in millions $) to U.S. Exporters. Program Low Estimate Best Estimate Component Registration/Testing 294 333 Administration 40 40 Risk Assessment 12 14 Total 346 387 High Estimate 370 40 20 430 Note: The low estimate signifies a 10% chance that the actual value will be lower than that shown. Similarly, the high estimate signifies a 10% chance that the actual value will be higher than that shown. The “best” estimate signifies a 50% chance that the actual value will be higher or lower than that shown. 3 Although the white paper states that 30,000 chemicals would be covered, this figure apparently excludes unique polymeric substances, of which there are tens of thousands. If each unique polymer were subject to registration, the estimated cost of the program would be much more than the ACC model suggests. In addition, history suggests that the authorization process could be very expensive in some cases (several million dollars per chemical), much more than the average cost figure ($150,000 per chemical) used in the ACC model. KPMG has determined that the timeframe envisioned in the white paper (11 years) is not adequate to complete the testing requirements, given limitations in existing laboratory capacity. If laboratory capacity is limited, the cost of chemical testing will be greater than current market prices suggest. 4 This scenario provides an incentive for the EU to require importers to pay more than their fair share of the program cost. For the purpose of this paper, however, the Council assumes equitable cost sharing. 3 U.S. Exports at Risk According to the EU white paper, U.S. exports will be affected in two ways. The first is the imposition of fees to cover the cost of the program. The second is the possibility that products will be banned from the EU market, placing entire categories of U.S. exports at risk. This section describes quantitatively the value of U.S. exports at risk. In general, the impact of the proposed policy depends greatly on how fairly it is implemented. If exporters are targeted inequitably, EU producers will have a competitive advantage over U.S. exporters, and U.S. exports will be at risk. Even if U.S. exporters are charged fees that are equitably shared, some exporters (small and medium enterprises are particularly at risk) will withdraw from the market if the increase in fixed cost cannot be passed on entirely to customers. Of special interest are U.S. exports of chemicals subject to authorization. If the EU fails to authorize a chemical, the product cannot be sold in the EU market. This possibility underscores the importance of understanding the value of U.S. exports of both chemicals subject to authorization and products made from chemicals subject to authorization. Exports of Chemicals. In the aggregate, the United States exported roughly $17 billion worth of chemicals to the EU in the year 2000, which represents 6.3% of EU chemical demand.5 Chart 1 shows the relative value of U.S. chemical exports to the EU by industry segment. Basic chemicals represent 65% of the total value of chemical exports. Chart 1. U.S. Chemical Exports to the EU (Year 2000) Basic Specialties Consumer Products Source: CEFIC, U.S. International Trade Commission 5 The Council used CEFIC data on the 1999 value of extra-EU imports ($57.6 billion), extra-EU exports ($99.3 billion), and EU production ($402.7 billion) to determine the share of EU apparent consumption of chemicals (i.e., demand) met by U.S. imports ($25.6 billion). This figure for the value of U.S. chemical imports is greater than the $17 billion figure provided elsewhere in this paper because it includes life science products (pharmaceuticals and crop protection chemicals) that are not subject to the proposed EU chemicals policy. 4 Chart 2 shows the major categories of basic chemicals that are exported from the US to the EU. Bulk petrochemicals and intermediates represent 44% of the total value of basic chemical exports, followed by polymers (36%) and inorganic compounds (9%). The U.S. International Trade Commission keeps statistics on the value of exports to the EU by product type. All U.S. chemical exports are potentially subject to the proposed EU policy. Of particular interest chemical exports that will be subject to authorization.6 Table 2 lists six chemicals that are subject to authorization and are exported in significant amounts to EU countries. In the year 2000 (the most recent year for which data are available), these chemicals represented $171 million in U.S. exports. Chart 2. U.S. Basic Chemical Exports to the EU bulk petrochemicals polymers inorganics other Source: U.S. International Trade Commission Table 2. U.S. Exports of Selected Chemicals Subject to Authorization. Chemical Subject to Authorization Value of U.S. Exports (millions $) Acrylonitrile 43 Propylene oxide 43 Phenylenediamine 39 Phenol 27 Chromium oxides 13 1,3-Butadiene 6 Total 171 Source: U.S. International Trade Commission 6 ACC used a list of chemicals that are currently listed by the EU as Category 1 or 2 carcinogens, mutagens, or reproductive toxins (CMRs). According to the EU white paper, these chemicals will be subject to authorization. 5 Unfortunately, U.S. data on chemical exports are seldom grouped by specific chemical, but rather by category (e.g., heterocyclic compounds). To estimate the upper-bound value of U.S. chemical exports subject to authorization, the Council matched the U.S. ITC list of export categories against the EU list of chemicals in need of authorization. From this exercise, the Council concluded that as much as $918 million in annual U.S. exports are subject to authorization.7 Therefore, on the basis of U.S. export information, chemicals that will be subject to EU authorization represent somewhere between $171 million and $918 million in annual exports. This estimate (between $171 million and $918 million) is likely to be low because, as noted in the EU white paper, the current list of chemicals in need of authorization is likely to expand by an additional 500 chemicals after the evaluation phase. Exports of Finished Products. Should the EU charge U.S. exporters fees to cover data generation for chemicals used in finished products (a circumstance contemplated in the white paper), the impact would be wide in scope. Virtually all of the major products exported from the U.S. to the EU are made from commercial chemicals. Even if the EU only targeted products made from chemicals on the authorization list, the number of products would be large. Of the chemicals on the authorization list, 22 are commercially important, representing $18.6 billion in annual U.S. production (see Table 3). Selected end use products made from just four of these chemicals represented $8.8 billion in U.S. exports in the year 2000 (see Table 4). Another troubling issue of particular relevance to finished products is confidential business information. Information collected and made public under the EU policy in some cases represents confidential business information (e.g., the identity of chemicals used in a lubricating fluid may be the source of competitive advantage). If exporters are required to disclose confidential business information, U.S. exports to the EU will drop. In the long run, innovation and productivity will suffer. Conclusions At a minimum, U.S. exporters will be forced to pay a share of the cost of data generation under the proposed EU policy. This cost, which is expected to be between $346 and $430 million over the 11-year life of the program, will either be (1) passed on to downstream customers in the form of higher prices or (2) absorbed and profit margins reduced, affecting the decision to export. The second option becomes more likely should the EU develop a system that unfairly burdens U.S. exporters.8 7 This number is conservative because the Council did not match ITC export categories having less than $5 million in annual value against the authorization list. 8 The EU could implement a system that unfairly penalizes U.S. exporters if it (1) charges exporters on a non-market share basis or (2) does not accept testing data generated by the exporter. 6 Table 3. U.S. Production Value of Chemicals Subject to Authorization. Chemical Value of U.S. Production (millions $) Acrylamide 138 Acrylonitrile 1,265 Asbestos 5 Benzene 3,329 Benzyl chloride 50 Beryllium 236 1,3-butadiene 1,107 1,2-dibromo-3-chloropropane 30 Dibutyl phthalate 9 Epichlorohydrin 752 Ethylene dichloride 2,622 Ethylene oxide 4,689 2-ethoxyethanol 49 Hydrazine 55 Lead chromate 18 Methyl chloride 233 Phenols, ammonia liquor extract 5 Propylene oxide 1,354 Sodium dichromate 235 Trichloroethylene 159 Vinyl chloride monomer 2,157 Zinc chromates 30 Total 18,527 Sources: Chemical Marketing Reporter, Chemical Week, SRI Chemical Economics Handbook, and the U.S. International Trade Commission. Table 4. Value of U.S. Exports Made from Chemicals on the Authorization List. Chemical Selected End Use1 Value of U.S. Exports (millions $) Acrylonitrile Telephones 31 Business machines 7,485 Propylene oxide Boats and boat hulls 230 Tubs/shower stalls 6 1,3-Butadiene Tires (for aircraft and motor 190 vehicles) Belts/gaskets/hoses 188 Phenol Printed circuit boards 641 Plywood, particleboard, and laminated wood 75 Total 8,846 Sources: U.S. International Trade Commission, SRI Chemical Economics Handbook 1 Only some commercially important end uses were identified and quantified. 7 If profit margins were reduced, small and medium enterprises (SMEs) would experience a disproportionate impact. Theoretically, this scenario should occur in any competitive market where an increase in fixed cost is imposed through government policy. Because markets for commodity chemicals are competitive, the Council believes that the EU policy would force SMEs to exit the EU market rather than accept lower profit margins for their products. Should the EU fail to authorize commercially important chemicals, the impact on U.S. exporters could be significant. Between $171 million and $918 million in annual U.S. exports are at risk for chemicals that will be subject to authorization. Because the EU believes as many as 1,350 chemicals would be in need of authorization, the value of U.S. chemical exports at risk is likely to be much larger (an upper-bound estimate of $17 billion annually). If the EU is successful in targeting finished products made from chemicals, the impact would be far reaching because (1) production of nearly all U.S. exports involve chemicals that would be subject to the EU policy; (2) confidential business information would be disclosed, affecting the decision to export; and (3) innovation would be adversely affected. Prepared by Keith B. Belton, Martha Moore, Emily Myers, and Kevin Swift American Chemistry Council January 11, 2002 8