File Ref:

advertisement

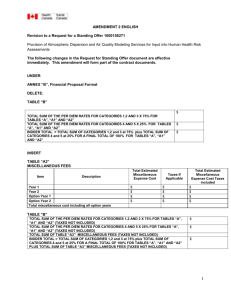

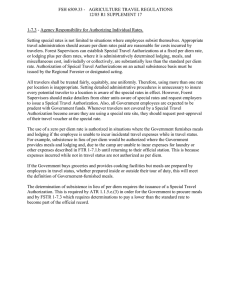

Payroll Tax UNAQUITTED PER DIEMS Normally, advances for a per diem allowance are acquitted. However, University policy changes have allowed unacquitted per diems for overseas travel only. The Australian Taxation Office does not consider non acquittance of Per Diem rates as a Fringe Benefit provided the rates are within the Reasonable Benefits Limits (RBL). The State Governments have a different view and considers this as part of the cost of employment. Accordingly Payroll Tax (4.95% for S.A.) needs to be calculated on the unacquitted amount & paid to the State Government. Please note: This is not a Fringe Benefit & consequently will not appear on an individual’s Payment Summary (previously called Group Certificate). Below is the process: Complete a Request for Unacquitted Per Diem The per diem will be expensed against natural account 2023 within the CC-Project nominated. At the end of each period the Payroll Tax rate is calculated on the total amount for the period in natural account 2023 as shown below The result of this calculation is debited against the same CC – Project, etc but using natural account 2055 (Payroll Tax Non-Acquit per diem). EXAMPLE Period 3 has a balance of $2,000 in Entity - CC – Project – 2023 $2,000 x 4.95% = $99.00 is debited against Entity - CC – Project – 2055 N.B. PER DIEMS FOR OTHER OVERSEAS TRAVEL STILL NEEDS TO BE ACQUITTED Further information, please refer to: The provisions of the University's Travel policy (https://www.flinders.edu.au/ppmanual/finance/travelaccommodation-and-subsistence.cfm), which covers airline travel, accommodation, meals and incidentals. The Reasonable overseas/per diem allowance amounts as published by the ATO are available at http://www.flinders.edu.au/finance/tax-information/tax-information_home.cfm . Receipts/documentation will be required for non- pre-paid accommodation, and expenses which exceed the per diem rate.