The Top 10 Reasons Why Private Company Directors and Officers

advertisement

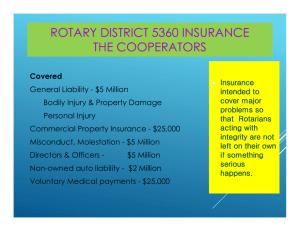

Willis Why Private Company Management Liability is Critical Management liability claims affect all companies, large and small, public and private. Many relate management liability claims with the front page headlines of Enron, Adelphia, Tyco, MCI Worldcom, Healthsouth, etc. While these public company management liability claims attract the greatest attention, there are thousands of private company claims made every year which correlate to millions of dollars in settlements and jury awards. Yet often private company directors and officers feel that due to their nonpublic filing status the likelihood of a claim is negligible. But, the fact is that the directors and officers of private companies are vulnerable to these claims. Because they are often involved in day-to-day operations and the decision makers in most circumstances, private company directors and officers are more likely to be named in lawsuits initiated by employees and others. Moreover, in closely-held private companies, the owner’s personal net worth may be tied to the financial health of the company making costly D&O liability claims even more devastating. As mentioned above, relatively few private company management liability claims make headlines, but these claims are filed virtually everyday by employees charging private company directors and officers with wrongful termination, discrimination and harassment. Courts have held both management and the company responsible for wrongful acts of subordinates, and for negligent supervision, improper screening of employees, and failing to investigate or respond to employment-related violations. Right or wrong, employment claims are costly, some 85 percent of all employment practices cases are settled, usually for undisclosed amounts. And the number of employment practices claims filed against directors and officers has doubled in recent years. Nearly 80,000 employment practices claims were filed with the EEOC in 1999; monetary damages in these cases topped $200 million – compared to $169 million in 1998. The most common charges filed with the EEOC in 1999 were racial discrimination (37.3%), sex discrimination (30.9%), retaliation (25.4%), disability discrimination (22.4%), age discrimination (18.3%). Beyond employment practices claims, private companies may be sued by shareholders and customers, as well as competitors, government bodies, creditors and others. The following points demonstrate why the purchase of directors and officers insurance is critical: 1. D&O insurance from a quality insurer can take private companies through their IPO and into public ownership well protected. Developing a proven track record with a quality insurer provides an insured with an easier transition into the public D&O insurance market. Private companies with a established relationship with a D&O carrier often receive reduced pricing and expansive terms. 2. Complex claims brought by competitors, such as anti-trust and unfair competition claims against directors and officers, can generate sky-high defense and settlement costs. 3. Investigations by government and regulatory agencies can generate enormous defense costs – – even if no wrongdoing is found. And when wrongdoing is found, settlement values are often severe. 4. During the bankruptcy wave of the past 4 years there have been a record amount of creditor claims and bankruptcy trustee claims against bankrupt company boards. Lenders have sought restitution at the expense of the individual board members personal assets. 5. Company assets can be closely tied to the personal wealth of directors and officers, making protection for claims brought solely against the company vital. Willis 6. When the company cannot indemnify its directors and officers in D&O claims, D&O insurance can step in instead. 7. Shareholders of private companies frequently sue for inadequate or inaccurate disclosure in financial reports and statements made in private placement materials. 8. D&O insurance can protect the personal assets of a director’s or officer’s spouse, as well as the assets of a deceased director’s or officer’s estate. 9. With D&O insurance in place, management can focus on managing the company rather than managing protracted litigation The following scenarios, based on actual claims, illustrate the need for Directors, Officers and Private Company Liability Insurance. SHAREHOLDER SEEKS RESTITUTION A minority shareholder of a closely–held corporation alleges that the board of directors and certain officers conspired to assist the majority shareholder in maintaining majority control of the company when the minority shareholder attempted to purchase a greater controlling interest. At trial, a jury awarded the minority shareholder $4.2 million in compensatory damages and $445,000 in plaintiff’s attorney fees. CREDITOR SUES FOR BREACH OF FIDUCIARY DUTY A creditor of a Mississippi-based private company sues the company, their board of directors, and the controlling private equity group alleging, among other things, breach of fiduciary duty by the board. The creditor further alleges that the private equity group over-leveraged the company in a desperate attempt to compete against more savvy, well-funded competitors. The result was the company filing for Chapter 11 under a mountain of debt and laying off hundreds of employees. The case settled for $18 million. Defense costs were $2.3 million. FORMER EMPLOYEES ALLEGE DISCRIMINATION A former employee sued a California-based private company and their board of directors for disability discrimination and wrongful termination, alleging that the company failed to accommodate his medical condition after his back was injured on the job. The plaintiff also alleged that the insured’s actions caused him emotional distress. He sought punitive and compensatory damages. Although the plaintiff’s initial settlement demands exceeded $1.5 million, the matter was ultimately settled in mediation for $120,000. Defense costs totaled $110,000. EMPLOYEES SUE FOR HARASSMENT AND DISCRIMINATION Two female managers alleged that sexual harassment and discrimination was behind their slower-thanexpected rise through management. They sued their employer, demanding $3 million in damages. The case settled for $2 million. Defense costs were $1 million. The scenarios summarized herein are offered only as examples. Coverage depends on the actual facts of each case and the terms, conditions and exclusions of each individual policy. Policy terms may vary based on individual state requirements and may not be available in all states. Willis