IN THE HIGH COURT OF MALAYA AT KUALA LUMPUR (CIVIL

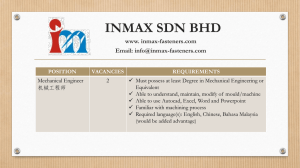

advertisement

IN THE HIGH COURT OF MALAYA AT KUALA LUMPUR (CIVIL DIVISION) ORIGINATING SUMMONS NO: S24-156-2010 In the matter of MAYA MAJU (M) SDN BHD And In the matter of the Circular Board Resolutions dated 19.8.2009 and an Undated Circular Resolution (Writing-Off Amount Due from Director) And In the matter of Sections 131 and 132 of the Companies Act 1965 In the matter of Chapters VI, IX, X, Specific Relief Act 1950 And In the matter of Order 7, Order 28 and Order 92 Rule 4, Rules of High Court 1980 BETWEEN DATO’ RAJA AZWANE BIN RAJA ARIFF 1 …PLAINTIFF AND 1. DATO’ MAN BIN MAT 2. MD NIZAM BIN MD SHERIF @ MD SHARIF …DEFENDANTS THE DECISION OF JUDICIAL COMMISSIONER Y.A. TUAN LEE SWEE SENG Prologue In all companies there will invariably be majority shareholders and minority shareholders. Problems arise when the minority is not consulted and decisions are made by the majority alone. The minority may be represented by directors and sometimes the so-called directors’ circular resolution is not circulated to the directors representing the minority shareholders to sign. Can the majority still say in any event the result would be the same if a properly constituted board and shareholders’ meeting were to be convened? The resolution would still be carried. Or would the aggrieved director have a remedy? Is that remedy different from that of a minority shareholder in a derivative action? This case will explore that and other related issues. 2 Parties Both the Plaintiff and the Defendants are directors of Maya Maju (M) Sdn Bhd (the Company). The Plaintiff is also a minority shareholder holding 25% of the equity in the Company controlled by the Defendants. Problem The Plaintiff is both aghast and aggrieved that there was a circular board resolution dated 19.8.2009 signed by only both the Defendants as directors of the Company, served on EON Bank Berhad on 3.9.2009. This 1st Directors’ Circular Resolution (DCR) was retrieved from the Bank at the Defendants’ instruction by the accounts manager one Hasrul bin mansor (HM). Thereafter on 9.9.2009 the said accounts manager on the instruction of the Defendants went again to EON Bank to serve a copy of the circular board resolution dated 19.8.2009 where the content is the same as the 1st DCR this time including the purported signature of the Plaintiff (the 2 nd DCR). The Plaintiff denied having signed the 2nd DCR. Both the 1st and 2nd DCRs are marked as Exhibit DRA 4 & 5 respectively in the Plaintiff’s Affidavit in Support of his Originating Summons (OS). 3 The effect of the 1st and 2nd DCRs is to allow the Bank to honour cheques signed by both the 1st Defendant and either the Plaintiff or the 2nd Defendant. Prior to the change that sought to be effected, the signatories were the 1st or 2nd Defendant from Group A and either the Plaintiff or one Dato’ Tan Kim Kuan (TKK) from Group B. The said TKK resigned as a Director on 7.4.2009. He had a second complaint in that a similarly worded DCR dated 19.8.2009 was sent to Ambank Berhad to effect a similar change to the signatories, marked as Exhibit DRA-6. The Plaintiff lodged a police report on 18.9.2009 with respect to his forged signature in the 2nd DCR, marked as Exhibit DRA-7. The Plaintiff was alerted on the 1st and 2nd DCR by an officer from EON Bank and he had also written to the Bank confirming that his purported signature as a Director in the 2nd DCR is a scanned signature and that he had not signed the 2nd DCR (Exhibit DRA-8). According to the Plaintiff, the said HM had on 11.9.2009 collected back the 2nd DCR and on 14.9.2009 again forwarded the 1st DCR to the Bank. The Plaintiff had the cooperation of an officer of the Bank who had made a 4 photocopy of the 2nd DCR before passing it back to HM. Subsequently the Defendants’ solicitors issued a Letter of Demand dated 14.9.2009 requiring the Bank to comply with the 1st resolution on the ground that it had been signed by a majority of the Directors. The said EON Bank before acting on the 1st DCR had required the Defendants to execute a letter of indemnity for the Bank and that was duly complied with. Article 90 of the Company’s Articles of Association under which the DCRs were passed reads: “A resolution in writing signed by a majority of the Directors for the time being or their alternates not being less than two Directors shall be a valid and effectual resolution as if it had been passed by a meeting of Director duly called and constituted.” The Plaintiff stated clearly and categorically that both the 1st and 2nd DCR and the DCR to Ambank Bank had not been served on him whether for his attention or for his signature at any material time. The Plaintiff’s stand is that the said DCRs had not been approved by the Board of Directors of the 5 Company and he further stated that he only knew about the DCRs after they were served by the Defendants on EON Bank and Ambank Berhad. The Plaintiff had another startling and shocking discovery when from his inquiry he found out that the Defendants have passed an undated circular board resolution to write-off an amount of RM4,868,216.50 due and owing from the 1st Defendant to the Company without his knowledge. The said undated resolution had been certified as a true company by the Company Secretary (see Exhibit DRA-9). Prayers This is an application by the Plaintiff pursuant to Sections 131 and 132 of the Companies Act 1965, Chapters VI,IX and X, Specific Relief Act 1950 and Order 7, Order 28 and Order 92 Rule4, Rules of High Court 1980 for the following orders:1) a declaration that the circular board resolution of Maya Maju (M) Sdn Bhd dated 19.8.2009 authorising the 1st defendant as the sole compulsory signatory to Maya Maju (M) Sdn Bhd’s bank account at EON Bank Bhd is invalid, null and void; 6 2) a declaration that the circular board resolution of Maya Maju (M) Sdn Bhd dated 19.8.2009 authorising the 1st defendant as the sole compulsory signatory to Maya Maju (M) Sdn Bhd’s bank account at Ambank Bhd is invalid, null and void; 3) a declaration that all cheques of Maya Maju (M) Sdn Bhd signed by the 1st and 2nd defendants pursuant to the aforesaid circular board resolutions dated 19.8.2009 are invalid, null and void; 4) a declaration that the undated board resolution of Maya Maju (M) Sdn Bhd purportedly approving the write-off of an amount of RM4,868,216.50 owing and payable by the 1st defendant to Maya Maju (M) Sdn Bhd is invalid, null and void; 5) an order that the aforesaid circular board resolutions dated 19.8.2009 of Maya Maju (M) Sdn Bhd be and are hereby cancelled and set aside; 6) an order that the aforesaid undated circular board resolution approving the write-off of the said sum of RM4,868,216.50 be and is hereby cancelled and set aside; 7 7) an order that the defendants affirm an affidavit and file the same in Court for the purpose of declaring the total amount of money paid out by Maya Maju (M) Sdn Bhd in respect of the cheques issued by the defendants pursuant to the said circular board resolutions dated 19.8.2009; 8) an order that the defendants pay to Maya Maju (M) Sdn Bhd the total amount of money paid out by Maya Maju (M) Sdn Bhd under the cheques issued by the defendants pursuant to the said circular board resolution dated 19.8.2009 within seven (7) days of this order; 9) an order that the defendants pay interest to Maya Maju (M) Sdn Bhd at the rate of 8% per annum in respect of all the monies adjudged herein from the date when such money was paid out by Maya Maju (M) Sdn Bhd to the date of their full repayment to Maya Maju (M) Sdn Bhd by the defendants; 10) an order that the 1st defendant pays the sum of RM4,868,216.50 to Maya Maju (M) Sdn Bhd within seven (7) days of this order; 11) cost of this action on a full indemnity basis; and 8 12) any other order of relief as deemed fair or expedient by this Honourable Court. The Defendants by Enclosure 5 by way of a summons-in-chambers applied for the following: 1) that prayers 3,4,6,7,8,9 and 10 in the Plaintiff’s Originating Summons dated 20.1.2010 be struck out pursuant to Order 18 rule 19 (1)(a) of the Rules of the High Court, 1980; 2) that prayers 1,2 and 5 in the Plaintiff’s Originating Summons dated 20.1.2010 be struck out pursuant to Order 18 rule 19(1)(b) and (d) of the Rules of the High Court 1980 and pursuant to the inherent jurisdiction of this Honourable Court; 3) by reason of 1) and 2) above, the Plaintiff’s instant Originating Summons be struck out. Along the way during submission, counsel for both parties by consent agree that the circular board resolution which is undated purporting to write-off the sum of RM4,868,216.50 owing and payable by the 1st Defendant to the Company is not a resolution at all and as such the Plaintiff 9 withdrew his prayers with respect to 4), 6) and 10) and the said prayers were struck out with no order as to costs. Principles Whether a Director has a cause of action against the other Directors who have perpetrated a wrong against the Company The Defendants submitted that the Plaintiff cannot bring this action in his personal capacity as a Director of the Company as the Plaintiff is seeking to prevent wrongs done to the Company that is the dissipation of funds by the issuance of cheques by the 2 Directors of the Company, the Defendants herein. It was further submitted that the monies in the bank accounts of the Company is undoubtedly the assets of the Company and not the asset of any one of the shareholders or directors of the Company. As support for this proposition the Defendants referred to Abdul Aziz Bin Atan & 87 Ors v.Ladang Rengo Estate Sdn Bhd [1985] 2 MLJ 165 and to the case of Abdul Rahim Bin Aki v. Krubong Industries Park (Melaka) Sdn Bhd and Ors [1995] 4 CLJ 551 at p.559-560 where on a derivative action, which is what a minority shareholder like the Plaintiff can bring 10 against the other Directors and the Company for a wrong suffered by the Company, Gopal Sri Ram JCA (as he then was) had this to say: “…It is based upon the premise that the company which has been wronged is unable to sue because the wrongdoers are themselves in control of its decision making organs and will not, for that reason, permit an action to be brought in its name. In these circumstances, a minority shareholder may bring an action on behalf of himself and all the other shareholders of the company, other than the defendants. The wrongdoer must be cited as defendants. So too must the company. The title to the action must reflect that the suit is being brought in a representative capacity. The statement of claim or other pleading filed in support of the originating process must disclose that it is a derivative action and recite the facts that make it so. Further there must be an express statement in the pleading that the action is being brought for the benefits of the company named as a defendant. An action that does not meet these requirements is liable to be struck out as being frivolous and vexatious.” The Plaintiff’s counsel however contended that this is not a derivative action but an action by a Director of the Company whose rights have been 11 infringed with the consequences that any cheques issued and honoured by the banks based on the impugned DCRs have to be paid back to the Company by the Directors responsible for the invalid acts. In the Chan Choon Ming v. Low Poh Choon & 4 Ors [1995] 1 CLJ 812, V C George J. (as he then was) dealt with a situation where the Plaintiff, a director of the fourth defendant company, complained that by several Art. 90 resolutions signed by a majority of the directors of the fourth defendant company, the second and third defendants were appointed as directors of the company and a certain number of shares were transferred in their favour from the first defendant. Subsequently, an extraordinary general meeting was convened where another Art 90 resolution was passed by the majority of the directors to remove the plaintiff from the board of directors. Of the several resolutions passed, only the last had been circulated to or otherwise brought to the plaintiff’s attention or knowledge prior to the resolutions being made. The plaintiff in an originating summons action prayed for a declaration that the appointment of the directors were null and void and consequential and other orders sought were granted. The Article 90 reads: 12 “A resolution in writing signed by a majority of the directors present in Malaysia entitled to receive notice of a meeting of the directors, shall be as valid and effectual as if it had been resolved at the meeting of the directors duly convened and held.” At p.814 and 815 V C George J (as he then was) held that:“It turns out that although the plaintiff had at all relevant times been a member of the board, none of the above Art. 90 resolutions save the one dated 12 July 1991 were at relevant times, circulated to or otherwise brought to the plaintiff's attention or knowledge. The short question for adjudication in this case is the validity of the Art. 90 resolutions signed by a majority of the directors but with all knowledge that there were these resolutions, kept away at all relevant times, from the plaintiff. The directors are the primary organ of a company. They have powers conferred on them to manage the company. These powers are conferred upon the directors collectively as a board. Prima facie, they can be exercised only at a board meeting of which due notice has been given and at which a quorum is present. And although majority 13 decision prevails, it is trite that a meeting of the majority without notice to the minority is ineffective - Re Portuguese Copper Mines [1889] 42 Ch. Div. 160; Young v. Ladies Imperial Club [1920] 2 KB 523. The exception to this, not relevant here, is that if all the directors are present and consciously made a decision, that decision will not be ineffective simply because formal notice was not given - Swiss Screens (Australia) Pty. Ltd. v. Borgess [1987] 11 ACLR 756, 758. Article 90 which is one of the articles under the general heading "Proceedings of Directors", has to be read in the context of the principle that the powers conferred upon directors are conferred on them collectively as a board. In that context it is inconceivable that notice of an intended resolution of the directors need not be given to every member of the board. If upon the majority signing such a resolution it is not necessary to pass it on to the others who are present in the country there could be a situation of a company being managed, not by the board, but by a clique, no doubt consisting of the majority of the board, using Art. 90 type of resolutions and leaving the minority completely in the dark as to what is happening in and to 14 the company. It cannot then be said that the business of the company is managed by the directors (as provided by Art. 73). In Pulbrook v. Richmond Consolidated Mining company [1878] 9 Ch. D. 610, 612, what Jessel M.R., said, in dealing with the case of a director who was improperly and without cause excluded from meetings of the board, is I think applicable to a director kept in the dark in respect of an Art. 90 resolution. He said, He has been excluded. Now, it appears to me that this is an individual wrong, or a wrong that has been done to an individual. It is a deprivation of his legal rights for which the directors are personally and individually liable. He has a right by the constitution of the company to take a part in its management, to be present, and to vote at the meetings of the board of directors. He has a perfect right to know what is going on at these meetings. It may affect his individual interest as a shareholder as well as his liability as a director, because it has been sometimes held that even a director who does not attend board meetings is bound to know what is done in his absence. 15 In my judgment to make Art. 73 meaningful and to give effect to the collective responsibility of the board, although all that is required for an effective Art. 90 resolution is that it be signed by the majority, it must be taken as implied that every member of the board has to have the resolution circulated to him or her before it can be accepted as a directors' resolution. Which is why in board room parlance, an Art. 90 type of resolution is usually referred to as a circular resolution. Each of the said resolutions, notice of which was not given to the plaintiff, is, in my judgment, ineffective. Article 89 reiterates s. 127 of the Companies Act 1965 to provide for the validity of acts of directors notwithstanding that it is afterwards discovered that there was some defect in the appointment of any such director. In Morris v. Kanssen & Ors. [1946] 1 All ER 586, 590 Lord Simonds expressing the opinion of the House of Lords in respect of an Article equivalent to the said Art. 89 said: There is, as it appears to me, a vital distinction between (a) an appointment in which there is a defect or, in other words, a defective appointment, and (b) no appointment at all. In the first case, it is implied that some act is done which purports to be an 16 appointment but is by reason of some defect inadequate for the purpose: in the second case, there is not a defect; there is no act at all. The section does not say that the acts of a person acting as director shall be valid notwithstanding that it is afterwards discovered that he was not appointed a director. In my judgment Art. 89 and s. 127 have no relevance in respect of the said ineffective Art. 90 resolutions the subject of this case in that as the resolutions were ineffective the purported appointment of the second and third defendants as directors were no appointments. This is not a case of some defect in their appointments. In effect they were never appointed. There was no appointment ab initio. Accordingly it was declared that the appointment of the second and third defendants as directors of the fourth defendant was null and void and the consequential and other orders sought were given.” The approach taken by his Lordship V C George J (as he then was) makes good sense and has support of the jurisprudence in UK and Australia, It augers well for good corporate practices in Malaysia. It is not uncommon 17 for the majority to often flex their muscles and ride roughshod over the rights of the minority or to bulldoze their way through any bargain they hope to strike. The fact that Art 90 merely requires a resolution in writing to be signed by a majority of the Directors of the Company for it to be valid and effectual does not mean that resolution does not have to be brought to the notice of all the Directors of the Company. It is the consultation with all the Directors, the conferring with one another and the consensus that may be arrived at that constitute the collective decision of the Board even if it be, at the end of the day, a majority’s decision. This process of consultation, conferring with one another and convincing one another as to what would be in the best interest of the company should not be short-circuited. The director who is in a minority but convinced that the action taken by the majority of the board would not be bona fide in the best interest of the company may have a few options before him: resign as a director; transfer his shares to the majority for a negotiated price, requisition for an EGM of members to more fully consider the resolution that is sought to be passed or even apply to court for the relevant injunction reliefs if what is sought to be done is against the Memorandum and Articles of Association of the company concerned. The majority with a view to acting in the best interest of the company cannot justifiably shut their ears to the objections and 18 arguments raised by the minority and who knows, the minority may at times convince the majority in the board that their proposed action might not be in the best interest of the company. It is even more pertinent when the rights of the Plaintiff here is being removed as in his right to be a co-signatory of all cheques without being given a right to be heard. There is a patent lack of good faith in the submission of the 1st DCR to EON Bank without the Plaintiff’s signature as a Director, a subsequent second submission of the 2nd DCR bearing a ‘scanned’ signature which is being vigorously denied by the Plaintiff as his signature and culminating in a comedy of errors in the recalling and return of the 2nd DCR and it being replaced by the 1st DCR-an embarrassing exposure of the Defendants’ egregious conduct! If a circular resolution of the board is held to be null and void under such a circumstance with respect to appointment of new directors, a fortiori it will nullify and void the purported change of signatories to the Company’s bank acoounts. In Khoo Choon Yam v. Gan Miew Chee & Ors [2000] 2 CLJ 788, the plaintiff who was a director of the 5th defendant company had been removed as a director pursuant to a resolution passed by two of the five existing directors of the company for the appointment of the 1st and 2nd 19 defendants as additional directors of the company. The resolution, however, was not sent to the plaintiff. The defendants contended that the plaintiff was not in Malaysia at that time but this was denied by the plaintiff. By an originating summons the plaintiff sought a few declarations and the court granted two declarations, first that the plaintiff was still a director and second that the appointment of the additional directors by a circular resolution dated 26.2.1999 was null and void. His Lordship Abdul Hamid Mohamad J. (as he then was) followed the case of Chan Choon Ming (supra) and held at p.791: “However, was the plaintiff entitled to be given a copy of the resolution for his consideration and approval or otherwise, whether or not he was in Malaysia? I am of the view that in law he has a right to be given notice of such resolution.” In Polybuiding (S) Pte Ltd v Lim Heng Lee and others [2001] 2 SLR(R)12 at p.15-16, G P Selvam J in the Singapore High Court quoted in extenso from the decision of V C George J (as he then was) in Chan Choon Ming (supra) and distilled the following propositions of law from an array of authorities: 20 (a) Every director of a company, by reason of being vested with the power to act on behalf of the company becomes a fiduciary. That fiduciary office imposes on every director an equitable duty to act bona fide in the interest of the company as a whole and not for personal and ulterior reasons. Lack of bona fides of the directors is a good ground to invalidate the written resolution. The impropriety of individual directors will be imputed to the company which has notice of the impropriety through its directors. See Chua Boon Chin v McCormack John Maxwell [1979-1980] SLR(R) 121, Howard Smith v Ampol Petroleum [1974] AC 821; [1974] 1 All ER 1126 and Lee Tak Samuel v Chou Wen Hsien [1984] HKC 409; [1984] 1 WLR 1202. (b) Since all directors collectively owe their duties to the company no director or group of directors can exclude one or more directors from their deliberations or exclude his input of his insight before a decision is taken. This is not a mere procedural propriety; it goes to the root of essential justice. See Chan Choon Ming v Low Poh Choon (1994) CSLR VI [254]. (c) Where the majority of directors abuse their voting powers by voting without good faith and for ulterior reasons and not for the good 21 of the company, they commit a wrong which can be remedied under s 216 of the Companies Act (Cap 50, 1994 Ed) (oppression or injustice to minority interest). (d) The directors are the primary organ of a company. They have powers conferred on them to manage the company. These powers are conferred upon the directors for their conscious and collective decision as a board. Prima facie, they can be exercised only at a board meeting of which due notice has been given and at which a quorum is present. And although majority decision prevails, a meeting of the majority without notice to the minority is ineffective - In re Portuguese Consolidated Copper Mines, Limited (1889) 42 Ch D 160; Young v Ladies' Imperial Club, Limited [1920] 2 KB 523 and Chan Choon Ming v Low Poh Choon ( [10] supra) at 2,041…… In this regard there is much merit in what is stated in Company Law (2nd Ed, 1997) by Walter Woon at p 216: Even if the articles allow a circular resolution to be effective when signed by the majority, notice of the resolution must still be given to all directors. Otherwise a cabal of controlling 22 directors could do things without the knowledge of the rest of the board, a situation fraught with danger for the company.” Whether res judicata would apply as the issues on the validity of the resolutions affecting the banks have been dealt with in the Section 181 Companies Act 1965 petition? Learned counsel for the Defendants submitted that the Plaintiff is bringing the action in his capacity as a director for alleged breaches of his rights and accepted the fact that the causes of action will be different. However, he submitted that the issues with respect to the DCRs with respect to the change of signatories with the Banks had already been canvassed and deliberated on and decided by the court in the section 181(1) Companies Act 1965 Petition in Kuala Lumpur High Court Petition No: D-26NCC-112009 where the Plaintiff herein and the said TKK were Petitioners and the Defendants here the Respondents in the Petition. Counsel for the Defendants quoted from the decision of Dr Hamid Sultan J in the Petition’s decision as follows on the DCRs purported change of signatories with respect to the Banks: 23 “The complaint in respect of signatories is not a matter the court will want to interfere with. It is trite on the facts of the case the court has no jurisdiction to interfere with the internal arrangement of companies so long as they are otherwise being managed in accordance with law. Further, the court will not concern itself with rationality of a business decision taken by the directors unless there is fraud. In the present case there is evidence to show that the 1st petitioner has difficulty being made available to sign cheques and there is no reason why the board should not appoint other persons to sign.” The test to be applied in deciding whether res judicata can be raised to bar a present proceeding based on a past proceeding is found in the clear exposition of Gopal Sri Ram JCA (as he then was) in Golden Vale Golf Range & Country Club v. Hong Huat Enterprise Sdn Bhd [1998] 3 CLJ 35, at p. 37-38: “Learned counsel for the plaintiff drew our attention to certain passages in the judgment of Siti Norma Yaakod JCA in which the merits of the case appear to have been discussed. The comments in these passages are mere obiter dicta and do not constitute the ratio of the case. It is only the ratio of the case which is binding 24 between the parties to a dispute or their successors…Further, to constitute res judicata, “the earlier judgment must, in terms of the Privy Council decision in Kok Hoong v. Leong Cheong Kweng Mines Ltd [1964] MLJ 49 at p.53,`necessarily and with precision’ determine the point in issue…….These issues were not at stake before this court in the earlier proceedings. It is therefore our judgment that the plea of res judicata cannot succeed.” (emphasis added) If further elucidation is necessary one can refer to Koperasi Belia Nasioanl Bhd v. Storage Enterprise (Port Kelang) Sdn Bhd [1998] 3 CLJ 335, at p. 337-338, where the Court of Appeal clarified as follows:“Nothing could be clearer than that Richard Talalla J made no adjudication on the point that the application to set aside Siti Norma Yaacob J's judgment was served out of time. All that Richard Talalla J found was that the judgment of Siti Norma Yaakob J that was served on the defendant has to be a sealed copy. In fact, it was a sealed copy of the judgment that the defendant received from the plaintiff on 3 February 1994. The 25 judge did not make any adjudication on the point under O. 42 r. 13 which was that the defendant's application to set aside the judgment that was served on the plaintiff more than thirty days after the defendant had received the sealed judgment of Siti Norma Yaakob J. When the Judge in the earlier proceedings made no adjudication, the plea of res judicata must fail.” (emphasis added) Along the same vein the Court of Appeal in The Pacific Bank Bhd v. Chan Peng Leong [1998] 2 CLJ 440, at p.448 held that: “In my judgment, it is of the essence, in cases of this nature, when the plea of res judicata is taken, to identify with precision the issue that was decided in the earlier proceedings, which it is contended operates as a bar to relitigation because to constitute a res judicata, the earlier judgment must, necessarily and with precision determine the point in issue”. (emphasis added) I agree with the Plaintiff’s counsel submission that the issue whether the Plaintiff has been denied of his right as a director to be served with notice 26 of the impugned circular resolutions was not decided at all in the section 181 Petition, let alone been decided with sufficient precision by the learned High Court Judge in the section 181 Petition. In other words the point raised must have been decided with sufficient precision, particularity and peculiarity and not just by a superficial and peripheral passing remark of a general nature. In a section 181 Petition it is not uncommon for the court to approach the sum total of the complaints and grievances from that global and big picture perspective rather than analyzing a particular right of a director, as in this case, of receiving notice of circular board resolution and the consequences that would ensue if the circular board resolution is declared null and void. In the Chee Pok Choy v. Scotch Leasing Sdn Bhd [2001] 2 CLJ 321 at p.331-333, the Court of Appeal explained the proper use of the doctrine of res judicata as follows:“In its wider sense, it encompasses issues, and causes of action that could justly and fairly have been equally adjudicated in the earlier suit or proceeding…Since the doctrine (whether in its narrow or broader sense) is designed to achieve justice, a court may decline to apply it 27 where to do so would lead to as unjust result…in Carl-Zeiss-Stiftung v. Rayner and Keeler Ltd (No.2) [1996] 2 All ER 532, 573, Lord Upjohn said:“As my noble and learned friend, Lord Reid, has already pointed out there may be many reasons why a litigant in the earlier litigation has not pressed or may even for good reasons have abandoned a particular issue. It may be most unjust to hold him precluded from raising that issue in subsequent litigation… All estoppels are not odious but must be applied so as work justice and not injustice, and I think that the principle of issue estoppels must be applied to the circumstances of the subsequent case with this overriding consideration in mind.” (emphasis added) Plaintiff’s counsel was at pains to point out that the section 181 Petition was filed by the Plaintiff and another shareholder TKK against (amongst others) the defendants in exercise of their statutory right as shareholders under section 181 (1) of the Companies Act 1965, whereas in this case, the Plaintiff is suing the Defendants based on his common law right as a director of a company to receive notice of circular board resolution. Although it appears that the same remedy is sought in both the sec 181 Petition and this OS (i.e. a declaration that the circular resolution dated 28 18.9.2009 is invalid, null and void), the issue leading to such a remedy is very different and miles apart from each other. The issue whether the plaintiff has been deprived of his common law right as a director to be served with notice of the impugned circular resolutions dated 19.8.2009 was not decided by the Court in the section181 Petition because the issue was not particularly and peculiarly relevant to the section 181 Petition. The Plaintiff respectfully submitted that the various issues raised by the Defendants in this application to strike out could and should rightly have been raised in the hearing of the OS itself in order to save time and cost. He further submitted that it is crystal clear that the Defendants filed this application with mala fide intention and for the collateral purpose of delaying the hearing of the OS and frustrating the legitimate intention of the plaintiff for a speedy disposal of the OS. The Defendants’ counsel drew my attention to the fact that the consequential remedies in prayers 8) and 9) of the OS are not orders that a Director of the Company can properly pray for as the wrong complained of is a wrong against the Company with respect to monies paid out pursuant 29 to alleged invalid circular board resolutions and so is the remedy of the interest payment by the Directors concerned on the sums paid out based on invalid resolutions. He further contended that it is open for the Plaintiff as a minority shareholder to bring a derivative action. I find merits in his argument. Pronouncement Based on the aforesaid consideration of the law and the principles on striking out under O18 r 19 Rules of the High Court 1980 as enunciated in the Supreme Court case of Bandar Builder Sdn Bhd & 2 Ors v. United Malayan Banking Corporation Bhd [1993] 4 CLJ 7 and the facts of the case I held that prayers 8) and 9) be struck out and that the remaining prayers should go for hearing other than 4), 6) and 10) which had been withdrawn by the Plaintiff and hence struck out. I also ordered costs to be 30 costs in the cause. Dated 22.9.2010 Sgd Y.A. Tuan Lee Swee Seng Judicial Commissioner Civil 2, High Court, Kuala Lumpur. Counsel for the Applicants/Defendants: Dato’ V Manokaran and M R Kumar (Kumar Associates) Counsel for the Respondent/Plaintiff: J T Chong (J T Chong Associates) Date of Decision: 2.8.2010. 31