Import Dependence of Foreign Trade: A case of China

advertisement

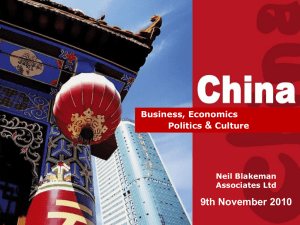

Paper for the 16th International Conference on Input-Output Techniques July 2-6, 2007, Istanbul, Turkey Import Dependence of Foreign Trade: A case of China1 Yang Cuihong, Pei Jiansuo Academy of Mathematics and Systems Science, the Chinese Academy of Sciences Abstract: Since reform and opening-up to the outside world, China’s foreign trade develops very rapidly, especially after China’s entry to the WTO in 2001. Foreign trade dependency ratio of China (FTDR), which is the ratio of total volume of foreign trade to GDP, has increased year by year, especially after 2001, from 38.7% in 1995 to 69.1% in 2006. While most of China’s exports are processing exports, intermediate materials of which including raw materials, accessories and components are mostly imported. So China’s exports have a high dependency ratio on imports, especially in Foreign-invested Enterprises (FIE). In processing trade, the value-added China could obtain from exports is much smaller than the total exports value would show. In this paper, we adopted the definition of vertical specialization proposed by Hummels, Ishii and Yi (2001) to depict the dependency ratio on imports of China’s exports. Based on China’s non-competitive input-output table capturing processing 1 Yang Cuihong, Academy of Mathematics and Systems Science, the Chinese Academy of Sciences, No. 55, Zhongguancun Dong Lu, Beijing 100080, P. R. China. Email: chyang@iss.ac.cn; Pei Jiansuo, Academy of Mathematics and Systems Science, the Chinese Academy of Sciences, No. 55, Zhongguancun Dong Lu, Beijing 100080, P. R. China. Email: jspei@amss.ac.cn. The authors would like to express their sincere thanks to late Professor Christian DeBresson for his valuable comments and important suggestions in our collaboration on the book China’s Re-entry into the Global Economy: Innovation, Learning, and Catching-up he edited, we drafted the chapter “China Foreign Trade Evolution and its Share in World Trade”. His wisdom and patience will be fully remembered by us. trade we compiled2, we give a modified version of Hummels, Ishii and Yi model (2001) on vertical specialization. We then estimate the direct and total VS share both of processing exports and non-processing export of 2002 and also make a brief comparison with that of the United States. The results show that, in 2002, the VS shares of processing exports of China are very high, direct VS share and total VS share amounting to 66.6% and 71.4% respectively. By contrast, those of non-processing export are much lower, with direct VS share and total VS share at 24.4% and 36.7%. While compared to other countries, China’s export have a high dependency ratio on imports, for example, the direct and total direct VS share of the United States are only 6.7% and 10.3% in 2002. By sectors, telecommunication equipment, computer and other electronic equipment sector, petroleum processing sector are highly dependent on imported intermediate inputs. Keywords: Vertical Specialization, Processing trade, China’s non-competitive input-output table capturing China’s processing trade. 1. Introduction Since reform and opening-up to outside world, China’s foreign trade develops very rapidly, especially after China’s entry to the WTO in 2001. At the same time, foreign trade dependency ratio of China (FTDR) has been increasing year by year. The 2 In a joint project by financial support from the Chinese University of Hongkong, with the collaboration of the Chinese University of Hongkong, Hongkong University of Science and Technology, University of California at Santa Cruz, the AMSS (Academy of Mathematics and Systems Science, the Chinese Academy of Sciences) team headed by Professor Chen Xikang compiled non-competitive input-output table of China for 2002. For comparison, we also constructed non-competitive input-output table of the United States for 2002. 1 traditional definition of FTDR is the ratio of gross value of foreign trade to GDP, by this method, China’s FTDR increase from 38.7% in 1995 to 69.1% in 2006. Although the FTDR of China is seemingly high, this index cannot truly measure the dependency ratio of Chinese economy on foreign countries, because FTDR of China has been overestimated. One of the most important reasons is that processing trade account for more than 50% of China’s foreign trade, for example, 57.4% in 2006. Since processing trade mainly use imported raw material, spare and accessory parts to manufacturing products and then export, processing trade doesn’t relate so closely to domestic economy as non-processing trade. According to our estimate, for year 2002, Chinese direct and total value-added induced by processing exports are 0.58 and 0.38 times that of non-processing exports, respectively (Lau, Chen, et.al 2006). The main limitation of FTDR is that it is not necessarily related to policy- a country can distort trade heavily, and still have a high trade dependency ratio (Edwards, 1998). For the case of China, China has been encouraging the production of processing trade by many ways, including free import taxes of intermediate inputs, while from this kind of trade, China can only get a small portion of processing fee. Simply calculated FTDR obviously exaggerates China’s dependency ratio on international market. As mentioned above, processing trade is the main body of China’s foreign trade, intermediate materials of which including raw materials, accessories and components are mostly imported. So China’s exports have a high dependency ratio on imports, especially in Foreign-invested Enterprises (FIE). In other words, international production fragmentation has great impact on China’s foreign trade. This is one of the 2 most important characteristics of international trade - increasing interconnectedness of production processes in a vertical trading chain that stretches across many countries, with each country specializing in particular stages of a good’s production sequence (Hummels, et. al, 2001). This phenomenon is labeled as several different terms by different researchers (Feenstra and Hanson, 1996, 1997; Feenstra, 1998; Deardorff, A., 1998; Hummels, et. al, 2001; Grossman and Helpman, 2005), for example, vertical specialization, international fragmentation of production, international disintegration of production, international outsourcing. China is now a major international outsourcing destination, importing raw materials for intermediate inputs and exporting to other countries after manufacturing in China, which constitutes a main part of China’s export. In this paper, we adopt vertical specialization (VS) to illustrate the import dependency of China’s foreign trade. Balassa (1967) is probably the first researcher who use the term “VS”, then Findlay (1978). Sanyal and Jones (1982), Dixit and Grossman (1982) established theoretic models for VS and trade in the framework of relative factor endowment, emphasizing that comparative advantages are the determinant of specialization. Regarding the measurement of VS, Campa and Goldberg (1997) investigated increases in external orientation in terms of industry export shares, import penetration, and imported input use in production by input-output technique for the United States, Canada, the United Kingdom and Japan. Hummels (2001) define the VS strictly in an input-output framework and by using input–output tables, calculate the vertical specialization for 10 OECD countries and four emerging market countries. Dean, Fung and Wang (2007) 3 measure Chinese vertical specialization by employing China’s input-output table of 1997 and 2002 by sector, export destination, and input source. Liu and Wu (2005), CCER(2006), Zhang and Sun(2006) investigate the degree of China’s vertical specialization by adopting Hummel’s VS index and input-output technique or econometric models. Yet, recent literature on fragmentation has focused on developing and testing various theories of the firm’s decision to fragment production across borders (Dean, Fung and Wang, 2007). As mentioned above, a few studies attempted to measure China’s vertical specialization by input-output techniques, but mainly are based on competitive input-output tables and use proportional calculation to estimate import matrix---assume that each commodity requires imports in proportion to their usage of inputs. In addition, these work do not differentiate vertical specialization of China’s processing trade and non-processing trade. Since production structure and source of intermediate inputs for processing trade and non-processing trade are quite different, their dependency ratio on imported materials differs too. In this paper, based on China’s non-competitive input-output tables capturing processing trade for 2002 we compiled, we study the import dependency of China’s total trade, processing trade and non-processing trade, mainly by employing Hummels, Ishii and Yi (2001) measure of vertical specialization. The paper is organized as follows. The following section gives an overview of China’s import dependency of foreign trade. The third section introduces basic methodology and data preparation. The section after shows main results of this paper 4 and discusses their interpretation. The fifth section concludes. 2. Overview of China’s Import Dependency of Foreign Trade---the Case of FIEs As mentioned in section 1, processing trade is the main body of China’s foreign trade, especially in FIE the processing export of which account for a little less than 80% of total processing export. Take processing export with imported materials (PIM) in FIE as an example1(table 1), the dependency ratio on import during 1990 and 1992 was usually over 90%. Since 1995, it decreases gradually but still higher than 60%, for example, in 2004, the dependency ratio on import of PIM export in FIE was 66.43%. From the perspective of commodities, more capital-intensive the commodities are, higher proportion of imported material in processing trade. Table 1 is here Due to lack of data for some industries, here we can only discuss the reliance of FIE processing trade on imported materials from domestic accessory ratio aspect. Import dependency ratio of FIE high-tech enterprises is very high. Most of the raw materials, accessories and components of FIE have to be imported. For example, among FIE high-tech enterprises in Beijing, 73.9% of them mainly rely on imported materials; for FIE high-tech enterprises in Shanghai, imported accessories and components from overseas account for 56% of total; similar situation exists in Suzhou, and moreover those domestic accessories are mainly low-grade or middle-grade products. The main reasons of low domestic accessory ratio are that, on one hand, the technology and 1 Processing trade includes two types: processing with imported materials (PIM) and processing with customer's materials (PCM), in which PIM is the main form, accounting for more than 70% of processing trade value (for example in 2002, 73%). 5 quality of domestic products could not meet the requirements of FIE, and globalization trend of high-tech industry also affects the adoption of domestic products of China. On the other hand, current tax policies of China also go against domestic accessories. Imported materials for processing trade are tax free, but if the enterprises buy domestic products, they cannot get reimbursement of the tax included, thus FIE has no enough enthusiasm to use domestic accessories. Some FIEs point out that for part of the accessories they require, both the quality and price of China domestic products have been very competitive. If tax reimbursement for export policy can be expanded to intermediate inputs, the domestic accessory ratio will increase and at the same time reduce the cost the FIE exported commodities. Before the middle of 1990s, FIE regarded China as a low-grade technological processing and assembly base, domestic accessory ratio was then very low. In recent years, however, domestic accessory ratio of FIE increases notably. Especially after 2000, percentage of home-made parts in FIE high-tech industry increase gradually. Take mobile communication equipments for example (Jiang, 2002a), Motorola Company has over 700 suppliers in China, purchased 7.5 billion RMB of domestic accessories and components in 2000 and more than 12 billion RMB in 2001; In Ericsson Company, localization degree of some mobile phones has been over 60%, accessories like charger and battery have been completely localized in China, furthermore many accessories are exported to overseas from China. In wireless base station, import substitution ratio increased to 51% in 2000 from 5% in 1999; Nokia Company purchased over 1 billion RMB domestic products of China. 6 Along with the increase of FDI, FIE has developed the production of accessories in China through further investment, therefore increase the localization degree and self-producing proportion of intermediate inputs in China. For example, in Japan-capital enterprises, domestic accessory ratio in China was only 20% in 1992, while in Southeastern countries up to 47% then. Till 2002, the domestic accessory ratio of Japan-capital enterprises in China reached 49.6% (Jiang, 2002b), while at the same time that of Southeastern countries do not change much. 3. Methodology and Data 3.1 Measure of Vertical Specialization by Hummels, Ishii and Yi (2001) Hummels et. al(2001) proposed a method by using input-output technique to measure vertical specialization, which has been widely accepted by international economic circle. In their paper, vertical specialization (VS) is depicted by two indexes: VS value and VS share.3 VS value is defined as the amount of imported intermediate inputs in producing exported products, VS share is the ratio of imported intermediate inputs to total exports value. 3.1.1 Direct VS share For country k and sector i, VS value is defined as follows4: IM VSki ki Eki X ki (1) Where, for country k and sector i, IM ki stands for imported intermediate inputs, 3 Hummels, Ishii and Yi (2001) give strict definition of vertical specialization (VS), emphasizing imported intermediate inputs to produce exported products. That is to say, VS share is the ratio of imported intermediate inputs to total exports value, not to total output value. 4 Formula (1)-(4) are cited and modified from Hummels, Ishii and Yi (2001) 7 Eki denotes exports, X ki stands for total output value. The first term of the right side means contribution ratio of imported intermediate inputs to total output value, while multiplying exports we obtain the imported content in exports. VS for country k is simply the sum of VS across all sector i, VSk VSki i VS share of total exports is as follows by formula: VS VSSk k Ek VS E ki i ki (2) i Where VSS k stands for VS share of total exports. VSS k can be expressed as: VSS k VS E ki i ki i VS E E ki ki i ki i E ki E VS ki ki i Ek Eki (3) That is to say, VS share of total exports for country k is equal to the export-weighted average of VS share of all sector exports for country k. In input-output framework, VSS k can be expressed as formula (4) in matrix notation: VSSk uAM E / Ek (4) where u is a 1n vector of 1’s. AM (aijm )nn is the matrix of direct imported input coefficients, aijm represents direct imports coefficient, i.e., imported products of sector i that are directly consumed by one unit output of sector j. E stands for a n1 vector of exports. Ek stands for total exports for country k. 3.1.2 Total VS share Before introducing total VS share, we firstly give a brief introduction of direct imports coefficient and total imports coefficient (Lau, Chen and Yang et.al, 2006). Take 8 steel products for exports for example, to illustrate the concept of direct imported inputs and total imported inputs of an exported product. In producing steel for exports, both imported intermediate inputs and domestically produced intermediate inputs (e.g., steel) are used. Direct imported inputs in steel production are pig iron, coke and so on. During the production of pig iron and coke, except domestically produced iron ore and coal, etc., imported iron ore and coal are consumed too, which is the first round of indirect imported inputs. The consumption of imported materials in the production of iron ore and coal is the second round of indirect imported products by steel production. There are infinitely many rounds of indirect imports. Denote B M as matrix of total imports coefficient, B M (bijm )nn n bijm aijm bikm a kjd (i, j=1, 2, …, n) (5) k 1 where aijd is domestic products of sector i that are directly consumed by one unit output of sector j. Denote AD as matrix of direct domestic input coefficient. Equation (5) can be expressed as matrix notation: B M AM B M AD (6) B M AM ( I AD )1 Direct VS share of total exports illustrate the dependency ratio on imported intermediate inputs directly used to produce one unit export of a certain sector. Total VS share of total exports is dependency ratio on imported intermediate inputs directly and indirectly used to produce one unit export of a certain sector. Based on equation (6), we can obtain total VS share of total exports, TVSSk , as follows: 9 TVSSk uAM (I AD )1 E / Ek (7) 3.2 Data Source The primary data sources are China’s non-competitive extended input-output tables capturing processing trade (abbreviated as China’s non-competitive EIOP table hereinafter) for 2002 (Lau, Chen and Yang et.al, 2006). The table form of China’s non-competitive input-output tables capturing processing trade is listed in table 2. For comparison, we also constructed non-competitive input-output table of the United States for 2002. From Bureau of Economic Analysis (BEA), U. S Department of Commerce, we obtained U.S Make Table, Use Table and import matrix for 2002, based on which and industry technology assumption we compiled non-competitive input-output table of the U. S. In China’s non-competitive EIO table, in order to capture China’s special production structure of its extensive participation in global production, we divide China’s total production into three parts(Lau, Chen and Yang et.al, 2006). The first one is production for domestic use in China (D); the second one is processing exports production (P); the third one is non-processing exports production and other production of FIEs (N). As mentioned earlier, in China much of the exports are produced by FIEs. Most of the products by FIEs are directly or indirectly exported, while some of their products are also used for domestic consumption, investment and intermediate inputs in China, which are listed as ‘other production of FIEs’. In our tables, we do not put FIEs’ products that are used domestically into production for domestic use D, because most of other production of FIEs is composed of components, parts, materials of the exported 10 commodities and its input structure is similar to that of exports production. Table 2 is here 3.3 New Formula to Estimate Total VS Share of Total Exports In China’s non-competitive EIOP table, domestic intermediate inputs are divided into nine sub-matrix: X DD , X DP , X DN ; X PD , X PP , X PN ; X ND , X NP and X NN , where X DD , X DP , X DN stand for matrices of products of D used as intermediate inputs by D, P and N, respectively; X ND , X NP and X NN denote matrices of products of N used as intermediate inputs by D, P and N, respectively5. The matrices of products of P used as intermediate inputs by D, P and N, X PD , X PP , X PN are assumed zero. Thus AD in traditional non-competitive input-output table should be transformed as follows: ADD A 0 AND _ D ADP 0 ANP ADN 0 ANN where ADD [ AijDD ] [ X ijDD / X Dj ] , ADP [ AijDP ] [ X ijDP / X Pj ] , ADN [ AijDN ] [ X ijDN / X jN ] , AND [ AijND ] [ X ijND / X Dj ] , ANP [ AijNP ] [ X ijNP / X Pj ] , ANN [ AijNN ] [ X ijNN / X jN ] , X ijDD , X ijDP , X ijDN are delivery of domestic products of sector i of D to sector j of D, P and N, respectively; X ijND , X ijNP , X ijNN are delivery of domestic products of sector i of N to sector j of D, P and N, respectively. X Dj , X Pj , X jN are the gross output value of sector j of D, P and N, respectively. 5 For simplicity, we then use D, P and N to express Production for domestic use, Processing exports, Non- processing exports and other production of FIEs in the following text. 11 Correspondingly, AM AMD , AMP , AMN , the element of which AMD , AMP , AMN are direct imports coefficient of D, P and N, respectively; AMD [ AijMD ] [ X ijMD / X Dj ] , AMP [ AijMP ] [ X ijMP / X Pj ] , AMN [ AijMN ] [ X ijMN / X jN ] X ijMD , X ijMP , X ijMN are the delivery of imported products of sector i to sector j of D, P and N, respectively. The direct VS share of D, P, N, i.e., VSS kD , VSSkP , VSS kN , can be obtained from formula (8): VSSk VSSkD , VSSkP , VSSkN u AM E / Ek (8) where E is a diagonal matrix, the element of the diagonal E D , E P , E N , are n1 vector of exports of D, P and N, respectively; Ek is a diagonal matrix, the element of the diagonal EkD , E kP , EkN , are total exports of D, P and N, respectively. Thus: VSSkD uAMD E D / EkD VSSkP uAMP E P / EkP (9) VSSkN uAMN E N / EkN _ We then obtain (I AD )1 as shown in formula (10)6. ( I ADD ) (I A ) 0 AND _ D 1 ADP I A NP B DD PD 0 B NN ( I A ) B ND ADN B DP B PP B NP B DN B PN B NN where: B DD ( I ADD )1 ( I ADD )1 ADN B NN AND ( I ADD )1 B DP ( I ADD )1 ADP ( I ADD )1 ADN B NN [ ANP AND ( I ADD )1 ADP ] B DP ( I ADD )1 ADP ( I ADD )1 ADN B NN ANP 6 Please see Lau, Chen and Yang et. al (2007) for detailed proof. 12 (10) B DN ( I ADD )1 ADN B NN B PD 0 , B PP I , B PN 0 B ND B NN AND ( I ADD )1 B NP B NN [ ANP AND ( I ADD )1 ADP ] B NN [ I ANN AND ( I ADD )1 ADN ]1 B DD , B DP and B DN denote matrices of total requirement coefficient of production D per unit of final demands of D, P and N, respectively. B PD , B PP and B PN denote matrices of total requirement coefficient of production P per unit of final demands of D, P and N, respectively. B ND , B NP and B NN denote matrices of total requirement coefficient of production N per unit of final demands of D, P and N, respectively. Then we obtain the new formulae of total VS share of total exports based on China’s non-competitive EIO table, shown in formula (11) _ _ TVSSk u AM (I AD )1 E / Ek (11) where TVSSk TVSSkD , TVSSkP , TVSSkN , in which TVSS kD , TVSS kP , TVSS kN are the total VS share of D, P, and N. From equation (11), we get: TVSSkD , TVSSkP , TVSSkN u( AMD B DD AMN B ND ) E D / EkD , u( AMD B DP AMP AMN B NP ) E P / EkP , N u( AM D B D N A M NB )N E / kN E N Thus, we can obtain the formulae of total VS share for D, P and N shown as 13 formulae (12)-(14):7 TVSSkD u ( AMD B DD AMN B ND ) E D / EkD (12) TVSSkP u( AMD B DP AMP AMN B NP ) E P / EkP (13) TVSSkN u( AMD B DN AMN B NN ) E N / EkN (14) 4. Empirical Analysis Based on section 3.3 and China’s non-competitive EIOP table for 2002, we calculate the China’s VS share for both processing exports and non-processing exports. The results are listed in table 3. Table 3 is here 4.1 Aggregate VS Share From Table 3, we can see that the direct VS share of processing export is quite high, the ratio of intermediate import content to China’s processing export is 66.6%. Total intermediate import content reached 71.4% of total export, a little higher than its direct share. Regarding non-processing export, the direct VS share is 24.4%, much lower than that of processing export. Unlike processing export, however, its total VS share is 1.5 times its direct VS share. Non-processing export and others use more domestically produced products, which in turn consume lots of rounds of imported intermediates. Processing exports, however, consume only a low ratio of domestically produced products, most of their intermediate input are imported from other countries, the chain effect of which do not occur in China but in other countries, this can partly explain why 7 Because the export of the production for domestic use is zero, so the total VS share of D is equal to zero. 14 the total VS share of processing export is only a little larger than its direct VS share. 4.2 VS Share of Processing Exports by Sector Table 3 shows that sixteen manufacturing sectors have VS share higher than average both for direct and total (figure 1). As mentioned earlier, telecommunication equipment sector of processing export has very high import dependency ratio, reaching 82.2% of the value of total exports. That of petroleum processing ranks the second (73%). Seven of the sixteen manufacturing sectors have direct VS share larger than average, the other five are: metals smelting and pressing (69.2%), metal products (73.8%), common and special equipment (69.4%), transport equipment (69.0%) and, electric equipment and machinery (72.4%). Most of these sectors belong to electromechanical products, which have a relatively higher value-added ratio. From figure 1, we can see that the intermediate inputs for high value-added products still rely heavily on imports. Besides manufacturing sectors, other sectors with relatively high direct and total VS shares included textile goods, chemicals, other manufacturing products, construction, renting and commercial service. Figure 1 is here 4.3 VS Share of Non-processing Exports by Sector Figure 2 is the chart of direct and total VS share of non-processing export by sector. Petroleum processing has the highest VS share (both direct and total).8 8 Although China's petroleum import is just nearly 6% of the world's trade volume, China’s dependency ratio of imported petroleum in the past several years keep increasing, the ratio of imported petroleum to China’s total petroleum consumption is only 29.1% in 2001, while has risen to 47.3% in 2006. 15 Telecommunication equipment, computer and other electronic equipment sector follows (with direct VS share 51.1% and total VS share 62%). The other sectors with higher total VS share include transport equipment (53.6%), common and special equipment (52.8%), electric equipment and machinery (51.8%), chemicals (51%), metals smelting and pressing (47.1%), metal products (45.8%) and, renting and commercial service (43.5%). Different from processing exports, several sectors almost do not directly use or a very small portion of imported materials in their production, while their total VS are relatively high, for example, scientific research, health service, social guarantee and social welfare and so forth. Figure 2 is here Since processing trade accounts for more than a half of China’s foreign trade, China’s import content of exports is quite high compared with other countries. Based on the non-competitive table of the United States for 2002 we compiled, we estimate that the direct VS share of the U.S. in 2002 is 6.7% and 10.3% for total VS share. 5. Conclusion Different from developed countries and most developing countries, processing trade plays a very important role in China’s trade development. Because most of the intermediate inputs for processing exports are imported, China’s export has a high dependency ratio on imports. Although some researchers addressed the issue of import dependency ratio of China’s export by using econometric model and input-output model for example VS share based on Hummels, Ishii and Yi theory (2001), but only consider 16 the VS share of China’s total export. In this paper, based on China’s non-competitive input-output table capturing processing trade, we give a modified version of Hummels, Ishii and Yi model on vertical specialization. We then estimate the direct and total VS share both of processing exports and non-processing export of 2002 and also make a brief comparison with that of the United States. The results show that, in 2002, the VS shares of processing exports of China are very high, direct VS share and total VS share amounting to 66.6% and 71.4% respectively. By contrast, those of non-processing export are much lower, with direct VS share and total VS share at 24.4% and 36.7% respectively. While compared to other countries, China’s export have a relatively high dependency ratio on imports, for example, the direct and total direct VS share of the United States are only 6.7% and 10.3% in 2002. By sectors, telecommunication equipment, computer and other electronic equipment sector, petroleum processing sector are highly dependent on imported intermediate inputs. Most of the sectors with high VS share of exports are basically electromechanical products, which are usually considered as high value-added products, showing that China is still just an assembly base, not an independent producer, of so-called high-technology products. Due to data limit, in this paper, we only estimate the VS share for processing exports and non-processing exports of 2002. We are planning to compile China’s non-competitive input-output tables both for 2005 and 2007, and based on which estimate the VS share for processing exports and non-processing exports over time. 17 References Balassa, B. (1967) Trade Liberalization Among Industrial Countries(New York, McGraw-Hill). Campa Jose and Goldberg Linda S.(1997) The Evolving External Orientation of Manufacturing Industries: Evidence from Four Countries, No 5919, NBER Working Papers from National Bureau of Economic Research CCER Team(2006) Vertical Specialization of China’s Export and Sino-US Trade, The Journal of World Economy (Shi Jie Jing Ji), 29(4), 3-11 (in Chinese) Deardoff, Alan (1998) Fragmentation in Simple Trade Models, Discussion Paper no.422, Research Seminar in International Economics, University of Michigan, January 7. Dean, Judith M., Fung, K.C. Fung and Wang, Zhi (2007) Measuring the Vertical Specialization in Chinese Trade, Working Paper, U.S. International Trade Commission Dixit, Avinash K, Gene M. Grossman(1982). Trade and Protection with Multistage Production, Review of Economic Studies, 49(4), 583-594. Edwards S. (1998), Openness, Productivity and Growth: What do we really know? Economic Journal 108, March, 383-398. Feenstra, R.C., Hanson, G.H.(1996). Foreign investment, outsourcing and relative wages. In: Feenstra, R.C., Grossman, G.M., Irwin, D.A. (eds.), The Political Economy of Trade Policy. Papers in Honor of Jagdish Bhagwati (Cambridge, MA, MIT Press) 89–127. 18 Feenstra, R.C., Hanson, G.H.(1997). Foreign direct investment and relative wages: evidence from Mexico’s maquiladoras. Journal of International Economics 42, 371–394. Findlay, R.(1978). An Austrian model of international trade and interest rate equalization. Journal of Political Economy, 86, 989–1008. Grossman, G.M., Helpman, E.(2005). Outsourcing in the global economy, Review of Economic Studies 72, 135–159 Hummels, David, Jun Ishii and Kei-Mu Yi (2001) The Nature and Growth of Vertical Specialization in World Trade. Journal of International Economics, 54, 75-96. Jiang Xiaojuan (2002a), China: Transfer from processing and assemble base to manufacturing base, International Trade (Guo Ji Mao Yi ), No. 3, 44-47(in Chinese) Jiang Xiaojuan (2002b), Export growth and structural change: contribution of FIE, Nankai Economic Research (Nan Kai Jing Ji Yan Jiu), No. 2, 30-34(in Chinese) Lau, L. J., Chen Xikang, Cheng, L. K., Fung, K. C., Pei Jiansuo, Sung, Y.-W., Tang Zhipeng, Xiong Yanyan, Yang Cuihong and Zhu Kunfu (2006). The Estimation of Domestic Value-Added and Employment Generated by U.S.-China Trade, Working Paper No. 295, Stanford Center for International Development, Stanford University Lau, Lawrence J., Chen Xikang, Yang Cuihong, Cheng, Leonard K., Fung, K.C., Sung, Y. W, Zhu Kunfu, Pei Jiansuo and Tang Zhipeng( 2007) Extended Input-Output Model 19 with Assets in Non-competitive Imports Type capturing China’s Processing Trade and Applications---Perspective of U. S.-China Trade Balances, Social Sciences in China (Chinese version), forthcoming in No.4. Liu Zhibiao, Wu Fuxiang (2005) Disintegration of Production in the Globalized Economy—An Empirical Study Based on Input-output Tables of Jiangsu Province, Zhong Guo Gong Ye Jing Ji, No. 4, 12-19(in Chinese) Sanyal, Kalyan K, Ronald W. Jones (1982) The Theory of Trade in Middle Products, American Economic Review, 72(1), 16-31. Wang Hongqing, Lv Likang (2005), Inward Foreign Direct Investment and China’s Processing Trade, Reform (Gai Ge), No. 7, 77-81(in Chinese) Zhang Xiaodi, Sun Jingwei (2006). Analysis on China’s International Competitiveness based on Vertical Specialization, Journal of World Economy (Shi Jie Jing Ji), 29(5), 3-11 (in Chinese). 20 Table 1 Processing trade with imported materials by FIE (million USD, %) Year Export of processing trade with imported materials Import of processing trade with imported materials Dependency ratio on import* 1990 1991 1992 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 6368 9879 14446 39177 48595 57663 61958 64161 84100 92252 117963 169219 236415 5741 9143 13279 34409 37757 42898 43211 45283 58894 59541 81523 115697 l57039 90.15 92.55 91.92 87.83 77.70 74.39 69.74 70.58 70.03 64.54 69.11 68.37 66.43 Value of domestic accessories** 533 626 992 4053 9212 12550 15935 16046 21425 27804 30974 45494 67470 Source: Calculated by the author according to Wang & Lv, 2005 * Dependency ratio on import=Import of processing trade with imported materials / Export of processing trade with imported materials ** Value of domestic accessories =( Export of processing trade with imported materials-Import of processing trade with imported materials)- Profit - Cost of non-raw materials; Profit=( Export of processing trade with imported materials-Import of processing trade with imported materials)*5%; Cost of non-raw materials=( Export of processing trade with imported materials-Import of processing trade with imported materials)*l0%. 21 Table 2: China’s non-competitive input-output tables capturing processing trade Intermediate Use Final Use Gross Production for Non- processing Processing Gross Exports and Exports Total Other Production Domestic Capital Production for Domestic Use (D) Domestic Processing -ally Exports Interme-d (P) diate Non-processing Inputs Exports and Other Production of FIEs Exports Others Formation of FIEs Output Final or Use Imports ption (P) Use (D) Total Consum- (N) 1,2,…, n 1,2,…, n 1,2,…, n X DD X DP X DN F DC F DI 0 FD XD 0 0 0 0 0 F PE FP XP X ND X NP X NN F NC F NI F NE FN XN X MD X MP X MN F MC F MI FM XM VD VP VN XD LD XP LP XN LN (N) Intermediate Inputs from Imports 1 : n Total Intermediate Inputs Value-added Total inputs Employees NOTE: The superscript D, P, N and M denote domestic products, processing exports, non-processing exports and imports respectively. The superscript DD stands for domestic products used by domestic use, DP domestic products used by processing exports, DN means domestic products used by non-processing exports and others, and so forth. 22 Table 3. VS Share based on China’s Non-competitive Extended Input-output Table capturing Processing Trade for 2002 Processing Exports (P) IO code 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Agriculture Coal mining, washing and processing Crude petroleum and natural gas products Metal ore mining Non-ferrous mineral mining Manufacture of food products and tobacco processing Textile goods Wearing apparel, leather, furs, down and related products Sawmills and furniture Paper and products, printing and record medium reproduction Petroleum processing, coking and nuclear fuel processing Chemicals Nonmetal mineral products Metals smelting and pressing Metal products Common and special equipment Transport equipment Electric equipment and machinery Telecommunication equipment, computer and other electronic equipment Instruments, meters, cultural and office machinery Other manufacturing products Scrap and waste Electricity and heating power production and supply Gas production and supply Water production and supply Construction Transport and warehousing Post Information communication, computer service and software Wholesale and retail trade Accommodation, eating and drinking places Finance and insurance 23 Non-processing Exports (P) Direct Total Direct Total 0.439 0.449 0.451 0.542 0.489 0.495 0.514 0.498 0.611 0.567 0.094 0.152 0.129 0.255 0.242 0.174 0.273 0.246 0.409 0.367 0.507 0.566 0.111 0.190 0.639 0.697 0.199 0.272 0.593 0.661 0.198 0.282 0.583 0.651 0.180 0.316 0.540 0.614 0.206 0.340 0.730 0.775 0.684 0.732 0.628 0.551 0.692 0.738 0.694 0.690 0.724 0.711 0.628 0.738 0.777 0.747 0.755 0.772 0.349 0.248 0.281 0.232 0.371 0.326 0.344 0.510 0.395 0.471 0.458 0.528 0.536 0.518 0.822 0.842 0.511 0.620 0.606 0.620 0.000 0.367 0.358 0.431 0.659 0.460 0.407 0.641 0.678 0.000 0.452 0.482 0.521 0.720 0.538 0.508 0.363 0.187 0.000 0.000 0.222 0.208 0.252 0.164 0.193 0.510 0.327 0.000 0.262 0.373 0.330 0.426 0.334 0.322 0.571 0.604 0.262 0.365 0.410 0.433 0.265 0.484 0.501 0.351 0.172 0.100 0.000 0.266 0.193 0.188 33 34 35 36 37 38 39 40 41 42 Real estate Renting and commercial service Tourism Scientific research General technical services Other social services Education Health service, social guarantee and social welfare Culture, sports and amusements Public management and social administration 0.000 0.632 0.054 0.000 0.000 0.501 0.330 0.000 0.385 0.295 0.001 0.670 0.188 0.001 0.001 0.569 0.418 0.001 0.461 0.383 0.000 0.327 0.086 0.000 0.000 0.200 0.113 0.000 0.178 0.110 0.175 0.435 0.157 0.412 0.246 0.319 0.222 0.406 0.285 0.212 Total 0.666 0.714 0.244 0.367 24 Textile goods Wearing apparel, leather, furs, down Sawmills and furniture Paper and products, printing and record Petroleum processing, coking Chemicals Nonmetal mineral products Metals smelting and pressing Metal products Common and special equipment Transport equipment Electric equipment and machinery Telecommunication equipment, Instruments, meters, cultural and Other manufacturing 0.2 Manufacture of food products and Figure 1 Direct and total VS share of processing trade by manufacturing sectors DVSS T VSS 1.0 0.9 0.8 0.7 0.6 0.5 0.4 0.3 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 25 0.0 Agriculture Coal mining, Crude petroleum Metal ore mining Non-ferrous Manufacture of Textile goods Wearing apparel, Sawmills and Paper and products, Petroleum Chemicals Nonmetal mineral Metals smelting and Metal products Common and Transport Electric equipment Telecommunication Instruments, Other Electricity and Gas production and Water production Construction Transport and Post Information Wholesale and Accommodation, Finance and Real estate Renting and Tourism Scientific research General technical Other social Education Health service, Culture, sports and Public management Figure 2 Direct and total VS share of non-processing trade by sectors 0.8 DVSS 26 TVSS 0.7 0.6 0.5 0.4 0.3 0.2 0.1 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42