CHAPTER 20 ADVANCED TOPICS Chapter Outline An Overview of

advertisement

CHAPTER 20

ADVANCED TOPICS

Chapter Outline

An Overview of the New Macroeconomics

Rational Expectations

The Random Walk of GDP

Real Business Cycle Theory

New Keynesian Models of Price Stickiness

The Rational Expectations Revolution

A Simple Aggregate Demand-Aggregate Supply Model

A Perfect Foresight Model

A Rational Expectations Model

The Rational Expectations Equilibrium Approach: Empirical Evidence

The Microeconomics of the Imperfect Information Aggregate Supply Curve

The Random Walk of GDP: Does Aggregate Demand Matter, or is it all Aggregate Supply?

Two Equivalent Representations of Trend and Shock

Is the Effect of Shocks Permanent or Temporary?

Real Business Cycle Theory

A Simple Real Business Cycle Model

A New Keynesian Model of Sticky Nominal Prices

Working With Data

Changes from the Previous Edition

The material covered in this chapter is basically unchanged.

Learning Objectives

Students should be familiar with the rational expectations approach and its implications for

stabilization policy.

Student should be able to distinguish between perfect foresight, rational expectations, and adaptive

expectations.

Students should be familiar with the concept of policy irrelevance.

Students should be able to distinguish between the effects of anticipated and unanticipated changes in

monetary policy.

Students should be able to explain the random walk of GDP theory and how supply side disturbances

may affect the growth trend of potential GDP.

Students should be able to explain the real business cycle theory and the propagation mechanism that

involves the intertemporal substitution of leisure.

Students should understand that the new Keynesian models are based on microeconomic foundations,

reflecting rational expectations and maximizing behaviour while still getting results that are

consistent with the AD-AS model.

Students should be familiar with the concept of menu costs and how the existence of imperfect

256

competition and labour contracts lead to wage and price stickiness.

Achieving the Objectives

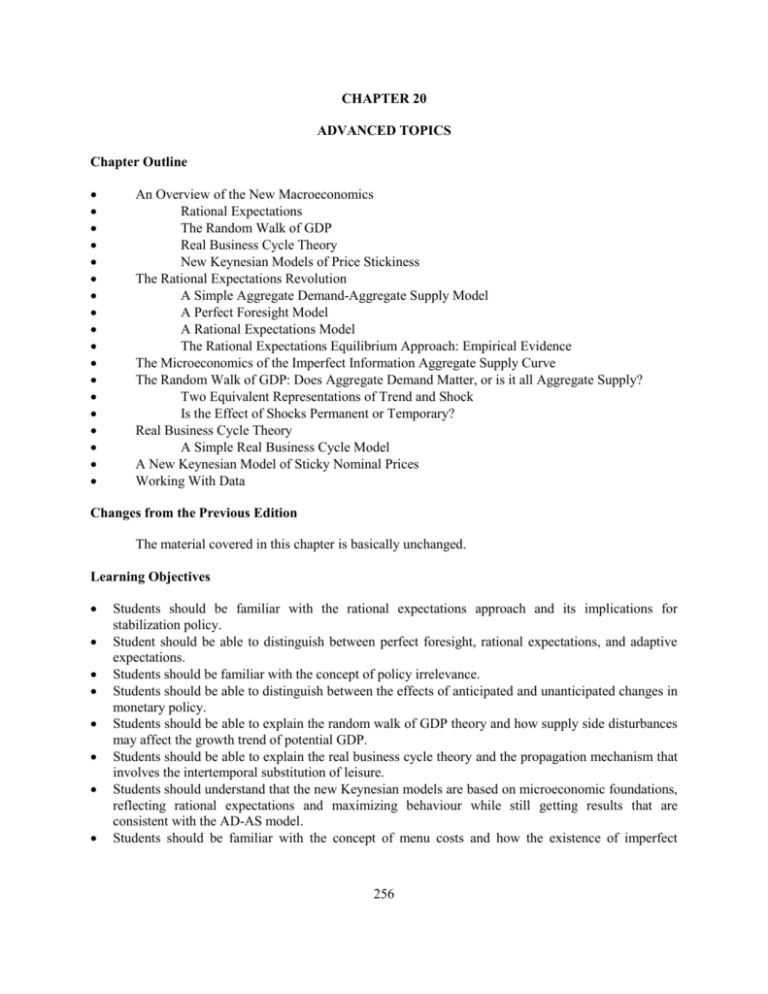

Chapter 20 starts with an overview of four theories: rational expectations, the random walk of

GDP theory, real business cycle theory, and the new Keynesian models of price stickiness. This overview

is important, since much of the material that follows is very technical and may be difficult to comprehend.

The rational expectations approach assumes that people use all relevant information in forming

their expectations and making forecasts of economic variables. The rational expectations model assumes

that markets clear very rapidly. This does not necessarily imply that people are always right, but only that

they do not commit systematic errors. Even though the model predicts (just as the classical model did)

that fiscal and monetary policies cannot affect the equilibrium level of output in the long run, it allows for

transitory deviation from full employment.

The random walk of GDP theory argues that changes in aggregate demand are not very important,

and only shocks to aggregate supply have permanent effects on GDP. After a shock, GDP does not tend to

return to a clearly identifiable trend but instead follows a random walk.

The real business cycle theory also argues that fluctuations in GDP are the result of real shocks to

the supply side and tries to explain the propagation mechanism, that is, the process by which these shocks

are spread through the economy. People seem to care more about their total lifetime supply of labour than

the particulars of when they work. This implies that labour supply is highly elastic in response to

temporary wage rate changes but not permanent changes.

The new Keynesian models were developed in response to the assertions of the rational

expectations approach. These models argue that even if people have rational expectations, wages and

prices still adjust only slowly due to the menu costs of price changes and the existence of wage contracts.

The rational expectations model is developed in three steps. First, a model is presented in which

price expectations are assumed to be exogenous, implying a large multiplier for monetary policy changes.

The second model assumes that people have perfect foresight, implying that the monetary policy

multiplier is zero. The final model assumes that people form rational expectations but with only partial

information. This implies a zero multiplier for anticipated monetary policy changes and a non-zero

multiplier for unanticipated monetary policy changes. The model derives the AD-curve from the quantity

theory of money equation, that is,

MV = PY.

It is written in the form

m + v = p + y,

where the lower case letters are the logarithms of these variables. Therefore, the equation can be

interpreted as "the change in money supply plus the change in velocity is equal to the change in the price

level plus the change in real output." The short-run aggregate supply curve is one that emphasizes price

expectations, that is,

p = pe + (y - y*).

With some mathematical manipulation of this model, we can conclude that economic agents make

predictions for the economy that are inconsistent with the predictions that the model itself makes. This

argument is known as the Lucas critique.

257

If we assume perfect foresight, that is, pe = p, then monetary policy is neutral and does not affect

real output, even in the short run. In assuming rational expectations, an error term is introduced, which is

the difference between actual and expected money supply, that is,

m = m - me.

It can be shown that if a change in monetary policy is anticipated, it will have no effect. But if it

comes as a surprise, it will affect output significantly. Robert Lucas assumed that economic agents

forecast the price level using imperfect information. These agents don't know whether a price change is

due to a change in the overall price level or market-specific demand. As a result, price changes are

attributed partially to both.

The rational expectations approach is theoretically very appealing, but it has not fared very well

in empirical testing. Nevertheless, it has become an important part of macroeconomics, primarily because

it provides the basis for the microeconomic foundations approach to macroeconomics. In addition,

economists find it very appealing to assume that individuals and firms use all available information

efficiently before making decisions, and that price expectations have a strong influence on the decisionmaking process of economic agents.

The random walk of GDP theory asserts that macroeconomic fluctuations are dominated by

supply shocks, which have permanent effects, while aggregate demand fluctuations are less important and

have only transitory effects. It also argues that the method used to model the trend path of GDP when

identifying shocks to the economy has significant implications. Assume the trend line is defined as

yt = + t.

It follows that

yt - yt-1 = ( + t) - [ + (t - 1)] ==> yt = yt-1 +

==> yt = .

An output shock ut can be introduced in two different ways. First, it can be added to the initial

equation, in which case

yt = + t + ut ==> yt = + ut - ut-1 .

But if it is added later, the following equation results:

yt = yt-1 + + ut ==> yt = + t + ut + ut-1 + ut-2 + ..... + u0.

The first case implies that a shock's effect is only transitory, lasting only one period. The second

case implies that the effect of a shock is permanent, accumulating over time. While the view that supply

shocks have a long-lasting effect on the economy is now generally accepted, the view that aggregate

demand shocks are unimportant is highly controversial.

The real business cycle theory argues that fluctuations in output are the result of real shocks

hitting the economy (changes in productivity or unanticipated changes in government spending, for

example), which are then propagated to other markets. Markets adjust very rapidly and remain in

equilibrium. The intertemporal substitution of leisure mechanism assumes that there is a high elasticity of

labour supply in response to temporary wage rate changes. However, this does not necessarily imply that

permanent wage rate changes will have a significant impact on the amount of labour supplied. While

people may choose to work more in a period when wages have increased temporarily, they will generally

258

maintain a relatively stable number of work hours in the long run. In other words, in those periods where

wages are temporarily lower, they may choose to substitute leisure for work. If the effect of the

intertemporal substitution of leisure is very strong, even a small change in productivity can have a large

effect on output.

The real business cycle models are technically complex and can often only be solved with the

help of computer simulations. Economists adhering to the real business cycle theory believe that the

parameters used in the models should be identified from microeconomic studies and should describe

consumers' and workers' preferences and firms' production functions adequately.

The new Keynesian approach tries to combine traditional Keynesian macroeconomics with

microeconomic foundations and explains how individual rational decision making under imperfect

competition leads to socially undesirable outcomes. It assumes that people have rational expectations but

that institutional arrangements in the labour market exist, which decrease the flexibility of wages. Wages

are generally set by contract for a period of time, while product prices may change at any time. Thus we

observe an upward-sloping short-run AS-curve, which shifts over time as wage contracts are renegotiated.

Similarly, microeconomic theory predicts that firms in an imperfectly competitive market are reluctant to

change prices since doing so could affect their market share or profits. Firms hesitate to change their

prices since the private benefits of doing so are much smaller than the social benefits and are often below

the menu cost of the adjustment. The new Keynesians therefore integrate the rational expectations

approach in their models but still get results that reflect those of the traditional AD-AS analysis.

Suggestions and Pitfalls

Chapter 20 presents several fairly new approaches to macroeconomics, each associated with a

different school of thought. This chapter has been moved to the end of the textbook because the material

is more advanced and students not inclined to sift through theoretical arguments may not find the material

easy to comprehend. While students may find it difficult to compare one approach with the other, they

should at least be able to identify which assertions make the most sense to them. Regardless of the

theoretical aspects of the different theories, students should have enough background in microeconomics

to know that markets may not always clear in a world that has institutional labour market constraints and

imperfect competition, especially when there is imperfect information. Therefore, it makes sense that

even the assumption of rational expectations may not ensure immediate market clearing.

When presenting the material in this chapter, instructors my want to pose the following questions:

Does it seem reasonable to assume that markets always clear?

How easily do wages and prices adjust?

How persuasive are the idea of rational expectations and the approach chosen by Lucas?

How large and long lasting are the effects of demand side shocks on the economy?

Do supply shocks affect the growth rate of potential GDP?

Can stabilization policy always keep the economy at full employment?

While students may have opinions on these issues, most will not be able to sort out the theoretical

arguments made by the different schools of thought presented in this chapter. Therefore, they need to be

aware that one of the most important questions in the debate over which theory appears to be most

reasonable is how well these different theories hold up empirically. In most cases, students will not have

the background in econometrics to understand the empirical papers listed in the footnotes of the text, so it

is up to the instructor to show how the empirical evidence should be assessed. Instructors should be

careful not to favor one particular theory too strongly, since students often are reluctant to disagree with

their instructors and are easily influenced by their opinions.

259

Since much of the material in this chapter may be difficult to comprehend, instructors have to

weigh carefully how much of it they want to cover. Section 20-1 provides a much-needed overview for an

initial discussion of the different approaches and should definitely be covered first. The other sections are

more technical, and may contain more detail on the different approaches than instructors feel is

appropriate for their classes. To avoid the impression that some theories are more important than others, it

is important to give each of these approaches sufficient coverage in a way that students can comprehend.

One compromise could be to forego any of the mathematical derivations and simply explain the

different theories using the overview and expanding on the most important concepts by referring to some

of the material in the following sections. Students should definitely know the difference between adaptive

expectations and rational expectations and the different implications of perfect foresight versus rational

expectations. These differences and their implications for monetary policy be can easily shown

graphically with an AD-AS diagram. If we have adaptive expectations, the AD-curve shifts first, followed

by an AS-curve shift in the long run that will restore a long-run equilibrium at the full-employment level

of output. If people had perfect foresight, however, the AD-curve and the AS-curve would shift

simultaneously to immediately reach a new long-run equilibrium at the full-employment level of output.

With rational expectations we have something in between, and the length of adjustment process depends

on how fast markets are able to clear.

One misconception that students often have is that people always make correct forecasts if they

have rational expectations. Therefore, it is important to point out that while people use all information

available to them, they are still prone to making errors, although not systematic ones. There are two

simple ways to make this clear to students. One way is to say that people who have adaptive expectations

realize only slowly that they are wrong. When they adjust, they may make things worse rather than better.

People with rational expectations realize rapidly that they have made a mistake and immediately try to

remedy the situation, which then improves the outcome. Unfortunately, due to market imperfections and

institutional arrangements, markets cannot clear instantaneously.

Another simple example is that workers with adaptive expectations try to make up for lost

purchasing power by negotiating wages based on the past inflation rate. This behaviour may lead to

layoffs and thus deviations from the full-employment level of output, since labour will become too

expensive. On the other hand, workers with rational expectations base their wage negotiations on the

expected rate of inflation, regardless of what has happened in the past. Therefore, under rational

expectations, a new long-run equilibrium is reached much faster than under adaptive expectations.

The random walk of GDP theory can also be represented graphically by an AD-AS model. If

there is a shift in the AD-curve, the economy adjusts back to the same level of full-employment output

Y*. But if there is a productivity shock, the long-run AS-curve shifts and the economy adjusts to a

different level of full-employment output. Since the AD-AS framework allows only for a static analysis,

however, Graphs 20-4 and 20-5 should also be used to show how the trend of GDP can change over time.

Students should be aware that the real business cycle theory is simply an outgrowth of the first

two theories discussed here. This theory asserts that fluctuations in output are the result of real shocks

hitting the economy, which are then propagated to other markets. These markets adjust rapidly and

remain in equilibrium. Students may have some difficulty understanding the concept of intertemporal

substitution of leisure and may not realize that they themselves practice such behaviour in their daily

lives. For example, assume a student who has figured out how many hours of study over the next two

weeks will earn her a B+ in economics and still leave enough time for her to attend four parties before the

next test. If, among all the parties on campus, the four best parties were equally distributed over the next

two weeks she would probably attend two of these each week without changing her study habits. But if all

four of the best parties occurred in the second week, she would probably study harder in the first week so

she could master the material and still attend at least three, if not four, of the most desirable parties the

next week.

260

Students probably find the models of the new Keynesians that try to explain price stickiness with

micro foundations most convincing. After all, they have had a course in microeconomics and are familiar

with the behaviour of firms in an imperfectly competitive market. They also know that wages tend to be

fixed by contract and cannot be easily changed. Therefore, they do not believe in an immediate wage and

price adjustment. Price stickiness, which is the basis of the new Keynesian approach, makes intuitive

sense to them. It should be pointed out that this approach was developed in response to the rational

expectations theory. It argues that even under the assumption of rational expectations, markets will not

adjust immediately because of labour contracts, imperfect markets, and adjustment costs. Students also

like this approach since it allows them to continue to use the familiar AD-AS framework. Instructors

should therefore point out that not everyone agrees with Mankiw's approach as discussed in Section 20-6.

There are other questions with which students still have to struggle. For example: what policies

are most successful in allowing markets to work more smoothly? Can fiscal or monetary stabilization

policy be used successfully to counter macroeconomic disturbances? The answers to these questions

clearly depend on how much weight one gives to the assertions made by the different theories discussed

in this chapter.

Integrating the different views in this chapter into a framework that is understandable to students

(such as the AD-AS model) is important. But it is even more important to enable students to judge which

assumptions are realistic. It is useful in this regard to spend some time asking students which of the

various approaches in the last two chapters make most sense to them and for what reasons. This should

initiate some good discussion and may provide the opportunity to explain certain key aspects in more

detail or to correct some misconceptions in the students' understanding of the various theories.

Solutions to the Problems in the Textbook

Discussion Questions:

1. Some of the aspects of the theories discussed in this chapter complement each other, but there are also

major disagreements. The real business cycle theory is an outgrowth of the rational expectations

theory and the random walk of GDP theory, while the new Keynesian models respond to the rational

expectations theory by showing why prices may still be sticky even under the assumption of rational

expectations. In both the real business cycle theory and the new Keynesian models, expectations are

formed rationally, but only the real business cycle theory assumes that markets clear very rapidly.

These theories therefore disagree on the speed of the price adjustment. They also disagree on the

sources of shocks to the economy. The question of whether output follows a random walk has also

been an important point of disagreement. If output shocks are important they must come from the

supply side and they must have permanent effects.

2. Rational expectations differ from perfect foresight in that expectations are imperfect. While rational

people will make efficient use of all information available, they may still make incorrect forecasts.

However, when expectations are rational, no systematic errors are made. The best guess for the

forecast error term is zero. Under perfect foresight, monetary policy is always neutral, that is, the

effect of monetary policy on real output is zero even in the short run. Under rational expectations,

monetary policy has a short-run effect on output if the policy change is unanticipated, but it is neutral

in the long run.

261

3. The propagation mechanism is the process by which a disturbance spreads through the economy. The

concept of intertemporal substitution of leisure is most often used to describe why people work more

in some periods than in others. Assume, for example, that there is a negative shock to technology

such that the marginal product of labour (and therefore the real wage rate) drops temporarily until the

market clears. Workers realize that, for the near future the real wage rate is lower than usual.

Therefore, they may choose to take some time off or work fewer hours than usual, intending to make

up for it later when the wage rate has increased again. In this way, a small change in wages (resulting

from a shock in technology) can create a large change in output, even though labour supply is fairly

insensitive to wage rate changes in the long run.

4. The models by Mankiw and Lucas both assume rational expectations. However, in Mankiw's menucost model of aggregate supply, firms have enough market power to set their own prices. Prices are

sticky, since firms are reluctant to change them due to the perceived loss of market share or profit or

the costs of doing so (the menu cost). In Lucas' imperfect-information model of aggregate supply,

firms are assumed to be price takers and prices adjust immediately to clear markets. Mankiw's model

is a new Keynesian model that argues that fiscal and monetary policies have short-run effects on

output, even if they are anticipated. Lucas' model is a new classical model that argues that monetary

and fiscal policy have only short-run effects on output if they are unanticipated. However, both

models permit a demand-based explanation of the business cycle.

5. The key assumption in Mankiw's model is that firms have the market power to set their own prices

and therefore face a downward-sloping demand curve for their product. Since the private benefits

from changing prices are smaller than the social benefits and are often outweighed by the menu costs,

rational decision-making under imperfect competition may still lead to socially undesirable outcomes.

6. Deep parameters are parameters that are an integral part of microeconomic theory. These fundamental

microeconomic relations describe the preferences of consumers and workers or firms' production

functions, including the marginal product of labour and capital.

7. In Lucas' imperfect-information model, shocks to aggregate supply will have their greatest effect

when they come unexpectedly and rarely, and when they affect the economy as a whole while most

previous shocks were only region or market specific. Most firms observe prices only in their own

market. As a result, if one of these rare economy-wide shocks affects all prices, it is interpreted

simply as a movement in prices of these region (or market) specific goods. As a response, firms will

change their production and we will therefore see a larger change in output.

8.a. A difference-stationary process is dominated by permanent shocks. A trend-stationary process is

dominated by transitory shocks.

8.b. If output is trend-stationary, most changes are transitory, suggesting that they were caused by

fluctuations in aggregate demand. Shocks to the AD-curve (changes in fiscal or monetary policies)

are more likely than supply shocks to cause temporary deviations from the full-employment level of

output. If output is difference-stationary, then the opposite is true, that is, disturbances in aggregate

demand are not very important and most shocks occur on the supply side, causing permanent changes

in the full-employment level of output.

8.c. If output were trend-stationary with breaks, then supply shocks would be fairly rare and in the interim

between them, disturbances in aggregate demand would play a greater role.

262

Application Questions:

2.a. Equation (3) can be used to solve for output and can be written as

y = [1/(1 + )]m + [1/(1 + )](v - pe) + [/(1 + )]y*

= [1/(1 + 2/3)]9 + [1/(1 + 2/3)](8 - 5) + [(2/3)/(1 + 2/3)]7 = (3/5)*9 + (3/5)*3 + (2/5)*7

= 50/5 = 10.

Equation (4) can be used to solve for price and can be written as

p = [/(1 + )](m + v - y*) + [1/(1 + )]pe = [(2/3)/(1 + 2/3)](9 + 8 - 7) + [1/(1 + 2/3)]5

= (2/5)*10 + (3/5)*5 = 35/5 = 7.

2.b. The model forecasts a price level of p = 7, although the expected price level that was used is p e = 5.

This implies that the predictions for the economy are inconsistent with the predictions of the model.

However, truly rational forecasters should make predictions that are consistent with the way that the

economy actually operates (or is assumed to operate in the model).

2.c. A perfect foresight model would predict that output does not deviate from its full-employment level

and that changes in money supply simply affect the price level, that is,

pe = p = m + v - y* = 9 + 8 - 7 = 10

and

y = y* = 7.

2.d. The perfect foresight model has two shortcomings: first, it cannot explain any deviation from the fullemployment level of output. Second, it assumes that people always have all relevant information and

always guess the price level correctly. This, however, seems unrealistic.

3.

Equation (11) states that the equilibrium solution for the level of output is

y = y*e + [1/(1 + )]m + [/(1 + )]y.

Equation (12) states that the equilibrium solution for the price level is

p = me + v - y*e + [/(1 + )](m - y*).

From these equations we can see that anticipated changes in potential output (y *e) enter both

equations with a coefficient of 1, positively in Equation (11) and negatively in Equation (12). This

means that output will rise and prices will fall if we have a supply shock, just as the perfect foresight

model predicts.

Unanticipated changes in potential output enter both equations with a coefficient of /(1 + ),

again positively in Equation (11) and negatively in Equation (12). This means that output will rise and

prices will fall if we have a supply shock, but by less than the AD-AS model predicts.

263

4. While early studies seemed to support the view that only unanticipated monetary changes affect

output, later studies questioned this view. Evidence was found that shifts in monetary policy that were

intended to lower inflation tended to be followed by recessions.

5.a. Equation (35) shows the total change in output caused by a change in the marginal product of labour.

This can be expressed in the following way:

%Y = {1 + 3[(1 - )/(1 - - )]}(%a) = {1 + 3[(1 - 0.35)/(1 - 0.35 - 0.05)]}(0.10)

= [1 + 3(0.65)/(0.6)](0.10) = 0.425.

5.b. Since neither or is close to one, there should not be a strong intertemporal substitution of leisure.

6.a. Empirical evidence suggests that intertemporal substitution of leisure is not very strong over the long

run.

6.b. Since intertemporal substitution of leisure is not very strong over the long run, the propagation

mechanism indicates that small shocks to technology do not generate large output changes.

7.a. According to equation (16), price expectations would change in the following way:

[E(p|pi)] = (1/)( pi) = (1/1) (0.75)4 = 3,

that is, if local prices rose to 4 times their original level, people would expect an overall price rise of

three times as much.

7.b. According to equation (15), output will increase by

yi = [pi - E(p|pi)] = (1/2)(4 - 3) = 1/2,

that is, output in the region will increase by half as much as a result of these price increases.

7.c. If = 0.25, then

[E(p|pi)] = (1/)(pi) = (1/1) (0.25)4 = 1, and

yi = [pi - E(p|pi)] = (1/2)(4 - 1) = 3/2,

that is, output will now change more than previously.

7.d. If = 1, then

[E(p|pi)] = (1/) (pi) = (1/1) (1)4 = 4, and

yi = [pi - E(p|pi)] = (1/1)(4 - 4) = 0,

that is, output will now not change at all.

264

Additional Problems:

1. "If people have rational expectations, then they will never make forecasting errors and the

economy will always remain at the full-employment level of output." Comment on this

statement.

If people have rational expectations they will make the best use of all information available to them

before making an economic decision. The expectations formed are consistent with the way the economy

actually operates. People are still prone to making errors, but not systematic ones. Therefore, if there is an

anticipated change in policy, people will adjust accordingly, markets will clear, and the economy will stay

at full-employment. But if the policy change is unanticipated, people will have forecast incorrectly and

the economy will deviate from the full-employment level of output in the short run. As soon as people

learn of their mistake, however, they will take action to correct it.

2. "A fully anticipated change in policy should not have any effect on real output in a rational

expectations model." Comment on this statement.

According to the simple rational expectations approach, markets always clear immediately and

stabilization policy is therefore ineffective. Any change in the AD-curve will be fully anticipated and

bring about a simultaneous and equivalent shift in the upward-sloping AS-curve. As a result, nominal

wages and prices will rise proportionately, but real output will remain the same. While transitory

deviations from full-employment are possible, they are simply the result of expectations errors and do not

last long. If forecasting errors are made, the government needs only to provide accurate new statistics and

markets will correct themselves, returning the economy to full employment.

Not everyone agrees with this approach and empirical evidence tends to support the idea that even

anticipated policy changes have real effects on the economy. For example, if wages are set by contracts

over a period of time, a price change resulting from a policy change will have an effect on real wages, and

thus employment and output. We will have an upward-sloping AS-curve that shifts over time as wages

are renegotiated. Since wage contracts tend to be valid for more than one year, and since not all wage

contracts are renegotiated at the same time, it is possible that even an anticipated policy change can have

a fairly long-lasting effect on the economy.

3. "A perfect-foresight model predicts that expansionary monetary policy has no effect on the

level of output." Comment on this statement.

Expansionary monetary policy will shift the AD-curve to the right. If inflationary expectations are fixed,

this will lead to an increase in both the price level and the level of output. However, under perfect

foresight price expectations are formed endogenously and are consistent with the price prediction of the

model. In other words, if a price increase is anticipated, workers will know that their real wage rate will

decrease unless their nominal wage rate is increased. Therefore they will demand a higher nominal wage

rate. But an increase in the nominal wage rate in proportion to the price increase will leave the real wage

rate unchanged. In this case, the upward-sloping AS-curve will shift left by the same proportion as the

AD-curve shifts right and the full-employment level of output and employment will remain unchanged

while prices increase. In other words, under perfect foresight, an increase in money supply of 1% leads to

a price increase of 1% but no change in the level of output. Thus, monetary policy is neutral in both the

short and long run. This assumes, however, that economic agents are always right in their predictions and

that output always stays at its full-employment level, which is quite unrealistic.

265

P

AD2

AS2

AD1

AS1

P2

P1

0

Y*

Y

4. "In a Lucas imperfect-information model of aggregate supply, an unanticipated fiscal policy

change will be ineffective in changing output." Comment on this statement.

In the Lucas imperfect-information model of aggregate supply, the effects of fiscal expansion are very

similar to those of monetary expansion. An unexpected increase in government spending raises aggregate

demand and leads to an increase in the price level. This unanticipated increase in the overall price level

will be interpreted as a partial increase in the anticipated price level, which will increase the level of

output to some degree. In other words, the short-run effect of expansionary fiscal policy is a shift in the

AD-curve to the right, without an equivalent shift to the left of the AS-curve (which is upward sloping,

with its position determined by the expected price level). Therefore we will have an increase in the level

of prices and output in the short run. In the long run, the economy will adjust back to the full-employment

level of output.

5. "The Lucas supply curve will shift to the left whenever the expected price level is below the

actual price level." Comment on this statement.

The expected price level determines the position of the Lucas supply curve. There is an equilibrium at the

full-employment level of output only if price predictions are correct. If the actual price level is above the

expected price level, workers perceive their real wage rates to be higher than they actually are. Thus,

employment and output are above the full-employment level. However, workers will soon learn of their

prediction errors and revise their forecasts. Realizing that real wages are actually not as high as they

thought, they will reduce their work effort and the economy will adjust back to the full-employment level

of output. The upward-sloping AS-curve will shift to the left and a full-employment equilibrium will be

reached at the actual (and now also predicted) price level.

6. Assume the Bank of Canada announces a 5% reduction in money supply, but then actually

reduces money supply by 10%. Explain the effects of such an unanticipated policy change in the

short run and long run according to the Lucas supply curve model.

If money supply is decreased by 10% rather then the expected 5%, the resulting price decrease will not be

fully anticipated by workers. The AD-curve will shift left and the upward-sloping AS-curve will shift

right, but the AD-curve shift will be of a larger magnitude. The levels of output and prices will both

decrease (the price decrease would be somewhere between 5% and 10%). However, as soon as workers

recognize their forecasting mistakes, they will adjust their expectations downward and the upward-

266

sloping AS-curve will shift further to the right. In the long run, the full-employment level of output will

be reached again and prices, nominal wages, and nominal money supply will all have decreased by 10%.

P

AS1

AS2

AD1

AD2

AS3

P2

P1

0

Y1

Y*

Y

7. Comment on this statement:

"The Lucas model predicts policy irrelevance, that is, it suggests that it makes little difference

whether fiscal or monetary policy is used, since neither one will affect output."

The Lucas model predicts that neither fiscal nor monetary policy will affect the level of output in the long

run. However, it allows for transitory deviations from the full-employment level of output, which are

caused by forecasting errors. These deviations do not last long since people ultimately recognize that they

have made errors and correct their behaviour.

8. "According to the Lucas imperfect-information model of aggregate supply, government policies

should not affect the unemployment rate." Comment on this statement.

The Lucas model assumes that the expected price level determines the position of the upward-sloping AScurve. When price expectations are correct, we will be at full employment. In an ideal case, any

anticipated change in policy that shifts the AD-curve will cause a simultaneous shift in the upwardsloping AS-curve, and markets will clear rapidly. Nominal wages and prices change proportionally so we

will stay at the full-employment level of output. However, if policy changes are unanticipated, price

expectations will adjust only partially and we will see a transitory change in the level of output and

therefore the unemployment rate. It should be noted that empirical evidence tends to support the notion

that even anticipated changes in government policies have real effects in the short run (people's

expectations are not always correct). In addition, because of wage contracts, wages tend to be rigid in the

short run. Prices also adjust only slowly in an imperfectly competitive environment. Thus even

anticipated policy changes tend to have a real effect on the economy.

267

9. "The random walk of GDP theory argues that permanent output fluctuations arise primarily

from unanticipated fiscal or monetary policy changes." Comment on this statement.

Actually, the random walk of GDP theory argues that most aggregate demand disturbances (due to fiscal

or monetary policy changes) are transitory in nature, whereas supply shocks tend to have permanent

effects on output.

10. "According to the random walk of GDP theory, output fluctuations are always temporary and

mostly the result of changes in technology." Comment on this statement

The random walk of GDP theory argues that most aggregate demand disturbances (due to fiscal or

monetary policy changes) are transitory and generally not very severe in nature. On the other hand, supply

shocks (due to changes in material prices, technology, or productivity) tend to have permanent effects on

output. Therefore most long-lasting changes in output come from random shocks on the supply-side and

cannot be accurately predicted.

11. "The intertemporal substitution of leisure propagation mechanism argues that the elasticity of

labour supply in response to a permanent change in the wage rate is very high." Comment on

this statement.

A propagation mechanism is a mechanism through which disturbances are spread throughout the

economy. Intertemporal substitution of leisure assumes that people prefer to work more in periods when

the wage rate is higher and less in periods when the wage rate is lower. Thus there is a very high elasticity

of labour supply in response to temporary changes in the wage rate. This, however, does not imply that

labour supply is very sensitive to permanent changes in wages. As a matter of fact, since there is nothing

to be gained from working more now and less later if wages increase permanently, the response of labour

supply to a permanent wage rate change may actually be quite small.

12. Explain the differences in the effect of intertemporal substitution of leisure between a

temporary and permanent wage increase.

The view that workers are willing to substitute leisure for work intertemporarily implies a high elasticity

of labour supply in response to a temporary wage rate change. When the wage rate increases temporarily,

workers may work more, but only in those periods when the wage rate is high. When the wage rate

declines again, workers will substitute leisure for work, that is, they will work less. A permanent wage

increase would not have the same effect, since it would not be to a worker's advantage to work more in

one period and less in the other.

13. "The real business cycle theory asserts that changes in the level of output can be largely

explained by unanticipated changes in money supply." Comment on this statement.

Most economists believe that an increase in money supply causes lower interest rates and more

investment, resulting in a higher level of national income. However, the real business cycle theory asserts

that changes in money supply do not cause major changes in output. Instead changes in money supply are

a reflection of changes in output and of the fact that the banking system expands the supply of money to

accommodate an increase in spending. In other words, the real business cycle theory does not give money

a central role in explaining fluctuations in output. Instead it argues that major fluctuations in output and

268

employment are the result of real shocks to the economy (changes in productivity, technology, or

government spending).

14. The fact that an upswing in economic activity always seems to be preceded by an increase in

money supply can be explained in two ways. What are the two explanations, which do you agree

with most, and why?

The answer to this question is student specific. Most economists believe that an increase in money supply

causes lower interest rates and more investment, resulting in a higher level of national income. However,

the real business cycle theory asserts that changes in money supply do not cause major changes in output,

but are instead a reflection of changes in output and of the fact that the banking system expands the

supply of money to accommodate an increase in spending. The real business cycle theory does not give

money a central role in explaining fluctuations in output. Instead it argues that major fluctuations in

output and employment are the result of real shocks to the economy (changes in productivity, technology,

or government spending).

15. Comment on the following statement:

"The new Keynesian models assert that people do not have rational expectations, since the

assumption of rational expectations would imply that markets always clear immediately."

The new Keynesian models state that even under the assumption of rational expectations, socially

undesirable outcomes may still occur due to imperfect competition. Firms in imperfectly competitive

markets are reluctant to change prices due to the menu costs involved and therefore markets will not clear

rapidly.

16. "If all economic agents have rational expectations, then all wages and prices must be perfectly

flexible and unemployment cannot exist." Comment on this statement.

The new Keynesian models argue that even if people have rational expectations, socially undesirable

outcomes may still occur due to imperfect competition and the existence of wage contracts. Prices may

not change freely, since firms in an imperfectly competitive market are reluctant to change them, due to

the menu costs involved. Nominal wages are set by contracts over a period of time, so the economy may

adjust only slowly to a decrease in aggregate demand. Thus a rate of unemployment higher than the

natural rate can exist over an extended period of time.

17. “Lucas’ imperfect-information model and Mankiw’s menu-cost model are actually quite similar

and they both have the same policy implications.” Comment on this statement.

Mankiw’s and Lucas’ models both assume rational expectations. However, in Mankiw’s menu-cost model

of aggregate supply, firms have enough market power to set their own prices. Prices are sticky, since

firms are reluctant to change them due to the perceived costs of doing so, namely the menu costs or the

loss of market share or profit. In Lucas’ imperfect-information model of aggregate supply, firms are

assumed to be price takers and prices adjust immediately to clear markets. Mankiw’s model is a new

Keynesian model that argues that fiscal and monetary policies have short-run effects on output, even if

they are anticipated. Lucas’ model is a new classical model that argues that monetary and fiscal policy

have only short-run effects on output if they are unanticipated. However, both models permit a demandbased explanation of the business cycle.

269

18. "The actual impact of fiscal and monetary policy is not so much determined by whether

expectations are rational but by whether wages and prices are flexible." Comment on this

statement.

The rational expectations hypothesis says that people consistently make optimal choices to maximize

their utility using all available information. Since people know the outcome of an announced policy

measure, they always try to adjust immediately and therefore markets clear very rapidly. Only

unannounced policy changes have a temporary effect on the level of output, unemployment, and inflation.

However, even if expectations are rational, there are always wage contracts, costs of price adjustment

(menu costs), imperfect information, and imperfect competition. Wages and prices do not adjust

immediately and markets cannot clear immediately. The more rigid wages and prices are, the larger the

effect of a disturbance. Similarly, the longer it takes for inflationary expectations to adjust, the longer it

takes for the economy to adjust back to full employment after a disturbance or policy change.

270