Bias in Feeder Cattle Futures, Ryan Broxterman

advertisement

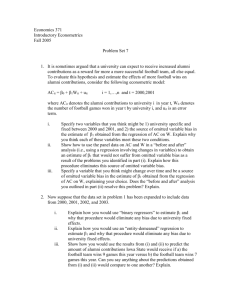

Bias in Feeder Cattle Futures May 13, 2004 Ryan Broxterman Dr. John Fox Dr. Jim Mintert 1 Table of Contents Introduction …………………………………………………...…………1 Body …………………………………………………………………….2-6 Data ……………………………………………………….………2 Model ………………………………………………….………….2 Regression Analysis ……………………………………….……...4 Forecasting ………………………………………………….…….6 Trade Simulation ………………………………………….………6 Conclusion …………………………………………………………...…..7 Bibliography …………………………………………………….……….8 Appendix Mean Regression ………………………………………………….i T-Stat Regression …………………………………...….…………ii Chart of 2003-2004 Contracts ……………………………………iii Chart of Forecast Errors …………………………………………..iv 2 Bias in Feeder Cattle Futures Introduction Feeder cattle contracts are traded at the Chicago Mercantile Exchange. They were first started in 1972 and now consist of 8 contract months. As long as these markets have been around there has always been a debate about their efficiency. One sign of market inefficiency is bias. As defined by Kastens and Schroder (1995) market bias is “the tendency to move either up or down into expiration.” Futures markets should be unbiased in the long run. If the market is biased you would expect arbitrage or profit taking to occur and take the bias out of the market. However there must be at least the perception of profit opportunity in order for traders to trade the market. In any futures market it is important to keep this balance between market efficiency and profit opportunity. The objective of my research is to study past futures contracts to see if there is indeed an upward or a downward bias in feeder cattle futures prices. Because bias is the tendency for price of a contract to move up or down into expiration, an upward bias would happen if the market decreased in price as the contract nears expiration. A downward bias would occur if a market increased in price as the market neared expiration. If there is no bias and the market is efficient you would expect the number of contracts increasing in price to be approximately equal to the number decreasing in price. 3 Data All data for this project was obtained from the Bridge CRB program. Data was arranged so that the last day of each contract was designated as day n, second to last day, day n-1, the third to last day, day n-2 and so on. A chart of each of the futures contracts was conducted from start to close to see if there was any visible bias. This returned inconclusive results so I decided to test for statistical significance. A small sample of the data used is attached at the end of the report. Model In developing a model to determine if there is a bias in feeder cattle prices I first needed to chose the times to analyze. I choose 2 week average intervals in order to get around daily ups and downs in the market. I used the last two weeks (days n through n-9 where day n is the final day) as my base and compared it to day n-80 through day n89, a two week period about 4 months before the close. I then compared these two averages using both a simple mean change and also by running a t-test for 2 sample means with unequal variances. The t-test provides a t-stat which indicates the statistical significance of the mean difference. In order for the difference in means to be considered statistically significantly higher, the t-stat must be above 2 in absolute power. The results of these t-tests are provided below. A significantly higher t-stat would be upward biased while a significantly lower t-stat would be downward biased. 4 January Count Significantly Higher Significantly Lower No Significant Difference March Count Significantly Higher Significantly Lower No Significant Difference April Count Significantly Higher Significantly Lower No Significant Difference May Count Significantly Higher Significantly Lower No Significant Difference 26 9 17 31 14 14 3 31 13 15 3 32 15 15 2 August count Significantly Higher Significantly Lower No Significant Difference September count Significantly Higher Significantly Lower No Significant Difference October count Significantly Higher Significantly Lower No Significant Difference November count Significantly Higher Significantly Lower No Significant Difference 31 10 19 2 30 8 19 3 30 10 16 4 31 14 13 4 My third step was to then run a regression. I regressed both the t-stats and the mean changes in separate regressions against a time factor which was figured starting with 1 for 1972 contracts, 2 for 1973 contracts and so on. I also used dummy variable to represent each of the 8 contract months using January as my default. 5 Regression Analysis The difference in means between the final 2 weeks and the earlier 2 week period (day n-80 to n-89) was regressed on a time trend variable and a set of dummy variables representing different contract months. The results can be found in the Appendix page 1. These results can be interpreted by saying the in year 0 or 1971 the price 4 months before the close will be $2.04 less than the price at the close. It can be further interpreted by saying that in each subsequent year this price difference will drop by $.053. This indicates that over time feeder cattle futures seem to be getting more and more efficient or at least showing less bias. The estimated coefficients on the dummy variables show that in months March, April, May, and November the difference in means seems to be smaller than in January. Because the values of each of these coefficients are negative it means that the price difference is less for these contract months than it is for January, or that they are more efficient than January. In August, September, and October this price difference seems to be larger, evident by the positive coefficient. This suggests that these contract months were more inefficient. The statistical significance of this regression does not seem to be real good. It has an R-squared term on .0249 which is pretty small. Also the P-values of the coefficients are fairly low. The intercept and the time factor are not too bad being .14 and .209 however the high p-values on the dummy variables tell me that there probably isn’t a lot of difference between the different contract months. Figure 2 shows the residuals of the regression. As you can see bias seems to follow time periods. It seems that several contracts will be over predicted by the model then several will be under predicted. The pattern doesn’t appear to be completely 6 random. If this study would have been done 15 years ago it may have been possible to gain profit from trading this bias however it looks like the market is becoming more efficient which is what the regression is telling us. The results of this regression tell me that in the January contract of 2002 the bias would be $.42/cwt. (2.04 + (20021972)*.054). This is obviously considerably lower than the $2.04/cwt. bias predicted for 1971. A 2nd regression model was ran using the t-statistics for the test of difference in mean between the two price periods. The results of the t-stat regression can be found on page 2 of the appendix. The t-stat regression tells us the statistical significance of the findings. An intercept of 9.008 means that in year 0 or 1971 the predicted difference in means is statistically significant because it is greater than 2. The idea that feeder cattle futures markets are becoming more and more efficient is backed up by this regression. A coefficient of -.231 for time means that as time goes on the statistical significance of this mean difference gets less and less and therefore indicates the markets are becoming more efficient. The dummy variables in this regression tell us how much the statistical significance changes as we change contract months. Because January is the default month, if the month we are observing is March we would subtract 1.11 from the intercept meaning that March seems to be less statistically significant than January. March, April, May, October, and November all are less significantly significant than January. However, August and September seem to be more statistically significant than January, evident by the fact that the coefficients of these terms are positive. The R-squared value of this regression also seems to be very low. It is only .0378 while the standard error is high at 21.63. The P-values of the intercept and time in this regression also seem to be 7 good while all of the dummy variables are very poor, thus suggesting that there isn’t a lot of change of the different contracts. Forecasting Results from the regression model were used to forecast the eight 2003 contracts along with the January and March contracts of 2004. I used 2 methods to forecast the price at expiration. For my first forecast I simply used the average futures price of day n80 threw day n-89 to predict the price at expiration. For my second forecast I used the mean regression model that I developed. I then used the root-mean-squared forecast error to compare these two models for performance. In this analysis the lower that the error is the better your model is. I received a forecast error of 12.36 for the first model and an error of error of 12.14 for the second model. This means that neither of these forecasts is working very well at predicting the price at the close in these 10 contract months. It further tells me that my model is only performing slightly better than the average price 4 months before the close. Trade Simulation For the last part of my analysis I ran a trade simulation of the 8 contracts of 2003 and the January and March contracts of 2004. I simulated trading the bias that I found by going long one contract 90 trading days before the close and selling that contract back on the close. I returned a net profit of $28,675 from this trading simulation. This is an impressively high number considering the discovery mad cow disease in the U.S. on December 23, 2003, and the sharp downtrend that it caused. This large profit didn’t come as a surprise however due to current market conditions. During these months 8 feeder cattle were in short supply and caused an inverted market. This inverted market in turn lead to the sharp increase in price as these contracts neared expiration. Conclusion I have concluded that the feeder cattle futures market may have a slight downward bias. The market seems to increase in price a little as the contract nears a close. The overall average of each contracts difference from 4 months before the close of the contract to the close is 88 cents/cwt. This bias however does not seem to be of great statistical significance. This is evident by the low R-squared values in the regression and also the high standard errors. I am not overly confident in saying that this finding was important simply because of the fact that it is of little statistical significance. Or I at least am confident in saying that I would not trade the bias. 9 References Bridge CRB, Terry L. Kastens and Ted C. Schroeder, “Efficiency Tests of Kansas City Wheat Futures,” December 1996 Terry L. Kastens and Ted C. Schroeder (1995), “A Trading Simulation Test For WeakForm Efficiency In Live Cattle Futures,” The Journal of Futures Markets, 6:649675 10