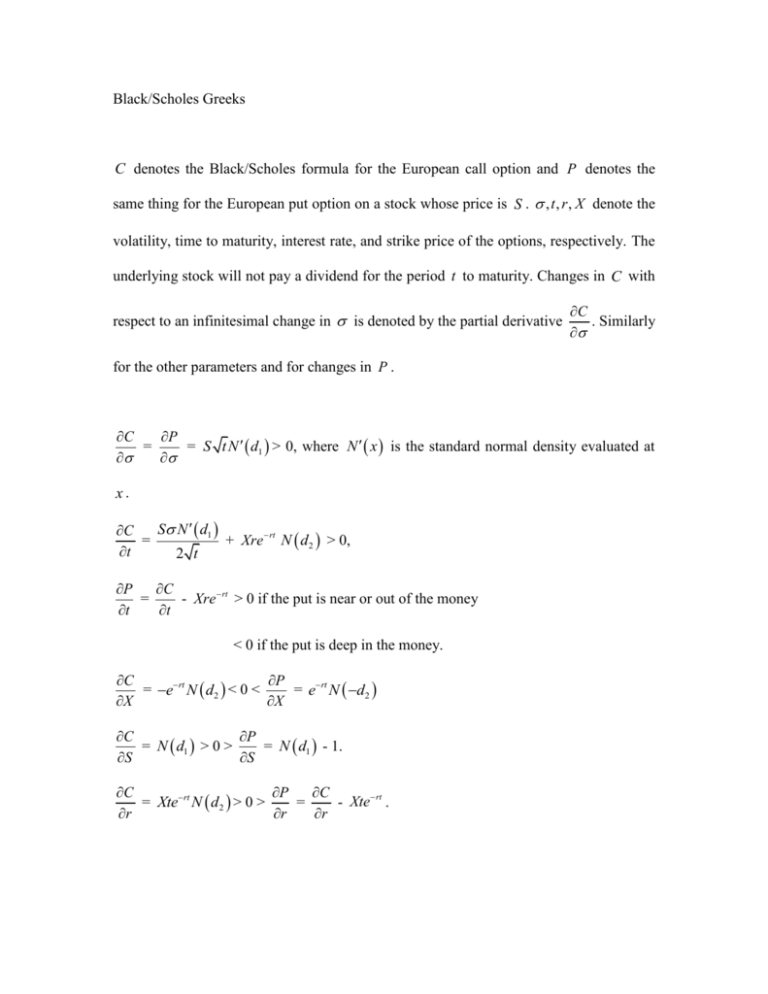

Black/Scholes Greeks

advertisement

Black/Scholes Greeks C denotes the Black/Scholes formula for the European call option and P denotes the same thing for the European put option on a stock whose price is S . , t , r , X denote the volatility, time to maturity, interest rate, and strike price of the options, respectively. The underlying stock will not pay a dividend for the period t to maturity. Changes in C with respect to an infinitesimal change in is denoted by the partial derivative C . Similarly for the other parameters and for changes in P . C P = = S t N d1 > 0, where N x is the standard normal density evaluated at x. S N d1 C = + Xre rt N d2 > 0, t 2 t P C = - Xre rt > 0 if the put is near or out of the money t t < 0 if the put is deep in the money. C P = e rt N d2 < 0 < = e rt N d2 X X C P = N d1 > 0 > = N d1 - 1. S S C P C = Xte rt N d2 > 0 > = - Xte rt . r r r