Output & Costs

advertisement

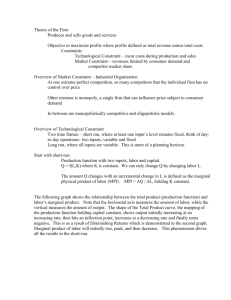

1.5 Output and Costs ** This note is summarized by Hui Wang. Important reference Study Guides of Stalla Review for CFA Exams Learning Outcomes The candidate should be able to: a. differentiate between short-term and long-term decision time frames; b. describe and explain the relations among total product of labor, marginal product of labor, and average product of labor, and describe increasing and decreasing marginal returns; c. distinguish among total cost (including both fixed cost and variable cost), marginal cost, and average cost, and explain the relations among the various cost curves; d. explain the firm’s production function, its properties of diminishing returns and diminishing marginal product of capital, the relation between short-run and longrun costs, and how economies and diseconomies of scale affect long-run costs. Production decision time frame Short run is the time span between one where the quantity of no input is variable and one where the quantities of all inputs are variable. Simply put, at least one input is fixed. Long run is a time frame in which the quantities of all inputs can be changed. Put another way, there is no fixed input in the long run. Sunk cost We use the concept of sunk cost to describe such investment- the cost already incurred which cannot be recovered regardless of future events. When a firm makes production decisions, it should ignore sunk cost. The only relevant costs that influence its decisions are the short-run cost of changing variable inputs and the long-run cost of changing its plant. Short-run production The production function is a table, a graph, or an equation showing the maximum product output achieved from any specified set of inputs. The function summarizes the characteristics of existing technology at a given time. 1 / 12 Average product (AP) is the ratio of total product to the total quantity of an input used to produce the product. For example, the average product of labor is AP = , holding K constant Marginal product (MP) is the change in output that results from one additional unit of a factor of production, all other factors remaining constant. For example, the marginal product of labor is MP = or MP = , holding K constant The general relation between marginal product and average product is: MP < AP AP declines MP > AP AP rises MP = AP AP is maximized This average-marginal relation for production is closely tied to the law of diminishing marginal returns, which refers to how the marginal product of an input usually decreases as more of the input is used. Isoquants An isoquant is a graph of all possible combinations of inputs that result in the production of a given level of output. Isoquants have several properties: 1) the farther the isoquant is from the origin, the greater the output it represents; 2) isoquants are always downward-sloping and convex to the origin; 3) two different isoquants can never cross; 4) any combination of inputs above or to the right of an isoquant results in more output than any point on the isoquant. If the distance between isoquants increases as output increases, the firm’s production function is exhibiting decreasing returns to scale; if the distance is decreasing as output increases, the firm is experiencing increasing returns to scale. Short-run cost We need to analyze three cost concepts: fixed, variable, and total. Total fixed cost (TFC) is the cost of production that does not change with changes in the quantity of output produced by a firm in the short run. Total variable cost (TVC) is the cost of production that varies directly in proportion to the number of units produced. Variable cost often includes labor expenses and raw material cost. Total cost (TC) is the sum of total fixed and total variable costs. 2 / 12 Total fixed cost can be represented by a horizontal line. Variable costs start at original point, increase with output at a decreasing rate and then increase with output at an increasing rate. The total cost curve is the vertical summation of the fixed cost curve and the total variable cost curve. Average fixed cost (AFC) is the total fixed costs divided by the quantity (Q) of units produced. Average fixed cost is a per-unit measure of fixed costs. Average variable cost (AVC) is a firm’s variable costs divided by the quantity (Q) of total units of output. Initially, average variable cost decreases as output increases. However, as output increases, at some point of increased production, average variable cost rises, AVC= = Where L is the number of variable inputs used in the production, and w is per unit cost of L. We defined average product as: AP= Therefore AP is the inverse of L/Q. Now we can rewrite AVC as AVC= W* So we can think AVC as the inverse of average product times the cost per unit of input. Since average product initially increases with output, reaches a maximum, and then begins to decline. Given the inverse relationship between AVC and AP, AVC mirrors the behavior of AP- when AP increase, AVC decreases; when AP decreases, AVC increases. So we expect AVC to initially decrease, hit a minimum, and then increase. Average total (ATC) is total cost divided by output. ATC can also be derived by the sum of AVC and AFC, ATC= = = + = AFC+AVC The marginal cost (MC) of an additional unit of output is the cost of the additional inputs needed to produce that output. Mathematically, the marginal cost is the derivative of total production costs with respect to the level of output. If ΔTVC is the change in total variable costs resulting from a change in output of ΔQ and if ΔTFC is the change in total fixed costs resulting from a change in output of ΔQ then, 3 / 12 MC= But TFC is constant in the short-run, which means that ΔTFC is zero; therefore MC= = w* Recall that we defined MP as MP= Therefore we can rewrite MC as MC= w* Average total cost and average variable cost initially decreases, reach a minimum, and then increase as output increases. The average total cost curve is the vertical summation of the average fixed cost and the average variable cost curves. Marginal cost intersects with both average total cost and average variable cost at their minimum level. Moreover, when marginal cost is below the average cost, average cost falls and when marginal cost is above the average cost, average cost rises. Average total cost achieves its minimum at a higher output rate than average variable cost because the increases in average variable cost are, up to a point, more than offset by decreases in average fixed cost. Further discussion in cost curves There are two reasons for the U shape of the average total cost curve, (1) As output increases, the total fixed cost is spread over a larger quantity of output and thus the average fixed cost declines. (2) The production will eventually enter the phase of diminishing returns. The position of a firm’s short-run cost curves may vary with the following two factors: (1) Technology. (2) Prices of inputs. Cost curves and product curves 4 / 12 AP and MP AP MP 0 Variable input Cost MC 0 Phase A Phase B AVC Output Phase C Phase A: rising MP and falling MC; rising AP and falling AVC Phase B: falling MP and rising MC; rising AP and falling AVC Phase C: falling MP and rising MC; falling AP and rising AVC A firm that seeks to maximize its profit will choose to organize production at Phase B. Long-run cost In the long-run all inputs are variable, and firms have options to build plants of different size. The long-run average cost function (LAC) shows the minimum cost per unit of all output levels when any desired size plant is built. Any point on the long-run average cost curve is the lower-cost point of the corresponding short-run cost function for the given output level. The long-run total cost function represents the relationship between long-run total cost and output. The long-run total cost of a given output level equals the long-run average cost times output. The long-run total cost curve pass through the origin. The long-run marginal cost function represents the change in the long-run total cost of producing a good or service resulting from a change in the quantity of output produced. Economies of scale and diseconomies of scale Economies of scale: the increase in efficiency of production as the number of goods being produced increases. With given factor prices, if the percentage increase in output exceeds the percentage increase in all factors of production, the 5 / 12 firm is experiencing economies of scale. Economies of scale arise from greater specialization of both labor and capital. Diseconomies of scale: a firm may grow beyond the scale of production that minimizes long-run average cost and produce goods or services at increased perunit costs. Diseconomies of scale arise from the difficulty of managing a very large firm: there will be greater challenge of organizing the firm and greater cost of communicating information. Constant returns to scale: a production function exhibits constant returns to scale if changing all inputs by a positive proportional factor has the effect of increasing output by that factor. The general case is that: a new start-up firm will first experience decreasing average cost as it expands its production, then the firm will reach its minimum Scale economies and returns to scale generally produce the U-shaped long-run marginal cost curve. Term Total Fixed cost Total Variable cost Total cost Symbol TFC TVC TC Equation Marginal cost MC MC = Average fixed cost AFC AFC = Average variable cost AVC AVC = Average total cost ATC ATC = AFC + AVC TC = TFC + TVC 6 / 12 Exercise Problems: (provided by Stalla PassMaster for CFA Exams.) Q1. Q2. Q3. 7 / 12 Q4. Q5. Q6. Q7. Q8. 8 / 12 Q9. Q10. 9 / 12 EXPLANATION Q1. Q2. Q3. Q4. 10 / 12 Q5. Q6. Q7. Q8. Q9. 11 / 12 Q10. 12 / 12