Australian University Domestic Tuition Fees

advertisement

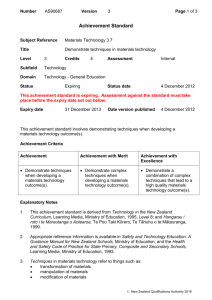

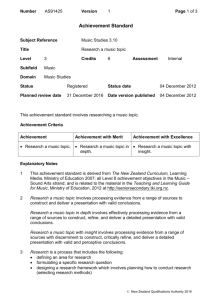

Australian University Tuition Fees Compared with New Zealand University Tuition Fees Australia New Zealand Fee Comparison Figure 1 compares the ratio of the fees charged in 2003 in the various subject disciplines of New Zealand universities, with similar programmes in Australia under the HECS1. Figure 1: Ratio of tuition fees in New Zealand universities to 2003 AUT Auckland Waikato Massey Victoria Arts/Humanities 0.79 0.84 0.90 0.78 0.75 Education 0.79 0.84 0.90 Nursing 0.96 0.92 0.94 Maths 0.55 0.59 0.69 Computing 0.55 0.67 0.69 0.65 0.61 Health 0.55 0.67 Agriculture 0.65 Science 0.55 0.67 0.69 0.62 0.66 Engineering 0.78 0.69 0.68 Commerce 0.55 0.67 0.63 0.55 0.61 Law 0.58 0.56 0.52 Medicine 1.44 Dentistry Veterinary 0.97 Australian HECS rates in Canterbury 0.86 Lincoln 0.76 0.68 0.68 0.71 0.75 0.64 0.55 Otago 0.74 0.66 0.68 0.67 0.53 0.65 0.52 0.52 1.37 1.37 Notes: 1. Australian HECS rates were converted to New Zealand dollars for comparative purposes. Exchange rate $1NZ =$0.9181Aus in March 2003. 2. New Zealand fees are GST inclusive. Source: New Zealand Vice Chancellors’ Committee, Fees for domestic students 2003, DEST Higher Education: Report for 2003 to 2005 triennium. In most subject areas, New Zealand universities charge a lower fee than in Australia. Disciplines such as law, science, mathematics, computing, agriculture and commerce have significantly lower fees than in Australia. The only exceptions to the trend are medicine and dentistry where the New Zealand fees are up to 1.44 times greater than in Australia. A comparison of nominal domestic per EFTS fees charged in New Zealand universities with those charged in Australian higher education shows that, not only are Australian tuition fees higher than in New Zealand, but the gap in the average fee has been widening since 2001. This is a result of the impact of fee stabilisation in New Zealand over this period, along with steady increases in the Australian HECS rates. Between 2001 and 2003, New Zealand university per EFTS tuition fees decreased by 3.0 percent, from $3,852 to $3,7362. This compares with the average per EFTSU 3 fee charged to Australian students under the HECS, which increased by 6.0 percent from $4,711 to $4,9944. 1 A value of less than 1.0 indicates that the New Zealand fee is of a lower value. Note that for comparison purposes, this fee includes GST. 3 EFTSU = Equivalent Full-Time Student Unit. 4 The Australian fees are quoted in New Zealand dollars for comparison purposes. Exchange rate $1NZ =$0.9181Aus in March 2003. 2 Figure 2: Average New Zealand domestic student tuition fees per EFTS in universities and average Australian HECS per EFTSU 1999-2003 $6,000 $5,000 $4,000 $3,000 $2,000 $1,000 $0 1999 2000 2001 NZ Fee 2002 2003 Aus fee (NZ$) Notes: 1. The New Zealand fees are GST inclusive. 2. Australian HECS data has been converted to New Zealand dollars for comparison purposes. Exchange rate $1NZ =$0.9181Aus in March 2003. Source: DEST Higher Education: Report for 2003 to 2005 triennium. The Structure of Fee Charging in Australia 5 In Australia, student fees are charged in universities through the Higher Education Contribution Scheme (HECS). Under the HECS, students are charged a fee for undertaking study with the option of deferring this payment if they cannot pay the fees upfront 5. If students pay upfront they receive a discount of 25 percent on their HECS contribution. A partial payment attracts a discount of 25 percent on the amount paid. People who are unable to make any upfront payments face the full contribution. Any deferred fees constitute a debt that is recovered through the tax system, like student loan debt in New Zealand. Since 1997, there have been three levels of HECS fee set by the Australian federal government for different subject disciplines 6. Fields of study are assigned to fee bands by a mix of factors that take account both of cost and of the expected earnings of graduates in the field. Thus, the highest fee band includes one low cost discipline (law) and three high cost, high earnings fields (medicine, veterinary science and dentistry). By contrast, a high cost field with low earnings potential (agriculture) is assigned to the medium band. From 2005, the HECS rates will rise – by between 2 and 3 percent. The universities will no longer be required to charge the HECS fee, however. From 2005, universities will be free to set their own fees, provided the fee is no more than 125 percent of the HECS rate7. If a university sets a fee above the HECS rate, then the student may not borrow more than the HECS limit through the HECS scheme; the margin above the HECS rate must be paid upfront. The new structure means that, for the first time, different Australian universities will have different fees. Universities could increase their fees by 27 – 28 percent in 2005. It is also possible that some Australian universities will charge lower fees in 2005 than in 2004. In Australia, there are also a number of full fee paying places made available to domestic students. These have been excluded from this analysis. 6 Before 1997, there was a flat HECS rate, irrespective of field of study. 7 In effect, the 125 percent rule acts as an upper bound on fees in the same way as the New Zealand fee course cost maximum.