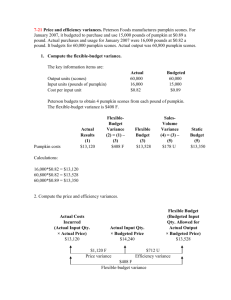

7-21 Price and efficiency variances

advertisement

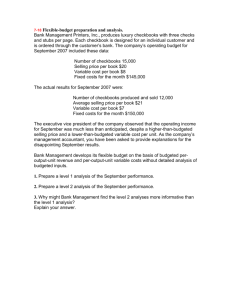

7-21 Price and efficiency variances. Peterson Foods manufactures pumpkin scones. For January 2007, it budgeted to purchase and use 15,000 pounds of pumpkin at $0.89 a pound. Actual purchases and usage for January 2007 were 16,000 pounds at $0.82 a pound. It budgets for 60,000 pumpkin scones. Actual output was 60,800 pumpkin scones. 1. Compute the flexible-budget variance. The key information items are: Output units (scones) Input units (pounds of pumpkin) Cost per input unit Actual 60,800 16,000 $0.82 Budgeted 60,000 15,000 $0.89 Peterson budgets to obtain 4 pumpkin scones from each pound of pumpkin. The flexible-budget variance is $408 F. Pumpkin costs Actual Results (1) $13,120 FlexibleBudget Variance (2) = (1) – (3) $408 F Flexible Budget (3) $13,528 SalesVolume Variance (4) = (3) – (5) $178 U Static Budget (5) $13,350 Calculations: 16,000*$0.82 = $13,120 60,800*$0.82 = $13,528 60,000*$0.89 = $13,350 2. Compute the price and efficiency variances. Actual Costs Incurred (Actual Input Qty. × Actual Price) $13,120 Actual Input Qty. × Budgeted Price $14,240 $1,120 F Price variance Flexible Budget (Budgeted Input Qty. Allowed for Actual Output × Budgeted Price) $13,528 $712 U Efficiency variance $408 F Flexible-budget variance 3. Comment on the results in requirements 1 and 2. The favorable flexible-budget variance of $408 has two offsetting components: (a) Favorable price variance of $1,120––reflects the $0.82 actual purchase cost being lower than the $0.89 budgeted purchase cost per pound. (b) Unfavorable efficiency variance of $712–-reflects the actual materials yield of 3.80 scones per pound of pumpkin (60,800 ÷ 16,000 = 3.80) being less than the budgeted yield of 4.00 (60,000 ÷ 15,000 = 4.00). (The company used more pumpkins (materials) to make the scones than was budgeted.) One explanation may be that Peterson purchased lower quality pumpkins at a lower cost per pound. How can determining the causes of these variances help the company improve? Determining the causes of variances would help the company improve as managers’ attention could be focused on problematic areas, if for example materials of higher quality are purchased at a higher price, such price increase should be taken into account when preparing the budget for the next period. If lower quality materials have been purchased, the purchasing manager should be advised not to use lower quality materials as this would result in a lower product quality. In the case of Quantity Variances could be a result from an unexpected machinery breakdowns, for example, hence managers would need to put a maintenance schedule for the machines to avoid such unpleasant problems. In the case of an Unfavorable Efficiency Variance which mostly result from hiring unskilled workers, management can start arranging training courses for such unskilled labor so as they achieve the company’s standards In short, all variances either favorable or unfavorable need to be investigated. A threshold may be fixed at say 5% and all variances above this should be investigated. The causes of the variances should be ascertained and the processes changed so as to ensure that the variances do no recur. If it is found that variances are due to incorrect standards in which case the standards themselves need to be changed. 7-18 Flexible-budget preparation and analysis. Bank Management Printers, Inc., produces luxury checkbooks with three checks and stubs per page. Each checkbook is designed for an individual customer and is ordered through the customer’s bank. The company’s operating budget for September 2007 included these data: Number of checkbooks 15,000 Selling price per book $20 Variable cost per book $8 Fixed costs for the month $145,000 The actual results for September 2007 were: Number of checkbooks produced and sold 12,000 Average selling price per book $21 Variable cost per book $7 Fixed costs for the month $150,000 The executive vice president of the company observed that the operating income for September was much less than anticipated, despite a higher-than-budgeted selling price and a lower-than-budgeted variable cost per unit. As the company’s management accountant, you have been asked to provide explanations for the disappointing September results. Bank Management develops its flexible budget on the basis of budgeted peroutput-unit revenue and per-output-unit variable costs without detailed analysis of budgeted inputs. 1. Prepare a level 1 analysis of the September performance. Level 1 Analysis Actual Results (1) 12,000 a $252,000 d 84,000 168,000 150,000 $ 18,000 Units sold Revenue Variable costs Contribution margin Fixed costs Operating income Static-Budget Variances (2) = (1) – (3) 3,000 U $ 48,000 U 36,000 F 12,000 U 5,000 U $ 17,000 U Static Budget (3) 15,000 c $300,000 f 120,000 180,000 145,000 $ 35,000 $17,000 U Total static-budget variance 2. Prepare a level 2 analysis of the September performance. Level 2 Analysis Units sold Revenue Variable costs Contribution margin Fixed costs Actual Results (1) 12,000 a $252,000 d 84,000 168,000 150,000 FlexibleBudget Flexible Variances Budget (2) = (1) – (3) (3) 0 12,000 b $12,000 F $240,000 e 96,000 12,000 F 24,000 F 5,000 U 144,000 145,000 Sales Volume Static Variances Budget (4) = (3) – (5) (5) 3,000 U 15,000 c $300,000 $60,000 U f 120,000 24,000 F 36,000 U 0 180,000 145,000 Operating income $ 18,000 $19,000 F $ (1,000) $36,000 U $ 35,000 $19,000 F $36,000 U Total flexible-budget Total sales-volume variance variance $17,000 U Total static-budget variance a 12,000 × $21 = $252,000 d 12,000 × $7 = $ 84,000 b 12,000 × $20 = $240,000 e 12,000 × $8 = $ 96,000 c 15,000 × $20 = $300,000 f 15,000 × $8 = $120,000 3. Why might Bank Management find the level 2 analysis more informative than the level 1 analysis? Explain your answer. Level 2 analysis provides a breakdown of the static-budget variance into a flexiblebudget variance and a sales-volume variance. The primary reason for the staticbudget variance being unfavorable ($17,000 U) is the reduction in unit volume from the budgeted 15,000 to an actual 12,000. One explanation for this reduction is the increase in selling price from a budgeted $20 to an actual $21. Operating management was able to reduce variable costs by $12,000 relative to the flexible budget. This reduction could be a sign of efficient management. Alternatively, it could be due to using lower quality materials (which in turn adversely affected unit volume).