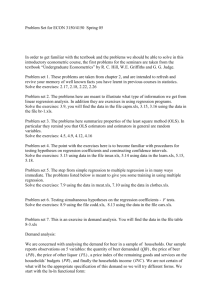

Additional seminar exercise for week 44

advertisement

ECON 4135 Additional seminar exercise for week 44 We are concerned with analysing the demand for beer in a sample of households. Our sample reports observations on 5 variables: the quantity of beer demanded in litres (QB ) , the price of beer (PB) , the price of other liquor ( PL) , a price index of the remaining goods and services on the households’ budgets (PR) , and finally the households income (INC ). All prices are in US$. Our small data set is taken from the file: table8-3.dat, which is supplementary material to the book: Undergraduate Econometrics by R. Carter Hill, W. E. Griffiths, G.G. Judge, and is listed below. To get the data into Stata, copy and paste. We are not certain of what will be the appropriate specification of this demand so we will try different forms. We start with the ln-ln functional form: (1) ln(QBi ) 0 1 ln( PBi ) 2 ln( PLi ) 3 ln( PRi ) 4 ln( INCi ) i where i denotes the random disturbances. Question A. How will you interpret the regression parameters in this demand function. Use Stata to estimate this model on the supplied data. Question B. Do you think the signs of the estimates are reasonable? Substantiate your assertions. Explain how the numbers in the column P t in the regression output from Stata are calculated. Standard consumer demand theory tells us that if prices and income increase by the same proportion we should expect no change in the quantity demanded. The consumers are said to have no money illusion. Question C. Show that the assumption of no money illusion applied to the demand function (1) implies the restriction: (2) 1 2 3 4 0 Question D. Use results and information from your regression to test the hypothesis: H 0 : 1 2 3 4 0 against with significance level 0.05 . H a : 1 2 3 4 0 Now we are told that the ln-ln functional form (1) has certain theoretical drawbacks. In addition to (1) we thus wish to analyse two forms which are linear in the relative price and the real income. 1 (3) QBi 1 2 ( PLi PBi ) 3 ( PRi / PBi ) 4 ( INCi PBi ) ui (4) QBi 0 (1 PBi ) 1 2 ( PLi / PBi ) 3 ( PRi / PBi ) 4 ( INCi / PBi ) vi where u i and vi denote random disturbances. Use Stata to estimate the regression equations (3) and (4). Question E. Which of the two equations (3) or (4) do you think is appropriate for testing the assumption of no money illusion? State the reason for your choice and explain how you would test this hypothesis. Question F. Assume that the number of household members ( Ni ) has been wrongly excluded from the regressions (3) and (4). What could be meant by this? Choose one of these regressions for further study, and explain formally how this misspecification affects the OLS estimates of the ' s when: (i) N i is uncorrelated with the explanatory variables already used in the equation. (ii) N i is correlated with the explanatory variables already used in the equation. QB 81.7 56.9 64.1 65.4 64.1 58.1 61.7 65.3 57.8 63.5 65.9 48.3 55.6 47.9 57.0 51.6 54.2 51.7 55.9 52.1 52.5 44.3 57.7 51.6 53.8 50.0 46.3 46.8 51.7 49.9 PB 1.78 2.27 2.21 2.15 2.26 2.49 2.52 2.46 2.54 2.72 2.60 2.87 3.00 3.23 3.11 3.11 3.09 3.34 3.31 3.42 3.61 3.55 3.72 3.72 3.70 3.81 3.86 3.99 3.89 4.07 PL 6.95 7.32 6.96 7.18 7.46 7.47 7.88 7.88 7.97 7.96 8.09 8.24 7.96 8.34 8.10 8.43 8.72 8.87 8.82 8.59 8.83 8.86 8.97 9.13 8.98 9.25 9.33 9.47 9.49 9.52 PR 1.11 0.67 0.83 0.75 1.06 1.10 1.09 1.18 0.88 1.30 1.17 0.94 0.91 1.10 1.50 1.17 1.18 1.37 1.52 1.15 1.39 1.60 1.73 1.35 1.37 1.41 1.62 1.69 1.71 1.69 INC 25088 26561 25510 27158 27162 27583 28235 29413 28713 30000 30533 30373 31107 31126 32506 32408 33423 33904 34528 36019 34807 35943 37323 36682 38054 36707 38411 38823 38361 41593 2