populations and sampling distributions

advertisement

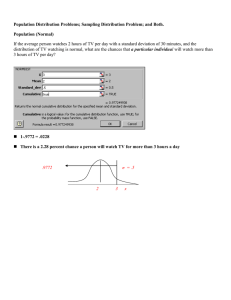

Population Distribution Problems; Sampling Distribution Problem; and Both. Population (Normal) If the average person watches 2 hours of TV per day with a standard deviation of 30 minutes, and the distribution of TV watching is normal, what are the chances that a particular individual will watch more than 3 hours of TV per day? Sampling If the average person watches 2 hours of TV per day with a standard deviation of 30 minutes, and the distribution of TV watching is normal, what are the chances that the average of a random sample of 16 individuals will be more than 3 hours of TV per day? Population (Normal) In the U.S., the average price of a gallon of regular gas last week was $1.55 with a standard deviation of $.10. Assuming the distribution was normal what percentage of gas stations were selling gas for less than $1.30? Sampling In the U.S., the average price of a gallon of regular gas last week was $1.55 with a standard deviation of $.10. Would it be unusual to randomly select 36 gas stations and find an average less than $1.30? How about less than $1.50? Population (Normal) On average an officer in the Kennett Police Department issues 13 traffic tickets per week with a standard deviation of 4 tickets. Officer Bob issued 20 tickets last week. Assuming the ticket distribution is normal is this unusual? Sampling On average an officer in the Kennett Police Department issues 13 traffic tickets per week with a standard deviation of 4 tickets. Six officers averaged 17 tickets last week. Assuming the ticket distribution is normal is this unusual? Population QVC averages 27 bad checks per day; yesterday they got 30 bad checks. Kevin thinks this is evidence of a problem. Is he right? Sampling QVC averages 27 bad checks per day, Last month (over 30 days), they averaged 30 bad checks per day. Kevin thinks this is evidence of a problem. Is he right? (Note the standard deviation of a Poisson distribution is the square root of the average) Explain why it would be impossible to answer this question accurately if the average was taken for February. Harder Problems George Jibberjaw is testing out a machine designed to put a product into a bag. He set the machine up and let it run for a while then he sampled 49 bags to see how much was getting in to each bag. In the sample, the average was 4.2 ounces with a standard deviation of .5 ounces. The next day he took another sample (49 bags) and the average was only 4 ounces, but the standard deviation was still .5 ounces. In his report to the boss, he states that based on his results the new machine is unreliable and definitely not a good investment. Is he right? Explain why or why not. . A local company searching for ways to save more money is considering leasing instead of buying the company cars for its sales representatives. The rules and charges for leases vary and are often complicated, so depending on the number of miles driven; the lease may or may not save money. Nationally, the cost per mile driven in any (owned or leased) vehicle is 28 cents with a standard deviation of 7 cents. The company’s current costs are in line with the national average. It is still possible, however, that the lease could be better for them. As a test, the company leases 40 cars for one year and finds the average cost per mile was 25 cents. The company’s executives disagree as to what this indicates. Bob Spendalot, says that that the test average is pretty close to the their previous average, and so the lease is not a better deal. 1. A company in the U.S. is considering investing in a new small company in another country. One executive is concerned about bankruptcy rates in that country. Unfortunately, the country does not keep accurate bankruptcy rates. However, companies that exist are required to register with the government each year. A person with some time can follow the companies until they disappear from the lists. Usually this means they went bankrupt. The company does not have time to do this for every firm that ever existed, so they try a sample. Of 36 randomly selected firms they followed through the lists, 4 were bankrupt within 10 years. In the U.S. approximately 8 percent of all companies go bankrupt within 10 years. Does this indicate that the risk of bankruptcy is higher than it is in the U.S.? Explain your answer. Answer only one of the following two questions (either 2a or 2b not both) 2a. (5 points) Without reference to a formula, explain why the standard error is less than the standard deviation. 2b. (5 points) Compare and contrast sampling distributions and population distributions. What are they, how are they the same and how are they different? 3. George Jibberjaw is testing out a machine designed to put a product into a bag. He set the machine up and let it run for a while then he sampled 49 bags to see how much was getting in to each bag. In the sample, the average was 4.2 ounces with a standard deviation of .5 ounces. The next day he took another sample (49 bags) and the average was only 4 ounces, but the standard deviation was still .5 ounces. In his report to the boss, he states that based on his results the new machine is unreliable and definitely not a good investment. Is he right? Explain why or why not. 4. A local company searching for ways to save more money is considering leasing instead of buying the company cars for its sales representatives. The rules and charges for leases vary and are often complicated, so depending on the number of miles driven; the lease may or may not save money. Nationally, the cost per mile driven in any (owned or leased) vehicle is 28 cents with a standard deviation of 7 cents. The company’s current costs are in line with the national average. It is still possible, however, that the lease could be better for them. As a test, the company leases 40 cars for one year and finds the average cost per mile was 25 cents. The company’s executives disagree as to what this indicates. Bob Spendalot, says that that the test average is pretty close to the their previous average, and so the lease is not a better deal. Tim Tightfist says that the lease is clearly the better deal. Give a statistical analysis of BOTH arguments. 5. Across the nation it takes an average of 4 minutes to process a customer at a drive through fast food window. In addition, drive through times tend to be normally distributed. At a local McDunalds the manager thinks his employees are not operating up to national standards. Because he doesn’t have time to check the speed of every clerk for every customer, it’s difficult to tell for sure. Based on a suggestion from a colleague, he decides to calculate a confidence interval. From behind the one way mirror in the booth above the clerks, he times several sales with the following results: Customer 1 2 3 4 5 6 7 8 Time (in minutes) 6.00 5.50 8.50 7.00 3.00 7.00 5.00 6.00 Assuming the manager uses a low confidence level, what is the manager likely to conclude after his study? Based on the same information, do you think his employees are not up to national standards? Explain your answer. 6. A pizza restaurant makes deliveries in an average of 45 minutes with a standard deviation of 6 minutes and the delivery times are normally distributed. When a customer orders a pizza, how long should they say the delivery will take if they only want to be late 25 percent of the time? To monitor performance, the manager occasionally samples 6 delivery times. What averages should he expect, if the restaurant is performing as usual? What average might indicate a problem? Explain why a small sample is o.k. in this case. 7. On average, employees at QVC rack up 4.6 sick days per year. Would it be unusual to find an employee out more than 7 days in one year? In a sample of 50 employees would it be unusual to see an average of 5 sick days per year? In a sample of 5 employees would it be unusual to see an average of 5 sick days per year? 8. The Federal Trade Commission mandates that the actual weight of a food product in any container should not be less than 95 percent of the advertised weight. For example a sixteen-ounce box of Cheerios must have at least 15.2 ounces inside. If a firm consistently violates this standard, the firm can be charged with false advertising. One company, seizing on an opportunity to increase profits, adjusts its filling machine to average 15.5 ounces with a standard deviation of .12 ounces. Assuming the weights are normally distributed, what are the chances that a randomly selected box will violate FTC standards? Recognizing the potential for fraud, the FTC changes its policy so that the average of 30 boxes should not be less than 98% of the advertised weight. Will this strategy catch the fraud perpetrated above? 9. Suppose a machine fills a package with 4 cookies. The weight of 4 cookies is normally distributed with a mean of 12 ounces and a standard deviation of 1 ounce. What weight should the company advertise on the package, so than 95 percent of the packages are above the advertised weight? Tim Tightfist is always wary of fraud. Lately he has been concerned with his toilet paper. To save money, he has been buying a brand that advertises 1000 sheets. Just to make sure, he counts them. At the end of his first roll he is alarmed to find there were only 978 sheets! First thing in the morning he calls the toll free number 1-800-SWI-PEME. “There were only 978!” he yells “You didn’t think I’d count them, but I did” “I’m sorry for the confusion,” replies the customer service rep. We get these calls all the time, she lies. The 1000 sheets is just an average. I’m sure that if you keep counting we’ll measure up to our claim. “Back to the drawing board so to speak,” he grumbles. Tim keeps counting, and several weeks later he has counted the sheets on 10 different rolls and finds an average of 988.5 sheets. After a few quick calculations he mutters “Now I’ve got the weasels!” A short toll-free conversation later he’s back in the bathroom counting. What did the customer service rep say this time? What should Tim do next if he wants to uncover the fraud? What would constitute conclusive evidence of malice aforethought on the part of the toilet paper magnates? 10. A local Wal-Mart typically loses $578 per day to theft. The losses are normally distributed with a standard deviation of $58. One month after hiring a new employee, the 30-day average was $585, and on one of those days it was actually $650! The manager wants to call the new employee in and fire him. Do you think there anything unusual about either of these figures? As part of a master plan to reduce losses, by increasing employee vigilance, the manager is planning to offer the staff a bonus if they show significant improvement (better than $578) over the next 30 days. What would constitute significant evidence of improvement?