Operations and Production Management

MGMT 405

Answer set 5

MGMT 405 Operations and Production Management

Answer set 5

(Reference chapters 12– William J. Stevenson-2007, ninth edition)

Problems

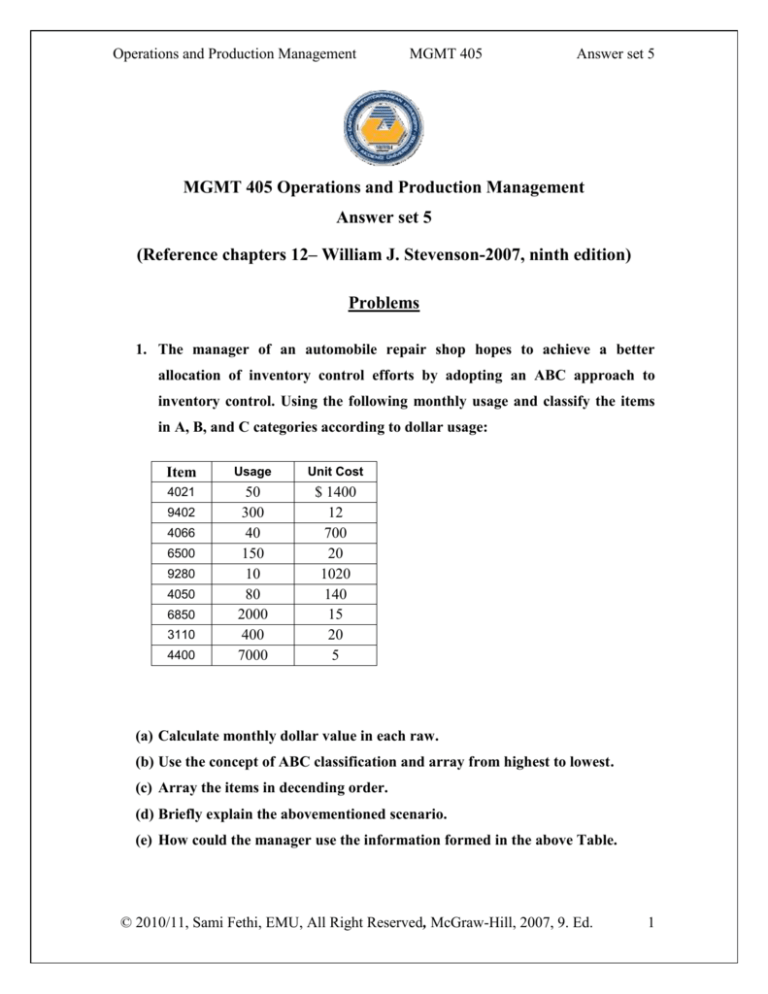

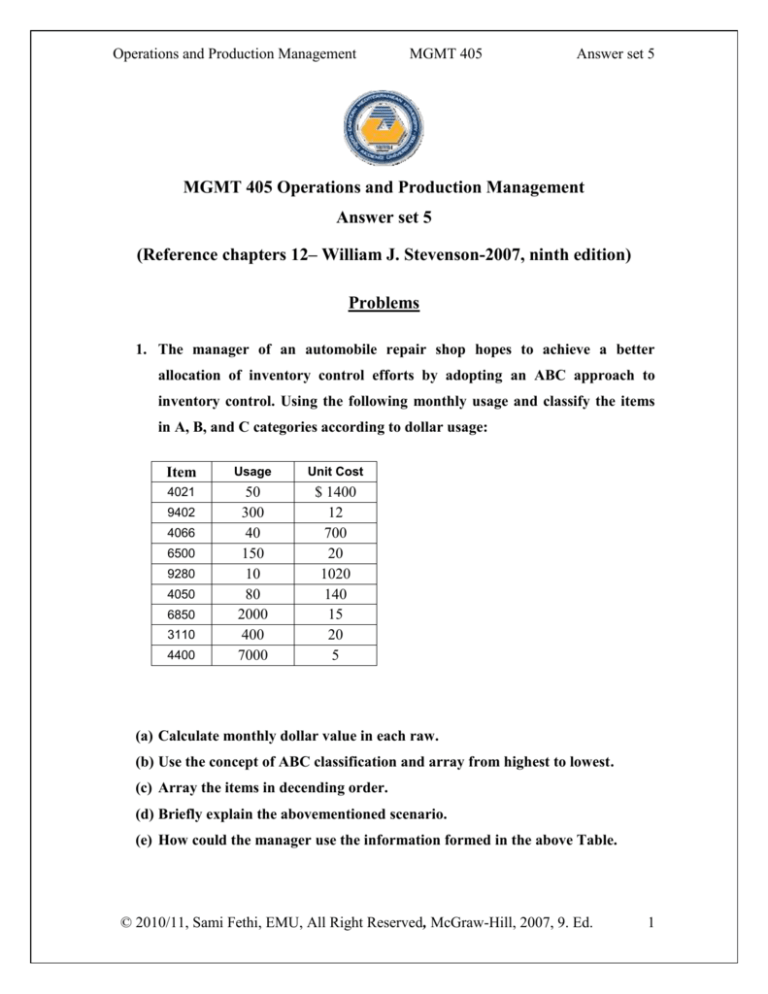

1. The manager of an automobile repair shop hopes to achieve a better

allocation of inventory control efforts by adopting an ABC approach to

inventory control. Using the following monthly usage and classify the items

in A, B, and C categories according to dollar usage:

Item

Usage

Unit Cost

4021

50

300

40

150

10

80

2000

400

7000

$ 1400

12

700

20

1020

140

15

20

5

9402

4066

6500

9280

4050

6850

3110

4400

(a) Calculate monthly dollar value in each raw.

(b) Use the concept of ABC classification and array from highest to lowest.

(c) Array the items in decending order.

(d) Briefly explain the abovementioned scenario.

(e) How could the manager use the information formed in the above Table.

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

1

Operations and Production Management

MGMT 405

Answer set 5

(f) After reviewing your classification scheme, suppose that the manager decides

to place 4400 into the A category. What may be some possible explanations

for this decision?

ANS:

(a) and (b)

Item

Usage

Unit Cost

4021

50

300

40

150

10

80

2000

400

7000

1400

12

700

20

1020

140

15

20

5

9402

4066

6500

9280

4050

6850

3110

4400

Usage X Unit Cost

Category

70000

A

3600

C

28000

B

3000

C

10200

C

11200

C

30000

B

8000

C

35000

B

(c ) In descending order

Item

4021

Usage X Unit Cost

70000

Category

A

4400

6850

4066

35000

30000

28000

B

B

B

4050

9280

3110

9402

6500

11200

10200

8000

3600

3000

C

C

C

C

C

d) The first item has relatively high monthly dollar value, so it seems reasonable to

classify them as A item. The next three items appear to have moderate monthly dollar

values and should be classified as B items. The remainder are C items due to their

relatively low monthly dollar value.

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

2

Operations and Production Management

MGMT 405

Answer set 5

e) To allocate control efforts.

(f) It may be important for some reason other than dollar usage such as cost of a stockout,

usage highly correlated to an A item etc....

2. A bakery buys flour in 25 pound bag. The bakery uses an average an average

of 4860 bags a year. Preparing an order and receving a shipment of flour

involves a cost of $ 10 per order. Annual carring cost is $ 75 per bag.

(a) Determine the EOQ?

(b) What is the average number of bags on hand?

(c) How many orders per year will there be?

(d) Compute the total cost of ordering and carring flour.

(e) How much would that affect the minimum total annual cost if the ordering

costs were to increase by $ 1 per order?

ANS:

(a) D=4860 bags per year, S=$ 10 and H=$ 75

Q

2 DS

2(4860)10

36 bags

H

75

(b) Q/2= 36/2= 18 bags

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

3

Operations and Production Management

MGMT 405

Answer set 5

(c)

Number of order per year :

4860 bags

D

135 orders

Q 36 bags / order

(d)

TC

36

Q

D

4860

H S

75

75 $ 2700

2

Q

2

36

(e)

Q

2DS

2(4860)11

37.757 bags

H

75

TC

Q

D

37.757

4860

H S

75

11 $ 2831.79

2

Q

2

37.757

Increased by 2831.79-2700= $ 131.79

3. A manufacturer produce x drug in 100-pound bags. Demand for this product

is 20 tons per day. The capacity for producing the product is 50 tons per day.

Setup costs $ 100, storage and handling costs are $ 5 per ton a year. The firm

operates 200 days per year and 1 ton is equal to 2000 pounds.

(a) How many bags per run areOptimal (i.e. run size)?

(b) What would the average inventory be for this lot size?

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

4

Operations and Production Management

MGMT 405

Answer set 5

(c) Determine the approximate lenght of a production run in days.

(d) About how many runs per year would there be Run time?

(e) How much could the company save annually if the setup cost could be reduced to

$25 per run ?

ANS:

(a)

P= 50 ton/day, time is 200 days, u=20 tons/days, D= 20x200=4000 tons/year ,S=$

100 and H=$ 5 ton per year.

The economic run quantity Q

2DS

H

(2) (4000) (100)

P

50

516.40 tons

P U

5

50 20

Or 516.40x2000= 10328 bags

(b)

I max

Qo

516.40

( p u)

(50 20) 309.84 tons or 6196.8 bags

p

50

I AV

I max Qo

309.84

( p u)

154.92 tons

2

p

2

(c)

Run length

QO 516.4

10.33 days

P

50

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

5

Operations and Production Management

MGMT 405

Answer set 5

(d)

Run per year

D 4000

7.75

Q 516.4

(e)

TCmin carring cos t or handling cos t setup cos t (

I max

D

309.84

4000

)H

S

($5)

($100) $ 1549

2

Qo

2

516.4

Handling cost =774.5

Setup cost=774.5

If setup cost is $ 25

The economic run quantity Q

I max

2DS

H

(2) (4000) (25)

P

50

258.2 tons

P U

5

50 20

Qo

258.2

( p u)

(50 20) 154.92 tons

p

50

TCmin carring cos t or handling cos t setup cos t (

I max

D

154.84

4000

)H

S

($5)

($25) $ 774.5

2

Qo

2

258.2

Savings would be 1549-774.5=$ 774.5

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

6

Operations and Production Management

4.

MGMT 405

Answer set 5

A manufacturer of exercise equipment purchases the pulley section of the

equipment from supplier who lists these prices: less than 1000, $5 each; 1000 to

3,999, $ 4.95 each; 4000 to 5999, $ 4.90 each; and 6000 and more $ 4.85.

Ordering costs are $ 50, annual carring costs per unit are 40 percent of purchase

cost, and annual usage is 4900 pulleys. Determine

(a) the common EOQ (the common minimum point)

(b) the total cost if the feasible minimum point is on the lowest price range, that is the

optimal order quantity.

(c) the total cost if the feasible minimum point is in any other price range.

ANS:

Range

Price

0 to 999

$ 5

1000 to 3999

4.95

4000 to 5999

4.90

6000 and more

4.85

(a)

H= 0.40 P

H= 0.40 (5)=2 ;H= 0.40 (4.95)=1.98; H= 0.40 (4.90)=1.96; H= 0.40 (4.85)=1.94

D=4900; S=$ 50

Q5

2DS

2(4900)(50)

494.97 nearly 495 seats

H

2

2 DS

2(4900)(50)

© 2010/11,

McGraw-Hill,

9. Ed.

Q4.95 Sami Fethi,

EMU, All Right Reserved,

497.46

nearly 4982007,

seats

H

1.98

7

Operations and Production Management

MGMT 405

Q4.90

2 DS

H

2(4900)(50)

500 seats

1.96

Q4.85

2 DS

H

2(4900)(50)

503 seats

1.94

Answer set 5

First one is feasible because it is in the range compared to the others.

(b)

TC = Carrying cost + Order cost + Purchase cost

TC 495

495

Q

D

4900

H

S PD

($2)

($50) ($5) (4900) $ 25490

2

Qo

2

495

(c)

TC1000

1000

Q

D

4900

H

S PD

($1.98)

($50) ($4.95) (4900) $ 25490

2

Qo

2

1000

TC 4000

TC 6000

5.

4000

Q

D

4900

H

S PD

($1.96)

($50) ($4.90) (4900) $ 27991

2

Qo

2

4000

6000

Q

D

4900

H

S PD

($1.94)

($50) ($4.85) (4900) $ 29626

2

Qo

2

6000

A newspaper publisher uses roughly 800 feet of baling wire each day to secure

bundles of newspapers while they are being distributed to carriers. The paper is published

Monday through Saturday. Lead time is six working days. The company desires a service

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

8

Operations and Production Management

MGMT 405

Answer set 5

level of 95% when stock-out risk for various levels of safety stocks are as follows: 1500

feet, 0.10; 1800 feet, 0.05; 2100 feet, 0.02; and 2400 feet, 0.01?

(a) What value of Z is appropriate?

(b) Find the standard deviation of lead time?

(c) What reorder point should be used?

ANS:

(a) What value of Z ias appropriate?

Daily usage=800feet/day

Lead time is 6 days

Safety stock= Zα dLT=1800 at level of 0.05 percent

Risk =1-0.95=0.05 percent

0.05 from z table (lead time), z= 1.64 (page 569, table 12.3)

(b) Find the standard deviation of lead time?

Safety stock = Z αdLT= 1800 at level of 0.05 percent

αdLT=1800/1.64= 1097.561

(c) What reorder point should be used?

ROP= Expected demand in (LT) + ZαdLT =(800)*(6)+1800= 6000 feet

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

9

Operations and Production Management

MGMT 405

Answer set 5

6. A manager of a construction supply house determined from historical records that

demand for sand during lead time averages 300 units. In addition, the manager

determined that demand during lead time could be described by a normal distribution that

has a mean of 300 units and a standard deviation of 30 units.

(a) Determine the appropriate Z-value whilst risk of stockout 1 percent?

(b) Determine ROP when the risk of stockout is 1 percent during lead time?

(c) Find the safety stock needed to attain a 1 percent risk of stockout during lead time?

(d) Would a stockout risk of 2 percent require more or less safety stock compared to a

1percent risk?

ANS:

(a) Risk =1-0.01=0.99 percent

0.99 from z table (lead time), z= 2.33 (page 569, table 12.3)

(b)

LT=300, αLT=30

ROP= Expected demand in (LT) + ZαdLT =300+(30) (2.33)= nearly 370 units

(c) Safety stock = Z αdLT= 2.33(30)= nearly 70 units

(d)

Ans: IF risk is 2

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

10

Operations and Production Management

MGMT 405

Answer set 5

Risk =1-0.01=0.98 percent

0.99 from z table (lead time), z= 2.04 (page 569, table 12.3)

LT=300, αLT=30

ROP= Expected demand in (LT) + ZαdLT =300+(30) (2.04)= nearly 361 units

Safety stock = Z αdLT= 2.04(30)= nearly 61.2 units

when risk is 2, z, safety stock and ROP are found smaller compared to the previous one.

7. A computer store sells an item which is supplied by a vendor who handles only that

item. Demand for this item recently changed. The manager wants a probability of at least

96 percent of not having a stockout during lead time. The manager expects demand to

average a dozen units a day and have a standard deviation of 2 units a day. Lead time is

variable averaging four days with standard deviation of one day. Assume normality and

seasonality is not a factor.

(a) Find the appropriate Z value.

(b) What is ROP?

Z= .96, d‾=12 units/day, αd=2units/day, LT=4 days, αLT=1 day

ANS:

(a)

(page 569, table 12.3)

(b)

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

11

Operations and Production Management

MGMT 405

Answer set 5

2

ROP d L T z L T d2 d LT

ROP 12 * 4 1.75 (4)(4) (144)(1) 70.14

8. Demand for jelly doughnuts on Saturdays at Don’s Doughnut Shoppe is shown in the

following table. If labor, materials, and overhead are estimated to be $ 3.20 per dozen,

doughnuts are sold for $ 4.80 per dozen, and left over doughnuts at the end of each day

are sold the next day at half price,

(a) Determine the shortage and excess costs

(b) Determine the service level

(c) Calculate the stockout risk factor

(d) list the cumulative tables for demand

(e) Compute the optimal number of doughnuts?

Demand

(Dozen)

Relative.Freq.

19

0.01

20

0.05

21

0.12

22

0.18

23

0.13

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

12

Operations and Production Management

24

0.14

25

0.10

26

0.11

27

0.10

28

0.04

29

0.02

MGMT 405

Answer set 5

ANS:

(a) Ce = Cost per unit- Salvage value per unit

=$ 3.20-2.40= $ 0.80 per dozen

Cs = Revenue per unit-Cost per unit

=$ 4.80-$ 3.20=$ 1.60 per dozen

(b) Service level = Cs/(Cs+Ce) = 1.60/(1.60+0.80)=0.67

(c) Stockout risk = 1.00 – 0.67 = 0.33

(d)

Demand

(Dozen)

Relative Freq. Cumulative Freq.

19

0.01

0.01

20

0.05

0.06

21

0.12

0.18

22

0.18

0.36

23

0.13

0.49

24

0.14

0.63

25

0.10

0.73

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

13

Operations and Production Management

26

0.11

0.84

27

0.10

0.94

28

0.04

0.98

29

0.02

1.00

MGMT 405

Answer set 5

(e) Since the service level falls between the cumulative probabilities of 0.63 (24) and 0.73

(25), this means that the company should stock 25 dozen doughnuts because 0.67 is

closer to 0.73.

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

14