Operations and Production Management

MGMT 405

Answer set 3

MGMT 405 Operations and Production Management

Answer set 3

(Reference chapter 3– William J. Stevenson-2007, ninth edition)

Problems and Solutions

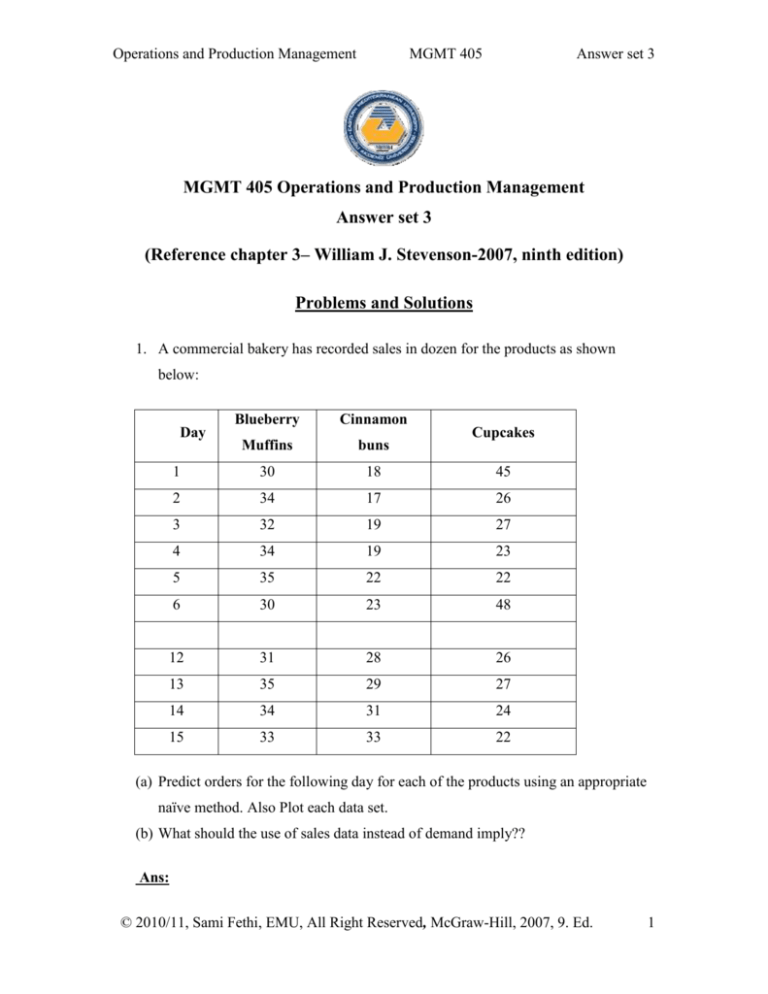

1. A commercial bakery has recorded sales in dozen for the products as shown

below:

Blueberry

Cinnamon

Muffins

buns

1

30

18

45

2

34

17

26

3

32

19

27

4

34

19

23

5

35

22

22

6

30

23

48

12

31

28

26

13

35

29

27

14

34

31

24

15

33

33

22

Day

Cupcakes

(a) Predict orders for the following day for each of the products using an appropriate

naïve method. Also Plot each data set.

(b) What should the use of sales data instead of demand imply??

Ans:

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

1

Operations and Production Management

MGMT 405

Answer set 3

(a) We need to use naive methods. This means that any simple appropriate method

can conducted. For example: Ploting each data set reveals that muffins orders are

almost stable, varying around an average (e.g. 33). The demand for cinnamon buns

has a trend. If we get the last three period, we realized that number increased two by

two so 33-31=2 and last one is 33+2=35. This is for the following day for cinnamon

buns. Demand for cupcakes has an apparent seasonal variation with peaks every five

days. Day 1=45, Day 6=48, Day 11=47 and the next peak would be Day 16=50.

A commercial bakery

60

sales

50

40

Blueberry Muffins

30

Cinnamon buns

20

Cupcakes

10

0

1

2

3

4

5

6

12

13

14

15

Days

(b) The use of sales data instead of demand implies that sales adequately reflect

demand. We are assuming that n stock-outs because demand equals sales if there are

no shortages.

2. A company records indicates that monthly sales for a seven-month period are

as follows:.

Month

Sales (000, unit)

Feb

19

Mar

18

Apr

15

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

2

Operations and Production Management

MGMT 405

May

20

Jun

18

July

22

Aug

20

Answer set 3

(a) Plot the monthly data as can be seen in the table above.

(b) Forecast the monthly sales using linear trend equation,

(c) A five-month moving average and exponential Smoothing technique? Assume

that smoothing constant and march forecast value are 0.20 and 19 respectively.

(d) The naïve approach

(e) A weight average method conducting 0.60 for August, 0.30 for July, and 0.10 for

June.

(f) Which method seems least appropriate? Why?

Ans:

(a)

Sales

25

000

20

15

Sales

10

5

0

Feb

Mar

Apr

May

Jun

July

Aug

month

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

3

Operations and Production Management

MGMT 405

Answer set 3

(b)

T (or x)

Square of t

Y

tY

1

1

19

19

2

4

18

36

3

9

15

45

4

16

20

80

5

25

18

90

6

36

22

132

7

49

20

140

Sum= 28

Sum of square= 140

Sum= 132

Sum= 542

n= 7

x y- x xy

n x -( x)

2

a=

2

b=

2

n xy- x y

n x 2 -( x)2

Or

If formula b is used first, it may be used formula a in the following format:

n xy x y

n x 2 x

2

a

Y b X

n

b

7(542) 28(132)

0.50

7(140) 28(28)

a

132 0.50(50)

16.86

7

Y = 16.86 + 0.50X

After Aug (7), For sept: Y = 16.86 + 0.50(8)=20.86

(b) MA5

15 18 22 20

19

5

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

4

Operations and Production Management

MGMT 405

Answer set 3

(c) Ft = Ft-1 + (At-1 - Ft-1)

Ft = forecast for period t

Ft-1 = forecast for the previous period

= smoothing constant

At-1 = actual data for the previous period

April-F=19+0.20(18-19)=18.8

May- F=18.8+0.20(15-18.8)=18.04

June- F=18.04+0.20(20-18.04)=18.43

July- F=18.43+0.20(18-18.43)=18.34

Aug- F=18.34+0.20(22-18.34) =19.07

Sep- F=19.07+0.20(20-19.07) =19.26

(d) It may be around 20 (19.26)

(e) WA=0.60 (20) + 0.30 (22) + 0.10 (18) =20.4

(f) Probably trend method because the data appear to vary around Y = 16.86 +

0.50(4) =18.86.

3. A cosmetics manufacturer’s marketing department has developed a linear trend

equation that can be used to predict annual sales of its popular hand-foot cream.

Ft = 80 + 15 t

Where Ft =Annual sales (000 bottles), and assume that t= 0 in1990

(a) Are annual sales increasing or decreasing? By how much.

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

5

Operations and Production Management

MGMT 405

Answer set 3

(b) Predict annual sales for the year 2006 using the equation.

(c ) Predict changes in annual sales the year between 1995 and 2005 using the

equation.

Ans:

(a) Ft = 80 + 15 t

15 is the slope of the equation so this value show us whether annual sales increase or

decrease. The sign of the value is positive that’s why annual sales are increasing by

15000 bottles per year.

(b) Ft = 80 + 15 t= 80+ 15(16) = 320000

Where t=2006-1990=16

(c) Ft = 80 + 15 t= 80+ 15(5) = 155000 in 1995

Ft = 80 + 15 t= 80+ 15(15) = 305000 in 2005

Change in sales between the relevant years= 305000-155000=150000

4. New Car sales with monthly indexes (seasonal relatives) for a dealer for the past

years are shown in the following table:

Month

Unit sold

index

Month

Unit sold

index

Jan

640

0.8

Jul

765

0.9

Feb.

648

0.8

Aug

805

1.15

Mar

630

0.7

Sept

840

1.20

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

6

Operations and Production Management

MGMT 405

Answer set 3

Apr

761

0.94

Oct

828

1.20

May

735

0.89

Nov

840

1.25

Jun

850

1.00

Dec

800

1.25

(a) Plot the data. Does there seem to be a trend?

sales volume

Unit Sales

900

800

700

600

500

400

300

200

100

0

Unit sold

index

Jan Feb. Mar Apr May Jun

Jul

Aug Sept Oct Nov Dec

Month

It seems that there exists a trend starting from 600 to 800.

(b) Compute the Deseasonalized car sales

Month

Unit sold

index

Deseasonalize =actual sales/seasonal relative

Jan

640

0.8

640/0.8=800

Feb.

648

0.8

810

Mar

630

0.7

900

Apr

761

0.94

809.6

May

735

0.89

825.8

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

7

Operations and Production Management

MGMT 405

Jun

850

1.00

850

Jul

765

0.9

850

Aug

805

1.15

700

Sept

840

1.20

700

Oct

828

1.20

690

Nov

840

1.25

672

Dec

800

1.25

640

Answer set 3

(c ) Plot both seasonalized and Deseasonalized car sales data on the same graph. Briefly

explain.

sales

1000

volume

800

seasonal

600

index

400

deseasonal

200

0

Jan Feb. Mar

Apr May Jun

Jul

Aug Sept Oct

Nov Dec

Month

Seasonalized car sales data are upward trend in sales and Deseasonalized car sales data

are downward trend in sales.

5. Two different forecast techniques (F1 and F2) were used to forecast demand for

cases of bottled water. Actual demand the two sets of forecasts are as follows:

Period and Demand

Predicted Demand

Period

Unit sold

F1

F2

1

68

66

66

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

8

Operations and Production Management

MGMT 405

2

75

68

68

3

70

72

70

4

74

71

72

5

69

72

74

6

72

70

76

7

80

71

78

8

78

74

80

Answer set 3

(a) Compute MAD for each set of forecast. Which forecast is better or appears to be

more accurate? Briefly explain.

(b) Compute MES for each set of forecast. Which forecast is better or appears to be

more accurate? Briefly explain.

(c) Compute MAPE for each set of forecast. Which forecast is better or appears to be

more accurate? Briefly explain.

(d) Compute a tracking signal for the 8th month for each forecast using the

cumulative error for 1 and 8.

(e) Compute 2s control limits for each forecast.

Ans:

Period

Demand

F1

e

e

e2

( e /actual)*100

1

68

66

2

2

4

3

2

75

68

7

7

49

9.3

3

70

72

-2

2

4

2.8

4

74

71

3

3

9

4

5

69

72

-3

3

9

4.3

6

72

70

2

2

4

2.7

7

80

71

9

9

81

11.2

8

78

74

4

4

16

5.1

32

176

42.4

586

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

9

Operations and Production Management

Period

Demand

F2

MGMT 405

e

e

Answer set 3

e2

( e /actual)*10

0

1

68

66

2

2

4

3

2

75

68

7

7

49

10.2

3

70

70

0

0

0

0

4

74

72

2

2

4

2.7

5

69

74

-5

5

25

6.7

6

72

76

-4

4

16

5.2

7

80

78

2

2

4

2.5

8

78

80

-2

2

4

2.5

24

106

32.9

(a) Compute MAD for each set of forecast. Which forecast is better or appears to be

more accurate? Briefly explain.

Ans:

MAD= ∑│Actual-Forecast│/n

MADF1= 32/8= 4

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

10

Operations and Production Management

MGMT 405

Answer set 3

MADF2= 24/8= 3

F2 forecast results appears to be more accurate because MAD model gives less error

than F1.

(b) Compute MES for each set of forecast. Which forecast is better or appears to be

more accurate? Briefly explain.

Ans:

MES= ∑│Actual-Forecast│2/ (n-1)

MESF1= 176/7= 25.14

MESF2= 106/7= 15.14

F2 forecast results appears to be more accurate because MES model gives less error

than F1.

(c) Compute MAPE for each set of forecast. Which forecast is better or appears to be

more accurate? Briefly explain.

Ans:

MAPE= (∑ (│Actual-Forecast│/actual)*100)/n

MAPE F1=42.4/8=5.34

MAPE F2==32.9/8=4.11

F2 forecast results appears to be more accurate because MAPE model gives less error

than F1.

(d) Compute a tracking signal for the 8th month for each forecast using the cumulative

error as well as limits of ± 4 for 1 and 8.

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

11

Operations and Production Management

MGMT 405

Answer set 3

Ans:

Tracking Signalt = ∑ (Actual-Forecast)/MADt

MSE

Control Limits= 0 +/- 2

CUM

Period

Demand

F1

e

e

1

68

66

2

2

2

2

75

68

7

7

9

3

70

72

-2

2

7

4

74

71

3

3

10

5

69

72

-3

3

7

6

72

70

2

2

9

7

80

71

9

9

18

8

78

74

4

4

22

ERROR

CUM

Period

Demand

F2

e

e

1

68

66

2

2

2

2

75

68

7

7

9

3

70

70

0

0

9

4

74

72

2

2

11

5

69

74

-5

5

6

6

72

76

-4

4

2

7

80

78

2

2

4

8

78

80

-2

2

2

ERROR

MADF1= 32/8= 4

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

12

Operations and Production Management

MGMT 405

Answer set 3

MADF2= 24/8= 3

MESF1= 176/7= 25.14

MESF2= 106/7= 15.14

MAPE F1=42.4/8=5.34

MAPE F2==32.9/8=4.11

Tracking Signalt = ∑ (Actual-Forecast)/MADt =cumulative error/ MADt

Tracking Signalt for F1= 22/4=5.5

Tracking Signalt for F2= 2/3=0.66

Tracking Signal is used to monitor a forecast whether the method is biased or not.

Values can be positive or negative and zero value would be ideal. Since 5.5 >4 the

forecast method 1 is biased. This means that using F1, we are underestimating

(positive bias)* demand. Since 0.66 < 4, the forecast is in control.

*overestimating

(negative bias).

(e) Compute 2s control limits for each forecast.

Ans:

Control Limits= 0 +/- 2

MSE

Control Limits for F1 = 0 +/- 2

MSE =0 +/- 2 √(25.14=+10.01 and -10.01

Control Limits for F2 = 0 +/- 2

MSE =0 +/- 2 √(15.14=+7.78 and -7.78

Since all errors for both forecasts 1 and 2 are within these limits, the forecasts are in

control (see column e for both F1 and F2 in the tables above).

© 2010/11, Sami Fethi, EMU, All Right Reserved, McGraw-Hill, 2007, 9. Ed.

13