Partial Answer Key

advertisement

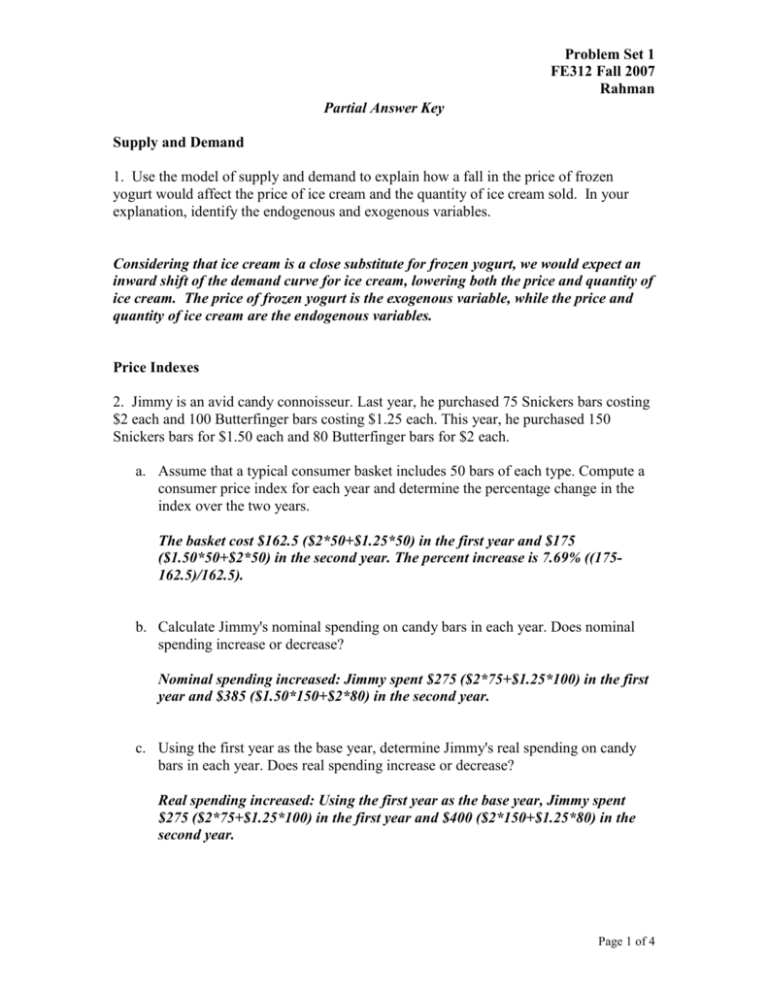

Problem Set 1 FE312 Fall 2007 Rahman Partial Answer Key Supply and Demand 1. Use the model of supply and demand to explain how a fall in the price of frozen yogurt would affect the price of ice cream and the quantity of ice cream sold. In your explanation, identify the endogenous and exogenous variables. Considering that ice cream is a close substitute for frozen yogurt, we would expect an inward shift of the demand curve for ice cream, lowering both the price and quantity of ice cream. The price of frozen yogurt is the exogenous variable, while the price and quantity of ice cream are the endogenous variables. Price Indexes 2. Jimmy is an avid candy connoisseur. Last year, he purchased 75 Snickers bars costing $2 each and 100 Butterfinger bars costing $1.25 each. This year, he purchased 150 Snickers bars for $1.50 each and 80 Butterfinger bars for $2 each. a. Assume that a typical consumer basket includes 50 bars of each type. Compute a consumer price index for each year and determine the percentage change in the index over the two years. The basket cost $162.5 ($2*50+$1.25*50) in the first year and $175 ($1.50*50+$2*50) in the second year. The percent increase is 7.69% ((175162.5)/162.5). b. Calculate Jimmy's nominal spending on candy bars in each year. Does nominal spending increase or decrease? Nominal spending increased: Jimmy spent $275 ($2*75+$1.25*100) in the first year and $385 ($1.50*150+$2*80) in the second year. c. Using the first year as the base year, determine Jimmy's real spending on candy bars in each year. Does real spending increase or decrease? Real spending increased: Using the first year as the base year, Jimmy spent $275 ($2*75+$1.25*100) in the first year and $400 ($2*150+$1.25*80) in the second year. Page 1 of 4 Problem Set 1 FE312 Fall 2007 Rahman d. Calculate the implicit price deflator (defined as nominal spending divided by real spending). How does this deflator compare the CPI calculated in part (a)? Which measurement do you think is more relevant in determining the change in Jimmy's cost of living? The implicit price deflator is 1 in the first year ($275/$275) and 0.9625 ($385/$400) in the second year. In other words, the change in the implicit price deflator implies deflation (overall prices going down), while the change in the CPI implies inflation (overall prices going up)!! Why the big difference? The GDP deflator adjusts with Jimmy’s spending behavior, while the CPI does not. Jimmy switches to the cheaper Snickers, lowering his overall cost of living. The implicit price deflator is more directly related to Jimmy's cost of living since it is based upon his purchases in each year. e. Finally [unrelated to the problem above with Jimmy], suppose you are a senator writing a bill to index Social Security and federal pensions. That is, your bill will adjust these benefits to offset changes in the cost of living. Would you use the GDP deflator or the CPI? Why? Obviously there’s no clear-cut answer. Ideally, one wants a measure of the price level that accurately captures the cost of living. Overestimating inflation is more costly to the government, but underestimating inflation would be more costly for those who rely on federal pensions. Factoral Distribution of Income 3. Use the neoclassical theory of distribution to predict the impact on the real wage and the real rental price of capital of each of the following events: a. A wave of immigration increases the labor force. According to the neoclassical theory of distribution, the real wage equals the marginal product of labor. Because of diminishing returns to labor, an increase in the labor force causes the marginal product of labor to fall. Hence, the real wage falls. b. An earthquake destroys some of the capital stock. The real rental price equals the marginal product of capital. If an earthquake destroys some of the capital stock (yet miraculously does not kill anyone and lower the labor force), the marginal product of capital rises and, hence, the real rental price rises. Page 2 of 4 Problem Set 1 FE312 Fall 2007 Rahman c. A technological advance improves the production function. If a technological advance improves the production function, this is likely to increase the marginal products of both capital and labor. Hence, the real wage and the real rental price both increase. 4. Suppose that the production function is Cobb-Douglas. That is, the production 1 function is Y F ( K , L) AK L . Further, assume that the parameter α = 0.3. a. What fractions of income do capital and labor receive? Do these seem like reasonable figures to you? Explain. Note that MPL = (1-α)*Y/L, and MPK = α*Y/L. Given that profit-maximizing firms hire factors of production until their marginal products equal their costs, MPL = W/P, and MPK = R/P. And since α = 0.3, we see that 30% of Y is paid to capital, while the rest is paid to labor. b. Suppose that immigration raises the labor force by 10 percent. What happens to total output (in percent)? The real rental price of capital (in percent)? The real wage (in percent)? Y1 = AK0.3L0.7, Y2 = AK0.3(1.1L0.7) Y2 / Y1 = (1.1)0.7 = 1.069 (R/P)1 = MPK = 0.3AK-0.7L0.7, (R/P)2 = 0.3AK-0.7(1.1L0.7) (R/P)2 / (R/P)1 = 1.069 (W/P)1 = MPL = 0.7AK0.3L-0.3, (W/P)2 = 0.7AK-0.7(1.1L-0.7) (W/P)2 / (W/P)1 = 0.972 Thus we see that while output and the rental rate of capital each rise by 6.9%, the wage falls by 2.8%. c. Suppose that a gift of capital from abroad raises the capital stock by 10 percent. What happens to total output (in percent)? The real rental price of capital (in percent)? The real wage (in percent)? Page 3 of 4 Problem Set 1 FE312 Fall 2007 Rahman Y1 = AK0.3L0.7, Y2 = A(1.1K0.3)L0.7 Y2 / Y1 = (1.1)0.3 = 1.029 (R/P)1 = MPK = 0.3AK-0.7L0.7, (R/P)2 = 0.3A(1.1K-0.7)L0.7 (R/P)2 / (R/P)1 = 0.935 (W/P)1 = MPL = 0.7AK0.3L-0.3, (W/P)2 = 0.7A(1.1K-0.7)L-0.7 (W/P)2 / (W/P)1 = 1.029 Thus output rises by 2.9%, rental rates fall by 6.5%, and wages rise by 2.9% d. Suppose that a technological advance raises the value of the parameter A by 10 percent. What happens to total output (in percent)? The real rental price of capital (in percent)? The real wage (in percent)? So the same thing for A, and you’ll see that everything rises by 10%. Returns to Scale 5. a. Suppose an automobile manufacturer is choosing between two production options. It can produce 100 cars with 200 workers and 50 machines, or it can produce 166 cars with 300 workers and 75 machines. Would you describe the manufacturer’s production function as exhibiting decreasing, constant, or increasing returns to scale? Explain. The capital stock and the labor force increase by 50% and the output increases by 66%. This is increasing returns to scale. b. Regardless of what your answer was in part a, we can say that this manufacturer faces diminishing marginal productivity for both machines and workers. Explain how this is possible. Increasing returns to scale refers to the change in output when both factors are increased in the same percentage. Diminishing marginal productivity describes the change in output when only one factor is altered. Page 4 of 4