MARGIN OF SAFETY

advertisement

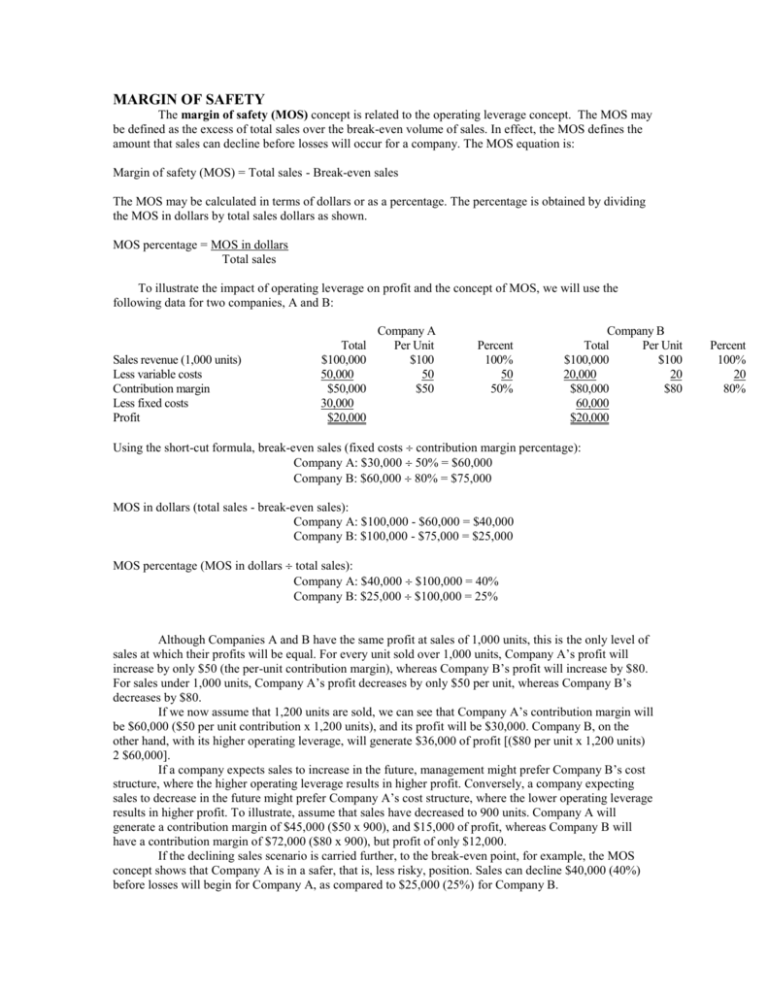

MARGIN OF SAFETY The margin of safety (MOS) concept is related to the operating leverage concept. The MOS may be defined as the excess of total sales over the break-even volume of sales. In effect, the MOS defines the amount that sales can decline before losses will occur for a company. The MOS equation is: Margin of safety (MOS) = Total sales - Break-even sales The MOS may be calculated in terms of dollars or as a percentage. The percentage is obtained by dividing the MOS in dollars by total sales dollars as shown. MOS percentage = MOS in dollars Total sales To illustrate the impact of operating leverage on profit and the concept of MOS, we will use the following data for two companies, A and B: Sales revenue (1,000 units) Less variable costs Contribution margin Less fixed costs Profit Total $100,000 50,000 $50,000 30,000 $20,000 Company A Per Unit $100 50 $50 Percent 100% 50 50% Company B Total Per Unit $100,000 $100 20,000 20 $80,000 $80 60,000 $20,000 Using the short-cut formula, break-even sales (fixed costs contribution margin percentage): Company A: $30,000 50% = $60,000 Company B: $60,000 80% = $75,000 MOS in dollars (total sales - break-even sales): Company A: $100,000 - $60,000 = $40,000 Company B: $100,000 - $75,000 = $25,000 MOS percentage (MOS in dollars total sales): Company A: $40,000 $100,000 = 40% Company B: $25,000 $100,000 = 25% Although Companies A and B have the same profit at sales of 1,000 units, this is the only level of sales at which their profits will be equal. For every unit sold over 1,000 units, Company A’s profit will increase by only $50 (the per-unit contribution margin), whereas Company B’s profit will increase by $80. For sales under 1,000 units, Company A’s profit decreases by only $50 per unit, whereas Company B’s decreases by $80. If we now assume that 1,200 units are sold, we can see that Company A’s contribution margin will be $60,000 ($50 per unit contribution x 1,200 units), and its profit will be $30,000. Company B, on the other hand, with its higher operating leverage, will generate $36,000 of profit [($80 per unit x 1,200 units) 2 $60,000]. If a company expects sales to increase in the future, management might prefer Company B’s cost structure, where the higher operating leverage results in higher profit. Conversely, a company expecting sales to decrease in the future might prefer Company A’s cost structure, where the lower operating leverage results in higher profit. To illustrate, assume that sales have decreased to 900 units. Company A will generate a contribution margin of $45,000 ($50 x 900), and $15,000 of profit, whereas Company B will have a contribution margin of $72,000 ($80 x 900), but profit of only $12,000. If the declining sales scenario is carried further, to the break-even point, for example, the MOS concept shows that Company A is in a safer, that is, less risky, position. Sales can decline $40,000 (40%) before losses will begin for Company A, as compared to $25,000 (25%) for Company B. Percent 100% 20 80% What is Company B to do about its low margin of safety? Unfortunately, there is no quick or easy solution to this problem. If possible, fixed costs may be reduced, which will lower the break-even point and improve the MOS. Alternatively, total sales may be increased, which will also improve the MOS. Essentially, the MOS concept helps identify a potential problem, the solution to which is found by analyzing the company’s cost structure and applying C-V-P analysis, as described in this chapter. As you can see, there is no simple answer as to which type of cost structure is better. As discussed in the previous section, operating leverage is neither good nor bad. Every company is different, so several factors must be considered: whether sales are expected to increase or decrease from the current level, how stable sales volumes are, and how willing management is to take risks. Certainly, low fixed costs and high variable costs (Company A’s cost structure) provide a much more conservative cost structure than low variable costs and high fixed costs (Company B’s cost structure). Thus, if management is reluctant to take risks, it will want its costs to be variable rather than fixed whenever possible. In our example, Company A has a higher MOS and will experience much narrower swings in profit than will Company B. Company B has a lower MOS and will be more profitable in good times, but will have higher losses in bad times. TO SUMMARIZE The margin of safety (MOS) for a company is defined as total sales minus the break-even sales. The MOS shows how much sales can decline before losses will occur for a company. Similar to operating leverage, MOS is a measure of risk to profits to which a company is exposed as sales volume changes. COMPUTING CONTRIBUTION MARGIN NOT REALIZED Thus far in the chapter, we have assumed that each product sells for only one price and have made no mention of selling the same product at different prices. This is a somewhat unrealistic assumption; as you know, not all seats on an airplane sell for the same price nor do matinee theater tickets sell for as much as evening theater tickets. The determination of whether discount airplane or movie tickets, for example, or other prices should be offered can be made only by looking at capacity. If a manufacturing firm, airline, or movie theater is not operating at full capacity, it may be a good decision to increase production (fill more seats) at a lower price. The decision of whether or not to use excess capacity to offer lower-price products or services can be aided by computing the contribution margin not realized. To illustrate, assume that a company sells three products, A, B, and C, at average sales prices of $5.34, $4.23, and $15.00 per unit, respectively. Assume also that the variable costs per unit are $1.59 for product A, $1.53 for product B, and $7.55 for product C. Further assume that the company has unused capacity at the current production levels of 100,000 units of product A, 900,000 units of product B, and 100,000 of product C. If the company can sell all the additional products it can make by discounting the selling price 15%, it would compute its contribution margin not realized as follows: Average selling price Average selling price less 15% Less variable costs Contribution margin per unit Unused capacity Contribution margin not realized Product A $5.34 $4.54 1.59 $2.95 x 100,000 $295,000 Product B $4.23 $3.60 1.53 $2.07 x 900,000 $1,863,000 Contribution margin not realized measures the extent to which the company effectively manages its capacity and the effect unutilized capacity is having on the company’s profitability. Calculating contribution margin not realized helps firms make better decisions regarding sales and profit opportunities, downsizing, and redeployment of resources. It is important, however, that capacity decisions be made for the long run rather than on a periodby-period basis. Measurements of optimal capacity, such as those above, can break managers out of routine year-to-year planning and give companies a stretch target to reach for. If capacity is not being used, it should be reported for what it is: waste. Unused capacity should also be addressed with the same intensity that a company would tackle other kinds of waste. Product C $15.00 $12.75 7.55 $5.20 x 100,000 $520,000 Like any management tool, decisions concerning contribution margin not realized should be made carefully. A company may well decide that keeping a supply of unused capacity is beneficial so that it can respond quickly to surges in customer demand. The job of a management accountant is to provide decision makers with information (such as contributions lost by not using excess capacity) so they can make intelligent decisions. Managers then use that information to make decisions. Usually, the better the information, the better the decisions. In the cases of capacity decisions, efficiently using resources is critical to the success of most firms and often determines whether some firms will even survive. TO SUMMARIZE If an organization is not operating at full capacity with normal selling prices, it may be wise to produce and sell additional goods (up to capacity) at discounted prices. To determine the extent of lost profits, the contribution margin not realized can be calculated. Like all management tools, this calculation of contribution margin not realized should be used carefully and usually should be considered only with a long-run perspective.