Expected Utility

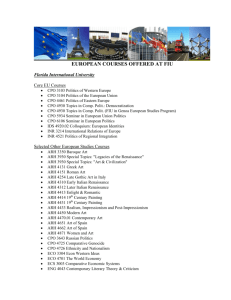

advertisement

*** THE EXPECTED UTILITY HYPOTHESIS

Given the existence of risky events, how do people make decisions under risk? A simple

possibility is to maximize the expected value of rewards. But do people behave in the way consistent with

the maximization of expected rewards?

* The St Petersburg Paradox:

Consider the game: flip a coin repeatedly until a head is obtained for the first time; receive the

reward $(2n) if the first head is obtained on the nth toss. What is the maximum willingness-to-pay (WTP)

of individuals to play this game?

Empirically, it is typically found that individuals have a WTP for the game that is positive but

finite. Yet, the expected value of the reward is:

E(reward) = n1 2n(1/2)n = 1 + 1 +... = .

Thus, if individuals behaved in a way consistent with the maximization of expected rewards, their WTP for

the game should be infinite. The fact that the WTP is finite indicates that people typically do not behave as

if they maximized the expected value of rewards (Bernoulli, 18th century).

* The Expected Utility Hypothesis: (EUH)

People make decisions on the basis of the expected utility of rewards.

Notation: Consider a choice among alternative risky rewards: a1, a2, a3, ... (e.g. alternative monetary

rewards). Each ai is a random variable with a given subjective probability distribution.

Let

a1 ~* a2 denote indifference between a1 and a2,

a1 * a2 denote that a2 is not preferred to a1,

a1 >* a2 denote that a1 is preferred to a2.

Under the expected utility hypothesis, choices among the ai's are made so as to maximize EU(a), where E

is the expectation operator and U(.) is a utility function representing preferences.

But is the Expected Utility Hypothesis reasonable? And how do we know that U(a) exists?

* The Existence of the Utility Function U(a):

Assumptions:

A1- (ordering and transitivity)

. For any a1 and a2, exactly one of the following must hold:

a1 >* a2, a2 >* a1, or a1 ~* a2.

. If a1 * a2 and a2 * a3, then a1 * a3. (transitivity).

A2- (independence)

For any a1, a2, a3 and any (0 < < 1), then a1 * a2 iff

[ a1 + (1-)a3] * [ a2 + (1-) a3].

(the preferences between a1 and a2 are independent of a3).

A3- (continuity)

For any a1, a2, a3 where a1 <* a3 <* a2, then there exists numbers (, ), 0 < < 1, 0 < <

1, such that

a3 <* [ a2 + (1-) a1] and a3 >* [ a2 + (1-) a1].

A4- For any a1, a2 satisfying Pr[a1: a1 * r] = Pr[a2: a2 * r] = 1 for some r, then a2 * a1.

A5. If there exists an integer m0 such that {a1 a1 * sm} * a2, sm * sm+1 * sm+2 ..., for every

m m0, then a1 * a2.

2

. If there exists an integer n0 such that {a1 a1 * tn} * a2, tn * tn+1 * tn+2 ..., for every n

n0, then a1 * a2.

Theorem: Under assumptions A1-A5, for any a1, a2, there exists a utility function U(a) such that

a1 * a2 iff EU(a1) EU(a2),

where U(a) is a utility function defined up to a positive linear transformation.

Thus, assumptions A1-A5 justify the expected utility hypothesis as an appropriate behavioral rule.

Note: EU(ai) = Σj U(aij) Pr(aij) (in the discrete case)

Thus, under the EUH, the objective function of the decision maker is linear in the probabilities.

This follows from the independence assumption (A2).

Note: Assumptions A4-A5 are rather technical: they are made to guarantee that EU() is "measurable"

when distributions are unbounded... Assumptions A1-A3 are the more crucial ones: they are the

ones that tend to be questioned if the predictions from the EUH are found to be inconsistent with

actual behavior under risk.

Note: If U(a) is a utility function, then the positive linear transformation W(a) = + U(a) is a utility

function exhibiting the same preferences as U(a) for any > 0.

Proof: a1 >* a2 EU(a1) EU(a2) + EU(a1) + EU(a2) EW(a1) EW(a2).

Note: The above discussion assumes that EU(a) exists (i.e., that EU(a) < ).

* DIRECT ELICITATION OF PREFERENCES:

1- Case of monetary rewards where a = scalar: (a = $)

Assume:

aL a aU,

U(a) = a strictly increasing function.

a/ Questionnaire Design: Find the answer to the following questions:

1. Find the reward a1 obtained with certainty which is regarded by the person as equivalent to the

lottery:

{aL with probability 1/2; aU with probability 1/2}.

2. Find the reward a2 obtained with certainty which is regarded as being equivalent to the lottery:

{a1 with probability 1/2; aU with probability 1/2}.

3. Find the reward a3 obtained with certainty which is regarded as being equivalent to the lottery:

{a1 with probability 1/2; aL with probability 1/2}.

4. etc...

b/ Finding U(a) from the questionnaire results:

. Choose U(aL) = 0 and U(aU) = 1 (because U(a) is defined up to a positive linear transformation).

. From "1.", a1 ~* [aL with probability 1/2; aU with probability 1/2]. Under the EUH, this implies

that U(a1) = 1/2 U(aL) + 1/2 U(aU) = .5.

. From "2.", a2 ~* [a1 with probability 1/2; aU with probability 1/2]. Under the EUH, this implies

that U(a2) = 1/2 U(a1) + 1/2 U(aU) = .75.

. From "3.", a3 ~* [a1 with probability 1/2; aL with probability 1/2]. Under the EUH, this implies

that U(a3) = 1/2 U(a1) + 1/2 U(aL) = .25.

. etc...

. Plot U(a) and draw a line through the points to obtain an estimate of the utility function of the

individual.

Note: The method can be modified using lotteries with probabilities other that 1/2, or lotteries comparing

3

risky outcomes.

Note: Empirical validation of the method can be done by asking additional questions. For example, find

the reward A obtained with certainty and regarded as being equivalent to the lottery {a2 with probability

1/2; a3 with probability 1/2}. Under the EUH, it follows that U(A) = 1/2 U(a2) + 1/2 U(a3) = 1/2. Thus,

U(A) = U(a1) = 1/2. U(a) being strictly increasing, this implies A = a1. If A a1, then:

. either there is need to iterate the questions until A = a1 (assuming that the EUH holds);

. or the behavior of the individual is not consistent with the EUH.

2- Multidimensional Case: U(x) where x = (x1, x2, ...) = multidimensional vector (e.g. x1 = money, x2 =

leisure, etc...).

The procedure discussed in "1-" can be used changing one dimension at a time, the other

dimensions being held constant. But this gets complicated for dimensions greater than two.

The Case of Additive Utility: U(x) = Σi ki Ui(xi), 0 Ui(xi) 1, 0 ki 1, Σi ki = 1.

a/ Use the procedure in "1-" to estimate each Ui(xi), i = 1, 2, ...

b/ Estimate ki:

Let

xi+ = most preferred level of xi with Ui(xi+) = 1,

xi- = least preferred level of xi with Ui(xi-) = 0,

for all i = 1, 2, ...

Using a questionnaire, find the probability p1 such that the person is indifferent between

{(x1+, x2-, x3-, ...) with certainty} and {(x1+, x2+, x3+, ...) with probability p1; (x1-, x2-, x3-, ...)

with probability (1-p1)}. Under the EUH, this implies

U(x1+,x2-,x3-,..) = p1 U(x1+,x2+,x3+,..) + (1-p1) U(x1-,x2-,x3-,..)

or

k1 = p1[k1 + k2 + ...] + (1-p1) [0]

or

k1 = p1.

Repeat the procedure with p2, p3, ... to estimate k2, k3, ...