solving economic models by means linear programming with linear

advertisement

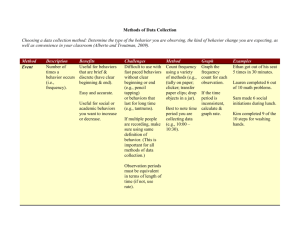

354 Review of Management and Economical Engineering, Vol. 6, No. 5 SOLVING ECONOMIC MODELS BY MEANS OF LINEAR PROGRAMMING WITH OBJECTIVE FUNCTION LINEAR ON INTERVALS Dorin LIXĂNDROIU TRANSILVANIA University of Brasov lixi.d@unitbv.ro Abstract: The paper analyzes the defining modality in the linear programming models of objective functions linear on intervals by means of binary variables. This allows the accomplishment of some optimization models of productive processes, which bear a closer relation to reality. Keywords: economic modeling, linear programming, objective function linear on intervals. 1. INTRODUCTION In the economic models that lead to linear programming, the objective function to be optimized (maximization or minimization) is linear. For instance, in the models for optimizing production, for a volume of production x and a variable unit cost c, the objective function has the form: z c x . This approach does not bear any relation to reality when the fixed costs vary on intervals or the direct variable costs (or the unit receipts) differ on disjoint intervals of the amount of produced or sold products. In order to write the objective functions in these complex economic situations, we will consider the cost functions linear on intervals in what follows [WIL, 1993], [GIA, 2003]. 2. THE COST FUNCTION LINEAR ON INTERVALS The form of the objective function presented above cannot be accepted when the production decision also involves a fixed cost, i.e. the partial production cost of the good considered is 0 , if the production is zero; if x>0, it equals c x K , . For solving, we introduce the binary variable y , defined as follows: y = 0, if x =0 y = 1, if x >0. This allows the introduction of the fixed cost in the objective function, which will take the following form: International Conference on Business Excellence 2007 355 Min z, with z c x K y .... (1) The connection between x and y can be achieved by the supplementary restriction: x M y, where M is a constant greater or equal to the maximum value that x can take. Generalization. For any objective function (cost or income) linear on intervals, the fictitious variables xk can be introduced, which take values on the interval ( M k1 , M k ] , with M0 =0. On each interval, the variable cost is constant, and the values xk will all be zero, excepting the interval which includes the value x. Figure 1 presents an example of objective function of the total cost. This is neither concave (the average production cost does not rise when x increases), nor convex (average production cost does not decrease when x increases). Figure 1. The total cost function The generalization allows the approach of the uniform rebates (figure 2) and of the progressive rebates (figure 3) in supply activities. Figure 2. The total cost function in case of a uniform rebate 356 Review of Management and Economical Engineering, Vol. 6, No. 5 Figure 3. The total cost function in case of a progressive rebate When building up the model, the variable x will be replaced by x1 x2 x3 x4 . The objective function for the relative part of this production cost becomes: Min z, with z c1 x1 K 1 y1 c2 x2 K 2 y 2 c3 x3 K 3 y3 c4 x4 K 4 y4 ... under restriction: 0 x1 M 1 y1 M 1 y 2 x2 M 2 y 2 M 2 y 3 x3 M 3 y 3 (2) M 3 y 4 x4 M 4 y 4 y1 y 2 y3 y4 1 In figure 4, we present the graph of a concave cost function (the function is nondecreasing). Figure 4. The concave total cost function Remark. If x varies discontinuously, for a variation ε of the cost function, we have to decide whether x = Mi belongs to the interval i or i+1. Supposing the upper bounds of the intervals are excluded, there will be: International Conference on Business Excellence 2007 0 x1 M 1 y1 M 1 y 2 x2 M 2 y 2 M 2 y3 x3 M 3 y3 M 3 y4 x4 M 4 y4 357 (3) y1 y 2 y3 y4 1 The last restriction does not allow that x belong to the interval (Mi_- ε, Mi). Model (2) can be generalized for a number of N intervals: z ci xi K i yi Min z, with i under restrictions: M i 1 yi xi M i yi , for each i=1,2,...,N yi 1 (4) i Model (4) contains 2 N 1 restrictions. If the number of intervals is greater than 3, we can have a more efficient alternative statement, which requires N+1 restrictions [GIA, 2003], starting from the idea that each xk included between Mk-1 and Mk can be represented as a linear combination having the form: (5) xk k 1 M k 1 k M k , with k 1 k 1 3. AN EXAMPLE OF APPLICATION We now consider the issue of the distribution of “clients” (warehouses) to the production or distribution centers. We suppose there are m production/ distribution centers and n warehouses. We consider that all the production/ distribution centers are open and the capacity of each center does not vary in the lapse of time considered. If we re-arrange the distribution, new warehousing locations could be considered, as well as closing some of the existing warehouses. Thus, it is necessary to introduce a cost function linear on intervals, like the one in figure 1. We assume a warehouse could be supplied by several production/ distribution centers. We note: Qi , i = 1,2,...,m – the present production/ distribution capacity of the center i Dj , j = 1,2,...,n – the demand of the warehouse j Cij, i = 1,2,...,m, j = 1,2,...,n, - the cost of the full satisfaction of the demand of warehouse j by the center i qij, i = 1,2,...,m, j = 1,2,...,n, - the amount of the demand of warehouse j met by center i The objective minimization function will be the sum of the production and distribution costs of all the centers. In order to have a clear presentation, reference will be made in what follows only to a single production/ distribution center out of the m centers, which will be represented as α. It is assumed that it has a capacity of Qα = 7000 units at present. n Cj qj The delivery cost for center α = j 1 D j 358 Review of Management and Economical Engineering, Vol. 6, No. 5 The production cost for center α, (in case of a production xα ) will be a linear function on intervals, for instance: 0 for xα = 0 100 + 0.25 xα for x 5000 150 + 0.15 xα for 5000 x 9000 Remark. The value of 9000 units can be interpreted as a maximum value of the production of center α, which cannot be exceeded. According to the before-mentioned statements, two new variables will be introduced, associated to the production of the center α, which will be represented as xα1 , xα2 x x 1 x 2 , and two binary variables represented as yα1 , yα2. The production cost for the center a can be found in the objective function under the following form: 0.25 x 1 100 y 1 0.15 x 2 150 y 2 Correspondingly, the following restrictions are added: 0 x 1 5000 y 1 5000 y 2 x 2 9000 y 2 Conclusion. Defining some economic models with a closer relation to reality can lead to complex statements, which actually comprise basic structures that can be applied without any difficulty. REFERENCES [GIA, 2003] Giard, V., Processus productifs et Programmation linéaire, Ed. Economica, Paris, 2003. [GOL,1973] Golstein, E., Youdine, D., Problèmes particuliers de la programmation linéaire, Editura Mir, Moscou, 1973. [LIX, 2000] Lixandroiu, D., Consideraţii asupra modelelor care conduc la programarea liniară mixtă, in Buletinul Ştiinţific nr.1/2000 al Universităţii Creştine Dimitrie Cantemir Braşov, pag. 126-130. [LIX, 2003a] Lixandroiu, D., Using Linear Programming in Project Management, in Proceedings of The 13th International Symposium Alternative Economic Strategies, 2003, Brasov, Editura Era, Bucuresti, pag.292-296. [LIX, 2003b] Lixandroiu, D., Petcu, N., On Some Models for Investment Optimum Choice, in Proceedings of The International Scientific Conference microCAD 2003, Miskolc, Hungary, pag.63-67. [LIX, 2006] Lixandroiu, D., On Logical Restrictions in Economic Models Solved Through Means of Linear Programming, in Proceedings of The 6th Biennial International Economic Symposium SIMPEC 2006, Braşov, Editura Infomarket, Vol.1, pag. 175-181. [WIL, 1993] Williams, H.P., Model Building in Mathematical Programming, Wiley, 1993.