Medical Lifestyle PLUS Insurance Policy Benefits & Coverage

advertisement

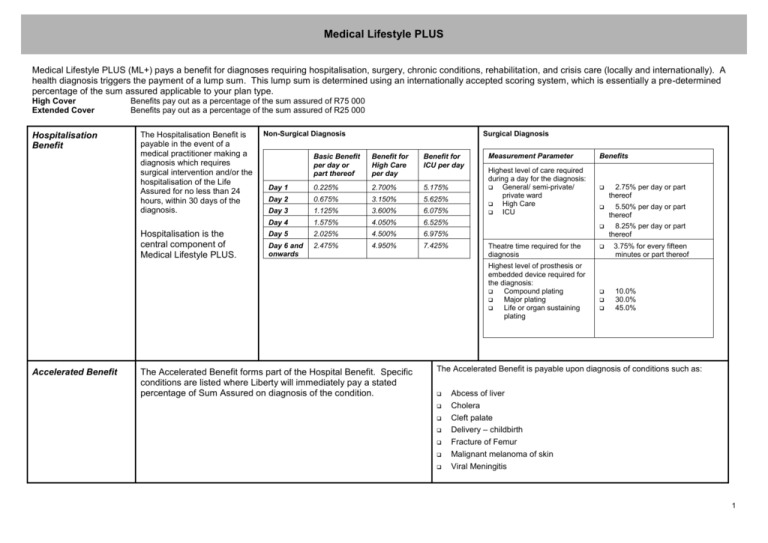

Medical Lifestyle PLUS Medical Lifestyle PLUS (ML+) pays a benefit for diagnoses requiring hospitalisation, surgery, chronic conditions, rehabilitation, and crisis care (locally and internationally). A health diagnosis triggers the payment of a lump sum. This lump sum is determined using an internationally accepted scoring system, which is essentially a pre-determined percentage of the sum assured applicable to your plan type. High Cover Extended Cover Hospitalisation Benefit Benefits pay out as a percentage of the sum assured of R75 000 Benefits pay out as a percentage of the sum assured of R25 000 The Hospitalisation Benefit is payable in the event of a medical practitioner making a diagnosis which requires surgical intervention and/or the hospitalisation of the Life Assured for no less than 24 hours, within 30 days of the diagnosis. Hospitalisation is the central component of Medical Lifestyle PLUS. Non-Surgical Diagnosis Surgical Diagnosis Basic Benefit per day or part thereof Benefit for High Care per day Benefit for ICU per day Day 1 0.225% 2.700% 5.175% Day 2 0.675% 3.150% 5.625% Day 3 1.125% 3.600% 6.075% Day 4 1.575% 4.050% 6.525% Day 5 2.025% 4.500% 6.975% Day 6 and onwards 2.475% 4.950% 7.425% Measurement Parameter Highest level of care required during a day for the diagnosis: General/ semi-private/ private ward High Care ICU Theatre time required for the diagnosis Highest level of prosthesis or embedded device required for the diagnosis: Compound plating Major plating Life or organ sustaining plating Accelerated Benefit The Accelerated Benefit forms part of the Hospital Benefit. Specific conditions are listed where Liberty will immediately pay a stated percentage of Sum Assured on diagnosis of the condition. Benefits 2.75% per day or part thereof 5.50% per day or part thereof 8.25% per day or part thereof 3.75% for every fifteen minutes or part thereof 10.0% 30.0% 45.0% The Accelerated Benefit is payable upon diagnosis of conditions such as: Abcess of liver Cholera Cleft palate Delivery – childbirth Fracture of Femur Malignant melanoma of skin Viral Meningitis 1 Chronic Benefit This benefit is payable upon diagnosis of specific long-term medical conditions as listed. The Chronic Benefit pays a percentage of the sum assured on a monthly basis. The maximum Chronic Benefit payable in respect of a Life Assured in any contract year is limited to the sum assured. The Chronic Benefit is payable upon diagnosis of the following conditions: Cancer Chronic Renal Failure Diabetes (Type 1 only) End Stage Lung Disease Crisis Care Benefit This benefit is split into Emergency Transport Southern Africa* (Netcare 911) and emergency international cover and care through Europ Assistance. The maximum emergency international benefit is R5 million for any one period of overseas travel of less than 90 days. This benefit is available for lives assured under the age of 81 years, and is subject to certain terms and conditions. * Southern Africa: South Africa, Botswana, Swaziland, Zimbabwe; Lesotho, Mozambique, Namibia. Recovery Benefit Crisis Care Benefits in Southern Africa Emergency medical response to a scene of a medical emergency by road or air ambulance Emergency (telephonic 911 type) medical advice and information Transfer of the Life Assured to the most appropriate medical facility Transfer of life saving medications and emergency blood if required Hospital admission deposit guarantees, currently R 5,000, if required Non-emergency/general medical (telephonic) consultation and advice Repatriation of Life Assured or the return of mortal remains Companionship and/or care of stranded minors Rape Crisis Centres of Excellence Specialised Travel Advice. This benefit will pay a percentage of the sum assured in the event of a Life assured requiring specific therapy, as a result of a: Epilepsy Heart Failure Transplant organ rejection Cystic fibrosis Parkinson’s Disease International Crisis Care Benefits Emergency medical expenses Related expenses Emergency medical assistance Transportation / repatriation Return after medical treatment Burial, cremation or return of mortal remains Transmission of urgent messages Consular referral Emergency travel and accommodation arrangements Direct payment of medical bills. Examples include: Rehabilitation facilities Violent Crime event; Step-down facilities Hospitalisation related to a surgical diagnosis; Hospice Hospitalisation related to any one or more eligible non-surgical diagnoses. Physiotherapy Speech Therapy. The Recovery Benefit is limited to the 42 days immediately following either the date on which the violent crime took place, or the end date to which the Hospitalisation Benefit relates. Statutory notice: Medical Lifestyle PLUS is not a medical scheme. A medical scheme is indemnity based and pays actual medical costs subject to plan type limits. Medical Lifestyle PLUS is a non-indemnity product and pays a fixed percentage determined by your selected sum assured on the occurrence of a health event - actual cost is irrelevant, as is what you choose to do with the payment. 2