DOF INSTALLER TO BUILD TWO HIGH

advertisement

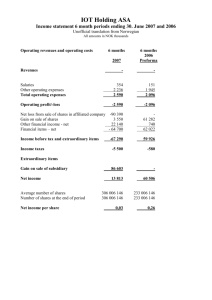

MARINE ACCURATE WELL ASA – CONTEMPLATED PRIVATE PLACEMENT OF SHARES IN CONNECTION WITH PROPOSED RESTRUCTURING Date: 8 June 2010 Marine Accurate Well ASA (“MARACC”) intends to raise gross proceeds of NOK 213–360 million (approx USD 33–56 mill) through a private placement of shares by issuing a minimum of 474 million and maximum of 800 million new shares at a subscription price of NOK 0.45 per share. The minimum issue amount of NOK 213 million has been fully underwritten by certain key stakeholders. The private placement will be subject to approval by shareholders at the Annual General Meeting in MARACC to be held on 16 June 2010 and the successful completion of the proposed restructuring and conversion of MARACC’s three outstanding bond issues into equity. The application period will open on 8 June 2010 and close on 21 June 2010 at 18:00 hours (CET). However, the application period may close earlier or be extended at MARACC's discretion. The purpose of the contemplated private placement of shares is to partly finance the on-going construction of MARACC’s well intervention and drilling unit currently being built at COSCO Shipyard in China, as well as for general corporate purposes. The remaining unfunded capex requirement post the proposed restructuring, but before the contemplated private placement, is estimated to approximately USD 260 million (excluding completion and start-up costs, as well as applicable financing costs in relation to unfunded capex). Carnegie ASA and Pareto Securities AS have been retained as managers for the contemplated private placement of shares. For further information, please contact: Asle Solheim, CEO of MARACC Tel: +47 99 32 84 65