Probability Concepts

advertisement

PROBABILITY CONCEPTS

Key concepts are described

Probability rules are introduced

Expected values, standard deviation,

covariance and correlation for individual

portfolio returns are explained

Probability Terminology

Random variable: uncertain number

Outcome: realization of random variable

Event: set of one or more outcomes

Mutually exclusive: cannot both happen

Exhaustive: set of events includes all possible

outcomes

Two Properties of Probability

Probability of an event, P(Ei), is between 0 and 1

0 ≤ P(Ei) ≤ 1

For a set of events that are mutually exclusive and

exhaustive, the sum of probabilities is 1

ΣP(Ei) = 1

Types of Probability

Empirical: based on analysis of data

Subjective: based on personal perception

A priori: based on reasoning, not experience

Odds For or Against

Probability that a horse will win a race = 20%

Odds for: 0.20 / (1 – 0.20) = 1/4

= one-to-four

Odds against: (1 – 0.20) / 0.20 = 4/1

= four-to-one

Conditional vs. Unconditional

Two types of probability:

Unconditional: P(A), the probability of an event

regardless of the outcomes of other events, e.g.,

probability market will be up for the day

Conditional: P(A|B), the probability of A given that

B has occurred, e.g., probability that the market will

be up for the day, given that the Fed raises interest

rates

Joint Probability

The probability that both of two events will occur is their

joint probability

Example using conditional probability:

P (interest rates will increase) = P(I) = 40%

P (recession given a rate increase) = P(R|I) = 70%

Probability of a recession and an increase in rates,

P(RI) = P(R|I) × P(I) = 0.7 × 0.4 = 28%

Probability that at Least One of Two

Events Will Occur

P(A or B) = P(A) + P(B) – P(AB)

We must subtract the joint probability P(AB)

Don’t double

count P(AB)

Addition Rule Example

P(I) = prob. of rising interest rates is 40%

P(R) = prob. of recession is 34%

Joint probability P(RI) = 0.28 (calculated earlier)

Probability of either rising interest rates or recession

= P(R or I) = P(R) + P(I) – P(RI)

= 0.34 + 0.40 – 0.28 = 0.46

For mutually exclusive events the

joint probability P(AB) = 0 so:

P(A or B) = P(A) + P(B)

Joint Probability of any Number of

Independent Events

Dependent events: knowing the outcome of one

tells you something about the probability of the other

Independent events: occurrence of one event does not

influence the occurrence of the other. For the joint

probability of independent events, just multiply

Example: Flipping a fair coin, P (heads) = 50%

The probability of 3 heads in succession is:

0.5 × 0.5 × 0.5 =0.53 = 0.125 or 12.5%

Calculating Unconditional Probability

Given:

P (interest rate increase) = P(I) = 0.4

P (no interest rate increase) = P(IC) = 1 – 0.4 = 0.6

P (Recession | Increase) = P(R|I) = 0.70

P (Recession | No Increase) = P(R|IC) = 0.10

What is the (unconditional) probability of recession?

P(R) = P(R|I) × P(I) + P(R|IC) × P(IC)

= 0.70 × 0.40 + 0.10 × 0.60 = 0.34

An Investment Tree

Prob of good stock performance 30%

Prob of good economy

Expected

EPS = $1.51

70%

60%

40%

Prob of poor economy

Prob of poor stock performance

60%

40%

EPS = $1.80

Prob = 18%

EPS = $1.70

Prob = 42%

EPS = $1.30

Prob = 24%

EPS = $1.00

Prob = 16%

Expected Value using Total

Probability

Using the probabilities from the Tree:

Expected(EPS) = $1.51

= .18(1.80) + .42(1.70) + .24(1.30) + .16(1.00)

Conditional Expectations of EPS:

E(EPS)|good economy =

.30(1.80) + .70(1.70) = $1.73

E(EPS)|poor economy =

.60(1.30) + .40(1.00) = $1.18

Covariance

Covariance: A measure of how two variables move

together

Values range from minus infinity to positive infinity

Units of covariance difficult to interpret

Covariance positive when the two variables tend to be

above (below) their expected values at the same time

For each observation, multiply each probability

times the product of the two random variables’

deviations from their means and sum them

Correlation

Correlation: A standardized measure of the linear

relationship between two variables

Values range from +1, perfect positive correlation

to –1, perfect negative correlation

r is sample correlation coefficient

ρ is population correlation coefficient

Correlation

Example: The covariance between two assets is

0.0046, σA = 0.0623 and σB = 0.0991. What is

the correlation between the two assets (ρA,B)?

Expected Value, Variance, and

Standard Deviation (probability model)

Expected Value: E(X) = ΣP(xi)xi

Expected Value, Variance, and

Standard Deviation (probability model)

Variance: σ2(X) = ΣP(xi)[xi – E(X)]2

Standard deviation: square root of σ2 = 0.1136

Portfolio Expected Return

Expected return on a portfolio is a

weighted average of the expected returns

on the assets in the portfolio

Portfolio Variance

and Standard Deviation

Portfolio variance also uses the weight of the

assets in the portfolio

Portfolio standard deviation is the square root of

the variance

Joint Probability Function

Returns

RB= 40%

RA= 20%

0.15

RA= 15%

RA= 4%

RB= 20%

RB= 0%

E(RB)=18%

Probabilities

0.60

0.25

E(RA)=13%

CovAB=

0.15 (.20 - .13) (.40 - .18) +

0.6 (.15 - .13) (.20 - .18) +

0.25 (.04 - .13) (0 - .18)

= 0.0066

Bayes’ Formula

Prob. of interest

rate cut (C)

60%

70%

Good earnings (G) 42%

30%

Poor earnings (P) 18%

20%

40%

Prob. of no interest

rate cut

80%

Prob (C|G) = 42/(42 + 8) = 84%

Prob (C|G) = [Prob(G|C) × Prob(C)]/Prob(G)

Prob (C/G) = (70%

*

60% )/ (42% +8%)

Good earnings (G) 8%

Poor earnings (P) 32%

Factorial for Labeling

Out of 10 stocks, 5 will be rated buy, 3 will be rated

hold, and 2 will be rated sell. How many ways

are there to do this?

10!

2,520

5! 3! 2!

Choosing r Objects from n Objects

When order does not matter and with just 2

possible labels, we can use the combination

formula (binomial formula)

Example: You have 5 stocks and want to place

orders to sell 3 of them. How many different

combinations of 3 stocks are there?

Choosing r Objects from n Objects

When order does matter, we use the

permutation formula:

You have 5 stocks and want to sell 3, one at a

time. The order of the stock sales matters. How

many ways are there to choose the 3 stocks to

sell in order?

Calculator Solutions: nCr and nPr

How many ways to choose 3 from 5, order

doesn’t matter? 5 → 2nd → nCr → 3 → = 10

How many ways to choose 3 from 5, order does

matter?

5 → 2nd → nPr → 3 → = 60

Functions only on BAII Plus (and Professional)

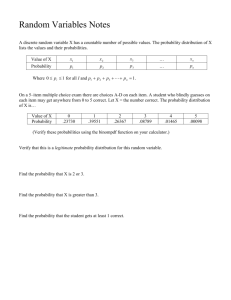

Probability Functions

A probability function, p(x), gives the probability

that a discrete random variable will take on the

value x

e.g. p(x) = x/15 for X = {1,2,3,4,5}→ p(3) = 20%

A probability density function (pdf), f(x) can be

used to evaluate the probability that a continuous

random variable with take on a value within a range

A cumulative distribution function (cdf), F(x),

gives the probability that a random variable will be

less than or equal to a given value

Properties of Normal

Distribution

Completely described by mean and variance

Symmetric about the mean (skewness = 0)

Kurtosis (a measure of peakedness) = 3

Linear combination of normally distributed random

variables is also normally distributed

Probabilities decrease further from the mean, but the

tails go on forever

Multivariate normal: more than one r.v., correlation

between their outcomes

Confidence Interval: Normal Distribution

Confidence interval: a range of values around an

expected outcome within which we expect the actual

outcome to occur some specified percent of the time.

Confidence Interval: Normal

Distribution

90% confidence interval = X ± 1.65s

95% confidence interval = X ± 1.96s

99% confidence interval = X ± 2.58s

Example: The mean annual return (normally

distributed) on a portfolio over many years is 11%,

and the standard deviation of returns is 8%. A 95%

confidence interval on next year’s return is 11% +

(1.96)(8%) = –4.7% to 26.7%

Standard Normal Distribution

A normal distribution that has been standardized

so that mean = 0 and standard deviation = 1

To standardize a random variable, calculate the

z-value

Subtract the mean (so mean = 0) and divide by

standard deviation (so σ = 1)

Calculating Probabilities Using

the Standard Normal Distribution

Example 1: The EPS for a large sample of

firms is normally distributed and has µ = $4.00

and σ = $1.50. Find the probability of a value

being lower than $3.70.

3.70 is 0.20 standard deviations below the

mean of 4.00.

Calculating Probabilities Using the

Standard Normal Distribution

Example 1 cont.: Here we need to find the area

under the curve to the left of the z-value of –0.20.

Calculating Probabilities Using the

Standard Normal Distribution

For negative z-value

calculate 1 – table value

Excerpt from a Table of

Cumulative Probabilities for a

Standard Normal Distribution

Calculating Probabilities Using the

Standard Normal Distribution

Find the area to the left of z-value + 0.20: From

the table this is 0.5793

Since the distribution is symmetric, for negative

values we take 1 minus the table value

Probability of values less than $3.70 is

1 – 0.5793 = 42.07%

With a z-table for negatives, F(-0.20) = 0.4207