Intermediate

Accounting

4-1

Prepared by

Coby Harmon

University of California, Santa Barbara

4

Income Statement and

Related Information

Intermediate Accounting

14th Edition

Kieso, Weygandt, and Warfield

4-2

Learning Objectives

4-3

1.

Understand the uses and limitations of an income statement.

2.

Prepare a single-step income statement.

3.

Prepare a multiple-step income statement.

4.

Explain how to report irregular items.

5.

Explain intraperiod tax allocation.

6.

Identify where to report earnings per share information.

7.

Prepare a retained earnings statement.

8.

Explain how to report other comprehensive income.

Income Statement and Related Information

Income

Statement

Format of the

Income

Statement

Usefulness

Limitations

Elements

Single-step

Quality of

Earnings

Multiple-step

Condensed income

statements

Reporting

Irregular Items

Discontinued

operations

Extraordinary items

Intraperiod tax

allocation

Earnings per share

Unusual gains and

losses

Changes in

accounting

principles

Retained earnings

statement

Comprehensive

income

Changes in

estimates

Corrections of

errors

4-4

Special

Reporting Issues

Income Statement

Usefulness

Evaluate past performance.

4-5

Predicting future performance.

Help assess the risk or uncertainty of

achieving future cash flows.

LO 1 Understand the uses and limitations of an income statement.

Income Statement

Limitations

Companies omit items that cannot be

measured reliably.

4-6

Income is affected by the accounting

methods employed.

Income measurement involves

judgment.

LO 1 Understand the uses and limitations of an income statement.

Income Statement

Quality of Earnings

Companies have incentives to manage income to meet or

beat Wall Street expectations, so that

market price of stock increases and

value of stock options increase.

Quality of earnings is reduced if earnings management

results in information that is less useful for predicting future

earnings and cash flows.

4-7

LO 1 Understand the uses and limitations of an income statement.

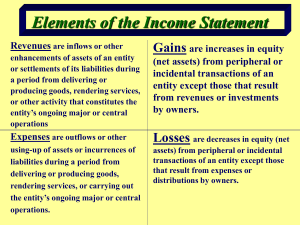

Format of the Income Statement

Elements of the Income Statement

Revenues – Inflows or other enhancements of assets or

settlements of its liabilities that constitute the entity’s ongoing

major or central operations.

Examples of Revenue Accounts

4-8

Sales

Dividend revenue

Fee revenue

Rent revenue

Interest revenue

LO 1 Understand the uses and limitations of an income statement.

Format of the Income Statement

Elements of the Income Statement

Expenses – Outflows or other using-up of assets or

incurrences of liabilities that constitute the entity’s ongoing

major or central operations.

Examples of Expense Accounts

4-9

Cost of goods sold

Rent expense

Depreciation

expense

Salary expense

Interest expense

LO 1 Understand the uses and limitations of an income statement.

Format of the Income Statement

Elements of the Income Statement

Gains – Increases in equity (net assets) from peripheral or

incidental transactions.

Losses - Decreases in equity (net assets) from peripheral or

incidental transactions.

Gains and losses can result from

4-10

sale of investments or plant assets,

settlement of liabilities,

write-offs of assets.

LO 1 Understand the uses and limitations of an income statement.

Single-Step Format

Single-Step Income

Statement

Revenues

Expenses

SingleStep

Net Income

No distinction between

Operating and Non-operating

categories.

4-11

Income Statement (in thousands)

Revenues:

Sales

$ 285,000

Interest revenue

17,000

Total revenue

302,000

Expenses:

Cost of goods sold

149,000

Selling expense

10,000

Administrative expense

43,000

Interest expense

21,000

Income tax expense

24,000

Total expenses

Net income

247,000

$ 55,000

Earnings per share

$

0.75

LO 2 Prepare a single-step income statement.

E4-4: Prepare an income

statement from the data below.

Single-Step Format

Income Statement

For the year ended Dec. 31, 2012

Administrative expense:

Officers' salaries

Revenues:

$

4,900

Sales

Depreciation

3,960

Rental revenue

Cost of goods sold

63,570

Rental revenue

17,230

Selling expense:

$

96,500

17,230

Total revenues

113,730

Expenses:

Cost of goods sold

63,570

17,150

Transportation-out

2,690

Selling expense

Sales commissions

7,980

Administrative exense

8,860

Depreciation

6,480

Interest expense

1,860

96,500

Income tax expense

7,580

Income tax expense

7,580

Total expenses

99,020

Interest expense

1,860

Sales

4-12

Net income

$

14,710

LO 2 Prepare a single-step income statement.

Single-Step Format

Review

The single-step income statement emphasizes

a. the gross profit figure.

b. total revenues and total expenses.

c. extraordinary items more than it is emphasized in the

multiple-step income statement.

d. the various components of income from continuing

operations.

4-13

LO 2 Prepare a single-step income statement.

Format of the Income Statement

Multiple-Step Income Statement

Separates operating transactions from nonoperating

transactions.

Matches costs and expenses with related revenues.

Highlights certain intermediate components of

income that analysts use.

4-14

LO 3 Prepare a multiple-step income statement.

Multiple-Step Format

Intermediate Components of the Income Statement

1. Operating section

2. Nonoperating section

3. Income tax

4. Discontinued operations

5. Extraordinary items

6. Earnings per share

4-15

LO 3 Prepare a multiple-step income statement.

Multiple-Step Format

The presentation

divides information

into major sections.

1. Operating Section

2. Nonoperating

Section

3. Income tax

4-16

Income Statement (in thousands)

Sales

Cost of goods sold

Gross profit

Operating expenses:

Selling expenses

Administrative expenses

Total operating expense

Income from operations

Other revenue (expense):

Interest revenue

Interest expense

Total other

Income before taxes

Income tax expense

Net income

$ 285,000

149,000

136,000

10,000

43,000

53,000

83,000

$

17,000

(21,000)

(4,000)

79,000

24,000

55,000

LO 3 Prepare a multiple-step income statement.

Illustration (E4-4): Prepare

an income statement from the

data below.

Multiple-Step Format

Income Statement

For the year ended Dec. 31, 2012

Administrative expense:

Officers' salaries

Sales

$

4,900

Cost of goods sold

Depreciation

3,960

Cost of goods sold

63,750

Operating Expenses:

Rental revenue

17,230

Selling expense

Selling expense:

32,750

17,150

Administrative exense

2,690

Sales commissions

7,980

Income from operations

Depreciation

6,480

Other revenue (expense):

96,500

Income tax expense

7,580

Interest expense

1,860

8,860

Total operating expenses

26,010

6,740

Rental revenue

17,230

Interest expense

(1,860)

Total other

15,370

Income before tax

22,110

Income tax expense

Net income

4-17

96,500

63,750

Gross profit

Transportation-out

Sales

$

7,580

$

14,530

Multiple-Step Format

Review

A separation of operating and non operating activities of a

company exists in

a. both a multiple-step and single-step income statement.

b. a multiple-step but not a single-step income statement.

c. a single-step but not a multiple-step income statement.

d. neither a single-step nor a multiple-step income

statement.

4-18

LO 3 Prepare a multiple-step income statement.

Reporting Irregular Items

Companies are required to report irregular items in the

financial statements so users can determine the long-run

earning power of the company.

Illustration 4-5

Number of Irregular Items

Reported in a Recent Year

by 500 Large Companies

4-19

LO 4 Explain how to report irregular items.

Reporting Irregular Items

Irregular items fall into six categories

1. Discontinued operations.

2. Extraordinary items.

3. Unusual gains and losses.

4. Changes in accounting principle.

5. Changes in estimates.

6. Corrections of errors.

4-20

LO 4 Explain how to report irregular items.

Reporting Irregular Items

Discontinued Operations

Occurs when,

(a) company eliminates the

results of operations and

cash flows of a component.

(b) there is no significant continuing involvement in that

component.

Amount reported “net of tax.”

4-21

LO 4 Explain how to report irregular items.

Reporting Discontinued Operations

Illustration: KC Corporation had after tax income from continuing

operations of $55,000,000 for the year. During the year, it disposed

of its restaurant division at a pretax loss of $270,000. Prior to

disposal, the division operated at a pretax loss of $450,000 for the

year. Assume a tax rate of 30%. Prepare a partial income

statement for KC.

4-22

Income from continuing operations

Discontinued operations:

Loss from operations, net of $135,000 tax

Loss on disposal, net of $81,000 tax

Total loss on discontinued operations

$55,000,000

Net income

$54,496,000

315,000

189,000

504,000

LO 4 Explain how to report irregular items.

Reporting Discontinued Operations

Discontinued

Operations are reported

after “Income from

continuing operations.”

Previously labeled as

“Net Income”.

Moved to

4-23

Income Statement (in thousands)

Sales

Cost of goods sold

Gross profit

Interest expense

Total other

Income before taxes

Income tax expense

Income from continuing operations

Discontinued operations:

Loss from operations, net of tax

Loss on disposal, net of tax

Total loss on discontinued operations

Net income

$ 285,000

149,000

136,000

(21,000)

(4,000)

79,000

24,000

55,000

315

189

504

$ 54,496

LO 4

Reporting Irregular Items

Extraordinary items are nonrecurring material items that

differ significantly from a company’s typical business activities.

Extraordinary Item must be both of an

Unusual Nature and

Occur Infrequently

Company must consider the environment in which it operates.

Amount reported “net of tax.”

4-24

LO 4 Explain how to report irregular items.

Reporting Extraordinary Items

Are these items Extraordinary?

(a) A large portion of a tobacco manufacturer’s crops

are destroyed by a hail storm. Severe damage from

hail storms in the locality where the manufacturer

grows tobacco is rare.

YES

(b) A citrus grower's Florida crop is damaged by frost.

NO

(c) A company sells a block of common stock of a

publicly traded company. The block of shares, which

represents less than 10% of the publicly-held

company, is the only security investment the

company has ever owned.

4-25

YES

LO 4 Explain how to report irregular items.

Reporting Extraordinary Items

Are these items Extraordinary?

(d) A large diversified company sells a block of shares

from its portfolio of securities which it has acquired

for investment purposes. This is the first sale from

its portfolio of securities.

(e) An earthquake destroys one of the oil refineries

owned by a large multi-national oil company.

Earthquakes are rare in this geographical location.

(f)

4-26

A company experiences a material loss in the

repurchase of a large bond issue that has been

outstanding for 3 years. The company regularly

repurchases bonds of this nature.

NO

YES

NO

LO 4

Reporting Extraordinary Items

Illustration: KC Corporation had after tax income from continuing

operations of $55,000,000 during the year. In addition, it suffered

an unusual and infrequent pretax loss of $770,000 from a volcano

eruption. The corporation’s tax rate is 30%. Prepare a partial

income statement for KC Corporation beginning with income from

continuing operations.

Income from continuing operations

Extraordinary loss, net of $231,000 tax

$55,000,000

539,000

Net income

$54,461,000

($770,000 x 30% = $231,000 tax)

4-27

LO 4 Explain how to report irregular items.

Reporting Extraordinary Items

Extraordinary Items

are reported after

“Income from continuing

operations.”

Previously labeled as

“Net Income”.

Income Statement (in thousands)

Sales

Cost of goods sold

Gross profit

$ 285,000

149,000

136,000

Other revenue (expense):

Interest revenue

Interest expense

Total other

Income before taxes

Income tax expense

Income from continuing operations

Extraordinary loss, net of tax

Net income

17,000

(21,000)

(4,000)

79,000

24,000

55,000

539

$ 54,461

Moved to

4-28

LO 4

Reporting Extraordinary Items

Illustration 4-8

Income Statement Presentation

of Extraordinary Items

4-29

LO 4

Reporting Irregular Items

Reporting when both

Discontinued

Operations and

Extraordinary Items

are present.

Discontinued

Operations

Extraordinary Items

4-30

Income Statement (in thousands)

Sales

Cost of goods sold

Gross profit

Income before taxes

Income tax expense

Income from continuing operations

Discontinued operations:

Loss from operations, net of tax

Loss on disposal, net of tax

Total loss on discontinued operations

Income before extraordinary item

Extraordinary loss, net of tax

Net income

$ 285,000

149,000

136,000

79,000

24,000

55,000

315

189

504

54,496

539

$ 54,496

LO 4

Reporting Irregular Items

Review

Irregular transactions such as discontinued operations and

extraordinary items should be reported separately in

4-31

a.

both a single-step and multiple-step income

statement.

b.

a single-step income statement only.

c.

a multiple-step income statement only.

d.

neither a single-step nor a multiple-step income

statement.

LO 4 Explain how to report irregular items.

Reporting Irregular Items

Unusual Gains and Losses

Material items that are unusual or infrequent, but not both,

should be reported in a separate section just above “Income

from continuing operations before income taxes.”

Examples can include:

Write-downs of inventories

Foreign exchange transaction gains and losses

The Board prohibits net-of-tax treatment for these items.

4-32

LO 4 Explain how to report irregular items.

Reporting Irregular Items

Unusual Gains and Losses

4-33

Illustration 4-9

Income Statement

Presentation of Unusual

Charges

LO 4 Explain how to report irregular items.

Reporting Irregular Items

Changes in Accounting Principles

Retrospective adjustment.

Cumulative effect adjustment to beginning retained

earnings.

Approach preserves comparability.

Examples include:

►

change from FIFO to average cost.

►

change from the percentage-of-completion to the

completed-contract method.

4-34

LO 4 Explain how to report irregular items.

Reporting Irregular Items

Change in Accounting Principle: Gaubert Inc. decided in

March 2012 to change from FIFO to weighted-average inventory

pricing. Gaubert’s income before taxes, using the new weightedaverage method in 2012, is $30,000.

Pretax Income Data

Illustration 4-10

Calculation of a Change in

Accounting Principle

Illustration 4-11

Income Statement

Presentation of a Change

in Accounting Principle

(Based on 30% tax rate)

4-35

LO 4 Explain how to report irregular items.

Reporting Irregular Items

Changes in Estimate

4-36

Accounted for in the period of change and future periods.

Not handled retrospectively.

Not considered errors or extraordinary items.

Examples include:

►

Useful lives and salvage values of depreciable assets.

►

Allowance for uncollectible receivables.

►

Inventory obsolescence.

LO 4 Explain how to report irregular items.

Change in Estimate Example

Change in Estimate: Arcadia HS, purchased equipment for

$510,000 which was estimated to have a useful life of 10 years

with a salvage value of $10,000 at the end of that time.

Depreciation has been recorded for 7 years on a straight-line

basis. In 2012 (year 8), it is determined that the total estimated

life should be 15 years with a salvage value of $5,000 at the

end of that time.

Questions:

4-37

What is the journal entry to correct the prior years’

depreciation?

Calculate the depreciation expense for 2012.

LO 4 Explain how to report irregular items.

Change in Estimate Example

Equipment cost

Salvage value

Depreciable base

Useful life (original)

Annual depreciation

After 7 years

$510,000

First, establish NBV

- 10,000

at date of change in

estimate.

500,000

10 years

$ 50,000 x 7 years = $350,000

Balance Sheet (Dec. 31, 2011)

Fixed Assets:

4-38

Equipment

Accumulated depreciation

$510,000

350,000

Net book value (NBV)

$160,000

LO 4 Explain how to report irregular items.

Change in Estimate Example

Net book value

Salvage value (new)

Depreciable base

Useful life remaining

Annual depreciation

$160,000

5,000

155,000

8 years

$ 19,375

After 7 years

Depreciation

Expense calculation

for 2012.

Journal entry for 2012

Depreciation expense

19,375

Accumulated depreciation

4-39

19,375

LO 4 Explain how to report irregular items.

Reporting Irregular Items

Corrections of Errors

4-40

Result from:

►

mathematical mistakes.

►

mistakes in application of accounting principles.

►

oversight or misuse of facts.

Corrections treated as prior period adjustments.

Adjustment to the beginning balance of retained earnings.

LO 4 Explain how to report irregular items.

Reporting Irregular Items

Corrections of Errors: To illustrate, in 2013, Hillsboro Co.

determined that it incorrectly overstated its accounts

receivable and sales revenue by $100,000 in 2010. In 2013,

Hillboro makes the following entry to correct for this error

(ignore income taxes).

Retained earnings

Accounts receivable

4-41

100,000

100,000

LO 4 Explain how to report irregular items.

Special Reporting Issues

Intraperiod Tax Allocation

Relates the income tax expense to the specific items that give

rise to the amount of the tax expense.

Income tax is allocated to the following items:

(1) Income from continuing operations before tax.

(2) Discontinued operations.

(3) Extraordinary items.

4-42

LO 5 Explain intraperiod tax allocation.

Special Reporting Issues

Intraperiod Tax Allocation

Extraordinary Gain: Schindler Co. has income before income

tax and extraordinary item of $250,000. It has an extraordinary

gain of $100,000 from a condemnation settlement received on

one its properties. Assuming a 30 percent income tax rate.

Illustration 4-13

4-43

LO 5 Explain intraperiod tax allocation.

Special Reporting Issues

Intraperiod Tax Allocation

Extraordinary Loss: Schindler Co. has income before income

tax and extraordinary item of $250,000. It has an extraordinary

loss from a major casualty of $100,000. Assuming a 30 percent

income tax rate.

Illustration 4-14

4-44

LO 5 Explain intraperiod tax allocation.

Example of Intraperiod Tax Allocation

Income Statement (in thousands)

Sales

Cost of goods sold

Total other

$ 285,000

149,000

(4,000)

Income from cont. oper. before taxes

79,000

Income tax expense

24,000

Income from continuing operations

55,000

Note: losses reduce

the total tax

Calculation of

Total Tax

$24,000

Discontinued operations:

Loss on operations, net of $135 tax

315

Loss on disposal, net of $61 tax

189

Total loss on discontinued operations

Income before extraordinary item

Extraordinary loss, net of $231 tax

Net income

(135)

(61)

504

54,496

539

$ 53,957

(231)

$23,573

4-45

LO 5 Explain intraperiod tax allocation.

Special Reporting Issues

Earnings Per Share

Net income - Preferred dividends

Weighted average number of shares outstanding

4-46

An important business indicator.

Measures the dollars earned by each share of common

stock.

Must be disclosed on the the income statement.

LO 6 Identify where to report earnings per share information.

Special Reporting Issues

Earnings Per Share (BE4-8): In 2012, Hollis Corporation

reported net income of $1,000,000. It declared and paid preferred

stock dividends of $250,000. During 2012, Hollis had a weighted

average of 190,000 common shares outstanding. Compute

Hollis’s 2012 earnings per share.

Net income - Preferred dividends

Weighted average number of shares outstanding

$1,000,000

-

$250,000

= $3.95 per share

190,000

4-47

LO 6 Identify where to report earnings per share information.

Special Reporting Issues

Illustration 4-17

Divide by

weightedaverage

shares

outstanding

EPS

4-48

LO 6

Special Reporting Issues

Retained Earnings Statement

Increase

Net income

Net loss

Change in accounting

principle

Dividends

Change in accounting

principles

Error corrections

4-49

Decrease

Error corrections

LO 7 Prepare a retained earnings statement.

Special Reporting Issues

Woods, Inc.

Statement of Retained Earnings

For the Year Ended December 31, 2012

Balance, January 1

Net income

Dividends

Balance, December 31

$

$

1,050,000

360,000

(300,000)

1,110,000

Before issuing the report for the year ended December 31, 2012, you

discover a $50,000 error (net of tax) that caused 2011 inventory to be

overstated (overstated inventory caused COGS to be lower and thus net

income to be higher in 2011). Would this discovery have any impact on the

reporting of the Statement of Retained Earnings for 2012?

4-50

LO 7 Prepare a retained earnings statement.

Special Reporting Issues

Woods, Inc.

Statement of Retained Earnings

For the Year Ended December 31, 2012

Balance, January 1

Prior period adjustment - error correction

Balance, January 1 (restated)

Net income

Dividends

Balance, December 31

4-51

$

$

1,050,000

(50,000)

1,000,000

360,000

(300,000)

1,060,000

LO 7 Prepare a retained earnings statement.

Special Reporting Issues

Restrictions on Retained Earnings

Disclosed

4-52

In notes to the financial statements.

As Appropriated Retained Earnings.

LO 7 Prepare a retained earnings statement.

Special Reporting Issues

Comprehensive Income

All changes in equity during a period except those resulting

from investments by owners and distributions to owners.

Includes:

all revenues and gains, expenses and losses reported in

net income, and

all gains and losses that bypass net income but affect

stockholders’ equity.

4-53

LO 8 Explain how to report other comprehensive income.

Special Reporting Issues

Comprehensive Income

Income Statement (in thousands)

Sales

$ 285,000

Cost of goods sold

149,000

Gross profit

136,000

Operating expenses:

Selling expenses

10,000

Administrative expenses

43,000

Total operating expense

53,000

Income from operations

83,000

Other revenue (expense):

Interest revenue

17,000

Interest expense

(21,000)

Total other

(4,000)

Income before taxes

79,000

Income tax expense

24,000

Net income

$ 55,000

4-54

+

Other Comprehensive

Income

Unrealized gains and

losses on available-forsale securities.

Translation gains and

losses on foreign

currency.

Plus others

Reported in Stockholders’

Equity

LO 8 Explain how to report other comprehensive income.

Special Reporting Issues

Review

Gains and losses that bypass net income but affect

stockholders' equity are referred to as

a. comprehensive income.

b. other comprehensive income.

c. prior period income.

d. unusual gains and losses.

4-55

LO 8 Explain how to report other comprehensive income.

Special Reporting Issues

Companies must display the components of other

comprehensive income in one of three ways:

1. A second separate income statement;

2. A combined income statement of comprehensive

income; or

3. As part of the statement of stockholders’ equity

4-56

LO 8 Explain how to report other comprehensive income.

Special Reporting Issues

Comprehensive

Income

Illustration 4-19

Second income

statement

4-57

LO 8

Special Reporting Issues

Comprehensive

Income

V. Gill Inc.

Combined Statement of Comprehensive Income

For the Year Ended December 31, 2012

Combined

statement

Sales revenue

Cost of goods sold

600,000

Gross profit

200,000

Operating expenses

Net income

Unrealized holding gain, net of tax

Comprehensive income

4-58

$ 800,000

90,000

110,000

30,000

$ 140,000

LO 8

Special Reporting Issues

Comprehensive Income –

Statement of Stockholder’s Equity

Illustration 4-20

4-59

LO 8 Explain how to report other comprehensive income.

Special Reporting Issues

Comprehensive Income –

Balance Sheet Presentation

Illustration 4-21

Presentation of

Accumulated Other

Comprehensive

Income in the

Balance Sheet

Regardless of the display format used, the accumulated other

comprehensive income of $90,000 is reported in the stockholders’

equity section of the balance sheet.

4-60

LO 8 Explain how to report other comprehensive income.

Special Reporting Issues

Review

The FASB decided that the components of other

comprehensive income must be displayed

a. in a second separate income statement.

b. in a combined income statement of comprehensive

income.

c. as a part of the statement of stockholders‘ equity.

d. Any of these options is permissible.

4-61

LO 8 Explain how to report other comprehensive income.

RELEVANT FACTS

4-62

Presentation of the income statement under GAAP follows either a

single-step or multiple-step format. IFRS does not mention a singlestep or multiple-step approach. Extraordinary items are prohibited

under IFRS.

Under IFRS, companies must classify expenses by either nature or

function. GAAP does not have that requirement, but the U.S. SEC

requires a functional presentation.

IFRS identifies certain minimum items that should be presented on

the income statement. GAAP has no minimum information

requirements. However, the SEC rules have more rigorous

presentation requirements.

RELEVANT FACTS

4-63

IFRS does not define key measures like income from operations.

SEC regulations define many key measures and provide

requirements and limitations on companies reporting nonGAAP/IFRS information.

GAAP does not require companies to indicate the amount of net

income attributable to non-controlling interest.

GAAP and IFRS follow the same presentation guidelines for

discontinued operations, but IFRS defines a discontinued operation

more narrowly. Both standard- setters have indicated a willingness

to develop a similar definition to be used in the joint project on

financial statement presentation.

RELEVANT FACTS

4-64

Both GAAP and IFRS have items that are recognized in equity as

part of comprehensive income but do not affect net income. GAAP

provides three possible formats for presenting this information:

single income statement, combined statement of comprehensive

income, in the statement of stockholders’ equity. Most companies

that follow GAAP present this information in the statement of

stockholders’ equity. IFRS allows a separate statement of

comprehensive income or a combined statement.

Under IFRS, revaluation of property, plant, and equipment, and

intangible assets is permitted and is reported as other

comprehensive income. The effect of this difference is that

application of IFRS results in more transactions affecting equity but

not net income.

IFRS SELF-TEST QUESTION

Which of the following is not reported in an income statement

under IFRS?

a. Discontinued operations.

b. Extraordinary items.

c. Cost of goods sold.

d. Income tax.

4-65

IFRS SELF-TEST QUESTION

Which of the following statements is correct regarding income

reporting under IFRS?

a. IFRS does not permit revaluation of property, plant, and

equipment, and intangible assets.

b. IFRS provides the same options for reporting comprehensive

income as GAAP.

c.

Companies must classify expenses either by nature or function.

d. IFRS provides a definition for all items presented in the income

statement.

4-66

IFRS SELF-TEST QUESTION

Which of the following is not an acceptable way of displaying the

components of other comprehensive income under IFRS?

a. Within the statement of retained earnings.

b. Second income statement.

c. Combined statement of comprehensive income.

d. All of the above are acceptable.

4-67

Copyright

Copyright © 2012 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Copyright Act without the

express written permission of the copyright owner is unlawful.

Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser

may make back-up copies for his/her own use only and not for

distribution or resale. The Publisher assumes no responsibility for

errors, omissions, or damages, caused by the use of these

programs or from the use of the information contained herein.

4-68