(Fixed and Random Effects), Two Step Analysis of Panel Data Models

advertisement

Part 11: Heterogeneity [ 1/36]

Econometric Analysis of Panel Data

William Greene

Department of Economics

Stern School of Business

Part 11: Heterogeneity [ 2/36]

Agenda

Random Parameter Models

Fixed effects

Random effects

Heterogeneity in Dynamic Panels

Random Coefficient Vectors-Classical vs. Bayesian

General RPM Swamy/Hsiao/Hildreth/Houck

Hierarchical and “Two Step” Models

‘True’ Random Parameter Variation

Discrete – Latent Class

Continuous

Classical

Bayesian

Part 11: Heterogeneity [ 3/36]

A Capital Asset Pricing Model

R it 0t 1ti 2ti2 3t s i it

R it one period percentage return

0t expected return on a riskless security (stochastic)

1t expected premium on the 'market' portfolio, R Mt R 0t

2t "nonlinear" risk effect

3t "nonbeta risk" term

Data are [R it ,i ,i2 , s i ], generated by auxiliary regressions

Coefficients are 'random' through time.

Fama - MacBeth, "Risk, Return, and Equilibrium: Empirical

Tests," Journal of Political Economy, 1974.

Part 11: Heterogeneity [ 4/36]

Heterogeneous Production Model

Healthi,t i iHEXPi,t iEDUCi,t i,t

i country, t=year

Health = health care outcome, e.g., life expectancy

HEXP = health care expenditure

EDUC = education

Parameter heterogeneity:

Discrete? Aids dominated vs. QOL dominated

Continuous? Cross cultural heterogeneity

World Health Organization, "The 2000 World Health Report"

Part 11: Heterogeneity [ 5/36]

Parameter Heterogeneity

Unobserved Effects Random Constants

y it x it β c i it

y it i x it β it

i ui ,

E[ui | X i ] 0 --> Random effects

E[ui | X i ] 0 --> Fixed effects

E XE[ui | X i ] 0.

Var[ui | X i ] not yet defined - so far, constant.

Part 11: Heterogeneity [ 6/36]

Parameter Heterogeneity

Generalize to Random Parameters

y it x it βi it

βi β ui

E[ui | X i ] zero or nonzero - to be defined

E X [E[ui | X i ]] = 0

Var[ui | X i ] to be defined, constant or variable

"The Pooling Problem : " What is the consequence

of estimating under the erroneous assumption of

constant parameters. (Theil, 1960, "The Aggregation

Problem") (Maddala, 1970s - 1990s, "The Pooling

Problem")

Part 11: Heterogeneity [ 7/36]

Fixed Effects

(Hildreth, Houck, Hsiao, Swamy)

y it x it βi it , each observation

y i X iβi ε i , Ti observations

βi β ui

Assume (temporarily) Ti > K.

E[ui | X i ] =g(X i ) (conditional mean)

P[ui | X i ] =(X i -E[X i ])θ (projection)

E X [E[ui | X i ]] = E X [P[ui | X i ]] =0

Var[ui | X i ] Γ constant but nonzero

Part 11: Heterogeneity [ 8/36]

OLS and GLS Are Inconsistent

y i X iβi ε i , Ti observations

βi β ui

y i X iβ X iui ε i , Ti observations

y i X iβ w i

E[w i | X i ] X iE[ui | X i ] E[ε i | X i ] 0

Part 11: Heterogeneity [ 9/36]

Estimating the Fixed Effects Model

y1

y2

...

yN

X1

0

...

0

0

X2

...

0

...

0 β1 ε1

... 0 β2 ε2

... ... ... ...

... X N βN εN

Estimator: Equation by equation OLS or (F)GLS

1 N ˆ

Estimate β? i1βi is consistent for E[βi ] in N.

N

Part 11: Heterogeneity [ 10/36]

Partial Fixed Effects Model

Some individual specific parameters

y i Diαi +X iβ ε i , Ti observations

Use OLS and Frisch-Waugh

ˆ [N X Mi X ]1 [N X Mi y ], Mi I D (DD ) 1 D

β

i1 i D i

i1 i D i

D

i

i

i i

ˆ)

ˆ i [DiDi ]1 D(y i -X iβ

α

E.g., Individual specific time trends,

y it i0 i1 t x it β it ; Detrend individual data, then OLS

E.g., Individual specific constant terms,

y it i0 x it β it ; Individual group mean deviations, then OLS

Part 11: Heterogeneity [ 11/36]

Heterogeneous Dynamic Models

logYi,t i i log Yi,t 1 i x it i,t

long run effect of interest is i

i

1 i

See :

Pesaran,H., Smith,R., Im,K.,"Estimating Long-Run Relationships

From Dynamic Heterogeneous Panels," Journal of Econometrics, 1995.

(Repeated with further study in Matyas and Sevestre, The

Econometrics of Panel Data.

Smith, J., notes, Applied Econometrics, Dynamic Panel Data Models,

University of Warwick.

http://www2.warwick.ac.uk/fac/soc/economics/staff/faculty/jennifersmith/panel/

Weinhold, D., "A Dynamic "Fixed Effects" Model for Heterogeneous

Panel Data," London School of Economics, 1999.

Part 11: Heterogeneity [ 12/36]

Random Effects and

Random Parameters

THE Random Parameters Model

y it x it βi it , each observation

y i X iβi ε i , Ti observations

βi β ui

Assume (temporarily) Ti > K.

E[ui | X i ] =0

Var[ui | X i ] Γ constant but nonzero

We differentiate the classical and Bayesian interpretations

Randomness here is heterogeneity, not "uncertainty"

Bayesian approach to be considered later.

Part 11: Heterogeneity [ 13/36]

Estimating the Random

Parameters Model

y i X iβi ε i , Ti observations

βi β ui

y i X iβ X iui ε i , Ti observations

y i X iβ w i

E[w i | X i ] X iE[ui | X i ] E[ε i | X i ] 0

Var[w i | X i ] X iΓX i 2 ,iI <== Should 2 ,i vary by i?

Objects of estimation : β, 2 ,i , Γ

Second level estimation : βi

Part 11: Heterogeneity [ 14/36]

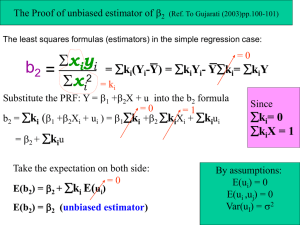

Estimating the Random

Parameters Model by OLS

y i X iβi ε i , Ti observations

βi β ui

y i X iβ X iui ε i , Ti observations

y i X iβ w i

b [Ni1 X i X i ]1 [Ni1 X i y i ] β [Ni1 Xi X i ]1 [Ni1 Xi w i ]

Var[b|X ]=[Ni1 X i X i ]1 [Ni1 X i ( X iΓX i 2 I) X ][Ni1 X i X i ]1

=2 [Ni1 X i X i ]1 [Ni1 X i X i ]1 [Ni1 (X i X i )Γ(Xi X)][Ni1 Xi X i ]1

the usual + the variation due to the random parameters

Robust estimator

ˆ iw

ˆ i X i ][Ni1 X i X i ]1

Est.Var[b] [Ni1 X i X i ]1 [Ni1 X i w

Part 11: Heterogeneity [ 15/36]

Estimating the Random

Parameters Model by GLS

y i X iβi ε i , Ti observations

βi β ui

y i X iβ X iui ε i , Ti observations

y i X iβ w i , Var[w i|X i ] = Ωi =( X iΓX i 2 ,iI)

ˆ [N X Ω-1 X ]1 [N X Ω-1 y ]

β

i1 i i

i

i 1 i i

i

2

ˆ and

For FGLS, we need Γ

ˆ ,i.

Part 11: Heterogeneity [ 16/36]

Estimating the RPM

1

bi β ( X i X i ) X i w i , w i =X iui +ε i

1

= β ui ( X i X i ) X iε i

1

Var[bi|X i ]=Γ+ ( X i X i )

2

,i

2

ˆ ,i

tTi 1 (y it x it bi )2

is unbiased

Ti K

(but not consistent because Ti is fixed).

Part 11: Heterogeneity [ 17/36]

An Estimator for Γ

E[bi|X i ] β

Var[bi|X i ]=Γ+2 ,i ( X i X i ) 1

Var[bi ] VarXE[bi|X i ] E X Var[bi|X i ]

=

0+

E X [Γ+2 ,i ( X i X i )1 ]

Γ+E X [2 ,i ( X i X i )1 ]

1 N

Estimate Var[bi ] with i1 (bi b)(bi b)'

N

1

2

1

Estimate E X [2 ,i ( X i X i ) 1 ] with Ni1

ˆ ,i ( X i X i )

N

2

1

ˆ= 1 Ni1 (bi b)(bi b)' - 1 Ni1

Γ

ˆ ,i ( X i X i )

N

N

Part 11: Heterogeneity [ 18/36]

A Positive Definite Estimator for Γ

1 N

1 N 2

1

ˆ

Γ= i 1 (bi b)(b i b)' i 1

ˆ ,i ( X iX i )

N

N

May not be positive definite. What to do?

(1) The second term converges (in theory) to 0 in Ti . Drop it.

(2) Various Bayesian "shrinkage" estimators,

(3) An ML estimator

Part 11: Heterogeneity [ 19/36]

Estimating βi

N

ˆ

β

GLS

i1 Wb

i i,OLS

Wi {Ni1 [Γ 2 ,i ( X i X i ) 1 ]} 1 [Γ 2 ,i ( X i X i ) 1 ]

Best linear unbiased predictor based on GLS is

ˆ Aβ

ˆ

ˆ

β

i

i GLS + (I-A i )bi,OLS bi,OLS A i (β GLS bi,OLS )

A i {Γ -1 [2 ,i ( Xi X i ) 1 ]1 } 1 Γ -1

ˆ | all data]=A Var[β

ˆ ]A

Var[β

i

i

GLS

i

[A i

ˆ ]

Var[β

GLS

(I-A i )]

WVar[bi,OLS ]i

Var[bi,OLS ]Wi A i

(

I

A

)

Var[bi,OLS ]

i

Part 11: Heterogeneity [ 20/36]

Baltagi and Griffin’s Gasoline Data

World Gasoline Demand Data, 18 OECD Countries, 19 years

Variables in the file are

COUNTRY = name of country

YEAR = year, 1960-1978

LGASPCAR = log of consumption per car

LINCOMEP = log of per capita income

LRPMG = log of real price of gasoline

LCARPCAP = log of per capita number of cars

See Baltagi (2001, p. 24) for analysis of these data. The article on which the

analysis is based is Baltagi, B. and Griffin, J., "Gasoline Demand in the OECD: An

Application of Pooling and Testing Procedures," European Economic Review, 22,

1983, pp. 117-137. The data were downloaded from the website for Baltagi's

text.

Part 11: Heterogeneity [ 21/36]

OLS and FGLS Estimates

+----------------------------------------------------+

| Overall OLS results for pooled sample.

|

| Residuals

Sum of squares

=

14.90436

|

|

Standard error of e =

.2099898

|

| Fit

R-squared

=

.8549355

|

+----------------------------------------------------+

+---------+--------------+----------------+--------+---------+

|Variable | Coefficient | Standard Error |b/St.Er.|P[|Z|>z] |

+---------+--------------+----------------+--------+---------+

Constant

2.39132562

.11693429

20.450

.0000

LINCOMEP

.88996166

.03580581

24.855

.0000

LRPMG

-.89179791

.03031474

-29.418

.0000

LCARPCAP

-.76337275

.01860830

-41.023

.0000

+------------------------------------------------+

| Random Coefficients Model

|

| Residual standard deviation

=

.3498

|

| R squared

=

.5976

|

| Chi-squared for homogeneity test = 22202.43

|

| Degrees of freedom

=

68

|

| Probability value for chi-squared=

.000000

|

+------------------------------------------------+

+---------+--------------+----------------+--------+---------+

|Variable | Coefficient | Standard Error |b/St.Er.|P[|Z|>z] |

+---------+--------------+----------------+--------+---------+

CONSTANT

2.40548802

.55014979

4.372

.0000

LINCOMEP

.39314902

.11729448

3.352

.0008

LRPMG

-.24988767

.04372201

-5.715

.0000

LCARPCAP

-.44820927

.05416460

-8.275

.0000

Part 11: Heterogeneity [ 22/36]

Country Specific Estimates

Part 11: Heterogeneity [ 23/36]

Estimated Γ

Part 11: Heterogeneity [ 24/36]

Two Step Estimation (Saxonhouse)

A Fixed Effects Model

y it i x it β it

Secondary Model

i ziδ

Two approaches

(1) Reduced form is a linear model with time constant zi

y it x it β ziδ it

(2) Two step

(a) FEM at step 1

(b) ai i (ai i ) ziδ v i

1

Var[v i ] 2 x i ( X iMDi X i ) 1 x i

Ti

Use weighted least squares regression of ai on zi

Part 11: Heterogeneity [ 25/36]

A Hierarchical Model

Fixed Effects Model

y it i x it β it

Secondary Model

i ziδ ui <========

Two approaches

(1) Reduced form is an REM with time constant zi

y it x it β ziδ ui it

(2) Two step

(a) FEM at step 1

(b) ai i (ai i ) ziδ ui v i

1

Var[ui v i ] u2 2 x i ( X iMDi X i ) 1 x i

Ti

Part 11: Heterogeneity [ 26/36]

Analysis of Fannie Mae

Fannie Mae

The Funding Advantage

The Pass Through

Passmore, W., Sherlund, S., Burgess, G.,

“The Effect of Housing Government-Sponsored

Enterprises on Mortgage Rates,” 2005,

Federal Reserve Board and Real Estate Economics

Part 11: Heterogeneity [ 27/36]

Two Step Analysis of Fannie-Mae

Fannie Mae's GSE Funding Advantage and Pass Through

RMi,s,t 0s ,t (1s ,tLTV) 2s ,t Smalli,s ,t 3s ,tFees i,s ,t

s4,tNew i,s ,t 5s ,tMtgCoi,s ,t s ,t Ji,s ,t i,s ,t

i, s, t individual, state,month

1,036,252 observations in 370 state,months.

RM mortgage

LTV= 3 dummy variables for loan to value

Small = dummy variable for small loan

Fees = dummy variable for whether fees paid up front

New = dummy variable for new home

MtgCo = dummy variable for mortgage company

J = dummy variable for whether this is a JUMBO loan

THIS IS THE COEFFICIENT OF INTEREST.

Part 11: Heterogeneity [ 28/36]

Average of 370 First Step

Regressions

Symbol

Variable

Mean

S.D.

Coeff

S.E.

RM

Rate %

7.23

0.79

J

Jumbo

0.06

0.23

0.16

0.05

LTV1

75%-80%

0.36

0.48

0.04

0.04

LTV2

81%-90%

0.15

0.35

0.17

0.05

LTV3

>90%

0.22

0.41

0.15

0.04

New

New Home

0.17

0.38

0.05

0.04

Small

< $100,000 0.27

0.44

0.14

0.04

Fees

Fees paid

0.62

0.52

0.06

0.03

MtgCo

Mtg. Co.

0.67

0.47

0.12

0.05

R2 = 0.77

Part 11: Heterogeneity [ 29/36]

Second Step

s ,t 0

1 GSE Funding Advantage s,t - estimated separately

2 Risk free cost of credit s,t

3 Corporate debt spreads s,t - estimated 4 different ways

4 Prepayment spreads,t

5 Maturity mismatch risk s,t

6 Aggregate Demands,t

7 Long term interest rate s,t

8 Market Capacity s,t

9 Time trends,t

10-13 4 dummy variables for CA, NJ, MD, VA s,t

14-16 3 dummy variables for calendar quarters s,t

Part 11: Heterogeneity [ 30/36]

Estimates of β1

Second step based on 370 observations. Corrected for

"heteroscedasticity, autocorrelation, and monthly clustering."

Four estimates based on different estimates of corporate

credit spread:

0.07 (0.11)

0.31 (0.11)

0.17 (0.10)

0.10 (0.11)

Reconcile the 4 estimates with a minimum distance estimator

ˆ11 -1 )

(

2

ˆ1 -1 )

(

1

2

3

4

-1

ˆ

ˆ1 -1 ),(

ˆ1 -1 ),(

ˆ1 -1 ),(

ˆ1 -1 )]'Ω

Minimize [(

ˆ3

(1 -1 )

4

(

ˆ

)

1 1

Estimated mortgage rate reduction: About 16 basis points. .16%.

Part 11: Heterogeneity [ 31/36]

The Minimum Distance Estimator

0.07 (0.11)

0.31 (0.11)

.017 (0.10)

0.10 (0.11)

Reconcile the 4 estimates with a minimum distance estimator

ˆ11 -1 )

(

2

ˆ

( - )

ˆ -1 1 1

ˆ11 -1 ),(

ˆ12 -1 ),(

ˆ13 -1 ),(

ˆ14 -1 )]' Ω

Minimize [(

ˆ3

(

)

1 1

4

(

ˆ

1 -1 )

ˆ

ˆ1

.07 / .112

(1 / .112 ) (1 / .112 ) (1 / .10 2 ) (1 / .112 )

.31 / .112

(1 / .112 ) (1 / .112 ) (1 / .10 2 ) (1 / .112 )

+ ...

Approximately .17%.

Part 11: Heterogeneity [ 32/36]

A Hierarchical Linear Model

German Health Data

Hsat = β1 + β2AGEit + γi EDUCit + β4 MARRIEDit + εit

γi = α1 + α2FEMALEi + ui

Sample ; all$

Reject ; _Groupti < 7 $

Regress ; Lhs = newhsat ; Rhs = one,age,educ,married

; RPM = female ; Fcn = educ(n)

; pts = 25 ; halton

; pds = _groupti ; Parameters$

Sample ; 1 – 887 $

Create ; betaeduc = beta_i $

Dstat ; rhs = betaeduc $

Histogram ; Rhs = betaeduc $

Part 11: Heterogeneity [ 33/36]

OLS Results

OLS Starting values for random parameters model...

Ordinary

least squares regression ............

LHS=NEWHSAT Mean

=

6.69641

Standard deviation

=

2.26003

Number of observs.

=

6209

Model size

Parameters

=

4

Degrees of freedom

=

6205

Residuals

Sum of squares

=

29671.89461

Standard error of e =

2.18676

Fit

R-squared

=

.06424

Adjusted R-squared

=

.06378

Model test

F[ 3, 6205] (prob) =

142.0(.0000)

--------+--------------------------------------------------------|

Standard

Prob.

Mean

NEWHSAT| Coefficient

Error

z

z>|Z|

of X

--------+--------------------------------------------------------Constant|

7.02769***

.22099

31.80 .0000

AGE|

-.04882***

.00307

-15.90 .0000

44.3352

MARRIED|

.29664***

.07701

3.85 .0001

.84539

EDUC|

.14464***

.01331

10.87 .0000

10.9409

--------+---------------------------------------------------------

Part 11: Heterogeneity [ 34/36]

Maximum Simulated Likelihood

Normal exit: 27 iterations. Status=0. F=

12584.28

-----------------------------------------------------------------Random Coefficients LinearRg Model

Dependent variable

NEWHSAT

Log likelihood function

-12583.74717

Estimation based on N =

6209, K =

7

Unbalanced panel has

887 individuals

LINEAR regression model

Simulation based on

25 Halton draws

--------+--------------------------------------------------------|

Standard

Prob.

Mean

NEWHSAT| Coefficient

Error

z

z>|Z|

of X

--------+--------------------------------------------------------|Nonrandom parameters

Constant|

7.34576***

.15415

47.65 .0000

AGE|

-.05878***

.00206

-28.56 .0000

44.3352

MARRIED|

.23427***

.05034

4.65 .0000

.84539

|Means for random parameters

EDUC|

.16580***

.00951

17.43 .0000

10.9409

|Scale parameters for dists. of random parameters

EDUC|

1.86831***

.00179 1044.68 .0000

|Heterogeneity in the means of random parameters

cEDU_FEM|

-.03493***

.00379

-9.21 .0000

|Variance parameter given is sigma

Std.Dev.|

1.58877***

.00954

166.45 .0000

--------+---------------------------------------------------------

Part 11: Heterogeneity [ 35/36]

“Individual Coefficients”

Frequency

--> Sample ; 1 - 887 $

--> create ; betaeduc = beta_i $

--> dstat

; rhs = betaeduc $

Descriptive Statistics

All results based on nonmissing observations.

==============================================================================

Variable

Mean

Std.Dev.

Minimum

Maximum

Cases Missing

==============================================================================

All observations in current sample

--------+--------------------------------------------------------------------BETAEDUC| .161184

.132334

-.268006

.506677

887

0

-.2 6 8

-.1 5 7

-.0 4 7

.0 6 4

.1 7 5

BET AEDUC

.2 8 5

.3 9 6

.5 0 7

Part 11: Heterogeneity [ 36/36]

A Hierarchical Linear Model

A hedonic model of house values

Beron, K., Murdoch, J., Thayer, M.,

“Hierarchical Linear Models with Application to

Air Pollution in the South Coast Air Basin,”

American Journal of Agricultural Economics, 81,

5, 1999.

Part 11: Heterogeneity [ 37/36]

HLM

y ijk log of home sale price i, neighborhood j, community k.

m

y ijk m1 mjk x ijk

ijk (linear regression model)

M

x mijk sq.ft, #baths, lot size, central heat, AC, pool, good view,

age, distance to beach

Random coefficients

mjk qm1 qj Nqjk w jk

Q

Nqjk %population poor, race mix, avg age, avg. travel to work,

FBI crime index, school avg. CA achievement test score

s 1 sE qm

vj

j

q

j

Sqm

E qm

air quality measure, visibility

j