Forecast Balance Sheet

advertisement

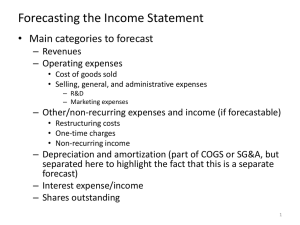

Forecasting Performance Presentation Overview • In this presentation, we focus on the mechanics of forecasting—specifically, how to develop an integrated set of financial forecasts that reflect the company’s expected performance. This presentation covers: 1. The appropriate level of detail. The typical forecast will be split into three time periods: the explicit forecast, a forecast of key value drivers, and continuing value. 2. How to build a well-structured spreadsheet model: one that separates raw inputs from computations, flows from one worksheet to the next, and is flexible enough to handle multiple scenarios. 3. The mechanics of the forecasting process. To arrive at future cash flow, we forecast the income statement, balance sheet, and statement of retained earnings. The forecasted financial statements provide the information we need for computing ROIC and free cash flow. 1 The Length and Detail of the Forecast • Before you begin forecasting individual line items, you must determine how many years to forecast and how detailed your forecast should be. The typical forecast is broken into three time periods: Today Years 1-5 A detailed 5- to 7-year forecast, which develops complete balance sheets and income statements with as many links to real variables (e.g., unit volumes, cost per unit) as possible. Years 6-15 A simplified forecast for the remaining years, focusing on a few important variables, such as revenue growth, margins, and capital turnover. Years 15+ Value the remaining years by using a perpetuity-based formula, such as the key value driver formula. 2 The Length and Detail of the Forecast • The explicit forecast period must be long enough for the company to reach a steady state, defined by the following characteristics: • The company grows at a constant rate and reinvests a constant proportion of its operating profits into the business each year. • The company earns a constant rate of return on new capital invested. • The company earns a constant return on its base level of invested capital. • In general, we recommend using an explicit forecast period of 10 to 15 years — perhaps longer for cyclical companies or those experiencing very rapid growth. • Using a short explicit forecast period, such as 5 years, typically results in a significant undervaluation of a company or requires heroic long-term growth assumptions in the continuing value. 3 Components of a Good Model • The valuation spreadsheet can easily become complex. Therefore, you need to design and structure your model before starting to forecast. • Well-built valuation models have certain characteristics. In your model, data should generally flow in one direction Raw historical data Integrated financials statements Forecast ratios Market data & WACC Reorganized financials ROIC & free cash flow Valuation summary • First, original data and user input are collected in only a few places. • Denote raw data or user input in a different color. • Unless specified as data input, numbers should never be hardcoded into a formula. 4 Components of a Good Model • Many spreadsheet designs are possible. In the valuation example from the last slide, the Excel workbook contains seven worksheets: 1. Raw historical data from company financials. 2. Integrated financials based on raw data. 3. Historical analysis and forecast ratios. 4. Market data and WACC analysis. 5. Reorganized financial statements (into NOPLAT and Invested Capital). 6. ROIC and FCF using reorganized financials. 7. Valuation summary including enterprise DCF, economic profit and equity valuation computations. 5 Overview of the Forecasting Process Although the future is unknowable, careful analysis can yield insights into how a company may develop. We break the forecasting process into six steps: 1. Prepare and analyze historical financials. Before forecasting future financials, you must build and analyze historical financials. In many cases, reported financials are overly simplistic. When this occurs, you have to rebuild financial statements with the right balance of detail. 2. Build the revenue forecast. Almost every line item will rely directly or indirectly on revenue. You can estimate future revenue by using either a top-down (marketbased) or bottom-up (customer-based) approach. Forecasts should be consistent with historical evidence on growth. 3. Forecast the income statement. Use the appropriate economic drivers to forecast operating expenses, depreciation, interest income, interest expense, and reported taxes. 6 Overview of the Forecasting Process We break the forecasting process into six steps: 4. Forecast the balance sheet: invested capital and nonoperating assets. On the balance sheet, forecast operating working capital, net property, plant, & equipment, goodwill, and nonoperating assets. 5. Forecast the balance sheet: investor funds. Complete the balance sheet by computing retained earnings and forecasting other equity accounts. Use cash and/or debt accounts to balance the cash flows and balance sheet. 6. Calculate ROIC and FCF. Calculate ROIC to assure forecasts are consistent with economic principles, industry dynamics, and the company’s competitive advantage. To complete the forecast, calculate free cash flow as the basis for valuation. Future FCF should be calculated the same way as historical FCF. Let’s examine each step in detail… 7 Step 1: Prepare Historical Financials Historical financials 1 Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF • To start the forecasting process, collect raw historical data and build the financial statements in a spreadsheet • Be sure to analyze and scrub historical data. You don’t want more detail than necessary and you should not unwittingly aggregate operating and nonoperating items. Balance sheet ($ million) Accounts payable and other liabilities Advances in excess of related costs Income taxes payable Short-term debt and current portion of LTD Current liabilities 2003 13,563 3,464 277 1,144 18,448 Note 12 - Accounts payable and other liabilities Accounts payable 3,822 Accrued compensation and employee benefit costs 2,930 Pension liabilities 1,138 Product warranty liabilities 825 Lease and other deposits 316 Dividends payable 143 Other 4,389 Accounts payable and other liabilities 13,563 Boeing’s balance sheet reports what appears to be an operating line item, but it is actually a mixture of operating, nonoperating, & financing! operating liability nonoperating liability source of financing Source: Boeing 10-K, 2003 8 Step 2: Build the Revenue Forecast Historical financials Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF • Creating a good revenue forecast is critical because most forecast ratios are directly or indirectly driven by revenue. The revenue forecast should be dynamic; constantly re-evaluate as new information becomes available. • To build a revenue forecast, use a top-down forecast, in which you start with the total market, or use a bottom-up approach, which starts with the company’s own forecasts. 1. Estimate quantity and pricing of aggregate worldwide market TOP DOWN 2. Estimate market share and pricing strength based on competition and competitive advantage Revenue Forecast Revenue Forecast 3. Extend short-term revenue forecasts to long-term BOTTOM UP 2. Estimate new customer wins and turnover 1. Project demand from existing customers 9 Step 3: Forecast the Income Statement • With a revenue forecast in place, next forecast individual line items related to the income statement. To forecast a line item, use a three-step process: • Decide what economically drives the line item. For most line items, forecasts will be tied directly to revenue. • Estimate the forecast ratio. Since cost of goods sold is tied to revenue, estimate COGS as a percentage of revenue. • Multiply the forecast ratio by an estimate of its driver. For instance, since most line items are driven by revenue, most forecast ratios, such as COGS to revenue, should be applied to estimates of future revenue. Historical financials Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF Step 1: Choose a forecast driver and compute historical ratios Forecast worksheet Percent 2004 2005E Revenue growth 20.0 Costs of goods sold / revenues 37.5 SG&A / Revenues 18.8 Depreciation / Net PP&E 7.9 20.0 37.5 Step 2: Estimate the forecast ratio. For simplicity, we start with an “as-is” forecast. 10 Step 3: Forecast the Income Statement • Multiply the forecast ratio by an estimate of its driver. • For instance, since most line items are driven by revenue, most forecast ratios, such as COGS to revenue, should be applied to estimates of future revenue. • This why a good revenue forecast is critical. Any error in the revenue forecast will be carried through the entire model. ForecastRatio Historical financials Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF Income statement $ Million 2004 2005E Revenues Cost of goods sold SG&A Depreciation EBIT 240.0 (90.0) (45.0) (19.0) 86.0 288.0 (108.0) Interest expense Interest income Non operating income Earnings before taxes (EBT) (23.0) 5.0 4.0 72.0 Taxes on EBT Net income (24.0) 48.0 COGS 2004 90 37.5% Revenues2004 240 COGS2005E ForecastRatio Revenues2005E 37.5% 288 108 Step 3: Multiply the forecast ratio by next year’s estimate of revenues (or applicable forecast driver) 11 Step 3: Forecast the Income Statement Historical financials Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF • The appropriate choice for a forecast driver depends on the company and the industry in which it competes. Below is some guidance on typical forecast drivers and forecast ratios for the most common financial statement line items. Income Statement Forecast Ratios Operating Non operating Line item • Cost of goods sold (COGS) • Selling, Gen, Admin (SG&A) • Depreciation • Nonoperating income Recommended forecast driver • Revenue • Revenue • Prior year net property, plant, and equipment (PP&E) Recommended forecast ratio • COGS / revenue • SG&A / revenue • Depreciation / net PP&E • Appropriate • Nonoperating income / nonoperating asset, if any Prior year total debt • Interest expense • • Interest income • Prior year excess cash • • nonoperating asset or growth in nonoperating income Interest expenset / total debtt-1 Interest expenset-1 / excess casht-1 12 Step 3: Forecast the Income Statement • To forecast depreciation, you have three options. You can forecast depreciation as a percentage of revenue or as a percentage of property, plant, and equipment. • For simplicity, let’s forecast next year’s depreciation using an “as-is” percentage of revenues. Historical financials Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF Forecast worksheet Percent 2004 2005E Revenue growth Costs of goods sold / revenues SG&A / revenues Depreciation /revenues EBIT / revenues 20.0 37.5 18.8 7.9 35.8 20.0 37.5 18.8 35.8 Income statement Example 1: Forecast Depreciation ForecastRatio Depreciation2004 19 7.9% Revenues2004 240 Depreciation2005E ForecastRatio Revenues2005E $ Million Revenue Cost of goods sold Selling, general and admin Depreciation EBIT 2004 2005E 240.0 (90.0) (45.0) (19.0) 86.0 288.0 (108.0) (54.0) 103.2 13 Step 3: Forecast the Income Statement Historical financials Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF Condensed income statement $ Million Example 2: Interest Expense ForecastRatio InterestExpense2004 23 7.6% T otalDebt 2003 224 80 EBIT Interest expense Interest income Non operating income Earnings before taxes (EBT) InterestExpense2005E ForecastRatio TotalDebt2004 Example 3: Interest Income InterestIncome2004 5 ForecastRatio 5.0% ExcessCash 2003 100 InterestIncome2005E ForecastRatio ExcessCash 2004 2004 2005E 86.0 (23.0) 5.0 4.0 72.0 103.2 5.3 89.4 Condensed balance sheet Assets Working cash Excess cash 2003 2004 5.0 100.0 5.0 60.0 Total assets 440.0 460.0 224.0 80.0 213. 0 80.0 . . . 2005E Liabilities and equity Short-term debt Long-term debt . . . Liabilities and equity 440.0 460. 0 14 Step 4: Forecast the Balance Sheet Historical financials Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF • To forecast the balance sheet, start with invested capital and nonoperating assets. Excess cash and sources of financing, such as debt, will be handled in the next step. • When forecasting balance sheet items, use the stock method. The relationship between balance sheet accounts and revenue (the stock method) is more stable than the change in accounts versus revenue (the flow method). Forecasting Accounts Receivable: An Example Revenue ($) Accounts receivable ($) Stock method Accounts receivable as a percentage of revenue Flow method Change in accounts receivable as a percentage of the change in revenue Year 1 Year 2 Year 3 Year 4 1,000 100 1,100 105 1,200 117 1,300 135 10.0% 9.5% 5.0% 9.8% 12.0% 10.4% The stock method leads to less variation 18.0% 15 Step 4: Forecast the Balance Sheet: InvCap Historical financials Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF • To forecast the balance sheet, start with items related to invested capital and nonoperating assets. Below, we present forecast drivers and forecast ratios for the most common line items. Typical forecast driver Typical forecast ratio Operating line items Accounts receivable Revenue Accounts receivable / revenue Inventories Cost of goods sold Inventories / COGS Accounts payable Cost of goods sold Accounts payable / COGS Accrued expenses Revenue Accrued expenses / revenue Net PP&E Revenue Net PP&E / revenue Goodwill Acquired revenues Goodwill / acquired revenue Nonoperating assets None Growth in nonoperating assets Pension assets or liabilities None Trend towards zero Deferred taxes Adjusted taxes Change in deferred taxes / adjusted taxes Nonoperating line items Let’s use these drivers to forecast working cash and net PP&E… 16 Step 4: Forecast the Balance Sheet: InvCap Example 1: Forecasting working cash ForecastRatio Cash 2004 5 2.1% Sales 2004 240 ForecastRatio Net PP & E 2004 250 104.2% Sales 2004 240 Net PP& E2005E ForecastRatioSales2005E Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF Partial Income statement $ Million Revenues Cash 2005E ForecastRatioSales2005E Example 2: Forecasting net PP&E Historical financials 2004 2005E 240.0 288.0 Partial Balance sheet $ Million 2004 Cash Excess cash Inventory Current assets 5.0 60.0 45.0 110.0 Net PP&E Equity investments Total assets 250.0 100.0 460.0 2005E 54.0 100.0 460.0 17 Step 5: Forecast Balance Sheet: The Plug Historical financials Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF • To complete the balance sheet, forecast the company’s sources of financing. To do this, first rely on the rules of accounting. Use the principle of clean surplus accounting: RE t+1 = RE t + Net Income – Dividends. These are driven by other forecasts, and should not be re-estimated. $ Million 2003 2004 2005E Starting retained earnings 36.0 56.0 82.0 Net income 36.0 48.0 59.4 (16.0) (22.0) (27.2) 56.0 82.0 114.2 44.4% 45.8% 45.8% Dividends declared Ending retained earnings Dividend/net income (percent) To forecast retained earnings, you must generate a forecast of dividend payout • Increasing the dividend payout ratio should keep excess cash at reasonable levels. Altering the payout policy, however, should not affect the value of operations in an enterprise DCF. If it does, your model is inconsistent with the principles of enterprise DCF. 18 Step 5: Forecast Balance Sheet: the Plug Historical financials Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF • At this point, five line items remain: excess cash, short-term debt, long-term debt, a new account titled newly issued debt, and common stock. • Some combination of these line items must make the balance sheet balance. For this reason, these items are often referred to as “the plug.” • Simple models use newly issued debt as the plug. • Advanced models use excess cash or newly issued debt, to prevent debt from becoming negative. Balance Sheet The Plug (use IF/THEN statement for advanced models) Excess Cash Remaining Assets Newly Issued Debt Remaining Liabilities & Shareholders’ Equity The Plug (for simple models) 19 Step 5: Forecast Balance Sheet: the Plug Historical financials Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF • Use excess cash or newly issued debt to “plug” the balance sheet. Step 1: Determine retained earnings using the clean surplus relation, forecast existing debt using contractual terms, and keep equity constant. Step 2: Test which is higher, assets excluding excess cash or liabilities and equity, excluding newly issued debt. Step 3: If assets excluding excess cash are higher, set excess cash equal to zero and plug the difference with newly issued debt. Otherwise, plug with excess cash. Balance Sheet Cash Excess cash Inventory Current assets 2003 5.0 100.0 35.0 140.0 2004 5.0 60.0 45.0 110.0 2005E 6.0 Net PP&E Equity investments Total assets 200.0 100.0 440.0 250.0 100.0 460.0 300.0 100.0 Liabilities and equity Accounts payable Short-term debt Current liabilities 15.0 224.0 239.0 20.0 213.0 233.0 24.0 213.0 237.0 Long-term debt Newly issued debt Common stock Retained earnings Total liabilities and equity 80.0 0.0 65.0 56.0 440.0 80.0 0.0 65.0 82.0 460.0 80.0 Plug 54.0 Plug 65.0 114.2 20 Step 6: Calculate ROIC and FCF Historical financials Revenue forecast Income statement Balance sheet Retained earnings ROIC and FCF The Home Depot Financial Statements • Once you have completed your income statement and balance sheet forecasts, calculate ROIC and FCF for each forecast year. • This process should be straightforward if you already computed ROIC and FCF historically. • Since a full set of forecasted financials are available, merely copy the two calculations across from historical financials to projected financials. $ millions Net Sales Cost of Merchandise Sold Selling, general, & administrative Depreciation Amortization EBIT <---------------------<------------------------------------------Historical --------------------> Projections ---------------------------------------------- 2001 53,553 (37,406) (10,451) (756) (8) 4,932 2002 58,247 (40,139) (11,375) (895) (8) 5,830 2003 64,816 (44,236) (12,658) (1,075) (1.3) 6,846 2004 71,943 (49,100) (14,050) (1,193) 0 7,600 2005 79,656 (54,364) (15,556) (1,321) 0 8,415 2006 87,983 (60,047) (17,182) (1,459) 0 9,295 53 (28) 0 0 4,957 79 (37) 0 0 5,872 59 (62) 0 0 6,843 89 (64) 0 0 7,625 98 (58) 0 0 8,455 109 (52) 0 0 9,352 Income Taxes Net Earnings (1,913) 3,044 (2,208) 3,664 (2,539) 4,304 (2,829) 4,796 (3,137) 5,318 (3,470) 5,882 Assets ($ millions) Cash and Cash Equivalents Short-Term Investments Receivables, net Merchandise Inventories Other Current Assets Total Current Assets 2001 2,477 69 920 6,725 170 10,361 2002 2,188 65 1,072 8,338 254 11,917 2003 2,826 26 1,097 9,076 303 13,328 2004 3,137 28.9 1,217.6 10,074.0 336.3 14,794 2005 3,473 32.0 1,348.2 11,154.0 372.4 16,380 2006 3,836 35.3 1,489.1 12,319.9 411.3 18,092 Net Property and Equipment Long-Term Investments Acquired Intangibles & Goodwill Other Assets Total Assets 15,375 83 419 156 26,394 17,168 107 575 244 30,011 20,063 84 833 129 34,437 22,269 93 925 143 38,224 24,657 103 1,024 159 42,322 27,234 114 1,131 175 46,745 Interest and Investment Income Interest Expense Non-Recurring Charge Minority Interest Earnings Before Taxes <----------- Historical -----------> $ millions NOPLAT Depreciation Gross cash flow Investment in operating working capital Net capital expenditures Decrease (increase) in capitalized operating leases Investments in intangibles & goodwill Decrease (Increase) in net operating assets Increase (Decrease) in accumulated other comp income Gross Investment Free Cash Flow <----------- Projected -----------> 2001 3,208 756 3,964 2002 3,981 895 4,876 2003 5,083 1,075 6,157 2004 5,185 1,193 6,378 2005 5,741 1,321 7,062 2006 6,342 1,459 7,801 834 (3,063) (775) (113) 105 (153) (3,165) (194) (2,688) (430) (164) 31 138 (3,307) 72 (3,970) (664) (259) 277 172 (4,372) (294) (3,399) (721) (92) 58 0 (4,448) (318) (3,708) (780) (99) 62 0 (4,843) (344) (4,036) (842) (107) 67 0 (5,261) 1,569 1,785 1,930 2,219 2,539 799 21 Other Issues in Forecasting • When forecasting you are likely to come across three additional issues: 1. Nonfinancial operating drivers. In industries where prices or technology are changing dramatically, your forecast should incorporate operating drivers like volume and productivity. • Consider the airline industry, where labor and fuel has been rising as a percentage of revenue – but for different reasons. Fuel is a greater percentage because oil prices have been rising. Conversely, labor is a greater percentage because revenue per seat mile has been dropping. 2. Fixed versus variable costs. The distinction between fixed and variable costs at the company level is usually unimportant because most costs are variable. For individual production facilities or retail stores, this is not the case, most costs are fixed. 3. Inflation. Often, the cost of capital is estimated using nominal terms. If this is the case, forecast in nominal terms. Be careful, however, high inflation will distort historical analyses. 22 Closing Thoughts • To value a company’s operations using enterprise DCF, we discount each year’s forecast of free cashflow for time and risk. In this presentation, we analyzed a sixstep process for forecasting a company’s financials, and subsequently its free cash flow. • While you are building a forecast, it is easy to become engrossed in the details of individual line items. But we stress, once again, that you must place your aggregate results in the proper context. • Always check your resulting revenue growth and ROIC against industry-wide historical data. If required forecasts exceed other company’s historical performance, make sure the company has a specific and robust competitive advantage. • Finally, do not make your model more complicated than it needs to be. Extraneous details can cloud the drivers that really matter. Only create detailed line item forecasts when they increase the accuracy of the company’s key value drivers. 23