ESTIMATION OF THE SOCIAL DISCOUNT RATE

advertisement

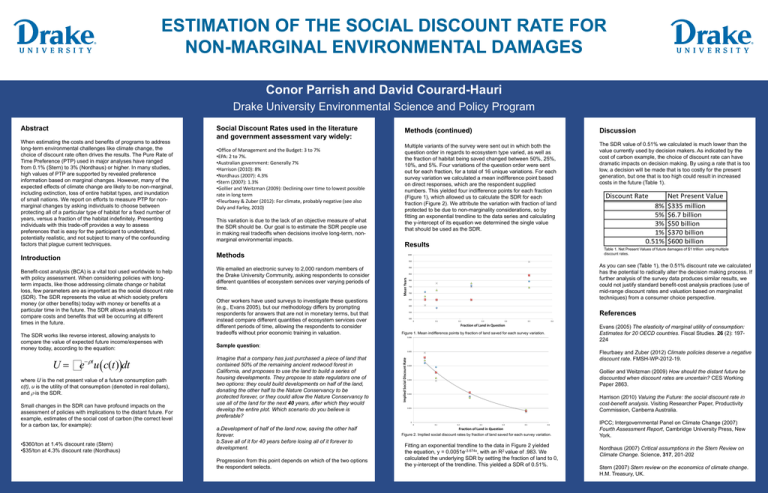

ESTIMATION OF THE SOCIAL DISCOUNT RATE FOR NON-MARGINAL ENVIRONMENTAL DAMAGES Conor Parrish and David Courard-Hauri Drake University Environmental Science and Policy Program Abstract When estimating the costs and benefits of programs to address long-term environmental challenges like climate change, the choice of discount rate often drives the results. The Pure Rate of Time Preference (PTP) used in major analyses have ranged from 0.1% (Stern) to 3% (Nordhaus) or higher. In many studies, high values of PTP are supported by revealed preference information based on marginal changes. However, many of the expected effects of climate change are likely to be non-marginal, including extinction, loss of entire habitat types, and inundation of small nations. We report on efforts to measure PTP for nonmarginal changes by asking individuals to choose between protecting all of a particular type of habitat for a fixed number of years, versus a fraction of the habitat indefinitely. Presenting individuals with this trade-off provides a way to assess preferences that is easy for the participant to understand, potentially realistic, and not subject to many of the confounding factors that plague current techniques. Social Discount Rates used in the literature and government assessment vary widely: •Office of Management and the Budget: 3 to 7% •EPA: 2 to 7%. •Australian government: Generally 7% •Harrison (2010): 8% •Nordhaus (2007): 4.3% •Stern (2007): 1.3% •Gollier and Weitzman (2009): Declining over time to lowest possible rate in long term •Fleurbaey & Zuber (2012): For climate, probably negative (see also Daly and Farley, 2010) This variation is due to the lack of an objective measure of what the SDR should be. Our goal is to estimate the SDR people use in making real tradeoffs when decisions involve long-term, nonmarginal environmental impacts. Methods (continued) Discussion Multiple variants of the survey were sent out in which both the question order in regards to ecosystem type varied, as well as the fraction of habitat being saved changed between 50%, 25%, 10%, and 5%. Four variations of the question order were sent out for each fraction, for a total of 16 unique variations. For each survey variation we calculated a mean indifference point based on direct responses, which are the respondent supplied numbers. This yielded four indifference points for each fraction (Figure 1), which allowed us to calculate the SDR for each fraction (Figure 2). We attribute the variation with fraction of land protected to be due to non-marginality considerations, so by fitting an exponential trendline to the data series and calculating the y-intercept of its equation we determined the single value that should be used as the SDR. The SDR value of 0.51% we calculated is much lower than the value currently used by decision makers. As indicated by the cost of carbon example, the choice of discount rate can have dramatic impacts on decision making. By using a rate that is too low, a decision will be made that is too costly for the present generation, but one that is too high could result in increased costs in the future (Table 1). Results Methods Introduction Table 1. Net Present Values of future damages of $1 trillion using multiple discount rates. 1000 950 The SDR works like reverse interest, allowing analysts to compare the value of expected future income/expenses with money today, according to the equation: U = ò e u ( c(t))dt - rt where U is the net present value of a future consumption path c(t), u is the utility of that consumption (denoted in real dollars), and r is the SDR. Small changes in the SDR can have profound impacts on the assessment of policies with implications to the distant future. For example, estimates of the social cost of carbon (the correct level for a carbon tax, for example): •$360/ton at 1.4% discount rate (Stern) •$35/ton at 4.3% discount rate (Nordhaus) Other workers have used surveys to investigate these questions (e.g., Evans 2005), but our methodology differs by prompting respondents for answers that are not in monetary terms, but that instead compare different quantities of ecosystem services over different periods of time, allowing the respondents to consider tradeoffs without prior economic training in valuation. Mean Years 850 800 750 700 650 600 References 550 500 0 0.1 0.2 0.3 0.4 0.5 0.6 Fraction of Land in Question Evans (2005) The elasticity of marginal utility of consumption: Estimates for 20 OECD countries. Fiscal Studies. 26 (2): 197224 Figure 1. Mean indifference points by fraction of land saved for each survey variation. 0.006 Sample question: Fleurbaey and Zuber (2012) Climate policies deserve a negative discount rate. FMSH-WP-2012-19. 0.005 Imagine that a company has just purchased a piece of land that contained 50% of the remaining ancient redwood forest in California, and proposes to use the land to build a series of housing developments. They propose to state regulators one of two options: they could build developments on half of the land, donating the other half to the Nature Conservancy to be protected forever, or they could allow the Nature Conservancy to use all of the land for the next 40 years, after which they would develop the entire plot. Which scenario do you believe is preferable? Implied Social Discount Rate Benefit-cost analysis (BCA) is a vital tool used worldwide to help with policy assessment. When considering policies with longterm impacts, like those addressing climate change or habitat loss, few parameters are as important as the social discount rate (SDR). The SDR represents the value at which society prefers money (or other benefits) today with money or benefits at a particular time in the future. The SDR allows analysts to compare costs and benefits that will be occurring at different times in the future. We emailed an electronic survey to 2,000 random members of the Drake University Community, asking respondents to consider different quantities of ecosystem services over varying periods of time. As you can see (Table 1), the 0.51% discount rate we calculated has the potential to radically alter the decision making process. If further analysis of the survey data produces similar results, we could not justify standard benefit-cost analysis practices (use of mid-range discount rates and valuation based on marginalist techniques) from a consumer choice perspective. 900 0.004 Gollier and Weitzman (2009) How should the distant future be discounted when discount rates are uncertain? CES Working Paper 2863. 0.003 0.002 Harrison (2010) Valuing the Future: the social discount rate in cost-benefit analysis. Visiting Researcher Paper, Productivity Commission, Canberra Australia. 0.001 0 0 a.Development of half of the land now, saving the other half forever. b.Save all of it for 40 years before losing all of it forever to development. Progression from this point depends on which of the two options the respondent selects. 0.1 0.2 0.3 0.4 0.5 0.6 Fraction of Land in Question Figure 2. Implied social discount rates by fraction of land saved for each survey variation. Fitting an exponential trendline to the data in Figure 2 yielded the equation, y = 0.0051e-3.674x, with an R2 value of .983. We calculated the underlying SDR by setting the fraction of land to 0, the y-intercept of the trendline. This yielded a SDR of 0.51%. IPCC; Intergovernmental Panel on Climate Change (2007) Fourth Assessment Report, Cambridge University Press, New York. Nordhaus (2007) Critical assumptions in the Stern Review on Climate Change. Science, 317, 201-202 Stern (2007) Stern review on the economics of climate change. H.M. Treasury, UK.