Value at Risk

advertisement

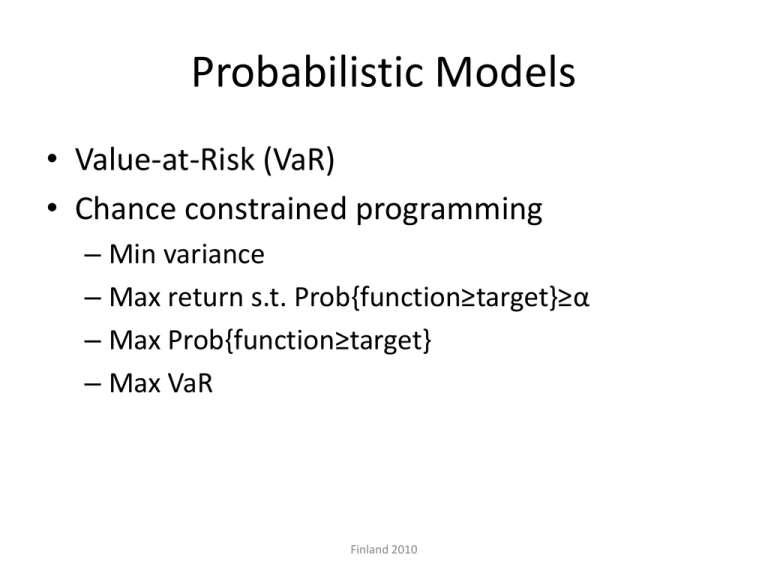

Probabilistic Models

• Value-at-Risk (VaR)

• Chance constrained programming

– Min variance

– Max return s.t. Prob{function≥target}≥α

– Max Prob{function≥target}

– Max VaR

Finland 2010

Value at Risk

Maximum expected loss given

time horizon,

confidence interval

Finland 2010

VaR = 0.64

expect to exceed 99% of time in 1 year

Here loss = 10 – 0.64 = 9.36

Finland 2010

Use

• Basel Capital Accord

– Banks encouraged to use internal models to measure

VaR

– Use to ensure capital adequacy (liquidity)

– Compute daily at 99th percentile

• Can use others

– Minimum price shock equivalent to 10 trading days

(holding period)

– Historical observation period ≥1 year

– Capital charge ≥ 3 x average daily VaR of last 60

business days

Finland 2010

VaR Calculation Approaches

• Historical simulation

– Good – data available

– Bad – past may not represent future

– Bad – lots of data if many instruments (correlated)

• Variance-covariance

– Assume distribution, use theoretical to calculate

– Bad – assumes normal, stable correlation

• Monte Carlo simulation

– Good – flexible (can use any distribution in theory)

– Bad – depends on model calibration

Finland 2010

Limits

• At 99% level, will exceed 3-4 times per year

• Distributions have fat tails

• Only considers probability of loss – not

magnitude

• Conditional Value-At-Risk

– Weighted average between VaR & losses

exceeding VaR

– Aim to reduce probability a portfolio will incur

large losses

Finland 2010

Optimization

Maximize f(X)

Subject to: Ax ≤ b

x≥0

Finland 2010

Minimize Variance

Markowitz extreme

Min Var [Y]

Subject to: Pr{Ax ≤ b} ≥ α

∑ x = limit

= to avoid null solution

x≥0

Finland 2010

Chance Constrained Model

• Maximize the expected value of a probabilistic

function

Maximize E[Y] (where Y = f(X))

Subject to: ∑ x = limit

Pr{Ax ≤ b} ≥ α

x≥0

Finland 2010

Maximize Probability

Max Pr{Y ≥ target}

Subject to: ∑ x = limit

Pr{Ax ≤ b} ≥ α

x≥0

Finland 2010

Minimize VaR

Min Loss

Subject to: ∑ x = limit

Loss = initial value - z1-α √[var-covar] + E[return]

where z1-α is in the lower tail, α= 0.99

x≥0

• Equivalent to the worst you could experience at the given

level

Finland 2010

Demonstration Data

Average return

Variance

Covariance

with S

Covariance

with B

Stock S

0.148

0.014697

Bond B

0.060

0.000155

0.000468

SCIP G

0.152

0.160791

-0.002222

-0.000227

Finland 2010

Maximize Expected Value of

Probabilistic Function

• The objective is to maximize return:

Expected return = 0.148 S + 0.060 B + 0.152 G

• subject to staying within budget:

Budget = 1 S + 1 B + 1 G ≤ 1000

Pr{Expected return ≥ 0} ≥ α

S, B, G ≥ 0

Finland 2010

Solutions

Probability

{return≥0}

0.50

0.80

0.90

0.95

0.99

α

Stock

Bond

0

0.253

0.842

1.282

2.054

379.91

556.75

622.18

668.92

-

Finland 2010

Gamble Expected

return

1000.00

152.00

620.09

150.48

443.25

149.77

377.82

149.51

331.08

149.32

Minimize Variance

Min 0.014697S2 + 0.000936SB - 0.004444SG +

0.000155B2 - 0.000454BG + 0.160791G2

st

S + B + G 1000 budget constraint

0.148 S + 0.06 B + 0.152 G ≥ 50

• S, B, G ≥ 0

Finland 2010

Solutions

Specified

Gain

≥50

≥100

≥150

≥152

Variance

Stock

Bond

Gamble

106.00

2,928.51

42,761

160,791

406.31

500.00

-

825.30

547.55

-

3.17

46.14

500.00

1,000.00

Finland 2010

Max Probability

α

Stock

Bond

Gamble

3

4

4.5

4.8

4.9 and up

157.84

73.21

406.31

500.00

-

821.59

914.93

547.55

-

20.57

11.86

46.14

500.00

-

Finland 2010

Expected

return

75.78

67.53

64.17

61.48

0

Real Stock Data – Student-t fit

Finland 2010

Logistic fit

Finland 2010

Daily Data: Gains

Ford

IBM

Pfizer

SAP

WalMart

XOM

S&P

Mean

1.00084

1.00033

0.99935

0.99993

1.00021

1.00012

0.99952

Std. Dev

0.03246

0.02257

0.02326

0.03137

0.02102

0.02034

0.01391

Min

0.62822

0.49101

0.34294

0.81797

0.53203

0.51134

0.90965

Max

1.29518

1.13160

1.10172

1.33720

1.11073

1.17191

1.11580

Cov(Ford)

0.00105

0.00019

0.00014

0.00020

0.00016

0.00015

0.00022

0.00051

0.00009

0.00016

0.00013

0.00012

0.00018

0.00054

0.00011

0.00014

0.00014

0.00014

0.00098

0.00010

0.00016

0.00016

0.00044

0.00011

0.00014

0.00041

0.00015

Cov(IBM)

Cov(Pfizer)

Cov(SAP)

Cov(WM)

Cov(XOM)

Cov(S&P)

0.00019

Finland 2010

Results

Model

Max Return

Min Variance

Normal

Pr{>970}>.95

t

Pr{>970}>.95

t

Pr{>970}>.95

Pr{>980}>.9

t

Pr{>970}>.95

Pr{>980}>.9

Pr{>990}>.8

Max

Pr{>1000}

Ford

1000.00

0

-

IBM

Pfizer

SAP

WM

XOM

S&P

Return

Stdev

-

-

-

-

-

-

1000.84

32.404

45.987

90.869

30.811

127.508

116.004

588.821

999.76

13.156

398.381 283.785

-

-

222.557

95.277

-

1000.49

18.534

607.162 296.818

-

-

96.020

-

-

1000.63

23.035

581.627 301.528

-

-

116.845

-

-

1000.61

22.475

438.405 279.287

-

-

220.254

62.054

-

1000.51

19.320

16.275 109.867

105.586

38.748

174.570

172.244

382.711

999.91

13.310

Finland 2010