Payroll Scorecard

advertisement

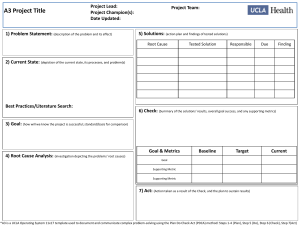

Metrics and Dashboards Presented by: Brent R Gow, CPP Director Global Payroll, Starbucks Coffee Co Agenda • • • • • • Why Payroll Metrics are Important Types of Payroll Metrics Review Purpose of the Dashboard Developing an Organizational Scorecard Using Metrics Tell a Story Integrating Payroll Metrics Throughout the Organization Effective Metrics • • • • • • Support decision making Measure performance Identify trends Define baselines Provide a basis for benchmarking Support Corporate Scorecard Using Metrics to Build Relationships • Use metrics to support and build upon relationships, but not to replace them • Strong value in maintaining an ongoing dialogue between your customer groups and at various levels • Strategic (Executive) • Tactical (Manager) • Operational (Employee) • Listen carefully to your customers! Understand their needs and their challenges • Create a win-win together 4 Data Based Decision • “You can not manage what you don’t measure” • “If you can not measure it you can not improve it” • “You can not defend it if you have not measured it” 5 Payroll Metrics Costs/Volumes • Payroll costs/administrative expenses (%) • Payees processed per FTE in Payroll • Average number of payroll payments per employee • Percentage of employees on direct deposit • Percentage of employees receiving checks • Percentage of employees with both check and direct deposit 6 Payroll Metrics Costs/Volumes • OT hours as a percentage of total hours worked • Paid time off hours/$ as percentage of total paid hours/$ • Number of Special Checks (i.e., Off-cycle Payments) • Number/Percentage of manual checks vs. system generated checks 7 Payroll Tax Metrics • • • • • Number of entities & tax jurisdictions for enterprise Number of provincial jurisdictions per entity Employer taxes as a percentage of total wages Percentage of penalties/interest paid on total taxes Percentage of penalties/interest paid on total gross wages • Number/percentage of tax abatements • Number/percentage of timely payments/reports • Number/percentage of late payments 8 Training Metrics • • • • Percentage of employees who participate in training Average number of employee hours spent training Amount of Training Dollars per employee Employees with expired certifications and licenses 9 HR Metrics • Total Number of Hired • Gender Staffing Breakdown • Internal Hires / External Hires • Performance Rating Distribution • Employee Engagement Level • Average Time to Fill • Performance Appraisal Participation Rate • Compensation Competiveness Compared to External Market Benchmarks (gap to market) • Average Performance Appraisal Rating • Termination Rate 10 HR Metrics • Leadership Gender Breakdown • Age Staffing Breakdown • Average Workforce Age • Average Employee Compensation • Type of Hires • Ethnic Background Staffing Breakdown • Average Merit Increase for Each Performance Rating • Health Plan Enrollment Rates • Average Workforce Tenure • Transfers • Internal Hire Rate • Retention Rate • Employee Satisfaction with Training • Benefits Expense per FTE • External Hire Rate 11 Training Metrics Quality • Percentage of errors by type • Payroll department error • Manager / supervisor error – timely, accurate • Employee error – time reporting not submitted • Number of amended T-4 statements • Number of Amended Tax Returns 12 Payroll Process Cost Distribution Payroll Process Labor Distribution 5% 7% 28% 10% Customer Service EE Time Processing HR Data Maintenance Input Processing Controls-Reconciliation 16% 7% Payroll Processing Document Management 5% Tax Filing 22% 13 We have all used dashboards… 14 Dashboard Proactive Management Tool • Visual representation Monitoring Business Activity to understand the “health” of a business • Provides info of Key Indicators • Information can be in the form of: – – – – Warnings Action Notices Next Steps Summaries of Business Conditions • Dynamic (Drill Down Capability) 15 Dashboard Example Measure Accuracy Manual payments outside payroll Service Desk (Total calls) Values 99.00% 1.00% 3.72% Percentile Ranking Place Measure Description 15th % Payslips produced without error (only those errors reported to Call Center) (calculated as % of payslip volume in month) Green ≥99% Amber ≥98% Red is <98% 75th % of manual payments made outside of payroll (calculated as % of payslip volume in month) Green ≤1% Amber ≤98% Red is >98% 15th % of calls received (calculated as % of payslip volume in month) Green ≤4% Amber ≤8% Red is >8% 16 Scorecard • Provides collection of reflective measures 1. 2. 3. 4. Performance of key business processes Financial perspectives Customer perspectives Learning and development perspective (i.e., Training) 17 Sample Scorecard Payroll Scorecard Categories People Metrics March Salaries actuals to plan (Fiscal) April Target Notes ($87,992) Favorable $61,119 Unfavorable Planned vs. Actual FTE's 33:28 33:29 New hire in April Payroll Metrics Check Processing Efficiencies % Direct Deposit (CN) March 97.04% Target April 96.86% 98% 842 929 N/A 28,146 28,257 N/A % of electronic vouchers (CN) 100% 100% # of Manual Cheques 2,119 1,468 N/A 0.64% 0.55% <1% 422 414 <100 # of printed checks (CN) # of vouchers (CN) Manual Cheques as % of total statements Check Reissue Tax March Target April Notes lower due to new hires reduction due to timely payroll transmission Notes # of Tax Returns filed N/A 327 N/A Qtly reporting # of Tax Deposits N/A 1422 N/A Qtly reporting Total $ Amount N/A $209,998,015.18 N/A Qtly reporting 18 Department Scorecard Go Green Electronic Payments -Direct Deposit -Debit Cards Under Budget _____% _____% _____% ___% of Total Budget Electronic Statements ______% Total number of payments _______ Total $$ of payments ________ Customer Feedback -Highly Satisfied ____% -Moderately Satisfied ____% -Somewhat Satisfied ____% Payroll Team ____ Years of Experience Attended ____ Hours of Training 19 Department Scorecard (with Graphics) 60 68% 50 Go Green 86% Electronic 40 30 20 5,867 Payments Fiscally Responsible 98% of Total Budget Exempt Non-Exempt 10 0 Direct Deposit Pay Cards $500,000 Customers are saying…”they are Highly Satisfied” Payroll Team Mitigates Risk and Manages Compliance with.. 100 7% 90 Highly Satisified Moderately Satisified Somewhat Satisified 15% 78% 80 70 60 50 40 120 Hours of Training 30 20 10 Hours of Training Years of Experience 44 Years of Experience 0 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr 20 Training Scorecard Quarterly Review Held: 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr 3/15/11 6/28/11 9/20/11 12/15/11 Individual Goal: To become a Certified Payroll Professional (CPP) and then move into a management position. Background: • 5 years of payroll administration • 5 years of customer service Training Activities Target Take Knowledge Assessment 01/31/11 Attend Chapter Study Group 05/20 – 8/15 Attend Fall Forum 09/2011 Sit for CPP Examination 09/2011 Accomplishments Knowledge Assessment Completed Attended APA Web Based Training Course Status Manager Feedback • Recommended Cindy become Certified to continue progress on her career path to a management position. • After CPP is obtained, additional knowledge and experience is needed in Management that will be offered internally. Next Steps Complete Inventory of Management Skills Complete Development Plan Attend Chapter Study Group 21 Benchmarking Metric Top Performer Peer Group 2012 2011 2012 2011 $41 $49 $84 $90 Process Cost/Payment $1.76 $2.06 $2.75 $3.03 Error Rate .02% .01% .06% .02% Paperless Payment Distribution Rate 90% 81% 76% 67% 1% 1% 2% 3% Process Cost/Employee Percent Off-Cycle Payments 22 Tips for Metrics Key is to use the “right” metrics • • • • • • • • Name of the Metric Description of what is measured How is the metric measured How often is the measure taken How are the thresholds calculated Current range of values considered normal for metric Best possible value of the metric Units of measurement 23 Data Sources • • • • • • • • HR/PR Database Financial Database Call Center Database Project Management Database Time and Attendance System Excel Spreadsheets Paper “Stickies” Other 24 Value Proposition: “Payroll Department Data Correlates to Bottom Line Success” Metric: Timeliness of Termination Notification Days Late for Notification Manager Terminations Late Terminations Company Property Organization Ongoing Expense $$ Increased Cost of Expenses (Phones/ PC’s) Decreased Profits 25 Data Collection Tool Performance Measure How will data be used? Operational Definition Data Source and Location Sample Size Who will Collect? Frequency of Collection How will Data be Collected? How will data be displayed 26 Data Collection Tool Performance Measure Cost Per Paycheck Cost Per Employee Operational Definition Data Source and Location Sample Size Who will Collect? Frequency of Collection How will Data be Collected? Total Expenses/ Number of Checks Produced BudgetExpenses To Date and Payroll Registers 100% Payroll Manager Quarterly Manually Total Expenses/ Number of Active Employees + Terminated Employees BudgetExpenses To Date and Payroll Registers 100% Payroll Manager Quarterly Manually How will data be used? How will data be displayed Report for Management Scorecard 27 Scorecard Integration • Reflect company strategy • Foundation on company goals • Mission, purpose and objective must be defined • Agreed upon measures • Tied into individual goals 28 Building the Foundation 1. Begin with the end in mind 2. Define a clear goal 3. Gain buy in from users 4. Design reporting templates 5. Identify data sources 6. Determine Frequency 7. Estimate overall effort 8. Understand audience needs 9. Align with organizational goals 10. Integrate with recognition: performance or bonus 29 Thank you Please complete your evaluation