Chapter 12

advertisement

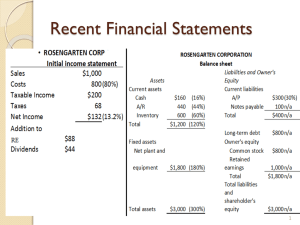

Chapter 12 SOME LESSONS FROM CAPITAL MARKET HISTORY 1 Chapter Overview Return of an investment: arithmetic and geometric The variability of returns Efficiency of capital markets 2 Return from a Security (1) Dollar return vs. percentage return Two sources of return ◦ dividend income ◦ capital gain (loss) realized or unrealized Div Pt 1 Pt Ri Pt Pt Dividend Payout Capital Gain 3 Mean Assume the distribution is normal Mean return - the most likely return A measure of centrality Best estimator of future expected returns 4 The First Lesson The difference between T-bills and other investment classes can be interpreted as a measure of the excess return on the risky asset Risk premium = the excess return required from an investment in a risky asset over a risk-free investment See Excel spreadsheet in “Discussions” folder 5 Arithmetic vs. Geometric Averages (1) Geometric return = the average compound return earned per year over multiyear period Geometric average return = T (1 R1 ) * (1 R2 ) *...* (1 RT ) 1 Arithmetic average return = the return earned in an average (typical) year over a multiyear period 6 Arithmetic vs. Geometric Averages (2) The geometric average tells what an investor has earned per year on average, compounded annually. The geometric average is smaller than the arithmetic (exception: 0 variability in returns) Geom. average ≈ arithmetic average – Var/2 7 Which Average to Use? Geometric mean is appropriate for making investment statements about past performance and for estimating returns over more than 1 period Arithmetic mean is appropriate for making investment statements in a forward-looking context and for estimating average return over 1 period horizon 8 The Variability of Returns Variance = the average squared deviation between the actual return and the average return (R R ) Var( R) 2 i T 1 Standard deviation = the positive square root of the variance Var 9 Standard Deviation Measure of dispersion of the returns’ distribution Used as a measure of risk Can be more easily interpreted than the variance because the standard deviation is expressed in the same units as observations 10 The Normal Distribution (1) A symmetric, bell-shaped frequency distribution Can be completely described by the mean and standard deviation 11 The Normal Distribution (2) 12 Z-score For any normal random variable: X Z Z – z-score (see “Supplements” folder) X – normal random variable - mean 13 Yet Another Measure of Risk VaR = statistical measure of maximum loss used by banks and other financial institutions to manage risk exposures • How much can a bank lose during one year? • Usually reported at 5% or 1% level 14 The Second Lesson The greater the potential reward the greater the risk Which types of securities have higher potential reward? See Excel spreadsheet in “Discussions” folder 15 Capital Market Efficiency Efficient capital market - market in which security prices reflect available information Efficient market hypothesis - the hypothesis that actual capital markets are efficient 16 What assumptions imply efficient capital market? 1. Large number of profit-maximizing participants analyze and value securities 2. New information about the securities come in random fashion 3. Profit-maximizing investors adjust security price rapidly to reflect the effect of new information 17 Forms of Market Efficiency Weak form – the current price of a stock reflects its own past prices Semistrong form – all public information is reflected in stock price Strong form – all information (private and public) is reflected in stock prices 18 Weak Form Efficiency Current stock price reflects all security market information You should gain little from the use of any trading rule that decides whether to buy/sell security based on the passed security market data Major markets (TSX, NYSE, NASDAQ) are at least weak form efficient January effect 19 Semistrong Form Efficiency Mutual fund managers have no special ability to beat the market Event studies (IPO, stock splits) support the semistrong hypothesis Quarterly earnings surprise – test results indicate abnormal returns during 13-26 weeks following the announcement of large unanticipated earnings change (earnings surprise) in a company 20 Strong Form Efficiency No group of investors has access to private information that will allow them to consistently experience above average profits Evidence shows that corporate insiders and stock exchange specialists are able to derive above-average profits 21