Costs, Activities, Estimation

advertisement

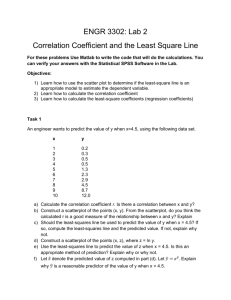

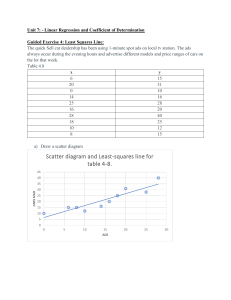

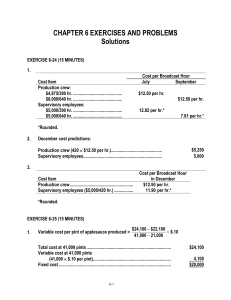

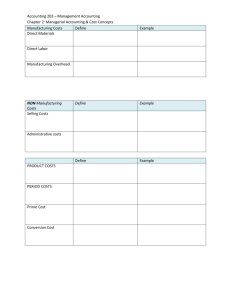

Module 14 Cost Behavior, Activity Analysis, and Cost Estimation Variable Costs Increases as activity increases Proportional to activity Equals zero dollars when activity is zero Example: Materials Higher variable costs per unit create a steeper line slope. Total variable costs (Y) Variable cost: Y = bX 0 Total activity (X) b = Variable cost per unit Fixed Costs Slope is zero, represented by a flat line. Total fixed costs (Y) Fixed cost: Y = a 0 Total activity (X) a = Total fixed costs No change as activity increases or decreases Example: Depreciation Mixed Costs Increase in a linear fashion when activity increases Positive in amount when activity is zero Example: Maintenance Contains both fixed and variable cost elements. Total mixed costs (Y) Variable portion Fixed portion Mixed cost: Y = a + bX 0 Total activity (X) b = Variable cost per unit Step Costs Increase in a step like fashion as activity increases Example: Supervisors Step cost: Y = ai Total step costs (Y) 0 Total activity (X) Relevant Range A portion of a range of activity associated with the fixed cost of the current or expected capacity A normal range of activity in which a company expects to operate, where the fixed costs remain linear, i.e., total cost remains the same Classifying Fixed Costs Classification depends on the immediate impact if the company attempts to change the fixed costs. Committed fixed costs, known also as capacity costs, are required to maintain the current service or production capacity or to fill previous legal Depreciation Real-estate taxes commitments. Training Advertising Discretionary fixed costs , known also as managed fixed costs, are set at a fixed amount each period by management. Cost Estimation What is it? The determination of the relationship between activity and cost An important part of cost management Identifying variable or fixed costs Analyzing available accounting records Interviews Purpose of cost estimation Cost prediction i.e., forecasting future costs Estimating Mixed Cost Components Methods of estimating fixed and variable cost components High-low method Scatter diagrams Least-squares regression analysis Variable Costs Mixed Costs Fixed Costs High-Low Cost Estimation Utilizes data from two time periods A high activity period, and a low activity period Step 1: Select a representative high point and a representative low activity point. Step 2: Determine variable costs per unit: Variable Costs = Per Unit Difference in total costs Difference in activity Step 3: Subtract total variable costs from total fixed costs using either the high or low point: Total Fixed Costs = Total costs – [Variable cost per unit × number of units] High-Low Example: Variable Costs Number of Shipments Low activity period High activity period January February March April 8,600 9,800 11,600 11,200 Variable cost $31,600 – $25,000 per unit (b) = 11,600 – 8,600 Packaging Costs $25,000 26,000 31,600 33,000 = $2.20 The variable cost of each unit produced is $2.20. High Low Example Fixed Costs Calculate fixed costs: Variable cost per unit (b) = $2.20 per unit a = Total costs – Variable costs January $25,000 = a + ($2.20 × 8,600 units) a = $6,080 March $31,600 = a + ($2.20 × 11,600 units) a = $6,080 The same total fixed costs result using either the high or low activity point. Scatter Diagrams Examine scatter diagram for abnormal data. Use judgment on the cost line. Can draw any number of lines… • Plot data • Draw line through points. Least-Squares Regression A mathematical technique to fit a unique costestimating equation to all the observed data Minimizes the vertical squared difference between the estimated and actual costs at each data point Technique generally reliable Can estimate errors Accomplished using Microsoft Excel® Statistical software Some calculators Least-Squares Criterion The least-squares method minimizes the sum of all squared vertical deviations between individual observations and the cost-estimating line. Cautions in Developing Cost Estimate Equations Managers are responsible for making decisions Mathematical models do not make decisions; they are tools to aid decision making Not all data are based on normal operating conditions, throw out the abnormal… Nonlinear relationships could exist Results should make sense and be explainable Unit Level Activity This activity is performed for each unit of product produced or sold, variable on units. Examples: Cost of raw materials Cost of cutting a component Cost of a box to package cereal Sales commission Batch Level Activity This activity is performed for each batch of product produced or sold. Examples: Cost of processing sales orders Cost of equipment setup Cost of moving a batch between work stations Cost of inspecting batches Product Level Activity This activity is performed to support the production of each different type of product. Examples: Cost of product development Cost of product marketing such as product-related advertising Cost of specialized equipment Facility Level Activity This activity is performed to maintain general capabilities. Examples: Cost of maintaining factory building and grounds Cost of non-specialized equipment Cost of general advertising Cost of factory supervisor