Slide

advertisement

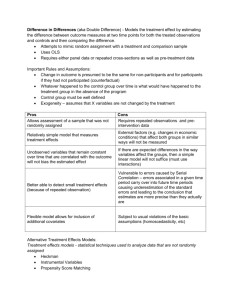

IS NEW ZEALAND’S COUNTERFACTUAL TEST COUNTERPRODUCTIVE? Lilla Csorgo Chief Economist, Competition Branch 1 SECTION 36: TAKING ADVANTAGE OF MARKET POWER →A person that has substantial degree of power in a market must not take advantage of that power for the purpose of • restricting the entry of a person into that or any other market; or • preventing or deterring a person from engaging in competitive conduct in that or any other market; or • eliminating a person from that or any other market. 2 THE COUNTERFACTUAL TEST →Would a firm without substantial market power, but otherwise in the same position as the firm which is alleged to have taken advantage of its substantial market power, have behaved in the same way as the firm with substantial market power? (Commerce Commission v Telecom Corporation, 2011) 3 UNILATERAL CONDUCT TESTS →No economic sense: whether the conduct in question contributed any profit to the firm apart from its exclusionary effect →Profit sacrifice: short-run profits with the anti-competitive conduct is lower than short-run profits without the conduct →Substantially disproportionate: anticompetitive effects are substantially disproportionate to any pro-competitive effects →Price-cost test: effective price’ (or ‘imputed price’) below some ‘appropriate measure of cost’, then outside the safe harbour 4 NO ECONOMIC SENSE TEST: CRITICISMS →False negatives: cases where there are both legitimate profits as well as profits from eliminating competitors →Exclusive-dealing arrangements: make economic sense “precisely because they lessen competition by rivals for the affected business.” (Dennis Carlton, Does Antitrust Need to Be Modernized?, J. Econ. Persp., Summer 2007) → No practical way to separate the economic benefits to a firm from the exclusionary impact on rivals →Focuses only indirectly on consumers and consumer welfare 5 COUNTERFACTUAL TEST IN PRACTICE →Would a firm without substantial market power have behaved in the same way as the firm with substantial market power? →Basically anything would go 6 COUNTERFACTUAL TEST IN PRACTICE →“The constraints acting upon the firm in the hypothetical market must neutralise the dominance in the actual market. The hypothetical market should, however, replicate the actual market, save for eliminating the dominance of the alleged contravener. The means of achieving that elimination is to posit in the hypothetical market as well as the alleged contravener (company X) at least one other firm (company Y) in effective competition with company X.” (Commerce Commission v Telecom Corporation) 7 WORSE THAN THE “NO ECONOMIC SENSE TEST” →If it appears that the hypothetical firm would undertake the same conduct, there’s no issue. →“…the laboratory version of the counterfactual is entirely a one-sided affair. It does not inquire into the actual firm’s contemporaneous documents and records to observe whether there is reason to believe that it acted for a proper or improper purpose, but rather only to help in the construction of counterfactual market.” (“Imagining a Counterfactual Section 36: Rebalancing New Zealand’s Competition Law Framework”, Andrew Gavil, draft paper 2013) 8 DOES SECTION 27 MAKE ALL OUR PROBLEMS GO AWAY? →No person shall enter into a contract or arrangement, or arrive at an understanding, containing a provision that has the purpose, or has or is likely to have the effect, of substantially lessening competition in a market. 9 CONCEPT OF COUNTERFACTUAL THROUGHOUT NZ COMPETITION LAW →“To assess whether a substantial lessening of competition is likely requires us to compare the likely state of competition if the merger proceeds (the scenario with the merger, often referred to as the factual) with the likely state of competition if it does not (the scenario without the merger, often referred to as the counterfactual)…” (Merger and Acquisition Guidelines, para 2.29) 10 SECTION 27: SKY CONTRACTS → Telecom, Vodafone, TelstraClear (now merged with Vodafone), and CallPlus → Contractual provisions at issue (key commitments): • Exclusivity provision: prohibits an RSP from reselling, or making available, any pay TV service on than Sky’s services. • No assistance clause: prohibits an RSP from providing ‘special assistance’ or ‘direct assistance’ to any party providing pay TV services. 11 SECTION 27: BENEFITS OF ARRANGEMENT →Benefits to Sky: • Access difficult to access market segments • Reduced churn →Benefit to RSP: • Competitive advantage relative to rivals that do not sell Sky 12 SECTION 27: THEORY OF HARM →Extending terms or resale/retransmission contracts beyond profit-maximising terms. →No bundling provision that prevents free-riding and/or any detrimental effect on Sky’s brand: • The RSP cannot bundle Sky content with third-party content, unless Sky gives its consent. 13 SECTION 27: PURPOSE AND EFFECT →“…the existence or not of an anti-competitive effect, or likely effect, may influence whether a court finds that a provision’s purpose is anti-competitive.” (Sky decision, paragraph 65) →“…consider the evidence of past entry by RSPs, and then consider the prospects of RSP entry in future.” (Sky decision, paragraph 181) 14 SECTION 27: FACTUAL V COUNTERFACTUAL →Factual: resell and RSPs cannot enter, but can choose not to resell and so have entry available →Counterfactual: Sky doesn’t enter reselling contracts, so have entry available • “Sky has told us that without the key commitments it may not enter into the RSP contract.” (Sky decision, paragraph 211). →Factual perhaps more competitive? – entry available under both but under the factual also has reselling option 15 SECTION 27: FACTUAL V COUNTERFACTUAL →Suppose purpose of key commitments was to exclusivity in return for favourable payment terms? →Commission argued that Sky would still resell absent the key commitments. • Factual: resell and RSPs cannot enter, but can choose not to resell and so have entry available • Counterfactual: resell but RSP can enter, as well as RSP choosing not to resell and so have entry available 16 SECTION 27: FACTUAL V COUNTERFACTUAL →Or argue that under factual, RSPs would never forego share of monopoly profits in favour of duopoly profits? • Factual: resell and RSPs cannot enter, and no possibility of entry • but come back up against purpose and effect • Counterfactual: Sky doesn’t resell, so have entry available 17 SOLUTION? →Substantial lessening of competition requirement →Did the alleged anti-competitive act significantly increase barriers to entry such that a preservation or enhancement of market power was likely? →Is there a reasonable business justification for the alleged anti-competitive act? →If yes, do the pro-competitive effects of this overwhelm the anti-competitive effects? 18 www.comcom.govt.nz CONTACT To contact the Commission with information about false or misleading trading practices, or anti-competitive behavior by businesses: CALL the Contact Centre on 0800 943 600 WRITE to Contact Centre, PO Box 2351, Wellington EMAIL contact@comcom.govt.nz