Financial Forecastings using Neural Networks ppt

advertisement

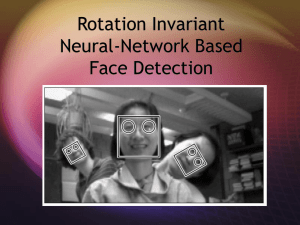

FINANCIAL FORECASTING USING NEURAL NETWORKS What is Financial Forecasting Prediction of prices of instruments of speculation Stocks Commodity futures Exchange Rates Interest Rates . Problem : Non linear and non stationary data Methods Used Fundamental Analysis Understanding the supply demand curve Involves studying of news and economic factors Technical Analysis Understanding historical price patterns Tools like moving average, learning systems Latest Approach: Combine Technical and Fundamental Analysis NEURAL NETWORKS Map some type of input stream of information to an output stream of data. They derive non-linear models that can be trained to map past and future values of the input output relationship .It extracts relationships governing the data that was not obvious using other analytical tools. Capability to recognize pattern and the speed of techniques to accurately solve complex processes, exploited exhaustively in financial forecasting. Trained without the restriction of a model to derive parameters and discover relationships, driven and shaped solely by the nature of the data. NEURAL NETWORKS V/S CONVENTIONAL COMPUTERS Neural networks have the unique capability of learning thus are adaptive .This problem solving tool creates a unique likeness to the human brain . Use the interconnectedness of the elements of the model rather than follow a set of sequential steps, that may or may not solve the problem like computers do. A different aspect of model building, where the unique relationships between the variables creates the model, rather than trying to force variables to conform to a theoretical abstract that may or may not exist. NEURAL NETWORKS IN FINANCE Neural networks are trained without the restriction of a model to derive parameters and discover relationships, driven and shaped solely by the nature of the data. Thus it has profound implications and applicability to the finance field. Some of the fields where it is applied are: Financial forecasting Capital budgeting and risk management Stock market analysis Used to analyze and verify Economic hypothesis and theories which were not possible otherwise. Govt. predicts interest rates to gauge the future inflationary situation of its economy . Neural Networking and Similarities with the Workings of the Human Brain A SIMPLE NEURON VECTOR INPUT TO NEURON LAYER OF NEURONS LAYER OF NEURONS ….. MULTIPLE LAYERS MULTIPLE LAYERS ….. NARX MODEL TRANSFER FUNCTIONS TRAINING ALGORITHMS trainlm : fastest and better for non-linear cases , default for feed-forwardnet . BACK-PROPOGATION Numerous such input/target pairs are used to train the Neural Network. TIME SERIES FORECASTING Time series forecasting or time series prediction, takes an existing series of data and forecasts the data values. The goal is to observe or model the existing data series to enable future unknown data values to be forecasted accurately. Done using the NARX model or NAR model . DIFFICULTIES Limited quantity of data . Noise in data – It obscures the underlying pattern of the data . Non-stationarity - data that do not have the same statistical properties (e.g., mean and variance) at each point in time Appropriate Forecasting Technique Selection . Preprocessing of Training Data Reason: Need to understand underlying patterns. Tools: Moving Average Fast Fourier Transform (FFT) Hilbert Huang Transform (HHT) Types Of Data Worked Upon Interest Rates (RBI 91 day Govt. Of India Treasury Bills) Sensex Data ( 2005-2010) Exchange Rates (Daily Exchange Rates of INR-Dollars 2004-2011) All the Data are divided into Three Sets 1. Training Set Testing Set Validation Set 2. 3. Types Of Preprocessing No Pre-Processing (Simple NN) Using FFT (FFT NN) Using HHT (HHT NN) All the types of data are used on all the types of preprocessing techniques , therefore generating 9 cases. Now, we Compare all of them Data-Wise. 1. Interest Rates The interest rate data is applied on all three kinds of preprocessing. The Error Graphs are as: Simple NN FFT NN HHT NN 2. Sensex Data The sensex data is applied on all three kinds of preprocessing. The Error Graphs are as: Simple NN FFT NN HHT NN 3. Exchange Rates The Exchange Rate data is applied on all three kinds of preprocessing. The Error Graphs are as: Simple NN FFT NN HHT NN Conclusion from Results Pre-processing can boost the Neural Network Performance The performance of Neural Network also depends on the nature of the data series Thank You