WARNING

All rights reserved. No part of the course materials

used in the instruction of this course may be

reproduced in any form or by any

electronic or mechanical means, including the use

of information storage and retrieval systems,

without written approval from the copyright owner.

©2006 Binghamton University

State University of New York

ISE 211

Engineering Economy

Chapter Four

Spreadsheets for Economic

Analysis

Chapter 5 >> Present Worth

Analysis

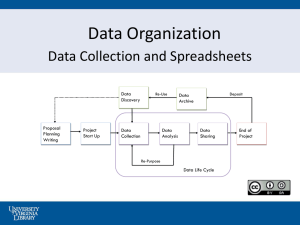

Application of Spreadsheets in Engineering Economy

Constructing

Tables of cash flows

Using annuity functions to calculate P, F, A, N, or i.

Using a block function to find present worth or

internal rate of return for a table of cash flows.

Making graphs for analysis and convincing

presentation.

Calculating “what if” for different assumed values of

problem variables

Spreadsheets Annuity Functions

To find the equivalent P

-PV(i,N,A,F,Type)

To find the equivalent A

-PMT(i,N,P,F,Type)

To find the equivalent F

-FV(i,N,A,P,Type)

To find N

NPER(i,A,P,F,Type)

To find i

RATE(N,A,P,F,Type, guess)

Spreadsheets Annuity Functions (cont’d)

Type =

0 or ommited

1

If payments are due

at the end of the period

at the beginning of the period

Guess is your guess for what the rate will be.

If you omit guess, it is assumed to be 10%.

If RATE does not converge, try different values for

guess. RATE usually converges if guess is between 0

and 1.

Example 1

A new engineer wants to save money for

down payment on a house. The initial

deposit is $685, and $375 is deposited at

the end of each month. The savings

account earns at an annual nominal rate

of 6% with monthly compounding. How

much is on deposit after 48 months?

Example 2

A new engineer buys a car with 0%

down financing from the dealer. The

cost with all taxes, registration, and

license fee is $15,732. If each of the 48

monthly payments is $398, what is the

monthly interest rate?

Spreadsheet Block Functions

Cash flows can be specified period-by-period as a block of

values.

These cash flows are analyzed by block functions that

identify the row or column entries for which a present worth

or an internal rate of return should be calculated.

Economic Criteria

Net present value

Internal rate of return

Excel Function

NPV(i,values)

IRR(values,guess)

Values for periods

1 to N

0 to N

Note: The cash flows for 1 to N are assumed to be end-of-

periods flows.

Example 1

Consider the following cash flow at 8% interest rate.

12,000

10,000

8,000

6,000

1

2

3

4

$2,500

a) Calculate the present worth value.

b) Calculate the internal rate of return.

Example 2

Graph the loan payment as a function of the

number of payments for a possible new car

loan. Let the number of monthly payments

vary between 36 to 60. The nominal annual

interest rate is 12%, and the amount

borrowed is $18,000.

Exercises (Chapter # 4)

4.125

4.127

4.129

4.135

Project Assignment #1

Problems

4.130 & 4.135 (using Excel).

Due via email:

Excel File Format: PA01_LastName.xls.

Problems should only be solved using spreadsheet

functions as discussed at the end of Chapter 4

(or lecture notes).

Chapter 5

Present Worth

Analysis

Economic Criteria

Situation

For Fixed Input

For Fixed Output

Neither Input nor Output Fixed

Therefore,

Criterion

Maximize Ouput

Minimize Input

Maximize (output-input)

we will examine ways to resolve

engineering problems, so that criteria for

economic efficiency can be applied.

Economic Criteria (cont’d)

Now we know how to convert a series of cash flows to

another form that is desired.

What form do we want to compare mutually exclusive

alternatives?

Chapter 5 -- Compare Present Worths

Chapter 6 – Compare equivalent Uniform Annual cash

flow

Chapter 7 – Figure out what interest rate allows benefits

to be bigger than costs

Applying Present Worth Techniques

Applying Present Worth Techniques (cont’d)

Present Worth Analysis is used to determine the present

worth value of future money receipts and disbursements.

Choose the option with the “Best” Present Worth.

There are three different analysis-period situations that are

encountered in economic analysis problems:

1) The “useful life” of each alternatives equals the analysis

period

2) The alternatives have useful lives different from the

analysis period

3) There is an infinite analysis period, n = .

1) Useful Lives Equal the Analysis Period

Example 1: A firm is considering which of two

mechanical devices to install to reduce costs in a

particular situation. Both devices cost $1000 and have

useful lives of five years and no salvage value. Device A

can be expected to result in $300 savings annually.

Device B will provide cost savings of $400 the first year

but will decline $50 annually, making the second year

savings $350, the third year savings $300, and so forth.

With interest at 7%, which device should the firm

purchase?

Example 2

Wayne County will build an aqueduct to bring water in

from the upper part of the state. It can be built at a

reduced size now for $300 million and be enlarged 25

years hence for an additional $350 million. An

alternative is to construct the full-sized aqueduct now for

$400 million. Both alternatives would provide the

needed capacity for the 50-year analysis period.

Maintenance costs are small and may be ignored. At 6%

interest, which alternative should be selected?

Example 3

A purchasing agent is considering the purchase of some new

equipment for the mailroom. Two different manufacturers

have provided quotations. An analysis of the quotations

indicates the following:

Manufacturer

Speedy

Allied

Cost

$1,500

1600

Useful life (years)

5

5

End-of-useful-life salvage value

$200

325

The equipment of both manufacturers is expected to perform

at the desired level of (fixed) output. For a five-year analysis

period, which manufacturer’s equipment should be selected?

Assume 7% interest and equal maintenance costs.

Example 4

A firm is trying to decide which of two alternate

weighing scales it should install to check a package

filling operation in the plant. The scale would allow

better control of the filling operation and result in

less overfilling. If both scales have lives equal to the

six-year analysis period, which one should be

considered? Assume 8% interest rate.

Alternate

Cost Uniform Annual Salvage Value

Benefit

$$$

Atlas Scale > $2000

$450

$100

Tom Thumb> $3000

$600

$700

2) Useful Lives Different from the Analysis Period

Example 1: Consider

the previous example 3.

Which alternative is best?

Manufacturer

Cost ($)

Useful life

(years)

End-of-useful life salvage

value ($)

Speedy

1500

5

200

Allied

1600

10

325

What if one item lasts 11 yrs and the other lasts 13 years?

Use

the least common multiple.

It seems unrealistic to use this as the analysis period,

so use the situation to decide on an appropriate

period.

Example, use __________, and assign some

terminal value to each alternative at the end of

____________.

You will be exposed to this kind of problems in the

homework.

3) Infinite Analysis Period – Capitalized Cost

Some projects need to be maintained permanently (forever):

roads, dams, graves, pipelines.

This particular analysis is called Capitalized Cost.

Capitalized Cost is the present amount of money required to be

invested at some interest rate to provide the service (or whatever)

for the project forever (indefinitely).

In this situation, you use the interest each year to pay for the

project, so you need to maintain the principal amount in the bank.

The cost each year is assumed to be the same – so each year we

withdraw A.

Illustration

End of

Year

1

2

3

.

546

Principal Interest

Earned

Withdraw

Example 1

You need $50/year for your grave

maintenance after you die. If you

earn 4%, how much do you need to

set aside by one year before you die?

Example 2

A city plans a pipeline to transport water

from a distant watershed area to the city.

The pipeline will cost $8 million and have

an expected life of seventy years. The city

anticipates it will need to keep the water

line in service indefinitely. Compute the

capitalized cost assuming 7% interest.

Assumptions in Econ Analysis

1) End of year conventions

Remember tables and formulas assume cash flow at the

end of the period

Spreadsheets can handle cash flows at beginning or end of

period – but be careful!

2) Use the viewpoint of the whole company / large entity – like

shipping department VS entire company.

3) Sunk costs – ignore them!

4) Borrowed Money

We assume that money spent in the problems is borrowed

at the same rate and conditions given in the problem.

Assumptions in Econ Analysis (cont’d)

5) Effect

of Inflation and Deflation

For now, assume no inflation or deflation –

prices are stable

6) Income Taxes

For now, no income taxes effects/consequences

Multiple Alternatives

For more than two alternatives, just get all the present worth values and choose

the best alternative for your situation.

Example 1: A contractor has been awarded the contract to construct a six-miles-long

tunnel in the mountains. During the five-year construction period, the contractor will need

water from a nearby stream. He will construct a pipeline to convey the water to the main

construction yard. An analysis of costs for various pipe sizes is as follows:

Installed cost of pipeline and pump

Cost per hour for pumping

2"

$22,000

$1.20

Pipe Size

3"

4"

$23,000

$25,000

$0.65

$0.50

6"

$30,000

$0.40

The pipe and pump will have a salvage value at the end of five years equal to the cost to

remove them. The pump will operate 2000 hours per year. The lowest interest rate at

which the contractor is willing to invest money is 7%. (The minimum required interest

rate for invested money is called the Minimum Attractive Rate of Return, MARR).

Select the alternative with the least present worth of cost.

Example 2

An investor paid $8,000 to a consulting firm to analyze what

he might do with a small parcel of land on the edge of town

that can be bought for $30,000. In their report, the consultants

suggested four alternatives. Assuming 10% is the minimum

attractive rate of return, what should the investor do?

Alternatives

A. Do nothing

B. Vegetable Market

C. Gas Station

D. Small motel

Total Investment including land ($)

0

$

50,000

$

95,000

$

35,000

Uniform net Annual benefit ($)

0

$

5,100

$

10,500

$

36,000

Terminal value at the end of 20 yr ($)

0

$

30,000.00

$

30,000.00

$

15,000.00

Example 3

A piece of land may be purchased for $610,000 to be

strip-mined for the underlying coal. Annual net

income will be $200,000 per year for ten years. At the

end of the ten years, the surface of the land will be

restored as required by a federal law on strip mining.

The cost of reclamation will be $1,500,000 more than

the resale value of the land after it is restored. Using

a 10% interest rate, determine whether the project is

desirable.

Example 4

Two pieces of construction equipment are being

analyzed. Based on an 8% interest rate, which

alternative should be selected?

Year

0

1

2

3

4

5

6

7

8

Alternative A

-$2,000

$1,000

$850

$700

$550

$400

$400

$400

$400

Alternative B

-$1,500

$700

$300

$300

$300

$300

$400

$500

$600

Using Spreadsheets

Example 1: NLE

Construction is bidding on

a project whose costs are divided into

$30,000 for startup and 12 equal payments

of $20,000 at the end of each month. If the

annual interest rate is 12.5%, compounded

monthly, what is the present worth?

Using Spreadsheets (cont’d)

Example 2: Regina Industries has a new product

whose sales are expected to be 1.2, 3.5, 7, 5, and 3

million units per year over the next 5 years.

Production, distribution, and overhead costs are

stable at $120 per unit. The price will be $200 per

unit for the first 2 years, and then $180, $160, and

$140 for the next 3 years. The R&D costs are $400

million. If the annual interest rate is 15%, what is the

present worth of the new product?

Homework # 05 (Chapter # 5)

4

9

10

11

16

20

48

52

54

63

67

68

71