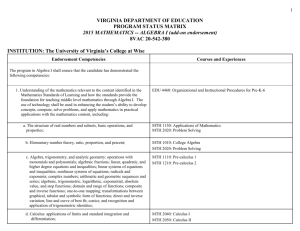

2.25% - Just Unit Trust

advertisement

24 October 2011 CONGRATULATIONS ! You have been converted to a Unit Trust Consultant. We trust you have faith in Unit Trust funds as a vehicle to achieve financial freedom. Thus, you will be doing your Fardhu Kifayah by engaging and helping many Muslim investors (especially) in their wealth accumulation plans in order to achieve prosperity here and hereafter. Always uphold our agency core values of being Just, Unique, Savvy & Street-smart, and Trustworthy. Important Telephone Numbers : Agent Service 03-6279 6900 Customer Service 03-6207 5000 Jasmalaila (Jas’s Assistant) 017-310 4171. “Shoot for the moon, even if you miss, you will land amongst the stars !” 24 October 2011 How to start ? 1) Be a believer . Start your own investment via KWSP (acc 1) or start a DDI (direct debit Instruction) plan. New UTC can start with own investment – initial RM1,000 and minimum monthly DDI of RM100 (through public bank or maybank). The DDI scheme can be done at zero service charge (thus you are not paid commission) and we prefer using Public Bank (DDI charge only 50cents versus Maybank”s RM2) 2) Attend Public Mutual Berhad (PMB) compulsory training : Success 101 – 1 day Free (Product) Quickstart – 1 day RM10 (Sales activities) Enquire training dates at your respective branches or via UTC Connect. 3) Get your system running Get your UTC Code from Agency Services 03-6279 6900 one week after your passed your UT exam. Apply the following at your branch : CAMs – to start monitor your investors investment and your sales. (this system has to be purchased together with Adept and Financial Advisor. Adept provides you with more than 100 slides to assist your sales presentation while FP Advisor can halp design financial plans for investors). There are training provided for CAMS-Adept-FP Advisor if you wish to attend. UTC Connect – access via www.publicmutual.com.my. This is a portal where you can check your sales performance, trip qualification, training schedules, internal memo from PMB to UTCs etc. 4) Attend Brainstorming and Coaching activities by JUST at Cheras as often as you can. Or you may check www.JustUnitTrust.com to download matter discussed. (usually by Wednesday onwards of each week). Download notes Jumpstart NOW ! from www.JustUnitTrust.com Download additional sales kit materials from www.JustUnitTrust.com 5) Your biz formula Revenue = C x A x N Revenue = number of Customers X Average sales per customer X Number of repeats So, UTCs should focus on how to increase these variables in order to get better Income. DDI sales 6) Your biz pillars Cash sales Recruitment Epf sales Motivation 7) How much INCOME do you want ? Focus 5 investors per month (EPF sales) or total EPF sales RM50,000 and get RM1,000 income (Month 1 to 3). Repeat the same activity in months 4 to 6, while getting repeat EPF sales (usually repeat sales amount gets lesser and lesser). So your income month 4 to 6 is RM1,800. And you shall get promotion to Agency Supervisor in month 7 with total sales RM500,000 and off course higher commission rate of 2.25% sales Mth 1 Mth 2 Mth 3 Mth 4 Mth 5 Mth 6 50,000 50,000 50,000 50,000 50,000 50,000 45,000 45,000 45,000 Repeat sales TS 50,000 50,000 50,000 95,000 95,000 95,000 Commission 2% 2% 2% 2% 2% 2% Income 1,000 1,000 1,000 1,800 1,800 1,800 For full-time UTCs, you should have even higher income,. So, just multiply your activities. sales Mth 1 Mth 2 Mth 3 Mth 4 Mth 5 200,000 200,000 200,000 200,000 200,000 200,000 150,000 150,000 150,000 Repeat sales Mth 6 TS 200,000 200,000 200,000 350,000 350,000 350,000 Commission 2% 2% 2% 2.25% 2.25% 2.25% Income 4,000 2,000 4,000 6,300 6,300 6,300 Here, you are promoted to Agency Supervisor in month 3 and commission rate of 2.25% So, work your plan ! J.U.S.T do it… Proposal of Recommended Islamic Funds. Due to present market volatility and opportunities, we prefer funds that are : Large fund size (above RM500m NAV) Favors higher Malaysia exposure (due to low beta and defensive nature of domestic equity market versus global) Detail funds information available at www.publicmutual.com.my as follows : 1) Prospectus http://www.publicmutual.com.my/OurProducts/FundProspectus.aspx 2) Price http://www.publicmutual.com.my/application/fund/fundprice.aspx 3) Performance chart (graph according to period selected) http://www.publicmutual.com.my/application/fund/performancenw.aspx 4) Quarterly Fund Review and Monthly Fund Review http://www.publicmutual.com.my/OurProducts/MonthlyQuarterlyFundReview.aspx Profile : Moderate – highly recommend P.Islamic Dividend Fund (PIDF) followed by P.Ittikal and P.Ittikal Sequel. 1) P. Ittikal and P. Ittikal Sequel • As P. Ittikal (par RM1 per unit) is currently open only for EPF sales. • For cash can invest in Public Ittikal Sequel newly launched. • Both PITTIKAL and PITSEQ have max 30% exposure including china, japan, usa, germany, australia. • Has value add features of FREE Takaful (Term Life and Total Permanent Disability coverage up to age 59, with min investment RM5,000) • Recommend Ittikal Sequel for long-term accumulation. 2) PIDF • Almost entirely domestic equity exposure. • May gain more from prospects of General Election expected next year • Recommend PIDF for lump sum transaction as already 90% exposed to equity. + extracted from Monthly Funds Preview (website) Profile : Aggressive – highly recommend P.Islamic Select Sector (PISSF) and P.Islamic Select Enterprise (PISEF) 1) PISSF • Large funds and amongst favorite for EPF investment. • Equity exposure 80% • Invest in 6 theme or economic sectors. 2) PISEF • Large funds and also amongst favorite for EPF investment. • Equity exposure almost 80% • Invest in 50 largest Syariah stocks on Bursa.