Unit 6. - Department of Economics

advertisement

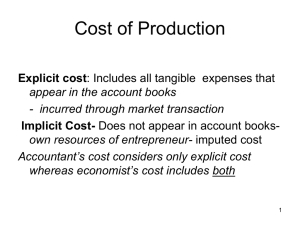

Unit 6. Analyses of SR Costs & Profits as Functions of Output Q ‘Liquid Gold’ Economics? Recent increases in crude oil prices have prompted much interest in trying to figure out their likely consequences on fuel prices ‘at the pump’. Politicians and others often wonder if pump price increases are ‘out of line’ with actual increases in the cost of the crude oil input. Are their concerns warranted? No More Babies? The CEO of Memorial Hospital recently conducted financial reviews of all departments in the hospital. During the review process, the head of the obstetrics unit proposed trying to increase the number of babies delivered in the department to make it more profitable. After reviewing the department’s financial statements for the previous month, the CEO discovered the unit delivered 540 babies that generated total costs of $3.132 million and total revenues of $2.754 million. The CEO raised the question as to why they would want to increase the number of deliveries when the unit was already losing $700 per delivery? How should the unit’s head respond to this concern? New Product Launch Advice Assume Compaq is scheduled to launch next month a new server at a cost of $5,500. This server will be competing against Dell’s version that was just introduced to the market. Dell’s server has basically the same features (and even a few more) for a cost of $4,500. To date, Compaq has invested more than $2.5 million in the development of its new server. What advice would you give Compaq on launching its new server, keeping in mind all the development money the company has already invested into the product? How to Produce? Several years ago, John Deere was about to begin building a capital-intensive factory to produce large, four-wheeldrive farm tractors. Then, grain prices dropped dramatically which reduced tractor demand. Deere management considered 1) stopping the construction of its own factory and, instead, 2) purchasing a Canadian company that could add to their tractor assembly capacity. Management recognized the company would have higher fixed costs, but lower marginal costs if it were to go ahead with construction of its own plant. Which course of action would you have recommended be pursued by Deere management? Lower Price to Sell More? Joe is the district sales manager for Agri Green. He has five sales representatives, each with their own geographical territory, reporting directly to him. One of his reps has noted it has become increasingly difficult to compete against other products with the company’s current stance on maintaining relatively high prices by industry standards. The rep has proposed permission to cut price by 10%. With current prices, the company’s profit margin is 25%. The sales rep is confident he/she could sell 50% more product with the 10% price reduction. Should Agri Green give the sales rep permission to sell at a 10% lower price? “Gentlemen, Stop Your Engines” Decker Truck Lines owns and operates about 600 semi tractor-trailers. Rising diesel fuel prices have been cutting into the company’s profit. Management is looking at alternative ways of reducing diesel fuel expenses. One strategy being considered is to offer drivers incentives (bonuses) to reduce idling time while out on the road. What specific information would be needed to implement such a plan and when would this plan result in increased profits for the company? Revenue/Cost Analysis Cy Shops’ manager has provided you with the following information for the business (q = units of product sold) TR = 44q – q2 TVC = 4q TFC = 120 The manager wants you to calculate the level of quantity sales that will result in the company a) breaking even, b) maximizing its profit, and c) maximizing its sales. What do you tell the manager? Costs of Production (Overview of Reality) Production costs are determined by 1) the productivity of inputs used by a business firm and 2) the prices paid for inputs used. The more productive the inputs are (i.e. the more efficient the production process is), the lower the costs of production will be. Likewise, lower input prices also result in lower costs of production. Cost Concepts SR and LR Cash and Noncash SR fixed & variable LR variable only Fixed and Variable Fixed don’t change w/output Variable vary w/output Cash = ‘explicit’ Noncash = ‘implicit’ = ‘opportunity’ foregone = ‘lost’ income Total & Average & Marginal TFC, TVC, TC AFC, AVC, ATC MC Opportunity Cost Examples Activity Opportunity Cost Work at home Lost wages Own & operate a business Lost wages Lost interest Own & operate farm land Lost rent Lost interest Own & operate machinery Lost interest Lost rent Attend college Lost wages Skip class/party Lost knowledge Lower grade Go to class/study Lost work Lost sleep Cost Concepts 1. Total = 2. Average = 3. Marginal = = total dollar cost associated with a given q of output dollar cost PER UNIT OF OUTPUT ADDITIONAL COST per unit of ADDITIONAL OUTPUT added cost of producing one more unit of output Cost Graphs Graphical Derivation of TVC from TP (L = variable input) 1. 2. 3. Multiply L by W to get TVC Rotate graph 90° counter clockwise Flip graph 180° Cost Graphs (cont’d) Cost Graphs (cont’d) General Cost Equations Cost Concept Average Total Fixed AFC = TFC/Q TFC = AFC · Q Variable AVC = TVC/Q TVC = AVC · Q Total ATC = TC/Q TC = ATC · Q TFC in Avg Cost Graph Total TVC in Avg Cost Graph TC in Avg Cost Graph Solving for TVC as function of q of output given production function equation: Step #1: Solve for L as a function of q given the production function equation (i.e. solve for the inverse equation) Step #2: In the TVC equation, TVC = wL, substitute the L as a function of q equation for L Calculating Cost Equations from Production Info Assume AFC = TFC/q = 1000/q q = 50L [L=(1/50)q = .02q] w = $20,000 TFC = $1,000 AVC = TVC/q = 400q/q = 400 ATC = AFC + AVC = 1000/q + 400 MC = Calculations TVC = w•L(q) = w (.02q) = (20,000)(.02q) = 400q TC = TFC + TVC = 1000 + 400q T C = 400 q Oil Production & Cost Questions 1. 2. If there are 44 gallons (output = Q) of oil per barrel (input = B), what is the corresponding production function equation? Given the price of a barrel of oil, what is the TVC and AVC equations for producing gallons of oil, and how do these changes with changes in the price of a barrel of oil? Review of some cost & production fn concept relationships MC TC Q AVC TVC WL Q WL Q Q W M PL W APL q f ( k , L ) SR production fn L = f(q) TVC=WL=wf(q) SR Profit Max (output) = TR – TC max /q = 0 TR/q - TC/q = 0 MR – MC = 0 MR = MC Optimal Output Level Profit-maximizing level of output A manager should keep producing additional output up to the point where the additional income equals the additional cost from the last unit MR = MC NOTE: Optimal Input Level (e.g. labor) MRP = MFC MPL • MR = w w MR = MR = MC M PL MRP vs MR MRP = additional revenue per additional unit of input MR = additional revenue per additional unit of output MFC vs MC MFC = additional cost per additional unit of input (= marginal factor cost) MC = additional cost per additional unit of output Profit Max Input Side = Profit Max Output Side Profit Max-Output Side (Alternative Cases) Case TR TC 1 Linear Linear 2 Linear Nonlinear 3 Nonlinear Linear 4 Nonlinear Nonlinear Profit Max Level of Output Nonlinear TR & Nonlinear TC Decreasing MR, Increasing MC The ‘Profit’ Equation = = = = = = = TR – TC TR – TVC - TFC PQ – (AVC)Q – TFC (P-AVC)Q – TFC (P-AVC)Q – (AFC)Q (P-AVC-AFC)Q (P-ATC)Q P Setter π P Taker π Four Math Cases/Examples of Profit Maximization Case TR MR TFC TVC TC MC 1 10q 10 120 4q 120+4q 4 2 10q 10 120 .1q2 120+.1q2 .2q 3 44q-q2 44-2q 120 4q 120+4q 4 4 44q-q2 44-2q 120 .1q2 120+.1q2 .2q Breakeven (B.E.) Analysis =0 TR – TVC – TFC = 0 PQ – (AVC)Q – TFC = 0 equation w/4 variables (P, Q, AVC, TFC) given any 3, solve for 4th B.E. Q = TFC/(P-AVC) B.E. P = AVC + AFC Note: analysis = desired amt Case #1 – Breakeven Q TR = TC 10q = 120 + 4q 6q = 120 q = 20 TR Check: = 10q = 10(20) = 200 - TFC -120 -120 -120 - TVC -4q -4 (20) -80 = = = =0 B.E. Q due to P to $8 (From $0) TR = TC 8q = 120 + 4q 4q = 120 q = 30 Case #1 Max MR = 10 > MC = 4 Keep increasing q to increase profit TR for a P Setting Firm (sets P but Q sold is variable) e.g. P2 < P1 $ TR1 (P = P1) TR2 (P = P2) Q Case #2 - Max MR = MC 10 = .2q Max = q* = 50 TR = 10q = 10(50) = 500 - TFC -120 -120 -120 - TVC -.1q2 -.1(50)2 -250 = 130 Quadratic Formula = formula that finds values of X that result in a quadratic equation’s value =0 Equation: aX2 + bX + c = 0 Formula: X = b and 2a ( b 4 ac ) 2 Case #2 Breakeven Q TR = TC 10q = 120 + .1q2 .1q2 – 10q + 120 = 0 a=.1, b=-10, c=120 q ( 10 ) 2 2 (.1) 10 100 48 .2 10 52 .2 Check: q=86.06TR-TC=10(86.06)-120-.1(86.06)2 = 860.6-120-740.6=0 Q=13.95TR-TC=10(13.95)-120-.1(13.95)2 = 139.50-120-19.50=0 ( 10 ) 4 (.1)(120 ) 10 7 .211 .2 86 .06 and 13.95 Stay-even Analysis => Determining the volume required to offset a change in costs, prices, or other factors. => Set profit equations equal and solve for unknown. => Π1 = Π2 => P1Q1 – AVC1Q1 – TFC = P2Q2 – AVC2 Q2 TFC For which of the following situations would the farmer produce corn in the SR? A. Price of corn = $2.00, AVC = $1, TFC = $100 B. Price of corn = $1.75, TVC = $1.50Q, TFC = $100 C. Price of corn = $2.50, TVC = $2.75Q, TFC = $100 D. Price of corn = $2.00, AVC = $1.00, TFC = $400 E. Price of corn = $1.75, TVC = $1.50Q, TFC = $275 Produce or Shut Down in SR? Let p = max by producing = TR – TVC – TFC SD = Max if shut down = - TFC Produce if p > SD TR - TVC – TFC > -TFC TR – TVC > 0 TR > TVC TR/q > TVC/q P > AVC Shut Down Profits Output q produced by a Ptaking firm Shut Down Graph Derivation of Market S (Qs) from Firm S (qf ) P = MC P = 5 + 10qf 10q* = -5 + P qf = -1/2 + .1P qs = 100qf = -50 + 10P 10P = 50 + Qs P = 5 + .1Qs LR Output P Disequilibrium LR Output P Equilibrium LR Break Even ? While firms may stay in business in the SR even though they are losing money, in the LR firms need to make money. In LR, firms need to cover all costs and have a NPV > 0. Real-World Cost Analysis Complexities 1. 2. 3. 4. Need to calculate costs of multiple variable and multiple fixed inputs. Some individual inputs may have fixed and variable components. Some inputs are use to produce multiple outputs, so need to allocate or assign input costs across products. Calculating input costs often more difficult than a simple input price x input quantity calculation (e.g. how to value/cost depreciable inputs).