FECLecture6 - Financial Engineering Club at Illinois

advertisement

FEC

FINANCIAL ENGINEERING CLUB

PRICING EUROPEAN OPTIONS

AGENDA

Stochastic Processes

Stochastic Calculus

Black-Scholes Equation

STOCHASTIC PROCESSES

A SIMPLE PROCESS

Let 𝑋𝑡 = 1 with probability 𝑝 = 0.5 and 𝑋𝑡 = −1 with probability 1 − 𝑝 = .5 (for

all t) and consider the symmetric random walk, 𝑀𝑡 = 𝑡𝑖=0 𝑋𝑖

Assume that 𝑋𝑖 ’s are i.i.d.

𝑋0 = 0

Both 𝑋 = (𝑋𝑡 : 𝑡 ∈ ℕ ∪ 0 ) and 𝑀 = (𝑀𝑡 : 𝑡 ∈ ℕ ∪ 0 ) are random processes

A random/stochastic process is (vaguely) just a collection of random variables

They could be i.i.d.

They may be correlated—they may even have different distributions

There is no general theory/application for random processes until more context and

structure is applied

A SIMPLE PROCESS

Note that 𝑋𝑡 ’s are iid with 𝐸 𝑋𝑡 = .5 ∗ 1 + .5 ∗ −1 = 0

, ∀𝑡 and

Var 𝑋𝑡 = 𝐸 𝑋𝑡 2 = .5 ∗ 1

Then 𝐸 𝑀𝑡 = 𝐸

𝑡

𝑖=0 𝑋𝑖

Var 𝑀𝑡 = Var

=

2

+ .5 ∗ −1

𝑡

𝑖=0 𝐸[𝑋𝑖 ]

𝑡

𝑖=0 𝑋𝑖

=

2

= 1, ∀𝑡

= 0 and

𝑡

𝑖=0 𝑉𝑎𝑟(𝑋𝑖 )

=𝑡

A SIMPLE PROCESS

Generally, we care about the increments of a process:

𝑡

𝑀𝑡 − 𝑀𝑠 =

𝑋𝑖

𝑖=𝑠+1

So that 𝐸 𝑀𝑡 − 𝑀𝑠 = 𝐸

𝑡

𝑖=𝑠+1 𝑋𝑖

= 0 , and 𝑉𝑎𝑟 𝑀𝑡 − 𝑀𝑠 = 𝑉𝑎𝑟

𝑡

𝑖=𝑠+1 𝑋𝑖

=𝑡−𝑠

The symmetric random walk is defined to have independent increments

A process X is said to have independent increments if, for 0 = 𝑡0 < 𝑡1 < … < 𝑡𝑚 the increments

𝑋𝑡1 − 𝑋𝑡0 , 𝑋𝑡2 − 𝑋𝑡1 , … , 𝑋𝑡𝑚 − 𝑋𝑡𝑚−1 are independent

QUADRATIC VARIATION

Define the quadratic variation of a sequence 𝑋 up to time 𝑡 as [𝑋, 𝑋]𝑡

= 𝑡𝑖=1(𝑋𝑖 − 𝑋𝑖−1 )2

This is a path-dependent measure of variation (thus it is random)

For some unique processes, it may not be random

For our symmetric random walk, note that a one step increment, 𝑀𝑖 − 𝑀𝑖−1 , is either 1

or −1. Thus

[𝑀, 𝑀]𝑡 =

𝑡

(𝑀𝑖 − 𝑀𝑖−1

𝑖=1

)2

=

𝑡

𝑖=1

1=𝑡

SCALED SYMMETRIC RANDOM WALK

Let 𝑊

𝑛

𝑡 =

𝑀𝑛𝑡

𝑛

be a scaled symmetric random walk

𝑛

If 𝑛 ∗ 𝑡 is not an integer, 𝑊

integers of 𝑛 ∗ 𝑡

𝑡 is interpolated between the two neighboring

Like a the symmetric r.w., the scaled symmetric r.w. has independent increments

𝐸𝑊

𝑛

𝑡 −𝑊

[𝑊 (𝑛) , 𝑊 (𝑛) ]𝑡

=

𝑛

𝑠

𝑛𝑡

𝑖=1

=0

𝑊

𝑛

𝑉𝑎𝑟 𝑊

𝑖

𝑛

−𝑊

𝑛

𝑖−1

𝑛

𝑛

2

𝑡 −𝑊

=

𝑛𝑡

𝑖=1

𝑛

𝑠

𝑋𝑖 2

𝑛

=𝑡−𝑠

=

𝑛𝑡 1

𝑖=1 𝑛

=𝑡

BROWNIAN MOTION

By the central limit theorem 𝑊

Brownian motion

𝑛

𝑡

𝑎.𝑠.

𝑊 𝑡 as 𝑛 → +∞, where 𝑊 𝑡 is a

Properties of B.M.

1) 𝑃 𝑊 0 = 0 = 1

2) 𝑊 has independent increments

3) 𝑊 𝑡 − 𝑊 𝑠 ~𝑁(0, 𝜎 2 𝑡 − 𝑠 ) for 𝑡 ≥ 𝑠 (we have been using B.M. with 𝜎 = 1)

4) 𝑃 𝑊 𝑡 𝑖𝑠 𝑐𝑜𝑛𝑡𝑖𝑛𝑢𝑜𝑢𝑠 = 1

BROWNIAN MOTION

Ex) What is 𝐸 𝑊(𝑡) 𝑊(𝑠)] assuming 𝑠 ≤ 𝑡 (suppose W has parameter σ)

𝐸𝑊 𝑡

𝑊 𝑠 ] = 𝐸 (𝑊(𝑡) − 𝑊 𝑠 ) + 𝑊 𝑠 𝑊 𝑠 ]

= 𝐸 𝑊 𝑡 − 𝑊 𝑠 ) |𝑊 𝑠 ] + 𝐸[𝑊(𝑠) 𝑊 𝑠 ]

=

0

+

𝑊(𝑠) = 𝑊(𝑠)

Ex) What is 𝑅𝑊 𝑠, 𝑡 = 𝐸 𝑊 𝑠 𝑊(𝑡) ?

𝑅𝑊 𝑠, 𝑡 = 𝐸 𝑊 𝑠 𝑊(𝑡) = 𝐸 𝑊 𝑠 − 𝑊 0

= 𝐸

𝑊 𝑠 −𝑊 0

= 𝑠𝜎 2 + 0 ∗ 0 = 𝑠𝜎 2

2

+ 𝐸 𝑊 𝑠 −𝑊 0

𝑊𝑡 − 𝑊𝑠 , 𝑊𝑠 independent

→ 𝑊 is a martingale

𝑊 𝑡 −𝑊 𝑠 +𝑊 𝑠 −𝑊 0

𝑊 𝑡 −𝑊 𝑠

BROWNIAN MOTION

Note that B.M. is a function and not a sequence of random

variables and so our definition of quadratic variation must be

altered:

Let 𝑃 be a partition of the interval 0, 𝑇 : 𝑡0 , 𝑡1 , … , 𝑡𝑛 with 0

= 𝑡0 < 𝑡1 < … < 𝑡𝑛 = 𝑇. Let 𝑃 = max 𝑡𝑗+1 − 𝑡𝑗 . For a

𝑗

function 𝑓 𝑡 , the quadratic variation of 𝑓 up to time T is

𝑓, 𝑓 𝑇 = lim

𝑃 →0

𝑛−1

𝑗=0

[𝑓 𝑡𝑗+1 − 𝑓(𝑡𝑗 )]2

BROWNIAN MOTION AND QUADRATIC

VARIATION

Note if 𝑓 has a continuous derivative,

𝑛−1

𝑗=0 [𝑓

𝑡𝑗+1 − 𝑓(𝑡𝑗

)]2

Then 𝑓, 𝑓 𝑇 ≤ lim

=

𝑛−1

𝑗=0

≤

𝑃

𝑃 →0

𝑃

𝑓′

𝑛−1

𝑗=0

𝑛−1

𝑗=0

= lim 𝑃 ∗ lim

𝑃 →0

=0 ∗

𝑃 →0

𝑇 ′

|𝑓

0

2

𝑥𝑗∗

𝑡𝑗+1 − 𝑡𝑗

2

𝑓 ′ 𝑥𝑗∗

𝑓′

𝑥𝑗∗

𝑛−1

𝑗=0

2

𝑡 | 𝑑𝑡 = 0

2

2

𝑓′

(by MVT)

𝑡𝑗+1 − 𝑡𝑗

𝑡𝑗+1 − 𝑡𝑗

𝑥𝑗∗

2

𝑡𝑗+1 − 𝑡𝑗

BROWNIAN MOTION AND QUADRATIC

VARIATION

For a B.M. 𝑊(𝑡), consider the random variable 𝑊 𝑡𝑗+1 − 𝑊 𝑡𝑗

𝐸

𝑉𝑎𝑟

𝑊 𝑡𝑗+1 − 𝑊 𝑡𝑗

𝑊 𝑡𝑗+1 − 𝑊 𝑡𝑗

− 2(𝑡𝑗+1 − 𝑡𝑗 ) 𝐸

2

2

= 𝑡𝑗+1 − 𝑡𝑗

2

=𝐸

𝑊 𝑡𝑗+1 − 𝑊 𝑡𝑗

𝑊 𝑡𝑗+1 − 𝑊 𝑡𝑗

2

2 −(𝑡

𝑗+1 − 𝑡𝑗 )

2

= 𝐸

𝑊 𝑡𝑗+1 − 𝑊 𝑡𝑗

4

+ (𝑡𝑗+1 − 𝑡𝑗 )2 = 3(𝑡𝑗+1 − 𝑡𝑗 )2 − 2(𝑡𝑗+1 − 𝑡𝑗 )2 + (𝑡𝑗+1 − 𝑡𝑗 )2 = 𝟐(𝒕𝒋+𝟏 − 𝒕𝒋 )𝟐

BROWNIAN MOTION AND QUADRATIC

VARIATION

𝑊 𝑡𝑗+1 −𝑊 𝑡𝑗

. Choose 𝑛 large so that 𝑡𝑗

𝑡𝑗+1 − 𝑡𝑗

2

𝑌𝑗+1

2

𝑡𝑗+1 − 𝑊(𝑡𝑗 )] = 𝑇

𝑛

Let 𝑌𝑗+1 =

[𝑊

Then 𝑊, 𝑊 𝑇 = lim

lim

𝑛→∞

2

𝑛−1 𝑌𝑗+1

𝑗=0 𝑛

𝑃 →0

𝑛−1

𝑗=0 [𝑊

𝑡𝑗+1 − 𝑊(𝑡𝑗

=

)]2

𝑗𝑇

. Then 𝑡𝑗+1

𝑛

= lim 𝑇 ∗

𝑛→∞

= 1 by LLN.

Conclusion 𝑊, 𝑊 𝑇 = lim

𝑃 →0

𝒅𝑾 𝒕 𝒅𝑾 = 𝒅𝒕

Similarly, 𝑑𝑡𝑑𝑡 = 0 and 𝑑𝑊𝑑𝑡 = 0

𝑛−1

𝑗=0 [𝑊

𝑡𝑗+1 − 𝑊(𝑡𝑗 )]2 = 𝑇

− 𝑡𝑗 =

2

𝑛−1 𝑌𝑗+1

𝑗=0 𝑛

𝑇

and thus

𝑛

= 𝑇 since

STOCHASTIC CALCULUS

ITO INTEGRAL

𝑇

𝑊

0

Let 𝑊

𝑡 𝑑𝑊 𝑡 = lim

𝑛→∞

𝑗𝑇

𝑛

𝑗𝑇

𝑛−1

𝑊

𝑗=0

𝑛

= 𝑊𝑗 and note that

1

2

𝑊

𝑗+1 𝑇

𝑛

𝑛−1

𝑗=0 (𝑊𝑗+1

−𝑊

=

=

=

𝑛−1

𝑗=0 𝑊𝑗

1

2

𝑊𝑗+1 − 𝑊𝑗 = 𝑊𝑛2 −

1

2

1 𝑛−1

1 𝑛−1

𝑛−1

2

2

𝑊

−

𝑊

𝑊

+

𝑊

𝑗

𝑗+1

𝑗=0

2 𝑗=0 𝑗+1

2 𝑗=0 𝑗+1

1 𝑛

1 𝑛−1

𝑛−1

2

2

𝑊

−

𝑊

𝑊

+

𝑊𝑗+1

𝑗

𝑗+1

𝑗=1

𝑗

𝑗=0

𝑗=0

2

2

1

1 𝑛−1

1 𝑛−1

𝑛−1

2

2

𝑊𝑛2 +

𝑊

−

𝑊

𝑊

+

𝑊𝑗+1

𝑗

𝑗+1

𝑗=0

𝑗

𝑗=0

𝑗=0

2

2

2

1

𝑊𝑛2 + 𝑛−1

𝑊𝑗2 − 𝑛−1

𝑗=0

𝑗=0 𝑊𝑗 𝑊𝑗+1

2

1

𝑊𝑛2 + 𝑛−1

𝑗=0 𝑊𝑗 𝑊𝑗 − 𝑊𝑗+1

2

− 𝑊𝑗 )2 =

=

Thus

𝑗𝑇

𝑛

𝑛−1

𝑗=0 (𝑊𝑗+1

− 𝑊𝑗 )2

ITO INTEGRAL

𝑇

𝑊

0

𝑡 𝑑𝑊 𝑡 = lim

𝑛→∞

=

𝑗𝑇

𝑛−1

𝑊

𝑗=0

𝑛

1

lim 𝑊 2

𝑛→∞ 2

1

2

= 𝑊2 𝑇 −

𝑇 −

1

2

1

2

𝑊

𝑛−1

𝑗=0

𝑗+1 𝑇

𝑛

𝑊

−𝑊

𝑗+1 𝑇

𝑛

𝑗𝑇

𝑛

−𝑊

𝑗𝑇

𝑛

2

𝑊, 𝑊 𝑇

Quadratic Variation

1

2

= 𝑊2 𝑇 −

1

𝑇

2

ITO’S LEMMA

We seek an approximation 𝑓 𝑇, 𝑊 𝑇

− 𝑓 0, 𝑊 0

By Taylor’s formula we have 𝑓 𝑡𝑗+1 , 𝑥𝑗+1 − 𝑓 𝑡𝑗 , 𝑥𝑗 = 𝑓𝑡 𝑡𝑗 , 𝑥𝑗 𝑡𝑗+1 − 𝑡𝑗 + 𝑓𝑥 𝑡𝑗 , 𝑥𝑗 𝑥𝑗+1

ITO’S LEMMA

𝑓 𝑇, 𝑊 𝑇

+

+

− 𝑓 0, 𝑊 0

𝑛−1

𝑗=0 𝑓𝑥 𝑡𝑗 , 𝑊 𝑡𝑗

𝑛−1

𝑗=0 𝑓𝑥𝑡 𝑡𝑗 , 𝑊 𝑡𝑗

=

𝑛−1

𝑗=0 𝑓

𝑡𝑗+1 , 𝑊 𝑡𝑗+1

𝑊 𝑡𝑗+1 − 𝑊(𝑡𝑗 ) +

1

2

− 𝑓 𝑡𝑗 , 𝑊 𝑡𝑗

𝑛−1

𝑗=0 𝑓𝑥𝑥

𝑡𝑗+1 − 𝑡𝑗 𝑊 𝑡𝑗+1 − 𝑊(𝑡𝑗 ) +

𝑡𝑗 , 𝑊 𝑡𝑗

1

2

𝑛−1

𝑗=0 𝑓𝑡𝑡

=

𝑛−1

𝑗=0 𝑓𝑡

𝑡𝑗 , 𝑊 𝑡𝑗

𝑊(𝑡𝑗+1 ) − 𝑊(𝑡𝑗 )

𝑡𝑗 , 𝑊 𝑡𝑗

2

𝑡𝑗+1 − 𝑡𝑗

𝑡𝑗+1 ) − 𝑊(𝑡𝑗 )

2

Now taking limits, lim 𝑓 𝑇, 𝑊 𝑇 − 𝑓 0, 𝑊 0 = 𝑓 𝑇, 𝑊 𝑇 − 𝑓 0, 𝑊 0

𝑛 →∞ 𝑇

𝑇

𝑇

= 0 𝑓𝑡 𝑡, 𝑊(𝑡) 𝑑𝑡 + 0 𝑓𝑥 𝑡, 𝑊 𝑡 𝑑𝑊 𝑡 + 0 𝑓𝑥𝑥 𝑡, 𝑊 𝑡 𝑑𝑡 since 𝑑𝑡𝑑𝑊 𝑡 = 0 and 𝑑𝑡𝑑𝑡 = 0

In differential form, Ito’s formula is 𝑑𝑓(𝑡, 𝑊 𝑡 = 𝑓𝑡 𝑡, 𝑊 𝑡 𝑑𝑡 + 𝑓𝑥 𝑡, 𝑊 𝑡 𝑑𝑊 𝑡

1

1

+ 2 𝑓𝑥𝑥 𝑡, 𝑊 𝑡 𝑑𝑊 𝑡 𝑑𝑊 𝑡 + 𝑓𝑥𝑡 𝑡, 𝑊 𝑡 𝑑𝑊 𝑡 𝑑𝑡 + 2 𝑓𝑡𝑡 𝑡, 𝑊 𝑡 𝑑𝑡𝑑𝑡

with the last two terms cancelling out to zero

ITO’S LEMMA

Ex) Suppose 𝑓 𝑡, 𝑥 = 𝑡𝑥 2 . What is 𝑑𝑓(𝑡, 𝑊 𝑡 )?

𝑓𝑡 𝑡, 𝑥 = 𝑥 2

𝑓𝑥 𝑡, 𝑥 = 2𝑡𝑥

𝑓𝑥𝑥 𝑡, 𝑥 = 2𝑡

Then 𝑑𝑓 𝑡, 𝑊 𝑡

= 𝑊 2 𝑡 𝑑𝑡 + 2𝑡𝑊 𝑡 𝑑𝑊 𝑡 +

1

2𝑡

2

𝑑𝑊 𝑡

2

= 𝑾𝟐 (𝒕)

ITO’S LEMMA

Ex) Suppose 𝑓 𝑡, 𝑥 = sin 𝑡𝑥 . What is 𝑑𝑓(𝑡, 𝑊 𝑡 )?

𝑓𝑡 𝑡, 𝑥 = 𝑥 ∗ cos 𝑡𝑥

𝑓𝑥 𝑡, 𝑥 = 𝑡 ∗ cos(𝑡𝑥)

𝑓𝑥𝑥 𝑡, 𝑥 = −𝑡 2 ∗ sin 𝑡𝑥

Then 𝑑𝑓 𝑡, 𝑊 𝑡 = (𝑥 ∗ cos 𝑡𝑥 )𝑑𝑡 + 𝑡 ∗ cos 𝑡𝑥 𝑑𝑊 𝑡 +

∗ 𝐜𝐨𝐬 𝒕𝒙 − 𝒕𝟐 ∗ 𝐬𝐢𝐧 𝒕𝒙 )𝒅𝒕 + 𝒕 ∗ 𝐜𝐨𝐬 𝒕𝒙 𝒅𝑾 𝒕

−𝑡 2

∗ sin 𝑡𝑥

𝑑𝑊 𝑡

2

= (𝒙

ITO’S LEMMA

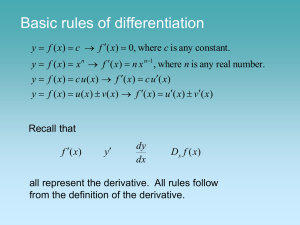

More generally, if 𝑋 𝑡 is a stochastic process

𝑑𝑓 𝑡, 𝑋 𝑡

1

= 𝑓𝑡 𝑡, 𝑋 𝑡 𝑑𝑡 + 𝑓𝑥 𝑡, 𝑋 𝑡 𝑑𝑋 𝑡 + 𝑓𝑥𝑥 𝑡, 𝑋 𝑡

2

𝑑𝑋 𝑡

2

We have been using Ito’s formula to construct stochastic differential equations (SDE’s)—that is,

differential equations with a random term.

Consider the SDE: 𝑑𝑋 𝑡 = 𝜎 𝑡 𝑑𝑊 𝑡 + 𝛼 𝑡 −

If 𝑆 𝑡 = 𝑆 0 exp 𝑋 𝑡 , what is 𝑑𝑆(𝑡)?

1 2

𝜎 (𝑡)

2

𝑑𝑡

ITO’S LEMMA

Here, 𝑆 𝑡 = 𝑓 𝑡, 𝑥 = 𝑆 0 exp 𝑥

Note that this is actually just a function of a single variable x

𝑓𝑡 𝑡, 𝑥 = 0

𝑓𝑥 𝑡, 𝑥 = 𝑆 0 exp{𝑥}

𝑓𝑥𝑥 𝑡, 𝑥 = 𝑆 0 exp{𝑥}

Then 𝑑𝑆 𝑡 = 𝑆 0 𝑒 𝑋

𝑡

𝑑𝑋 𝑡 +

1

𝑆

2

0 𝑒𝑋

𝑡

𝑑𝑋 𝑡

2

ITO’S LEMMA

Note that 𝑑𝑋 𝑡

2

= 𝜎 𝑡 𝑑𝑊 𝑡 + 𝛼 𝑡 −

1 2

𝜎

2

𝑡

𝑑𝑡

2

=

𝜎2

𝑡 𝑑𝑊 𝑡

2

+ 2𝜎 𝑡 𝛼 𝑡

BLACK-SCHOLES EQUATION

BLACK-SCHOLES

Let the underlying follow this SDE with constant rate and volatility: 𝑑𝑆 𝑡 = 𝛼𝑆 𝑡 𝑑𝑡 + 𝜎𝑆 𝑡 𝑑𝑊 𝑡

The only variable inputs to an options price are the time until maturity and the price of the stock, so

we start by considering the function

𝑐(𝑡, 𝑆(𝑡))

Ito’s formula tells us 𝑑𝑐 𝑡, 𝑆 𝑡

= 𝑐𝑡 𝑡, 𝑆 𝑡 𝑑𝑡 + 𝑐𝑥 𝑡, 𝑆 𝑡 𝑑𝑆 𝑡 +

1

1

𝑐

2 𝑥𝑥

𝑡, 𝑆 𝑡 𝑑𝑆 𝑡 𝑑𝑆 𝑡

= 𝑐𝑡 𝑡, 𝑆 𝑡 𝑑𝑡 + 𝑐𝑥 𝑡, 𝑆 𝑡 (𝛼𝑆 𝑡 𝑑𝑡 + 𝜎𝑆 𝑡 𝑑𝑊 𝑡 ) + 𝑐𝑥𝑥 𝑡, 𝑆 𝑡 𝜎 2 𝑆 2 𝑡 𝑑𝑡

2

1 2

= 𝑐𝑡 𝑡, 𝑆 𝑡 + 𝛼𝑆 𝑡 𝑐𝑥 𝑡, 𝑆 𝑡 + 𝜎 𝑡 𝑆 2 𝑡 𝑐𝑥𝑥 𝑡, 𝑆 𝑡 𝑑𝑡 + 𝜎𝑆(𝑡)𝑐𝑥 𝑡, 𝑆 𝑡 𝑑𝑊(𝑡)

2

BLACK SCHOLES

We need to take the present value of this so we consider the function:

𝑒 −𝑟𝑡 𝑐(𝑡, 𝑆(𝑡))

= −𝑟𝑒 −𝑟𝑡 𝑐 𝑡, 𝑆 𝑡 𝑑𝑡 + 𝑒 −𝑟𝑡 𝑑𝑐 𝑡, 𝑆 𝑡

1

= 𝑒 −𝑟𝑡 −𝑟𝑐 𝑡, 𝑆 𝑡 + 𝑐𝑡 𝑡, 𝑆 𝑡 + 𝛼𝑆 𝑡 𝑐𝑥 𝑡, 𝑆 𝑡 + 𝜎 2 𝑡 𝑆 2 𝑡 𝑐𝑥𝑥 𝑡, 𝑆 𝑡

2

−𝑟𝑡

+ 𝑒 𝜎𝑆(𝑡)𝑐𝑥 𝑡, 𝑆 𝑡 𝑑𝑊(𝑡)

Again, by Ito’s formula 𝑑𝑐 𝑡, 𝑆 𝑡

𝑑𝑡

BLACK SCHOLES

Meanwhile, we try to replicate the option contract as we did in the binomial option pricing model. That is, by

investing some money in a stock position and some in some money market account (a bond):

Let 𝑋 𝑡 be the value of our portfolio at time 𝑡

At time 𝑡 we invest a necessary amount ∆ 𝑡 into the stock and the remainder, 𝑋 𝑡 − ∆(𝑡), into the money

market instrument.

Then we gain ∆ 𝑡 𝑑𝑆(𝑡) from our investment in the stock

And 𝑟 𝑋 𝑡 − ∆ 𝑡 𝑑𝑡 from our investment in the money market instrument

Thus 𝑑𝑋 𝑡 = ∆ 𝑡 𝑑𝑆 𝑡 + 𝑟 𝑋 𝑡 − ∆ 𝑡 𝑑𝑡 = ∆ 𝑡 𝛼𝑆 𝑡 𝑑𝑡 + 𝜎𝑆 𝑡 𝑑𝑊 𝑡

By Ito’s lemma, the differential of the PV(stock) is 𝑑 𝑒 −𝑟𝑡 𝑆 𝑡

+ 𝑟 𝑋 𝑡 − ∆ 𝑡 𝑆 𝑡 𝑑𝑡

= 𝛼 − 𝑟 𝑒 −𝑟𝑡 𝑆 𝑡 𝑑𝑡 + 𝜎𝑒 −𝑟𝑡 𝑆 𝑡 𝑑𝑊 𝑡

Likewise, the differential of our discounted portfolio is 𝑑 𝑒 −𝑟𝑡 𝑋 𝑡

+ ∆ 𝑡 𝜎𝑒 −𝑟𝑡 𝑆 𝑡 𝑑𝑊 𝑡

= ∆ 𝑡 𝛼 − 𝑟 𝑒 −𝑟𝑡 𝑆 𝑡 𝑑𝑡

BLACK SCHOLES

At each time 𝑡, we want the replicating portfolio 𝑋 𝑡 to match the value of the option 𝑐 𝑡, 𝑆 𝑡

We do this by ensuring that 𝑑 𝑒 −𝑟𝑡 𝑋 𝑡

= 𝑑 𝑒 −𝑟𝑡 𝑐 𝑡, 𝑆 𝑡

∆ 𝑡 𝛼 − 𝑟 𝑒 −𝑟𝑡 𝑆 𝑡 𝑑𝑡 + ∆ 𝑡 𝜎𝑒 −𝑟𝑡 𝑆 𝑡 𝑑𝑊 𝑡

= 𝑒 −𝑟𝑡 −𝑟𝑐 𝑡, 𝑆 𝑡

+ 𝑐𝑡 𝑡, 𝑆 𝑡

+ 𝑒 −𝑟𝑡 𝜎𝑆(𝑡)𝑐𝑥 𝑡, 𝑆 𝑡 𝑑𝑊(𝑡)

+ 𝑟𝑆 𝑡 𝑐𝑥 𝑡, 𝑆 𝑡

+

for all 𝑡 and that 𝑋 0 = 𝑐 0, 𝑆 0 :

1 2

𝜎 𝑡 𝑆 2 𝑡 𝑐𝑥𝑥 𝑡, 𝑆 𝑡

2

𝑑𝑡

BLACK SCHOLES

At each time 𝑡, we want the replicating portfolio 𝑋 𝑡 to match the value of the option 𝑐 𝑡, 𝑆 𝑡

We do this by ensuring that 𝑑 𝑒 −𝑟𝑡 𝑋 𝑡

= 𝑑 𝑒 −𝑟𝑡 𝑐 𝑡, 𝑆 𝑡

∆ 𝑡 𝛼 − 𝑟 𝑆 𝑡 𝑑𝑡 + ∆ 𝑡 𝜎𝑆 𝑡 𝑑𝑊 𝑡

= −𝑟𝑐 𝑡, 𝑆 𝑡

+ 𝑐𝑡 𝑡, 𝑆 𝑡

+ 𝛼𝑆 𝑡 𝑐𝑥 𝑡, 𝑆 𝑡

+

for all 𝑡 and that 𝑋 0 = 𝑐 0, 𝑆 0 :

1 2

𝜎 𝑡 𝑆 2 𝑡 𝑐𝑥𝑥 𝑡, 𝑆 𝑡

2

𝑑𝑡 + 𝜎𝑆(𝑡)𝑐𝑥 𝑡, 𝑆 𝑡 𝑑𝑊(𝑡)

BLACK-SCHOLES

At each time 𝑡, we want the replicating portfolio 𝑋 𝑡 to match the value of the option 𝑐 𝑡, 𝑆 𝑡

We do this by ensuring that 𝑑 𝑒 −𝑟𝑡 𝑋 𝑡

= 𝑑 𝑒 −𝑟𝑡 𝑐 𝑡, 𝑆 𝑡

∆ 𝑡 𝛼 − 𝑟 𝑆 𝑡 𝑑𝑡 + ∆ 𝒕 𝝈𝑺 𝒕 𝒅𝑾 𝒕

= −𝑟𝑐 𝑡, 𝑆 𝑡

+ 𝑐𝑡 𝑡, 𝑆 𝑡

+ 𝛼𝑆 𝑡 𝑐𝑥 𝑡, 𝑆 𝑡

Need ∆ 𝒕 𝝈𝑺 𝒕 = 𝝈𝑺 𝒕 𝒄𝒙 𝒕, 𝑺 𝒕

+

for all 𝑡 and that 𝑋 0 = 𝑐 0, 𝑆 0 :

1 2

𝜎 𝑡 𝑆 2 𝑡 𝑐𝑥𝑥 𝑡, 𝑆 𝑡

2

→ ∆ 𝒕 = 𝒄𝒙 𝒕, 𝑺 𝒕

𝑑𝑡 + 𝝈𝑺(𝒕)𝒄𝒙 𝒕, 𝑺 𝒕 𝒅𝑾(𝒕)

BLACK-SCHOLES

At each time 𝑡, we want the replicating portfolio 𝑋 𝑡 to match the value of the option 𝑐 𝑡, 𝑆 𝑡

We do this by ensuring that 𝑑 𝑒 −𝑟𝑡 𝑋 𝑡

= 𝑑 𝑒 −𝑟𝑡 𝑐 𝑡, 𝑆 𝑡

∆ 𝒕 𝜶 − 𝒓 𝑺 𝒕 𝒅𝒕 + ∆ 𝑡 𝜎𝑆 𝑡 𝑑𝑊 𝑡

= −𝒓𝒄 𝒕, 𝑺 𝒕

+ 𝒄𝒕 𝒕, 𝑺 𝒕

+ 𝜶𝑺 𝒕 𝒄𝒙 𝒕, 𝑺 𝒕

Need ∆ 𝑡 𝜎𝑆 𝑡 = 𝜎𝑆 𝑡 𝑐𝑥 𝑡, 𝑆 𝑡

+

for all 𝑡 and that 𝑋 0 = 𝑐 0, 𝑆 0 :

𝟏 𝟐

𝝈 𝒕 𝑺𝟐 𝒕 𝒄𝒙𝒙 𝒕, 𝑺 𝒕

𝟐

𝒅𝒕 + 𝜎𝑆(𝑡)𝑐𝑥 𝑡, 𝑆 𝑡 𝑑𝑊(𝑡)

→ ∆ 𝑡 = 𝑐𝑥 𝑡, 𝑆 𝑡

1

Need∆ 𝑡 𝛼 − 𝑟 𝑆 𝑡 = −𝑟𝑐 𝑡, 𝑆 𝑡 + 𝑐𝑡 𝑡, 𝑆 𝑡 + 𝛼𝑆 𝑡 𝑐𝑥 𝑡, 𝑆 𝑡 + 2 𝜎 2 𝑡 𝑆 2 𝑡 𝑐𝑥𝑥 𝑡, 𝑆 𝑡

BLACK-SCHOLES

At each time 𝑡, we want the replicating portfolio 𝑋 𝑡 to match the value of the option 𝑐 𝑡, 𝑆 𝑡

We do this by ensuring that 𝑑 𝑒 −𝑟𝑡 𝑋 𝑡

= 𝑑 𝑒 −𝑟𝑡 𝑐 𝑡, 𝑆 𝑡

∆ 𝒕 𝜶 − 𝒓 𝑺 𝒕 𝒅𝒕 + ∆ 𝑡 𝜎𝑆 𝑡 𝑑𝑊 𝑡

= −𝒓𝒄 𝒕, 𝑺 𝒕

+ 𝒄𝒕 𝒕, 𝑺 𝒕

+ 𝜶𝑺 𝒕 𝒄𝒙 𝒕, 𝑺 𝒕

Need ∆ 𝑡 𝜎𝑆 𝑡 = 𝜎𝑆 𝑡 𝑐𝑥 𝑡, 𝑆 𝑡

Need 𝑐𝑥 𝑡, 𝑆 𝑡

𝟏 𝟐

𝝈 𝒕 𝑺𝟐 𝒕 𝒄𝒙𝒙 𝒕, 𝑺 𝒕

𝟐

𝒅𝒕 + 𝜎𝑆(𝑡)𝑐𝑥 𝑡, 𝑆 𝑡 𝑑𝑊(𝑡)

→ ∆ 𝑡 = 𝑐𝑥 𝑡, 𝑆 𝑡

𝛼 − 𝑟 𝑆 𝑡 = −𝑟𝑐 𝑡, 𝑆 𝑡

Simplifying this we need, 𝑟𝑐 𝑡, 𝑆 𝑡

+

for all 𝑡 and that 𝑋 0 = 𝑐 0, 𝑆 0 :

+ 𝑐𝑡 𝑡, 𝑆 𝑡

= 𝑐𝑡 𝑡, 𝑆 𝑡

+ 𝛼𝑆 𝑡 𝑐𝑥 𝑡, 𝑆 𝑡

+ 𝑟𝑆 𝑡 𝑐𝑥 𝑡, 𝑆 𝑡

1

+

1 2

𝜎

2

𝑡 𝑆 2 𝑡 𝑐𝑥𝑥 𝑡, 𝑆 𝑡

+ 2 𝜎 2 𝑡 𝑆 2 𝑡 𝑐𝑥𝑥 𝑡, 𝑆 𝑡

BLACK-SCHOLES

𝑟𝑐 𝑡, 𝑆 𝑡

With

= 𝑐𝑡 𝑡, 𝑆 𝑡

+ 𝑟𝑆 𝑡 𝑐𝑥 𝑡, 𝑆 𝑡

1

+ 𝜎 2 𝑆 2 𝑡 𝑐𝑥𝑥 𝑡, 𝑆 𝑡

2

∀𝑡 ∈ 0, 𝑇 , 𝑥 ≥ 0

𝑐 𝑇, 𝑥 = max{𝑥 − 𝐾, 0}

Is the Black-Scholes-Merton partial differential equation. Its is a backward parabolic equation, which are known to

have solutions. Using the fact that, 𝑐𝑡 𝑡, 0 = 𝑟𝑐 𝑡, 0 , we solve this ODE: 𝑐 𝑡, 0 = 𝑒 −𝑟𝑡 𝑐 0,0 = 𝑒 −𝑟𝑡 ∗ 0 = 0. This

gives us our first boundary condition at 𝑥 = 0:

𝑐 𝑡, 0 = 0, ∀𝑡

Additionally, lim 𝑐 𝑡, 𝑥 − 𝑥 − 𝑒 −𝑟

𝑥→∞

𝑇−𝑡

𝐾

= 0, ∀𝑡 ∈ 0, 𝑇

That is, the fact that as the underlying approaches ∞, the call option begins to look like the underlying minus the

discounted strike. This serves as the second boundary condition.

BLACK-SCHOLES

Solving the Black-Scholes-Merton PDE gives us the familiar results:

𝑆, 𝑡 = 𝑁 𝑑1 𝑆 − 𝑁 𝑑2 𝐾𝑒 −𝑟(𝑇−𝑡)

𝑃 𝑆, 𝑡 = 𝑁 −𝑑2 𝐾𝑒 −𝑟(𝑇−𝑡) − 𝑁 −𝑑1 𝑆

1

𝑆

𝑑1 =

∗ 𝑙𝑛

+

𝐾

𝜎 𝑇−𝑡

1

𝑆

𝑑2 =

∗ 𝑙𝑛

+

𝐾

𝜎 𝑇−𝑡

𝜎2

𝑟+

2

𝜎2

𝑟−

2

𝑇−𝑡

𝑇−𝑡

𝑁 𝑥 is the

standard-normal

CDF of x

BLACK-SCHOLES

Why doesn’t this method work for American options?

Early exercise is not modeled!

Pros

Gives an analytical (no algorithms necessary!) solution to the value of a European option

This is simple enough to be extended

The resulting PDE’s can be solved numerically

Cons

Some unrealistic assumptions about rates and volatilities does not match data

Normal distribution has thin tales under-approximates large returns in stocks

THANK YOU!

Facebook: http://www.facebook.com/UIUCFEC

LinkedIn: http://www.linkedin.com/financialengineeringclub

Email: uiuc.fec@gmail.com

President

Greg Pastorek

gfpastorek@gmail.com

Internal Vice President

Matthew Reardon

mreardon5@gmail.com