Section 1 - Marietta College

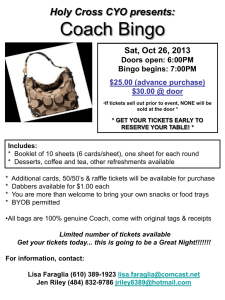

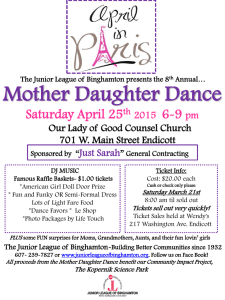

advertisement

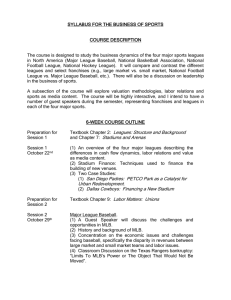

Welcome to The Economics of Sports! Why study sports economics? Comparing spectator sports: other industries Gross Output by Industry (millions of current dollars) 2005 2006 2007 2008 2009 2010 29,867 32,797 36,882 38,452 37,808 39,850 Car washes 8,462 Fluid milk and butter manufacturing 29,244 8,955 9,119 9,038 8,441 8,710 28,816 33,423 34,347 31,371 36,342 Spectator sports Source: http://www.bea.gov/industry/xls/GDPbyInd_GO_NAICS_1998-2010.xls Comparing spectator sports: other retail sectors Estimated Revenue for Employer Firms (millions of current dollars) Funeral homes/services 2004 2005 2006 2007 2008 2009 11,485 11,793 11,909 11,943 12,384 12,214 26,302 28,180 29,222 30,299 28,540 9,022 9,193 9,262 8,475 7,352 Passenger car rental/leasing 25,033 Video tape and disc rental 10,284 Source: http://www2.census.gov/services/sas/data/Historical/sas-09.pdf Why study sports economics? Sports and recreation industry is a big business. Unique industry/firm specific issues Popular and invokes emotion/fervor. Full of myths and mistaken intuition. Useful vehicle for indirect inference in other industries. Conventional Wisdom? o o o o o o o The NBA conspires to ensure The Finals goes seven games Anti-scalping laws lower prices at the ticket window The DH rule increases offensive output in the AL Hosting an Olympics is guaranteed to increase local economic activity After signing a big-salary contract, players play worse The low number of black NFL coaches is evidence of racism Higher ticket prices are caused by player salaries Overview of Course Review of Basic Economics Industrial Organization Why/how do cities finance facilities? Labor Do Teams/Leagues Maximize Profits? Do/Should Antitrust Laws Apply? Public Finance Will largely assume you know this Why Do Athletes Make So Much? Unions & Discrimination The NCAA, the Olympics, and Amateur Sports Economics Review Study of choices under constraints Who makes choices? Households Firms Governments We try to model decisions in simplified frameworks to isolate the issues that influence decision making. Market Model Demand shifters Income Price of related goods Consumer tastes Market size Price expectations $ S1 P1 Supply shifters Input prices Technology Taxes Price expectations Number of firms D1 Q1 quantity Price Elasticity Measure of price sensitivity %Q E %P d Elastic demand: |E| > 1 Inelastic demand: |E| < 1 • More substitutes • Big budget items • Longer time horizons Elasticity… TR = $50,000 %Q d E %P $ E=? 50 TR = $48,000 40 200 0.18 E 1100 0.82 10 0.22 45 D1 1000 1200 tickets Price Controls S1 Price Ceilings create shortages create black markets P1 Pceiling D1 Q1 Qd shortage tickets Price Controls surplus Price Floors Create surpluses S1 Pfloor P1 D1 Qd Q1 tickets Profit Maximization p = TR – TC p = Pq – [FC + VC] Profit maximizing output rule: MR=MC What output do the Yankees produce? [tickets? games? wins?] What kind of cost is Alex Rodriguez’s salary? Perfect Competition Assumptions Many small sellers/buyers Homogeneous product Free entry/exit Perfect information firms are price takers Perfect Competition $ MC $ S ATC MR = P P1 MR = MC D Q1 Market Quantity q1 Firm quantity Monopoly Relevant Market Any close substitutes? Entry Barriers Economies of scale Control over key input Government restrictions Monopoly Profits are maximized where MR = MC $ MC Price is set off of demand curve ATC P1 ATC1 MR = MC Q1 MR D Quantity Pricing Strategy: Phillies vs Flyers Assume each is a monopoly MC a backward “L” $ Does it pay to sell out? MC2 MC1 P2 P1 D Citizens Bank Park 43,500 Wells Fargo Center 19,537 NHL 20,444 NBA 19,500 Q 1 43,500 MR tickets 2012 Ticket Prices Phillies Field Level Club Level Flyers Game Season $70 $53 $38 $65 $48 $34 Cadillac Grille Game Season $215 $102 $160 $89 $120 $105 $93 $81 $65 $57 $47 $37 Lower Level $38 $30 $20 $33 $26 $16 Terrace Mezzanine $38 $30 $20 $34 $25 $16 Source: philadelphia.phillies.mlb.com and philadelphiaflyers.com 2012 Ticket Prices Sixers Cadillac Grille Game Season $49 $45 $169 $109 $59 $149 $95 $55 $45 $15 $35 $15 Lower Level Mezzanine Source: www.nba.com/sixers/tickets/ Regression Analysis Regression is a form of statistical analysis of economic behavior and theory. Regression analysis attempts to explain the variance of a particular variable of interest. Economic Model of Attendance A = f(W) Attendance A = α + βW intercept slope R2 measures “quality of fit” for entire model A = 20 +50W (5.63) (9.63) Winning Percentage “t statistic” 2009 A vs 2008 W NFL 100% 110% 90% 100% 2009 % of Capacity 2009 % of Capacity MLB 80% 70% 60% 50% 40% 30% 90% 80% 70% 60% 50% 40% 30% 20% 20% 10% 10% 0% 0% 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 2008 Winning Percentage A = 0.278 + 0.81 W (3.14) R2 = 0.234 0.9 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 2008 Winning Percentage A = 0.882 + 0.15 W (4.94) R2 = 0.430 0.8 0.9 Regression Example Consider a model of baseball attendance. We think that the following items might influence overall team attendance in the following ways Variable Sign of Relationship Price Negative Population Positive Day of Week Ambiguous Team Quality Positive Opponent’s Quality Positive Competing Events Negative Here are some actual regression results from Depken (2000, Journal of Sports Economics) Variable Description Coefficient Intercept -1.469 PAVE Ticket Price -0.451* CONAVE Concession Price -0.098* FRAGE Franchise Age 0.006 CITYTEN City Tenure -0.063** STAGE Stadium Age -0.087* WIN Winning % 0.739* LAGWIN Last Season Win% 0.389* POP City Population 0.163* INCOME City Income 0.957* PLAYERC Team Payroll 0.286* LEAGUE League 0.055** CAPACITY Stadium Capacity -0.266* YR90 1990 0.212* YR91 1991 0.193* YR92 1992 0.073 YR93 1993 0.203* YR95 1995 -0.129* YR96 1996 0.055 R2 = 0.696 N =174 Dependent Variable is log-Attendance * (**) indicates significance at the 0.05 (0.10) level Std. Error 2.98 0.11 0.02 0.03 0.03 0.02 0.12 0.13 0.03 0.21 0.06 0.03 0.08 0.07 0.06 0.06 0.06 0.06 0.06 t-Statistic 0.49 4.10 4.90 0.20 2.10 4.35 6.15 2.99 5.43 4.55 4.76 1.83 2.32 3.02 3.21 1.21 3.38 2.15 0.91 Franchise Economics and Owner Objectives Franchise Objectives Maximize profits? Championships? Ottawa Senators Best record in NHL: 2002-2003 Declared bankruptcy: 2003 Ego premium? Civic-mindedness? Franchise Revenues TR = RG + RB + RL + RS Gate Revenue Broadcast Revenue Licensing Revenue Stadium Revenue Gate Revenues: RG RG = RH + (1- )RP = home team’s share RH = home team gate RP = pooled gate from all other teams Impact of Revenue Sharing NFL: = 60% MLB: = 66% NBA, NHL: = 100% Financial stability? Competitive balance? Player Salaries? Broadcast Revenue: RB National revenue is shared equally Local revenue is not shared equally Tradeoff: RB vs RG? KC: A small market for MLB but not NFL Green Bay would have disappeared blackouts What determines broadcast rights payments? Demand by Advertisers Super Bowl XLVI: NBC received $3.5m for 30 seconds Broadcast Money Trail Sports Teams and Leagues Programming Rights Fees $ Media Providers (Networks, Cable, Satellite) Ad Slots Slot Fees $ Advertisers (Consumer Products Producers) Revenue from Broadcast Rights Agreements Sport Years Rights Total Fees Annual Average NFL 2006-2013 NBC, Fox, CBS, ESPN, DirecTV $23.9 billion $3.7 billion NBA 2009-2016 ABC/ESPN, TNT $7.44 billion $930 million MLB 2006-2013 ESPN, Fox, TBS $4.9 billion $713 million NASCAR 2007-2014 Fox, ABC/ESPN, TNT $4.4 billion $550 million PGA 2007-2012 CBS, NBC, Golf Ch. $3 billion $500 million NHL 2012-2021 Versus; NBC $200 million Source: Street & Smith’s Sports Business Journal $2 billion Stadium Revenue: RS Concessions Parking Naming rights: pros; colleges; individuals Luxury seats don't count as gate, therefore, don't have to share NFL Example: • luxury suite rents for $500,000 per year • 20 seats • claim each seat is worth $50 Team only shares = 0.4 * 20 * $50 * 8 games = $3200 Question: Why have we seen a move to small markets by NFL teams? Rams: LA St. Louis Raiders: LA Oakland Oilers: Houston Nashville Browns: Cleveland Baltimore Revenue Sharing is the key! Licensing Revenue: RL Generally shared with all teams Cowboys broke ranks with NFL in 1995 by signing Pepsi for stadium sponsorship NFL & Pepsi: $2.3b over 10 years Franchise Costs TC = CP + CA + CT + CS + OC Player Salaries Over 50% of team revenues Deferred compensation Bonuses Workers’ comp Pension contributions Player Development Administrative MLB and NHL Coaches and management Marketing Travel Stadium Opportunity Costs: Profit that could be earned in another city Some revenue and cost averages from professional sports in 2006 League Decisions Cincinnati Red Stockings (1869) National League (1876) $0.50 tickets No Sunday games No beer American Association (1882) $0.25 tickets on Sunday with beer! League Decisions $800 Setting the Rules $700 # games, game format, equipment $600 Teams $500 $400 $530 Benefits: Charlotte entry fee: NFL more revenue sources Costs: $300 Arizona sharing of league revenues Tampa Bay Minnesota Reduced geographical monopoly Columbus Reduces threat of moving $300 $200 $140 $130WHA, $125 AFL, USFL New leagues: ABA, $95 $50 League-wide Marketing $80 $100 $0 $700 Recent Franchise Fees Limiting Entry Houston Free-rider problem Competitive Balance and Revenue Sharing 1993 NHL 2000 NHL 1993 MLB 1999 MLB 1995 NBA 2004 NBA 1995 NFL 1999 NFL 2001 NFL Source: Major League Sports Teams, ODU Forecasting Project, 2001 Accounting Games Book Profit and Depreciation Profit = TR – TC Costs include interest expenses and depreciation of capital Corporate taxes depend on book profit Paying high administrative costs reduces book profit Interest is tax deductible (dividends are not) Player contracts are treated as depreciable assets Bill Veeck San Antonio Spurs example San Antonio Spurs Depreciation and Tax Savings (All figures in $ millions) 1993-94 1994-95 w/o Roster DEP w/Roster DEP w/o Roster DEP w/Roster DEP (1) NOR 4.9 4.9 0.3 0.3 (2) DEP 3.5 (3.5+10.7) 3.5 (3.5+10.7) (3) NAD 1.4 -9.3 -3.2 -13.9 (4) Taxes .5 0 0 0 (5) NADT .9 -9.3 -3.2 -13.9 Tax Savings 0 3.2 1.1 4.9 Category Assume: • $75m purchase price for franchise • 50% of player cost is depreciable • 3.5 year depreciation schedule ($10.7m/yr) • Tax rate = 35% Vertical Integration Beer company buys team Media outlet buys sports team AOL Time Warner Atlanta Braves (1976-2007) Tribune Company Chicago Cubs (1977-2007) Disney Anaheim Angels (1999-2003) /Anaheim Ducks Fox LA Dodgers (1998-2004) Double monopoly? (1993-2005) Vertical Integration Downstream Firm (Media) Upstream Firm (Team) Broadcast rights fee Pdown MC Pup MC MR Qup D MR D Qdown Vertically integrated firm sets transfer price to allocate profit across combined entity Set low broadcast rights fee to reduce team profits in order to plead poverty during lobbying for public subsidy Clicker Review If a team always sells out its home games, economists would say it is very likely that: h hi g ar e to o ss ... Pr ic es is er e Th er e is ex ce ss ... ce ex us ex i st s 0% 0% 0% 0% Th d) rp l c) su b) A surplus exists There is excess supply There is excess demand Prices are too high A a) If an industry is a monopoly, output is _____ and prices are _____ than if it were perfectly competitive. er 0% H ig h ig h er ,h ig he ,h w er Lo ig h 0% r er 0% er ,l ow ow er 0% H d) ,l c) w er b) Lower, lower Higher, lower Lower, higher Higher, higher Lo a) If demand for tickets to see the LA Lakers is inelastic, po .. re s po .. fa ns w ill re s po .. fa ns w ill re s .. ns w ill es . ill r fa d) 0% 0% 0% 0% w c) ns b) Fans will respond to a price increase with a proportional decrease in quantity demanded. fans will respond to a price increase with a less than proportional decrease in quantity demanded. fans will respond to a price increase with an infinitely large decrease in quantity demanded. fans will respond to a price increase with a more than proportional decrease in quantity demanded. Fa a) If income decreases and tickets to see a Notre Dame football game are a normal good, then the .. tic k. ... tic of fo r ly pp su m an de ly pp d of fo r tic tic k. ... .. 0% 0% 0% 0% su d) d c) m an b) demand for tickets will decrease. supply of tickets will increase. demand for tickets will increase. supply of tickets will decrease. de a) A negative aspect of anti-scalping laws is t.. . hu rt tic k. . th ey pr e ve n ... e ey th ey ca us ve n t. .. 0% 0% 0% 0% th d) pr e c) ey b) they prevent sell-outs. they cause people to pay more than they are willing to in order to get tickets. they prevent the market from matching willing buyers and sellers. they hurt ticket agencies. th a) If a game is not sold out, then the marginal cost to a team of accommodating one additional fan is ab ou al ft h. th ly .. 0% 0% ze ro . ... nt ia l se es ou te qu al to nf in i te . 0% 0% ti d) ab c) m os b) almost infinite. about equal to the team's payroll essentially zero. about half the cost of a ticket. al a) To determine the market demand for tickets to see the Boston Bruins play hockey we m ar gi vi ... de th e ad re d ... th e pr ad ic e. d .. th e qu an ti. . 0% 0% 0% 0% di d) th e c) d b) add the marginal revenue at each price. divide the revenue of the team by the number of fans. add the price consumers are willing to pay at each quantity. add the quantity demanded at each price. ad a) The league with the most equal split of gate receipts between the home and visiting teams is l’s eb al N e Th Na t ... BA N e Th as B 0% 0% HL 0% 0% FL d) N c) e b) The NFL The NBA Baseball’s National League The NHL Th a) Over the course of a single season, the largest proportion of team cost is sh ar ed by al ria va lt ... . bl e. 0% 0% 0% 0% ed d) fix c) ro . b) zero. fixed. variable. shared by all teams in the league. ze a) The ownership of professional teams by media outlets in g le .. r.. . be co m as is ow n kn is kn ve ho as ow n cr os s ... ... 0% 0% 0% 0% is d) ts c) en b) prevents cross subsidization. is known as horizontal integration. is known as vertical integration. is becoming less common. pr ev a) The Dallas Cowboys are such a valuable franchise because they ha ve ha ve do ... an y so m ne tra d a ve an ... iti .. .. b. in to ha p d) 0% 0% 0% 0% ta c) n b) can tap into both U.S. and Mexican media markets. have a tradition of winning that attracts fans from all over. have done an expert job of managing the salary cap. have so many luxury boxes. ca a) Marketing for a league is a public good if .. al lt ea s. y m s pa de m s .. riv e. .. a. y pa lt ea al lt ea m s pa y fo r .. . 0% 0% 0% 0% al d) m s c) lt ea b) all teams pay for the cost of advertising for small market teams. all teams pay an equal share of the cost of advertising campaigns. all teams derive benefit from an advertising campaign. all teams pay some share of the cost of advertising campaigns. al a)