15-L3-Final Exam Review - Department of Chemical Engineering

advertisement

Final Exam Review

This Powerpoint is a list of what we

covered in Design I.

Anything from this coverage may be

on your final exam.

(Obviously, I will emphasize the

material after the mid-term exam in the

final exam.)

Exam Format

• Open Book

• Open Notes

•

– Example of previous Final Exam in HW section of course website

• No solution is given

•

•

•

•

•

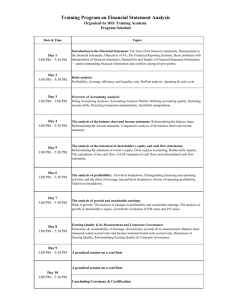

Reminder of Course Grading and Final Schedule

Weekly Homework:

20%

Minor Design Reports

30%

Mid-Term Exam

20%

Final Exam

30%

– (Monday, December 12, 2011

8:00 – 10:00 am, in classroom)

Chapters 1, 2, and 3

• Chpt. 1&2 - The Design Process

– Ethics in Chemical Engineering

– Product design

• Chpt. 3 – Molecular Structure Design

– Property estimation

• Chpt. 4 – Process Creation

– Gross Profitability Analysis

– Process Synthesis

• Start with the reactor (differences in molecular type)

• Separation (differences in composition)

• Heat transfer, pumping, compression, flash tanks

(differences in temperature, pressure, and phase)

• Integraton

Chapters 4 and 5

• Chapter 5 – Simulation to Assist in

Process Creation

– Steady-state flow sheet simulation

• Table 5.1 – Unit Subroutines

• Recycle (tear streams)

– Recycle convergence

• Chapter 6 – Heuristics for Process

Synthesis

– Summary on page 174, Table 6.2

– Using these as a start in design/simulation

Chapter 7 – Reactor Design

• Reactor models

– PFR, CSTR, Equilibrium, Stoichiometric

– Custom made models

• CSTR & PFR

– Kinetics used to size the reactors

– Catalytic reactors

• Equilibrium reactors

– Temperature effects

• Heat effects

• Reactor Design for selective product

distribution

Chapter 8 - Separation

• Common separation methods

– Table 8.1 – p. 211

• Criteria for selection of a separation method

– Separation Factor (SF)

– Energy separation agent (ESA)

• Distillation

–

–

–

–

–

–

–

Types: Tray vs. Packed towers

Reflux ratio

Equil. Trays

Column design

Design issues

Heuristics – page 161

Separation train synthesis - p. 219

– Mass separation agent (MSA)

• Needs a recycle loop

Chapter 18 – Heat Exchangers

• Heat duty

• Temperature driving force

• Type of equipment

– Shell and Tube

• Temperature driving force

– Correction factors (Figs. 18.14-16)

• Heat transfer coefficients and pressure drop

– Table 18.5 – Typical overall heat transfer coeff.

– Boiling HT ΔT = 45F for Nucleate Boiling, Fig 18.5

• Tube sheet layouts – Table 18.6, Figure 18.9

Chapter 19 – Separation Tower Design

• Distillation

– FUG method

– Plate efficiency

– Tower Diameter

– Pressure drop

• Absorption/Stripping

– Kremser method

– HETP values

– Tower Diameter

– Pressure drop

Chapter 20 – Pumps, Compressors, &

Expanders

• Pumps

– Various Types

• Compressors and Expanders

– Various Types

Chapter 22 - Costing

• Accounting

– Debits/credits; annual report; balance sheet

• Cost Indexes

• Capital investment costs (Table 22.32,pg. 591)

–

–

–

–

Bare model costs, Table 22.11

Total depreciable capital

Total permanent investment

Total capital investment

• Estimation of Total Capital Investment

–

–

–

–

Order-of-magnitude

Study estimate

Preliminary estimate

Definitive estimate

Chapter 22 - Costing

• Estimation of total capital

– Order-of-magnitude (method of Hill)

• See page 553, six tenths rule

• +/- 50%

– Study estimate (Method of Lang)

• See page 555

• +/- 35%

– Preliminary estimate (method of Guthrie)

•

•

•

•

See page 557

+/- 20%

Most likely used for decisions

Need fob equipment purchase cost

Chapter 22 - Costing

• Purchase cost

– Pumps and Motors – Figs. 22.3-6

– Fans, Blowers, Compressors – Figs. 22.7-9

– Heat exchangers, Fired Heaters – Figs.

22.10-12

– Pressure vessels and Towers – Fig. 22.13

and equations for trays, etc.

– Other equipment

• See equations and Table 22.32, pg. 591-5

Chapter 23 – Profitability Analysis

• Total Production Cost – Table 23.1, p. 604

– C = COM + general expenses

– COM is sum of direct manufacturing costs plus

operating overhead plus fixed costs

– General expenses are selling, research, admin

cost, incentive pay Profit (gross earnings) or pretax earnings = S – C where S is annual sales

revenue

• Profit (gross earnings) or pre-tax earnings =

S – C where S is annual sales revenue

• Net earnings or profit = (1-t) gross earnings

where t = ~37%

Chapter 23 – Profitability Analysis

• Profitability Measures

– Return on Investment (ROI)

• Definition, pg. 602 Eq. 23.1 & pg. 616 Eq. 23.7

• ROI should be greater than commercial interest rate, I

• Moderate risk: ROI = 25%

– Payback Period (PBP)

• Time required for the annual earning to equal the original

investment, pg. 616 Eq. 23.8

• Low risk should be less than 2 yr.

• Simple replacement should be less than one year

– Venture Profit (VP)

• Annual earnings in excess of minimum acceptable return

on investment, pg. 617 Eq. 23.9

– Annualized Cost

• Sum of production cost and a reasonable return on the

capital investment, pg. 617 Eq. 23.10

Chapter 17 – Profitability Analysis

• Time value of money

– Table 23.6 – Single Payments

– Table 23.8 – Annuity Factors – Uniform

Series Payments

– Equal payments p times per year, interest

compounded m times per year, Eq. 23.29

p.623

– Equal payments p times per year,

continuous compounding interest, Eq.

23.31 p. 623

Chapter 23 – Profitability Analysis

• Time value of money

– Comparing equipment purchases

• Present worth, p 620

• Capitalized costs and perpetuities, p. 626-627

• Depreciation

– Straight line

– ACRS and MACRS

Chapter 23 - Profitability

• Rigorous methods

– Net Present Value (NPV)

• Cash flows are computed for each year of

projected life of the plant

– Investor’s rate of return (IRR)

• Interest rate where NPV is zero

The last 2 weeks

• Trouble Shooting

– Several Articles

Typical Economics Problem

• Problem 1

• You have determined that you will retired at 60 (assume you are

now 25!) and you want $90,000 a year until you are 80. How

much money must you invest with an effective interest rate of

8% per year? (HINT: First calculate the present worth of the

money needed and then calculate the annuity amount).

• Solution

• Funds needed from 60-80 years of age with annuity (A) of

$90K/yr (20 years). Use Eq. 17.32 with I = 0.08, n=20:

•

P = A*{(1.08)^20 – 1}/(0.08*(1.08)^20)

•

= $883,633

• You pay for 35 years; use Eq. 17.28:

•

A = 883,633 * 0.08/{0.08*(1.08^35)}

•

= $5130 per year

The End

• Have a Great Semester Break!

• Design II

– The challenges of putting a whole

chemical plant together and making it

operated efficiently.