Model

advertisement

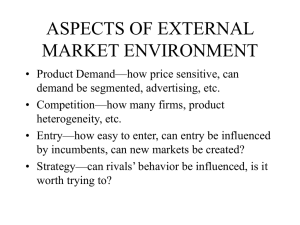

Raff Trade, Heterogeneity, Intermediation 1 International Trade, Firm Heterogeneity, and Intermediation Horst Raff, University of Kiel Zhejiang University 17-19 May 2011 Syllabus Raff Trade, Heterogeneity, Intermediation 2 International Trade with Heterogeneous Firms i. ii. iii. Introduction Trade Model with Monoplistic Competition (Krugman) Monopolistic Competition with Heterogeneous Firms (Melitz, Ottaviano) iv. Reciprocal Dumping Model (Brander) v. Reciprocal Dumping Model with Heterogeneous Firms (Long, Raff, Stähler) vi. Trade and Innovation vii. Intra-Industry Adjustment to Import Competition Intermediation in International Trade i. ii. iii. iv. Introduction Buyer Power in International Markets Imports and the Structure of Retail Markets Manufacturers and Retailers in the Global Economy Introduction Raff Trade, Heterogeneity, Intermediation 3 Basic Models of International Trade 1. Comparative advantage (Ricardo, Heckscher-Ohlin) 2. Economies of Scale (Krugman) 3. Reciprocal Dumping (Brander) Trade Models Based on Economies of Scale • may explain why we observe a lot of intra-industry trade between (rich) countries with similar technology and factor endowments, • provide a theoretical foundation for the gravity equation. Reciprocal Dumping Model • also features intra-industry trade (even in identical goods), • endogenous mark-ups, • competitive effects of trade. Krugman Model Raff Trade, Heterogeneity, Intermediation 4 I. Model Key elements: • • • • Dixit-Stiglitz preferences (love of variety), L consumers/workers (labor is the only factor of production) Monopolistic competition, general equilibrium Economies of scale in production Preferences: elasticity of substitution set of consumed varieties (endogenous) Krugman Model Raff Trade, Heterogeneity, Intermediation 5 Demand for variety i: Constant price elasticity of demand: Technology: labor requirement to produce y units of good i: Krugman Model Raff Trade, Heterogeneity, Intermediation 6 II. Equilibrium Each firm chooses price to maximize its profit: First-order condition (marginal revenue = marginal cost): Maximized profit: Krugman Model Raff Trade, Heterogeneity, Intermediation 7 Free-entry condition (zero profits): Labor market clearing: Equilibrium price index: Indirect utility is inversely proportional to the price index. Krugman Model Raff Trade, Heterogeneity, Intermediation 8 III. Free Trade (C integrated countries) No change in consumer prices No change in output per firm Greater product variety as consumers gain access to foreign varieties: Greater welfare / lower price index due to variety effect: Melitz-Ottaviano Model Raff Trade, Heterogeneity, Intermediation 9 I. Model Key elements: • • • • Quadratic, quasi-linear preferences (love of variety), L consumers/workers (labor is the only factor of production) Monopolistic competition, partial equilibrium Economies of scale in production Preferences: Melitz-Ottaviano Model Raff Trade, Heterogeneity, Intermediation 10 Demand for variety i: with average industry price: Price elasticity of demand: Technology: • Constant marginal cost: c • Fixed market entry cost: Melitz-Ottaviano Model Raff Trade, Heterogeneity, Intermediation 11 II. Equilibrium with homogeneous firms Each firm chooses price to maximize its profit: First-order condition: With symmetric firms: Melitz-Ottaviano Model Raff Trade, Heterogeneity, Intermediation 12 Free-entry condition (zero profits): Equilibrium allocation: Indirect utility: Melitz-Ottaviano Model Raff Trade, Heterogeneity, Intermediation 13 III. Free Trade (C integrated countries) Consumer prices fall as competition gets tougher Output per firm increases as firms need to sell more to break even Product variety rises as consumers gain access to foreign varieties: Greater welfare / lower price index due to lower prices and greater variety Melitz-Ottaviano Model Raff Trade, Heterogeneity, Intermediation 14 IV. Firm Heterogeneity Key changes relative to homogeneous firm model: • • • Firms draw their productivity/marginal cost from a distribution G(c) To obtain closed-form solutions assume a Pareto distribution Firms enter the market and pay their (sunk) entry cost before observing their productivity draw (expected zero-profit condition) Melitz-Ottaviano Model Raff Trade, Heterogeneity, Intermediation 15 Optimal output of a firm has to satisfy: Define: Firms with a marginal cost draw greater than produce any output do not The threshold summarizes all the information required to describe the behavior of firms that produce positive output. Melitz-Ottaviano Model Raff Trade, Heterogeneity, Intermediation 16 Melitz-Ottaviano Model Raff Trade, Heterogeneity, Intermediation 17 Free-entry condition (zero profits): Equilibrium allocation with Pareto distribution of productivity: where: Indirect utility: Melitz-Ottaviano Model Raff Trade, Heterogeneity, Intermediation 18 V. Free Trade (C integrated countries) The threshold value of the marginal cost becomes smaller, i.e., import competition forces the least efficient firms shut down Demand becomes more elastic Average prices and mark-ups fall (pro-competitive effect) Average output rises Higher average productivity Surviving firms are more profitable Greater product variety as consumers gain access to foreign varieties Greater welfare Melitz-Ottaviano Model Raff Trade, Heterogeneity, Intermediation 19 V. Costly Trade Additional threshold value of the marginal cost below which firms export: Only the most efficient firms export, less efficient firms sell only in the domestic market, the least efficient firms produce zero output. Expected zero-profit condition: Threshold value of the marginal cost above which firms shut down: Raff Trade, Heterogeneity, Intermediation 20 Brander Model – reciprocal dumping Raff Trade, Heterogeneity, Intermediation 21 I. Model Key elements: • • • • Quadratic, quasi-linear preferences 2 countries: home, foreign Segmented markets (no consumer arbitrage) Oligopolistic competition, partial equilibrium Preferences: Brander Model Raff Trade, Heterogeneity, Intermediation 22 Inverse demand in each country j =h,f: The home firm sells y units at home and exports x units. The foreign firm sells y* units in the foreign country and exports x* units to the home country. Brander Model Raff Trade, Heterogeneity, Intermediation 23 Technology: • Constant marginal cost: c • Fixed cost: f • Per-unit trade cost: t Brander Model Raff Trade, Heterogeneity, Intermediation 24 II. Equilibrium Each firm chooses domestic sales and exports to maximize its profit: With segmented markets and constant marginal cost we can focus on first-order conditions in the home market: Best-response functions: Brander Model Raff Trade, Heterogeneity, Intermediation 25 Cournot-Nash equilibrium Brander Model Raff Trade, Heterogeneity, Intermediation 26 Equilibrium domestic sales: Equilibrium exports are positive as long as Brander Model Raff Trade, Heterogeneity, Intermediation 27 Mark-up on domestic sales: Mark-up on exports: Reciprocal dumping: firms accept lower mark-ups on their exports. Melitz-Ottaviano Model Raff Trade, Heterogeneity, Intermediation 28 III. Trade Liberalization (reduction in t) Reduces each firm’s domestic sales and raises exports Raises total output in each country and lowers prices Has non-monotonic effect on social welfare since profits • pro-competitive effect due to import competition • profits may fall due to trade cost (cross-hauling) With free entry welfare effect is unambiguously positive due to procompetitive effect Brander Model Raff Trade, Heterogeneity, Intermediation 29 Welfare 0 Brander Model Raff Trade, Heterogeneity, Intermediation 30 Equilibrium with n firms in each country: Equilibrium profits: Long, Raff, Stähler Raff Trade, Heterogeneity, Intermediation 31 I. Model Key elements: • • • • Brander model Firms draw their marginal cost from a distribution F(c) as in Melitz/Ottaviano Firms observe only their own cost draw, but do not know the cost draws of their competitors Derive the Bayesian Nash equilibrium Long, Raff, Stähler Raff Trade, Heterogeneity, Intermediation 32 Inverse demand in each country j =h,f: Marginal cost drawn from distribution Long, Raff, Stähler Raff Trade, Heterogeneity, Intermediation 33 II. Equilibrium Firm i chooses domestic sales and exports to maximize its profit: First-order condition for domestic sales: Threshold value of the marginal cost above which domestic sales are zero: Optimal domestic sales: Raff Trade, Heterogeneity, Intermediation Long, Raff, Stähler 34 First-order condition for exports: Threshold value of the marginal cost above which exports are zero: Optimal exports: With symmetric countries every firm sells Hence expected output of rivals at home and abroad is: at home and exports Long, Raff, Stähler Raff Trade, Heterogeneity, Intermediation 35 Expected domestic sales: Expected exports: Expected-zero-profit condition Long, Raff, Stähler Raff Trade, Heterogeneity, Intermediation 36 III. Trade Liberalization (reduction in t) Reduces each firm’s expected domestic sales and raises expected exports Raises total expected output in each country and lowers expected prices Selection effect: the least efficient firms are forced to shut down Has non-monotonic effect on social welfare since profits • pro-competitive effect due to import competition • profits may fall due to trade cost (cross-hauling) With free entry welfare effect is unambiguously positive due to procompetitive effect Innovation and Trade Raff Trade, Heterogeneity, Intermediation 37 Innovation and Trade with Heterogeneous Firms Ngo Van Long (McGill University, Montreal) Horst Raff (IfW, University of Kiel) Frank Stähler (University of Würzburg) Innovation and Trade Raff Trade, Heterogeneity, Intermediation 38 How does trade liberalization affect productivity? Does trade liberalization raise or reduce the incentive to invest in R&D (specifically process R&D)? How do changes in R&D interact with selection effects whereby the least efficient firms are forced to shut down? Innovation incentives and trade Firms face tougher import competition and lose market share to foreign competitors, but gain better access to export markets. Overall effect of trade on R&D incentives is non-trivial Innovation and Trade Raff Trade, Heterogeneity, Intermediation 39 What does existing theory tell us about the link between trade liberalization and productivity? Models with homogeneous firms (Melitz/Ottaviano, Brander): • market integration leads to fewer but bigger firms, lower average cost (scale effect) Models with heterogeneous firms (e.g., Melitz/Ottaviano): • Trade liberalization raises productivity in two ways: 1. Selection effect: least efficient firms are forced to exit 2. Market-share reallocation effect: efficient firms gain market share at the expense of less efficient firms • No scale effect with CES preferences (Melitz). Innovation and Trade Raff Trade, Heterogeneity, Intermediation 40 Problems with the existing literature: Firm productivity is assumed to be exogenous: firms draw their cost from a given distribution. Fact is: firms may influence their productivity. • Trade liberalization may raise exports and productivity simultaneously. • Evidence that firms raise their productivity with a view to becoming exporters (e.g. Alvarez and Lopez, 2005). Our paper: Firms may invest in R&D to increase their chance of drawing a low marginal cost. Innovation and Trade Raff Trade, Heterogeneity, Intermediation 41 Model: 1. R&D investment through which firms can increase their chance of drawing a low marginal cost. 2. Oligopolistic competition: big firms exercise market power. 3. Cost draws and R&D spending remain private information. 4. Possible adjustments by firms to trade liberalization: • R&D decisions • Output adjustment • Entry and exit Innovation and Trade Raff Trade, Heterogeneity, Intermediation 42 • Higher r imlies a greater chance of drawing a low cost. • Cost distribution with R&D (r): • Convex cost of R&D: Innovation and Trade Raff Trade, Heterogeneity, Intermediation 43 Innovation and Trade Raff Trade, Heterogeneity, Intermediation 44 • Timing of the game 1. 2. 3. Firms choose R&D and make entry decision. Each firm learns its own cost. Firms choose domestic and export sales (Bayesian game). Innovation and Trade Raff Trade, Heterogeneity, Intermediation 45 Expected sales: Expected profit: R&D choice: . Raff Trade, Heterogeneity, Intermediation Innovation and Trade 46 • How does trade liberalization affect the threshold values of the marginal cost? • For both fixed and endogenous market structure we can prove: t Innovation and Trade Raff Trade, Heterogeneity, Intermediation 47 Trade Liberalization with Homogeneous Firms Endogenous R&D in the Brander model With and without zero-profit condition Innovation and Trade Raff Trade, Heterogeneity, Intermediation 48 Trade Liberalization with Heterogeneous Firms – no entry Innovation and Trade Raff Trade, Heterogeneity, Intermediation 49 Trade Liberalization with Heterogeneous Firms – free entry and exit (endogenous market structure) Innovation and Trade Raff Trade, Heterogeneity, Intermediation 50 Reduction in trade costs: (i) raises expected export sales due to • higher probability that any given firm will be efficient enough to be able to export • those firms that do export increase their shipments abroad (ii) reduces/raises expected local sales due to • greater import competition • greater probability that firm has to exit • higher R&D if trade cost is low Innovation and Trade Raff Trade, Heterogeneity, Intermediation 51 (iii) U-shaped relationship between trade cost and R&D: • • A firm selling only on the domestic market would have less incentive to invest in R&D, since trade liberalization reduces its market share. An exporter would have an incentive to increase R&D, since its expected output rises and hence the marginal benefit of cost reduction. High trade cost: probability that the firm will be able to export is small. Hence trade lib. reduces R&D. Low trade cost: almost all active firms will be exporters and raise output when trade is liberalized. Hence R&D increases. Innovation and Trade Raff Trade, Heterogeneity, Intermediation 52 Robust results (for both fixed and endogenous market structure) Trade liberalization: 1. raises (reduces) aggregate R&D spending if trade costs are low (high) 2. increases firm size provided that trade costs are high 3. induces least efficient firms to exit 4. raises social welfare if trade costs are sufficiently low Innovation and Trade Raff Trade, Heterogeneity, Intermediation 53 How does our model match up with the stylized facts of trade liberalization? The model reproduces the stylized fact that trade liberalization • reduces price-cost margins • lowers domestic sales of import-competing firms (at least provided that trade costs are high or that market structure is endogenous) • expands markets for very efficient firms • increases efficiency at the plant level (at least for low trade costs or endogenous market structure) • leads to different adjustment patterns within industries depending on the level of sunk entry costs. Firms that export tend to be larger and more productive than firms that do not export. Raff Trade, Heterogeneity, Intermediation 54 Intra-Industry Adjustment to Import Competition: Theory and Application to the German Clothing Industry Horst Raff (IfW, University of Kiel) Joachim Wagner (University of Lüneburg) Raff Trade, Heterogeneity, Intermediation 55 Intra-Industry Adjustment to Import Competition: Theory and Application to the German Clothing Industry Horst Raff (IfW, University of Kiel) Joachim Wagner (University of Lüneburg) Introduction Raff Trade, Heterogeneity, Intermediation 56 1. How do heterogeneous firms in an industry adjust to an import shock? 2. How does this affect industry productivity and competition in the short and the long run? We address these questions by constructing a simple heterogeneous-firm model and testing its predictions using micro-data for the German clothing industry. Stylized Facts Raff Trade, Heterogeneity, Intermediation 57 1. Significant increase in import penetration in the German clothing industry 2000-2006 • Due in part to successive elimination of import quotas under the Multi-Fibre Arrangement. • Second step: Jan. 1, 2002. Third and final step: Dec. 31, 2004. Large changes in output, employment, market structure. Stylized Facts Raff Trade, Heterogeneity, Intermediation 58 Stylized Facts Raff Trade, Heterogeneity, Intermediation 59 Stylized Facts Raff Trade, Heterogeneity, Intermediation 60 2. Significant firm heterogeneity in terms of size and labor productivity. Stylized Facts Raff Trade, Heterogeneity, Intermediation 61 Stylized Facts Raff Trade, Heterogeneity, Intermediation 62 Economic Issues Raff Trade, Heterogeneity, Intermediation 63 1. How does the industry adjust to import penetration? • • through changes in competition between heterogeneous firms in the industry, i.e., changes in outputs and market structure. 2. What does this imply for competition and industry productivity? 3. Do the competitive effects differ between the short and the long run? Theoretical Framework Raff Trade, Heterogeneity, Intermediation 64 Long, Raff, Stähler (2009): oligopoly model with heterogeneous firms. Short run: fixed number of entrants in the industry. Long run: endogenous market structure, number of entrants determined by an expected-zero-profit condition. (Questions 3 and 4 of the Advanced International Trade Exam 2009) Model Raff Trade, Heterogeneity, Intermediation 65 Key features: 1. Oligopoly model of a domestic industry facing import competition. 2. Heterogeneous firms: firms draw their marginal cost after entry, cost draws remain private information. 3. Firms play a Bayesian Cournot game. Model Raff Trade, Heterogeneity, Intermediation 66 Home inverse demand: p=A – Q – M M: import quota n domestic firms Costs: • Entry cost: fe • Marginal production cost: c • Cumulative distribution function: F(c) Timing of the game • Entry decision. • Each firm learns its own cost. Cost draws are private information. • Firms choose domestic sales (Bayesian Cournot game). Model Raff Trade, Heterogeneity, Intermediation 67 Cost level below above which a firm produces zero output: Output of firm i: Ex-post profit of firm i: Expected ex-ante profit: Model Raff Trade, Heterogeneity, Intermediation 68 Nash Equilibrium: all firms have the same expected output: Short run: Long run: Productivity: Short-run effects Raff Trade, Heterogeneity, Intermediation 69 Long-run effects Raff Trade, Heterogeneity, Intermediation 70 . Data Raff Trade, Heterogeneity, Intermediation 71 Panel data for enterprises from the German clothing industry (all plants with >20 employees or belonging to an enterprise with >20 employees) Industry, sales, total employees, hours worked by blue-collar workers, gross wages and salaries,… Active firms in the clothing industry: 2000: 614 2005: 310 2006: 274 Number of employees in the clothing industry: 2000: 66,881 2006: 31,420 Empirical Analysis Raff Trade, Heterogeneity, Intermediation 72 Empirical Analysis Raff Trade, Heterogeneity, Intermediation 73 Empirical Analysis Raff Trade, Heterogeneity, Intermediation 74 Conclusions Raff Trade, Heterogeneity, Intermediation 75 1. Simple oligopoly model used to derive predictions about the adjustment of an industry to import competition. 2. Pro-competitive effects in the short run disappear in the long run. 3. Predictions of the model for the short run are supported by data for the German clothing industry: The least efficient firms exit the market. The output of survivors decreases. Industry productivity rises (economically small effect and not statistically significant)